The Ohio Simple Agreement for Future Equity, also known as Ohio SAFE, is a legal document used by startups and early-stage companies to raise capital without giving away ownership stake or entering into complex negotiations. It is an innovative financing instrument designed to facilitate investment in promising business ventures. The Ohio SAFE operates on the principle of converting the invested amount into equity at a later date based on predefined triggers, such as a future financing round or an acquisition. By using this agreement, companies can offer potential investors the opportunity to invest money in exchange for future equity, allowing them to support startups while mitigating risk. There are different types of Ohio SAFE agreements based on the structure and terms established between the company and the investor. Some common variations include: 1. Ohio SAFE with a Valuation Cap: This type of agreement sets a maximum valuation at which the investment would convert into equity. If the company's valuation exceeds the cap, investors benefit from a better conversion rate, ensuring they receive a fair return on their investment. 2. Ohio SAFE with a Discount Rate: Here, investors are offered a discounted price per share compared to the price paid by future investors during subsequent financing rounds. This discount encourages early-stage investments by providing a financial incentive for early backers. 3. Ohio SAFE with a Valuation Cap and Discount Rate: This type combines both a valuation cap and a discount rate, offering investors the potential for maximum returns. If the valuation cap is not reached, the discount rate remains as a fallback mechanism to protect the investor's initial investment. 4. Ohio Safes with Variable Terms: Depending on the specific needs of the company and investor, custom variations of the Ohio SAFE agreement can be created, incorporating unique terms and features tailored to both parties' requirements. These could include provisions regarding board representation, conversion triggers, or investor rights. It is important to note that the Ohio SAFE is typically a standardized document with provisions based on industry best practices. However, it is always recommended for companies and investors to consult legal professionals to ensure all terms and conditions comply with Ohio state regulations and adequately protect their respective interests. In summary, the Ohio Simple Agreement for Future Equity (SAFE) is a flexible investment tool allowing startups and early-stage companies in Ohio to raise capital while deferring the conversion of investments into equity until specified triggers occur. It offers different variations such as those with valuation caps, discount rates, or a combination of both. These agreements provide a streamlined approach to fundraising, benefiting both the company seeking investments and the backers supporting their growth.

Ohio Simple Agreement for Future Equity

Description

How to fill out Ohio Simple Agreement For Future Equity?

You may devote several hours online attempting to find the legal papers template that suits the federal and state requirements you require. US Legal Forms gives 1000s of legal forms that happen to be evaluated by professionals. You can actually obtain or print the Ohio Simple Agreement for Future Equity from your assistance.

If you already possess a US Legal Forms accounts, you are able to log in and then click the Acquire option. After that, you are able to complete, change, print, or sign the Ohio Simple Agreement for Future Equity. Every single legal papers template you get is the one you have forever. To acquire yet another duplicate of any obtained type, proceed to the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms internet site for the first time, stick to the easy directions beneath:

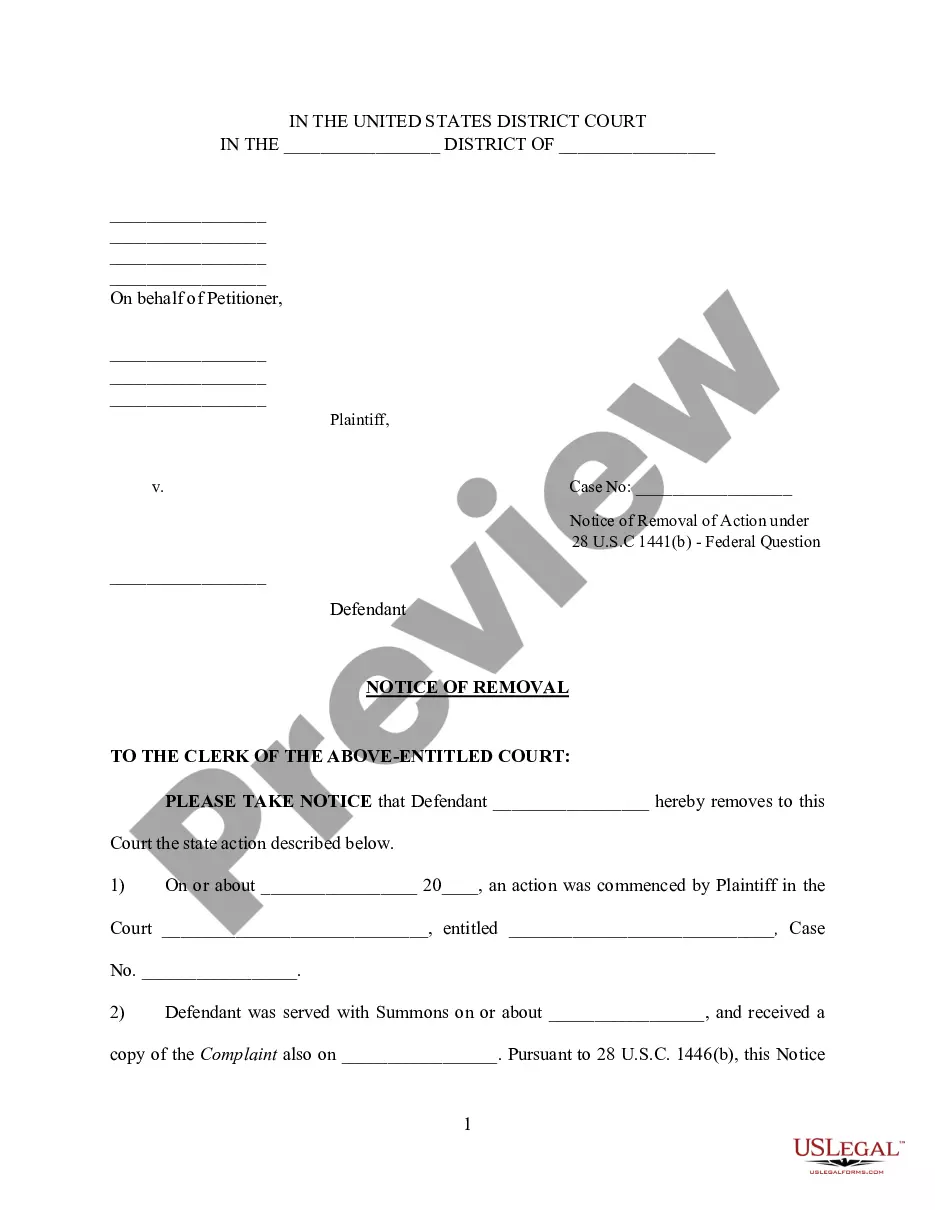

- Initially, make certain you have selected the correct papers template for the county/town that you pick. Browse the type outline to make sure you have chosen the proper type. If accessible, take advantage of the Preview option to check throughout the papers template as well.

- If you want to discover yet another edition of the type, take advantage of the Search field to find the template that meets your needs and requirements.

- After you have located the template you would like, click Get now to proceed.

- Find the costs strategy you would like, enter your credentials, and register for a free account on US Legal Forms.

- Comprehensive the transaction. You may use your bank card or PayPal accounts to purchase the legal type.

- Find the structure of the papers and obtain it for your device.

- Make changes for your papers if needed. You may complete, change and sign and print Ohio Simple Agreement for Future Equity.

Acquire and print 1000s of papers layouts utilizing the US Legal Forms web site, which provides the greatest assortment of legal forms. Use expert and condition-particular layouts to take on your small business or specific needs.