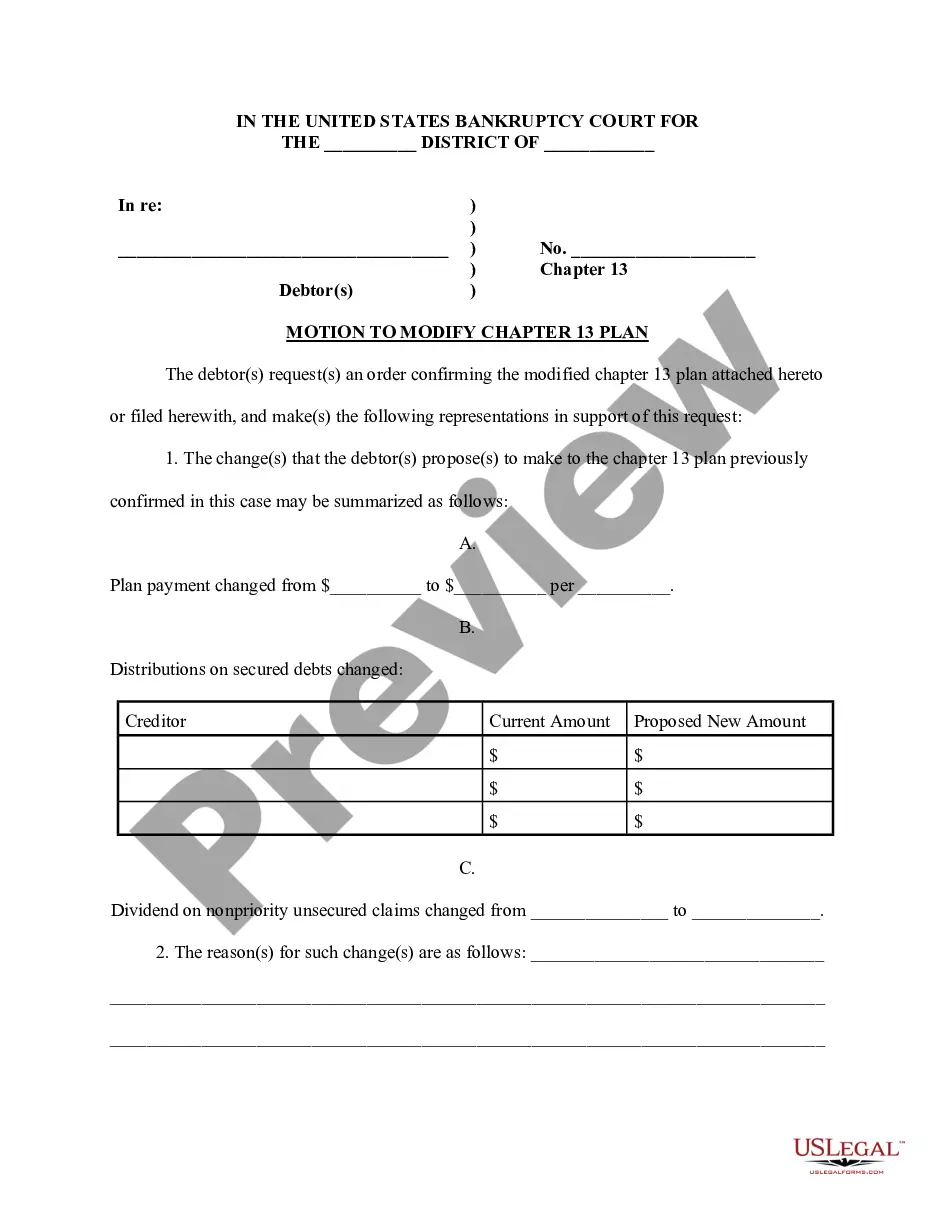

The Ohio Gust Series Seed Term Sheet is a legal document used in venture capital financing transactions to outline the terms and conditions of a potential investment in a startup company located in Ohio, United States. This term sheet serves as the preliminary agreement between the investor and the company, providing an overview of the investment terms, rights, and obligations of both parties. Keywords: Ohio Gust Series Seed Term Sheet, venture capital financing, startup company, investment terms, rights, obligations. There are different types of Ohio Gust Series Seed Term Sheets, tailored to accommodate varying investment scenarios and preferences. Some common variations include: 1. Standard Ohio Gust Series Seed Term Sheet: This is a typical term sheet that outlines the standard investment terms and conditions. It covers essential aspects such as the amount of funding, equity dilution, valuation, investor rights, founder obligations, and exit provisions. 2. Preferred vs. Common Ohio Gust Series Seed Term Sheet: This type of term sheet distinguishes between preferred stock held by investors and common stock held by founders and employees. It outlines the different rights, preferences, and privileges associated with the preferred shares, including liquidation preferences, anti-dilution protection, voting rights, and board representation. 3. Participating vs. Non-participating Ohio Gust Series Seed Term Sheet: This term sheet determines whether the investor has the option to participate in the company's future profits upon an exit event. Participating preferred stockholders are entitled to receive their liquidation preferences first and then share in the remaining proceeds with common shareholders. Non-participating preferred stockholders, on the other hand, must choose between their liquidation preference or converting their shares into common stock to participate in the overall distribution. 4. Founder-Friendly Ohio Gust Series Seed Term Sheet: This type of term sheet is designed to protect the interests and retain control for the startup's founders. It may include provisions such as founder vesting, which ensures that founders earn their equity over a specified period and incentivizes them to stay with the company. Additionally, it may limit the investor's ability to veto important company decisions or impose excessive control. 