An Ohio Convertible Secured Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Ohio. This type of promissory note is unique as it allows the lender to convert the outstanding loan amount into equity ownership in the borrower's company. The Ohio Convertible Secured Promissory Note serves as evidence of the borrower's promise to repay the loaned amount, along with any interest or fees incurred, within a specified time frame. By securing the promissory note, the lender obtains a legal claim to certain assets of the borrower in case of default, providing an added layer of protection. Within Ohio, there are various types of Convertible Secured Promissory Notes available to cater to different loan scenarios. Some common types include: 1. Ohio Convertible Secured Promissory Note with Fixed Interest Rate: This type of promissory note specifies a fixed interest rate that remains constant throughout the loan term. Both the lender and borrower agree upon this rate, and it is included in the document. 2. Ohio Convertible Secured Promissory Note with Variable Interest Rate: Unlike the fixed interest rate note, this variant has an interest rate that fluctuates based on specific factors such as market conditions. The note will outline the formula or index used to calculate the interest rate adjustments. 3. Ohio Convertible Secured Promissory Note with Conversion Limitations: This version of the promissory note imposes limitations on the lender's ability to convert the loan into equity. It may specify a conversion cap, which restricts the maximum amount convertible, ensuring the borrower retains control over the ownership percentage of their company. 4. Ohio Convertible Secured Promissory Note with Conversion Discount: In this type of note, the lender receives a discount or reduction in the conversion price when converting the loan into equity. This incentive compensates the lender for accepting the risk associated with the loan and encourages early conversion. It is crucial to draft and execute an Ohio Convertible Secured Promissory Note carefully, ensuring all essential terms are clearly stated. Both parties should seek legal counsel to ensure compliance with Ohio state laws and to protect their respective interests.

