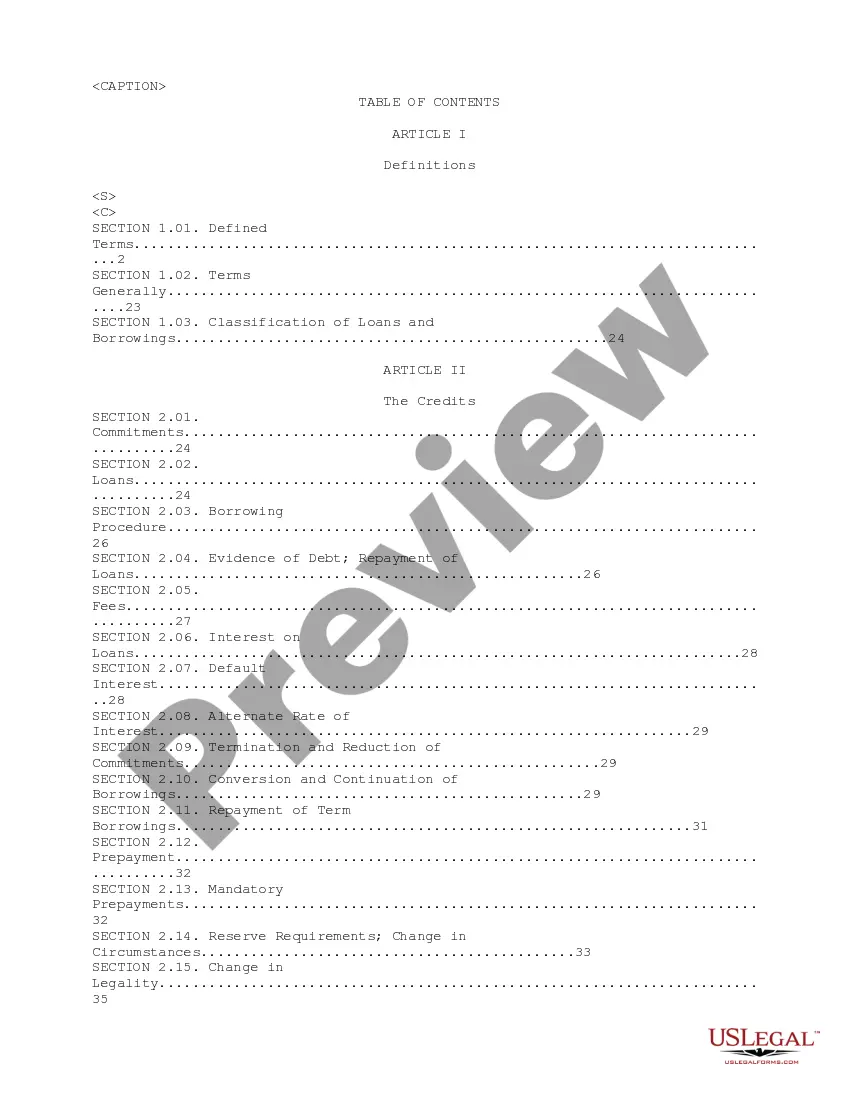

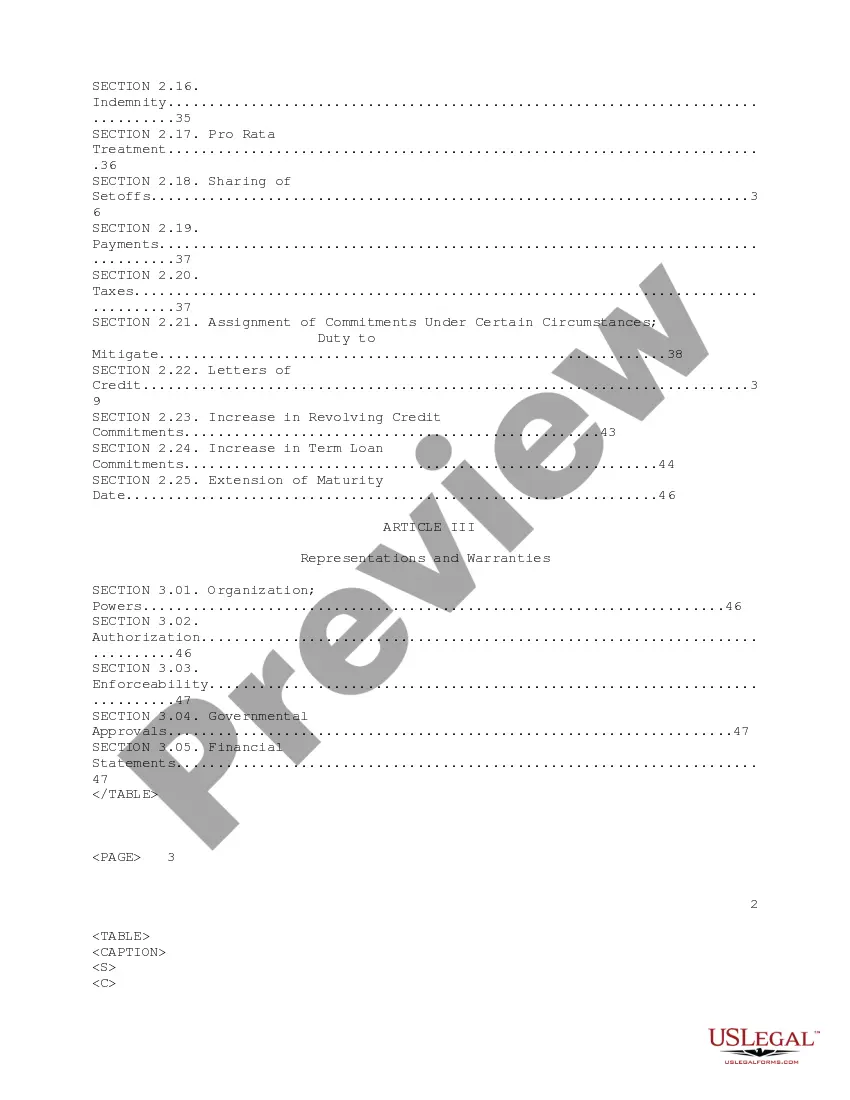

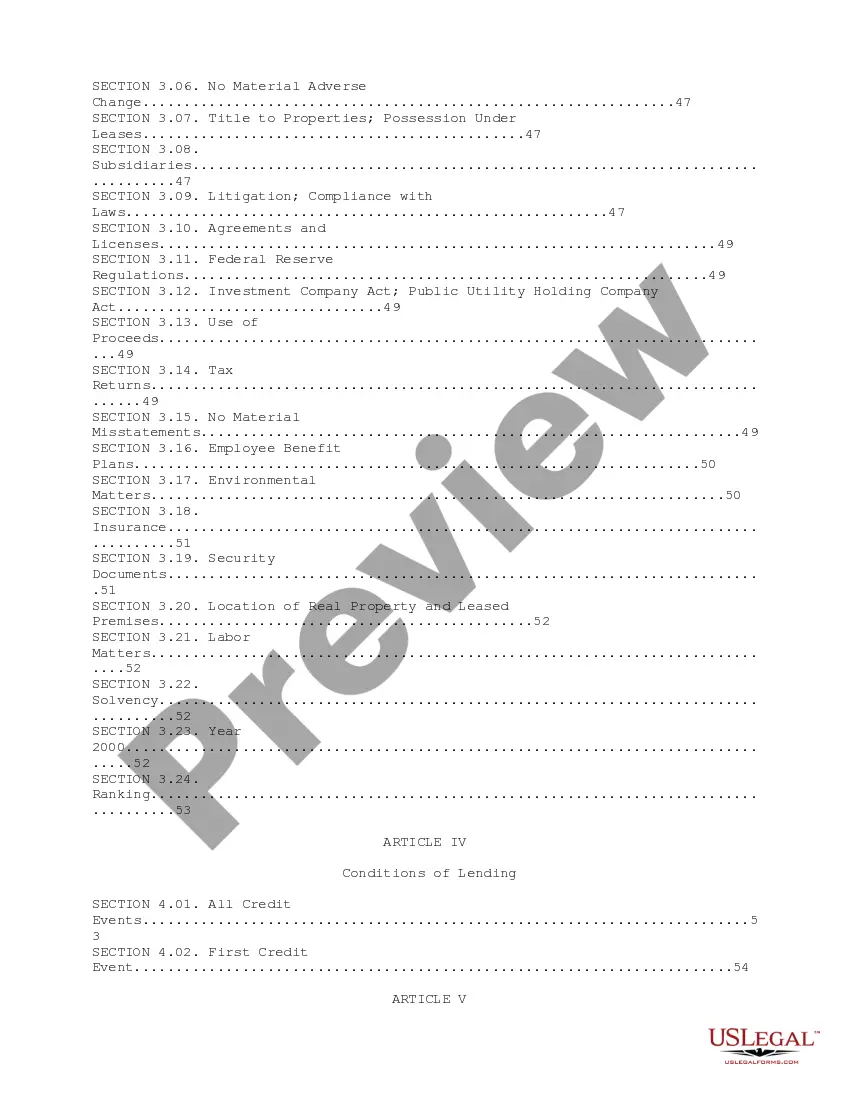

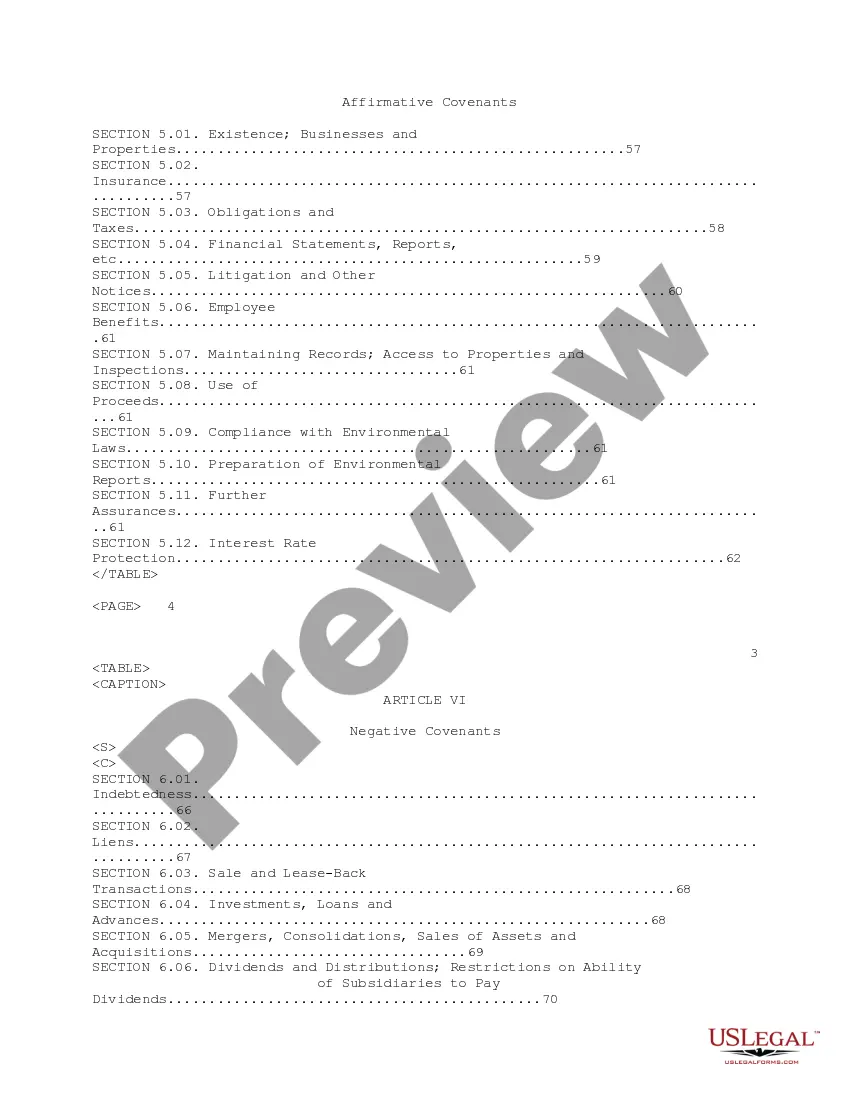

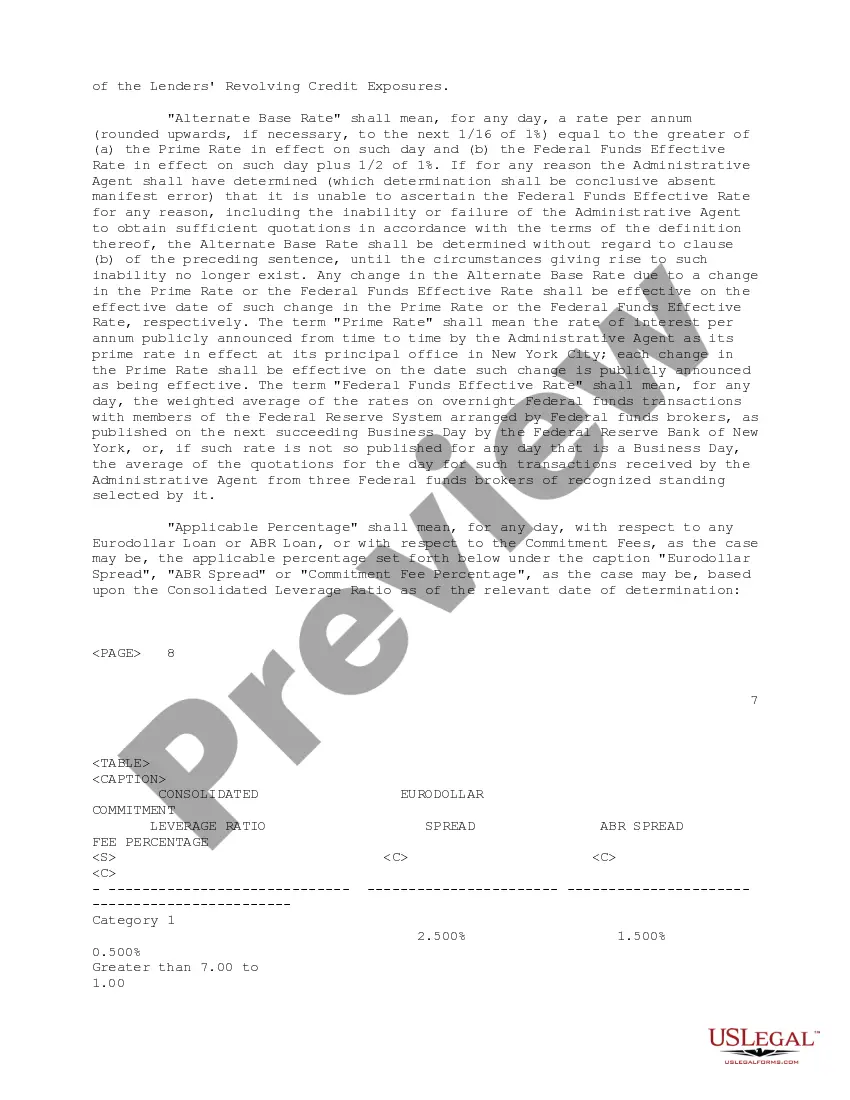

Ohio Credit Agreement regarding extension of credit

Description

How to fill out Credit Agreement Regarding Extension Of Credit?

You are able to spend hours on the Internet looking for the authorized record format that fits the federal and state demands you will need. US Legal Forms provides a large number of authorized varieties that are reviewed by pros. You can actually obtain or printing the Ohio Credit Agreement regarding extension of credit from your assistance.

If you currently have a US Legal Forms accounts, you can log in and click the Acquire switch. Next, you can total, revise, printing, or signal the Ohio Credit Agreement regarding extension of credit. Each authorized record format you buy is your own forever. To acquire yet another version associated with a purchased form, go to the My Forms tab and click the related switch.