5. Investor-Focused Ohio Gust Series Seed Term Sheet: Conversely, this term sheet is oriented towards protecting the investor's rights and maximizing their return on investment. It may include provisions like liquidation preferences that provide the investor with a specific multiple of their original investment before any proceeds are distributed to other shareholders upon a liquidation event. In conclusion, the Ohio Gust Series Seed Term Sheet is a crucial legal document in venture capital financing transactions. It outlines the investment terms, rights, and obligations for both investors and startup companies seeking funding in Ohio. The variations of the term sheet cater to different investment scenarios and preferences, ensuring a fair and mutually beneficial agreement.

Ohio Gust Series Seed Term Sheet

Description

How to fill out Ohio Gust Series Seed Term Sheet?

US Legal Forms - one of several greatest libraries of legitimate kinds in the States - offers a wide range of legitimate record themes you are able to download or print out. Using the web site, you will get 1000s of kinds for company and person purposes, sorted by groups, states, or keywords.You will find the most recent types of kinds just like the Ohio Gust Series Seed Term Sheet in seconds.

If you have a membership, log in and download Ohio Gust Series Seed Term Sheet through the US Legal Forms local library. The Acquire switch will show up on every single develop you perspective. You have accessibility to all in the past acquired kinds inside the My Forms tab of the accounts.

If you would like use US Legal Forms initially, here are easy directions to get you started out:

- Be sure to have selected the proper develop to your town/region. Click the Review switch to examine the form`s content material. Read the develop information to actually have selected the right develop.

- In the event the develop doesn`t satisfy your demands, make use of the Research field near the top of the display screen to get the one that does.

- If you are content with the shape, confirm your choice by clicking on the Buy now switch. Then, select the pricing plan you favor and supply your references to sign up for the accounts.

- Approach the financial transaction. Utilize your credit card or PayPal accounts to accomplish the financial transaction.

- Select the formatting and download the shape in your product.

- Make modifications. Fill out, edit and print out and sign the acquired Ohio Gust Series Seed Term Sheet.

Each format you put into your money does not have an expiration particular date and is the one you have eternally. So, if you wish to download or print out another version, just visit the My Forms segment and click about the develop you will need.

Gain access to the Ohio Gust Series Seed Term Sheet with US Legal Forms, the most extensive local library of legitimate record themes. Use 1000s of skilled and status-certain themes that satisfy your business or person requires and demands.