Ohio Convertible Note Financing

Description

Just like any other debt investment, senior convertible notes offer investors the ability to earn interest. Rather than cash payments, however, the interest payments typically will accrue and the amount the company owes the investor will increase over time.

Bothstartup companiesand well-established companies may opt to issue senior convertible notes to raise funds from investors. This type of company financing has the advantage of being fairly simple to execute. This means the process of issuing the notes is relatively inexpensive for companies and it allows them quicker access to investor funding."

How to fill out Convertible Note Financing?

Choosing the best legitimate file design could be a have a problem. Naturally, there are tons of themes accessible on the Internet, but how will you obtain the legitimate type you want? Use the US Legal Forms site. The assistance offers 1000s of themes, for example the Ohio Convertible Note Financing, which can be used for organization and personal demands. Each of the types are checked by specialists and meet federal and state specifications.

When you are already signed up, log in in your account and click on the Download option to find the Ohio Convertible Note Financing. Utilize your account to appear with the legitimate types you might have purchased formerly. Visit the My Forms tab of your respective account and acquire one more backup of your file you want.

When you are a brand new consumer of US Legal Forms, allow me to share basic guidelines that you should comply with:

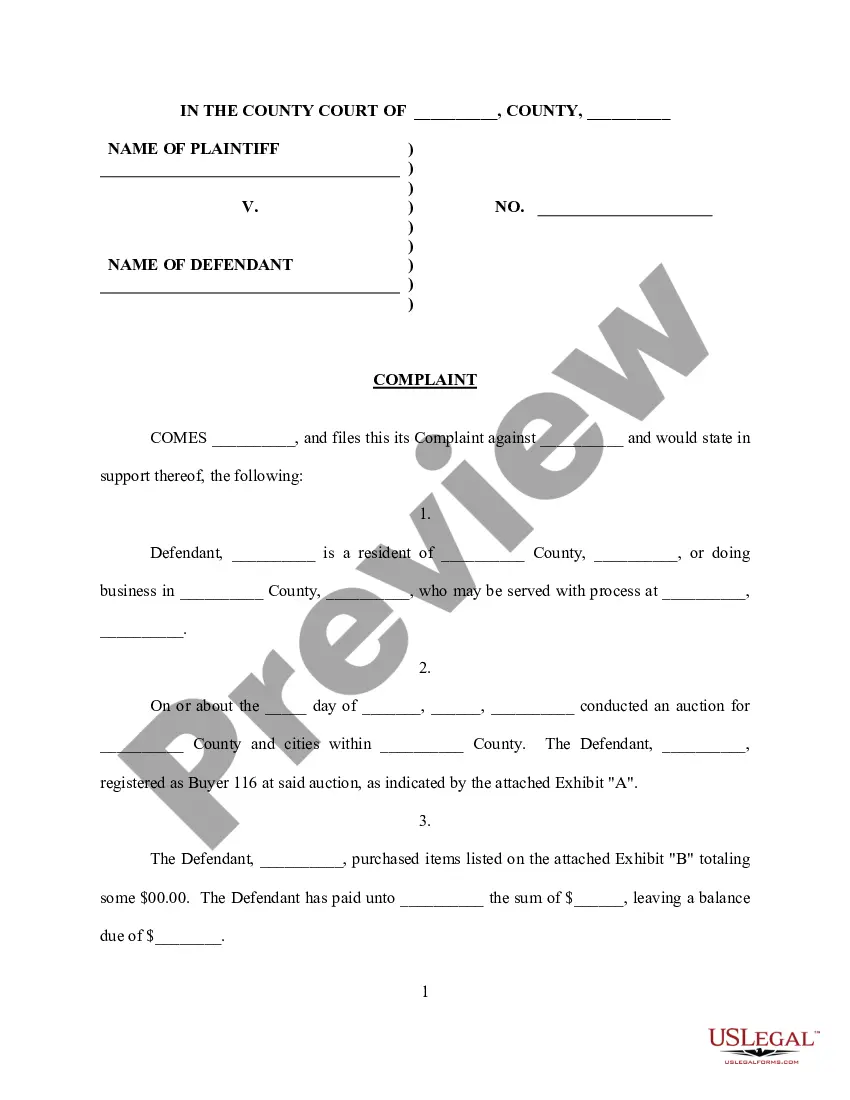

- Very first, be sure you have chosen the correct type for your metropolis/area. It is possible to check out the form using the Review option and look at the form description to make sure this is the best for you.

- In case the type fails to meet your needs, utilize the Seach area to discover the proper type.

- Once you are sure that the form is suitable, go through the Purchase now option to find the type.

- Choose the rates prepare you would like and type in the essential information and facts. Build your account and pay for an order making use of your PayPal account or charge card.

- Choose the file file format and acquire the legitimate file design in your product.

- Total, edit and print and indicator the obtained Ohio Convertible Note Financing.

US Legal Forms is the most significant library of legitimate types for which you will find a variety of file themes. Use the company to acquire appropriately-manufactured papers that comply with condition specifications.

Form popularity

FAQ

Simply multiply the convertible note's interest rate by the number of years that have passed since the convertible note was issued. In this case, we would multiply 6% by 5 to get an accrued interest of 30%.

Convertible loan notes can lead to dilution of existing shareholders' equity when the notes convert. This can be a disadvantage for start-ups that want to maintain control over their company.

Convertible loan notes are a hybrid form of debt finance, where funders offer a company an interest-bearing, repayable loan that's convertible into that company's shares at their discretion, or upon the occurrence of certain events.

In a convertible note, the loan will convert into equity when you raise what's known as a qualified financing. A qualified financing is equity financing (not a SAFE or Convertible Note round) above a certain threshold, usually $1 million.

Promissory Note. The Promissory Note (or Convertible Promissory Note) is the actual debt instrument in the deal. ... Note Purchase Agreement. ... Subscription Agreement. ... Note Holders Agreements and Voting Agreements. ... Subordination Agreement. ... Warrant to Purchase Stock.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Even in the case of stated interest that is paid periodically, a holder of a convertible note may be taxed on interest that has accrued since the most recent interest payment date but has not yet been paid at the time of conversion.

So the cash coming in from your convertible note will generally equate to the liability that you add to the balance sheet. And, if your accounting is doing a good job, the accrued interest is a non-cash expense that flows through your income statement and impacts your accumulated net income in the equity section.