If you work with the US Legal Forms web site the very first time, follow the simple recommendations beneath:

- Very first, make certain you have chosen the best record format for your county/metropolis of your choice. See the form description to make sure you have picked the correct form. If offered, utilize the Review switch to look through the record format at the same time.

- If you wish to find yet another model of your form, utilize the Research industry to find the format that meets your requirements and demands.

- Once you have identified the format you would like, just click Buy now to continue.

- Pick the prices strategy you would like, enter your references, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You should use your credit card or PayPal accounts to pay for the authorized form.

- Pick the formatting of your record and obtain it to the gadget.

- Make modifications to the record if necessary. You are able to total, revise and signal and printing Ohio Credit Agreement regarding extension of credit.

Acquire and printing a large number of record web templates utilizing the US Legal Forms web site, which provides the most important assortment of authorized varieties. Use professional and status-certain web templates to take on your company or specific needs.

Form popularity

FAQ

This rule is to regulate employee access to the confidential personal information that the department of insurance (department) keeps. This rule applies to both electronic records and records kept on paper.

Rule 3901-3-03 | Transactions subject to prior notice - notice filing. The purpose of this rule is to establish the form and content an insurer must use in order to give notice of a proposed transaction under section 3901.341 of the Revised Code.

The making of any misrepresentation, or any untrue, misleading or deceptive statement or assertion in support of or in connection with a request for a license renewal, an exemption, extension or for inactive status is an unfair and deceptive act or practice in the business of insurance.

Rule 51-7-03 | Food assistance: Mass change during the certification period. What is a mass change? A mass change is initiated by the state or federal government that may affect the entire caseload or significant portions of the caseload.

Rule 3901-1-54 sets forth uniform minimum standards for the investigation and disposition of property and casualty claims arising under insurance contracts or certificates issued to residents of Ohio by defining procedures and practices which constitute unfair claims practices.

A creditor shall not do any of the following: (A) Make a covered loan that includes any of the following: (1) Terms under which a consumer must pay a prepayment penalty for paying all or part of the principal before the date on which the principal is due.