Ohio Convertible Secured Promissory Note

Description

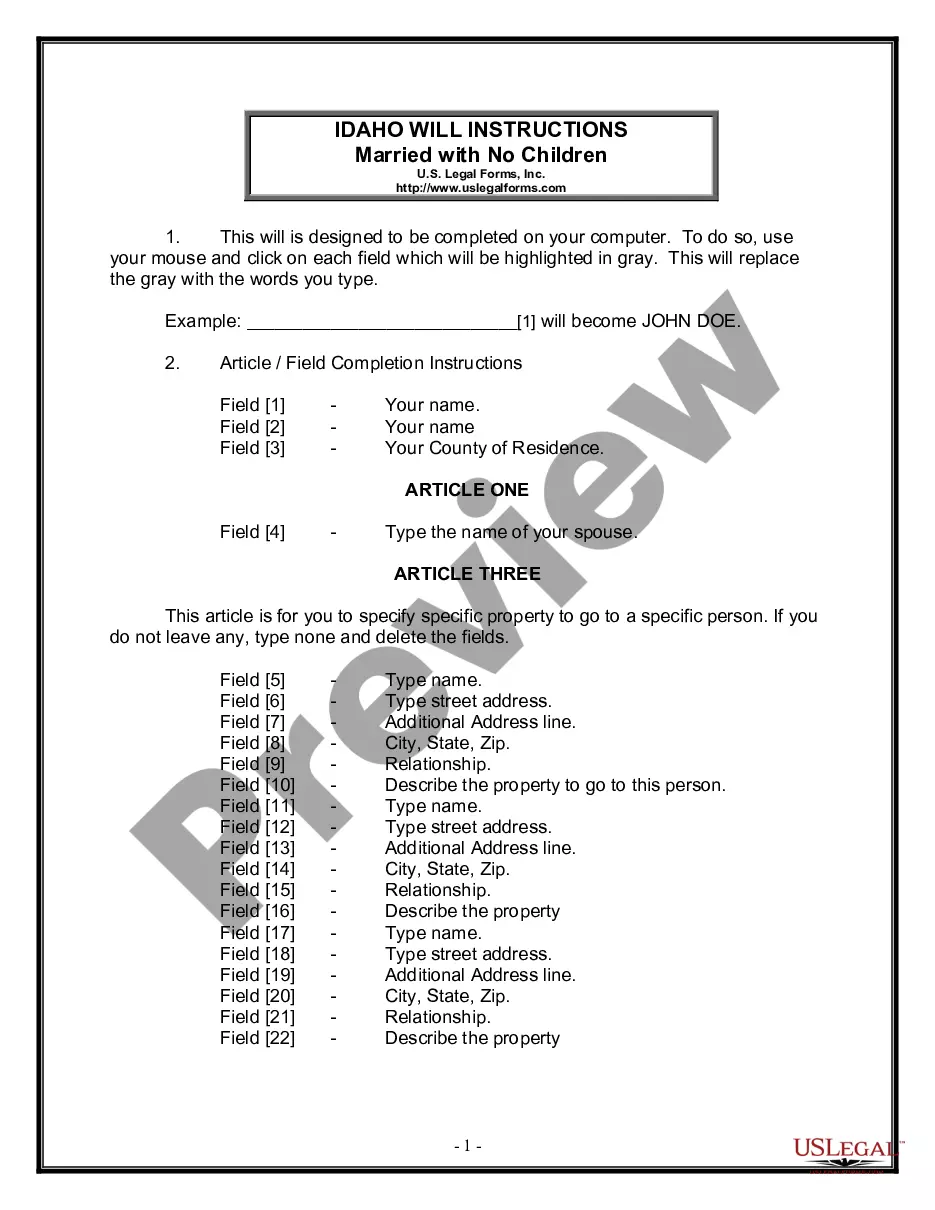

How to fill out Ohio Convertible Secured Promissory Note?

If you wish to total, download, or print out legitimate papers web templates, use US Legal Forms, the biggest variety of legitimate types, that can be found on the Internet. Use the site`s simple and easy hassle-free research to obtain the papers you need. A variety of web templates for enterprise and specific uses are sorted by classes and suggests, or key phrases. Use US Legal Forms to obtain the Ohio Convertible Secured Promissory Note in just a handful of mouse clicks.

If you are currently a US Legal Forms buyer, log in in your bank account and then click the Obtain option to get the Ohio Convertible Secured Promissory Note. You may also entry types you earlier acquired inside the My Forms tab of your bank account.

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form for the appropriate area/nation.

- Step 2. Take advantage of the Preview option to look over the form`s information. Don`t overlook to learn the description.

- Step 3. If you are unhappy together with the kind, use the Lookup area near the top of the screen to get other variations of the legitimate kind design.

- Step 4. Once you have identified the form you need, click on the Acquire now option. Opt for the costs plan you favor and add your references to sign up for the bank account.

- Step 5. Process the financial transaction. You can use your credit card or PayPal bank account to perform the financial transaction.

- Step 6. Find the formatting of the legitimate kind and download it on the product.

- Step 7. Full, revise and print out or signal the Ohio Convertible Secured Promissory Note.

Each legitimate papers design you buy is yours permanently. You possess acces to each kind you acquired inside your acccount. Select the My Forms segment and decide on a kind to print out or download once more.

Contend and download, and print out the Ohio Convertible Secured Promissory Note with US Legal Forms. There are millions of professional and state-distinct types you can utilize for your personal enterprise or specific needs.

Form popularity

FAQ

What should be included in a Secured Promissory Note? The amount of the loan and how that money may be transferred. All parties involved and their contact information. ... Repayment schedule. ... Any interest on the loan. ... The details of the collateral.

What Does a Promissory Note Contain? A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

There are three main options for selling a promissory note: to an individual, to a family member, or to a note-buying company. A note-buying company will offer you a partial or full purchase of the remaining balance on loan. The entire process of selling a promissory note can take 15 to 35 days.

Make the promissory note enforceable. The body of the document must include: Legal names of all parties that have a vested interest in the transaction. Address and phone numbers of each party involved, including the lender. The signature of the borrower and a witness.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A secured convertible promissory note, or SCP for short, is a type of security instrument that gives the holder the right to convert their debt into equity in the issuer company. Typically, an SCP will convert at a discount to the market value of the company's shares at the time of conversion.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Writing the promissory note terms First, you'll need the names and addresses of both the lender (or "payee") and the borrower. You should then list the basic promissory note terms and conditions: The amount of money being lent. The interest rate, if you are charging interest.