Ohio Grant Agreement from 501(c)(3) to 501(c)(4)

Description

How to fill out Grant Agreement From 501(c)(3) To 501(c)(4)?

US Legal Forms - one of many largest libraries of lawful kinds in the USA - provides an array of lawful document templates you can obtain or print out. While using site, you can get a large number of kinds for organization and specific functions, categorized by groups, says, or key phrases.You will find the latest types of kinds like the Ohio Grant Agreement from 501(c)(3) to 501(c)(4) within minutes.

If you currently have a monthly subscription, log in and obtain Ohio Grant Agreement from 501(c)(3) to 501(c)(4) in the US Legal Forms collection. The Download switch will show up on every single kind you see. You gain access to all formerly acquired kinds within the My Forms tab of your account.

In order to use US Legal Forms initially, listed below are straightforward directions to help you started out:

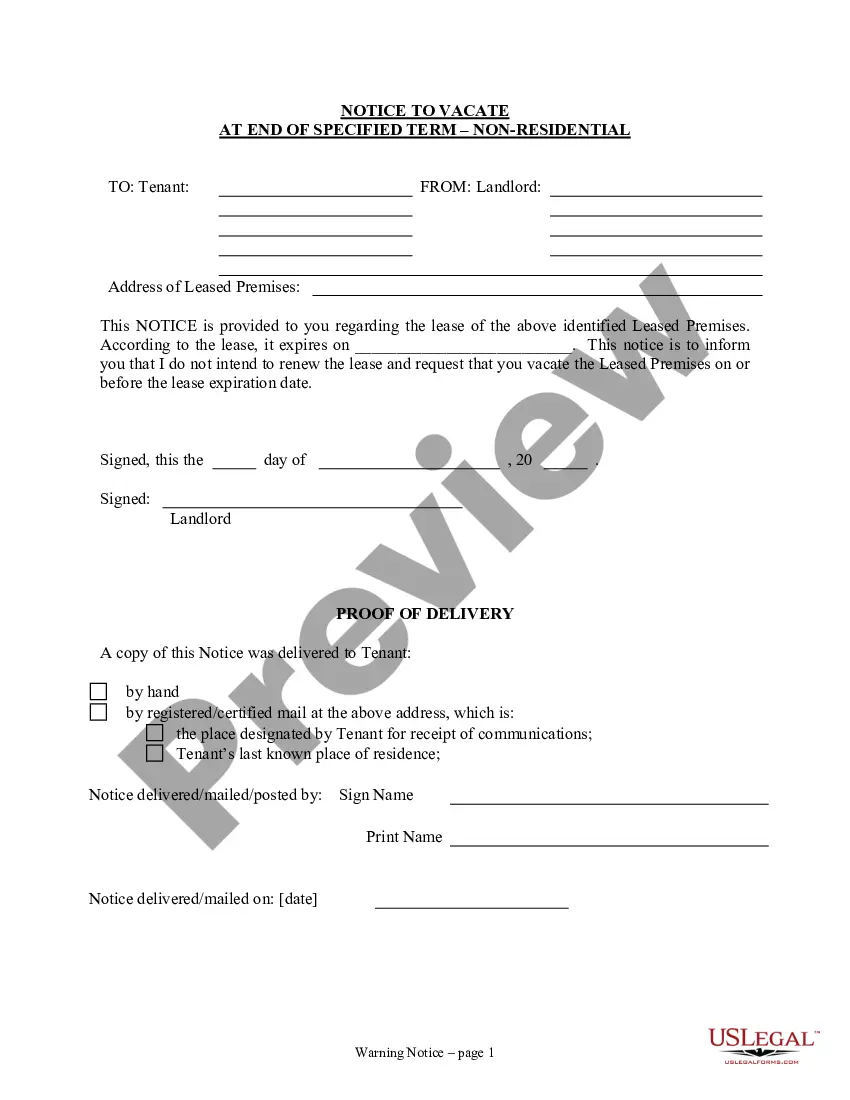

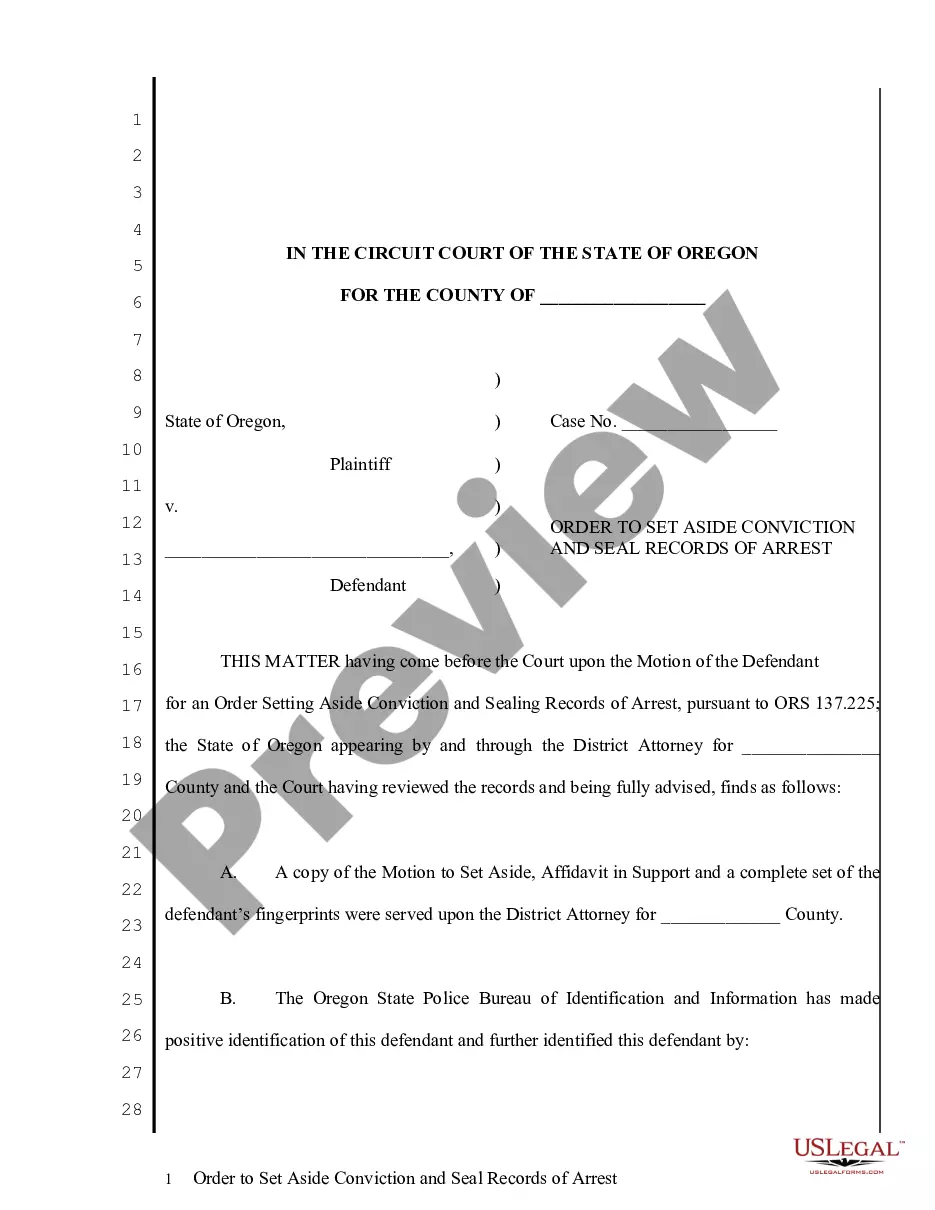

- Be sure to have chosen the best kind for your metropolis/county. Click on the Review switch to analyze the form`s articles. Read the kind outline to actually have chosen the right kind.

- In the event the kind does not match your specifications, utilize the Search discipline towards the top of the screen to discover the one that does.

- Should you be satisfied with the form, verify your decision by clicking on the Buy now switch. Then, pick the pricing plan you like and supply your qualifications to register to have an account.

- Approach the transaction. Utilize your Visa or Mastercard or PayPal account to perform the transaction.

- Find the formatting and obtain the form in your device.

- Make changes. Fill up, revise and print out and indication the acquired Ohio Grant Agreement from 501(c)(3) to 501(c)(4).

Every single web template you included in your bank account lacks an expiry date which is the one you have for a long time. So, if you wish to obtain or print out one more backup, just proceed to the My Forms segment and then click on the kind you require.

