Ohio Pre Incorporation Agreement

Description

How to fill out Pre Incorporation Agreement?

US Legal Forms - one of many greatest libraries of lawful types in the USA - gives a variety of lawful file layouts you can obtain or print out. Utilizing the site, you may get thousands of types for organization and person reasons, sorted by categories, states, or keywords and phrases.You will find the most up-to-date variations of types much like the Ohio Pre Incorporation Agreement within minutes.

If you have a membership, log in and obtain Ohio Pre Incorporation Agreement from the US Legal Forms collection. The Down load option will appear on every develop you view. You have access to all in the past saved types in the My Forms tab of your profile.

If you want to use US Legal Forms the first time, listed here are simple recommendations to get you began:

- Make sure you have selected the proper develop for your personal metropolis/area. Select the Preview option to check the form`s articles. See the develop description to actually have selected the right develop.

- In the event the develop doesn`t suit your needs, utilize the Research discipline at the top of the screen to obtain the one who does.

- When you are content with the form, validate your choice by clicking the Get now option. Then, opt for the prices prepare you prefer and offer your qualifications to sign up to have an profile.

- Method the transaction. Use your bank card or PayPal profile to complete the transaction.

- Find the file format and obtain the form on the system.

- Make adjustments. Fill up, revise and print out and indicator the saved Ohio Pre Incorporation Agreement.

Each format you put into your account does not have an expiration date and it is your own for a long time. So, if you want to obtain or print out another version, just proceed to the My Forms section and click on around the develop you require.

Obtain access to the Ohio Pre Incorporation Agreement with US Legal Forms, the most substantial collection of lawful file layouts. Use thousands of skilled and express-distinct layouts that satisfy your company or person requirements and needs.

Form popularity

FAQ

There is no annual fee (sometimes called an ?Annual Report?) in Ohio for LLCs. Should I hire an LLC formation service? You aren't required to hire a professional service company to form your Ohio LLC. You're allowed to form your LLC yourself if you'd like.

Promoters are generally held personally liable for pre-incorporation contract. If a company does not ratify or adopt a pre-incorporation contract under the Specific Relief Act, then the common law principle would be applicable and the promoter will be liable for breach of contract.

Plan to keep your LLC compliant and in active status on the state's website. Ohio LLCs are not required to file an annual report. You may need to pay quarterly tax payments and may also need to maintain a registered agent for your business.

Ratification is done when a company confirms the pre-registration contract expressly or impliedly such as making a payment for the contracted amount. Also statutory assumptions in s 129 apply in this case as well.

Do I have to file an annual report? Business entities in Ohio are not required to file an annual report.

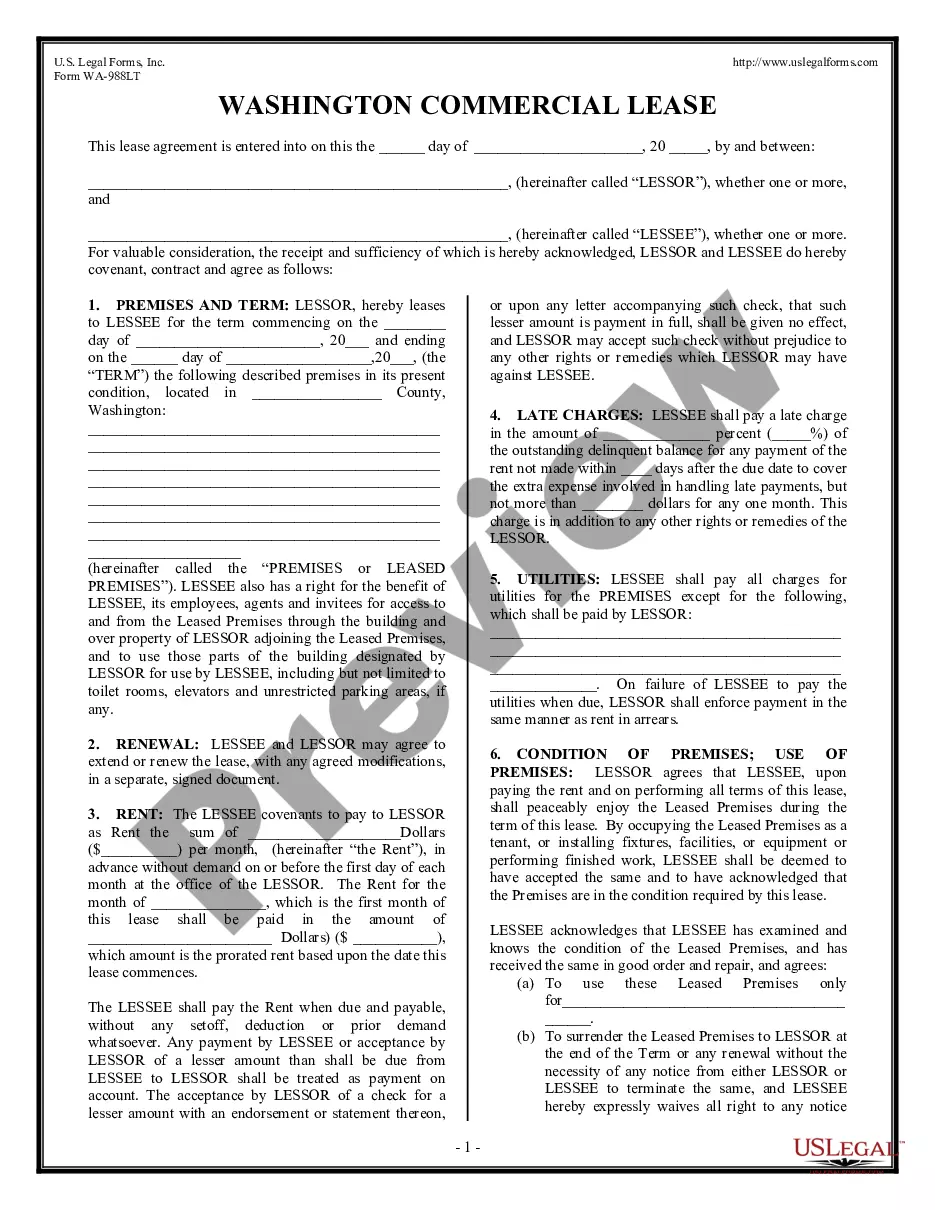

There are various types of pre-incorporation contracts that can be made by a company ing to their need before incorporation, such as a lease agreement, employment agreement, founder's agreement, shareholder agreement, etc.

The Ohio Secretary of State doesn't require you to file any annual information form or pay any annual fee for your LLC. Ohio is one of only 5 states that have a true ?No Annual Report Due?.

ZenBusiness: Create your LLC in Ohio Step 1: Choose a name for your LLC. ... Step 2: Appoint a statutory agent. ... Step 3: Check if you need an Ohio business license. ... Step 4: File articles of organization. ... Step 5: Draft an LLC operating agreement. ... Step 6: Comply with employer obligations. ... Step 7: Pay Ohio business taxes.