Obtain access to the Ohio Grant Agreement from 501(c)(3) to 501(c)(4) with US Legal Forms, by far the most considerable collection of lawful document templates. Use a large number of professional and express-specific templates that meet up with your organization or specific demands and specifications.

Form popularity

FAQ

To be legally organized, a nonprofit corporation must file Initial Articles of Incorporation (Articles) (Form 532B) with the Ohio Secretary of State's office. The filing fee is $99.00.

In addition to standard terms describing grant amounts and purposes, agreements also include provisions regarding intellectual property rights, reporting requirements, and indemnification, among other subjects. Special provisions are included that deal with international philanthropy.

If your organization is incorporated in Ohio, you may need to file a Certificate of Dissolution and return it to the Ohio Secretary of State. For organizations that have federal tax-exempt status, your organization may need to file a final Form 990 with the IRS.

A corporation may be dissolved voluntarily by the adoption of a resolution of dissolution by the directors or by the shareholders. The requirements for dissolving the corporation by resolution of the directors differ from those for dissolving the corporation by the shareholders.

While the Ohio Nonprofit Corporation Law sees nonprofit bylaws as regulations and not legal requirements, nonprofits are still advised to draft bylaws. OH § 1702.10 states that nonprofits may adopt bylaws to help govern how the nonprofit is organized and run.

The grant agreement defines what activities will be undertaken, the project duration, overall budget, rates and costs, the EU budget's contribution, all rights and obligations and more.

Most nonprofits are 501(c)(3) organizations, which means they are formed for religious, charitable, scientific, literary, or educational purposes and are eligible for federal and state tax exemptions. To create a 501(c)(3) tax-exempt organization, first you need to form a Ohio nonprofit corporation.

In order to dissolve a corporation all business tax accounts must be current on all filings and payments and closed. Corporate taxpayers are required to file form D5 ?Notification of Dissolution or Surrender? with the Ohio Department of Taxation once a final return and payment are made.