Ohio Catering Services Contract - Self-Employed Independent Contractor

Description

How to fill out Ohio Catering Services Contract - Self-Employed Independent Contractor?

If you have to total, download, or print lawful record web templates, use US Legal Forms, the most important collection of lawful types, that can be found on the web. Take advantage of the site`s basic and convenient look for to discover the paperwork you want. Various web templates for enterprise and specific functions are categorized by classes and says, or search phrases. Use US Legal Forms to discover the Ohio Catering Services Contract - Self-Employed Independent Contractor in just a few mouse clicks.

If you are presently a US Legal Forms client, log in in your account and click the Obtain key to find the Ohio Catering Services Contract - Self-Employed Independent Contractor. Also you can access types you previously delivered electronically within the My Forms tab of your own account.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape to the appropriate town/nation.

- Step 2. Use the Preview option to look through the form`s content material. Never neglect to read through the description.

- Step 3. If you are not happy using the form, make use of the Research discipline on top of the monitor to find other versions of your lawful form template.

- Step 4. Upon having discovered the shape you want, select the Acquire now key. Select the prices program you like and add your accreditations to register for the account.

- Step 5. Method the purchase. You may use your charge card or PayPal account to finish the purchase.

- Step 6. Select the file format of your lawful form and download it on your product.

- Step 7. Full, change and print or sign the Ohio Catering Services Contract - Self-Employed Independent Contractor.

Every lawful record template you acquire is yours for a long time. You have acces to each form you delivered electronically within your acccount. Go through the My Forms segment and choose a form to print or download yet again.

Compete and download, and print the Ohio Catering Services Contract - Self-Employed Independent Contractor with US Legal Forms. There are many specialist and condition-particular types you can utilize to your enterprise or specific demands.

Form popularity

FAQ

4 Effective Ways to Sell Your Catering ServicesSocial Media Marketing. In today's world, Social Media is something most people can't live without.Pay Per Click (PPC) Advertising.Email Marketing.Partnership with Social Media Influencers.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

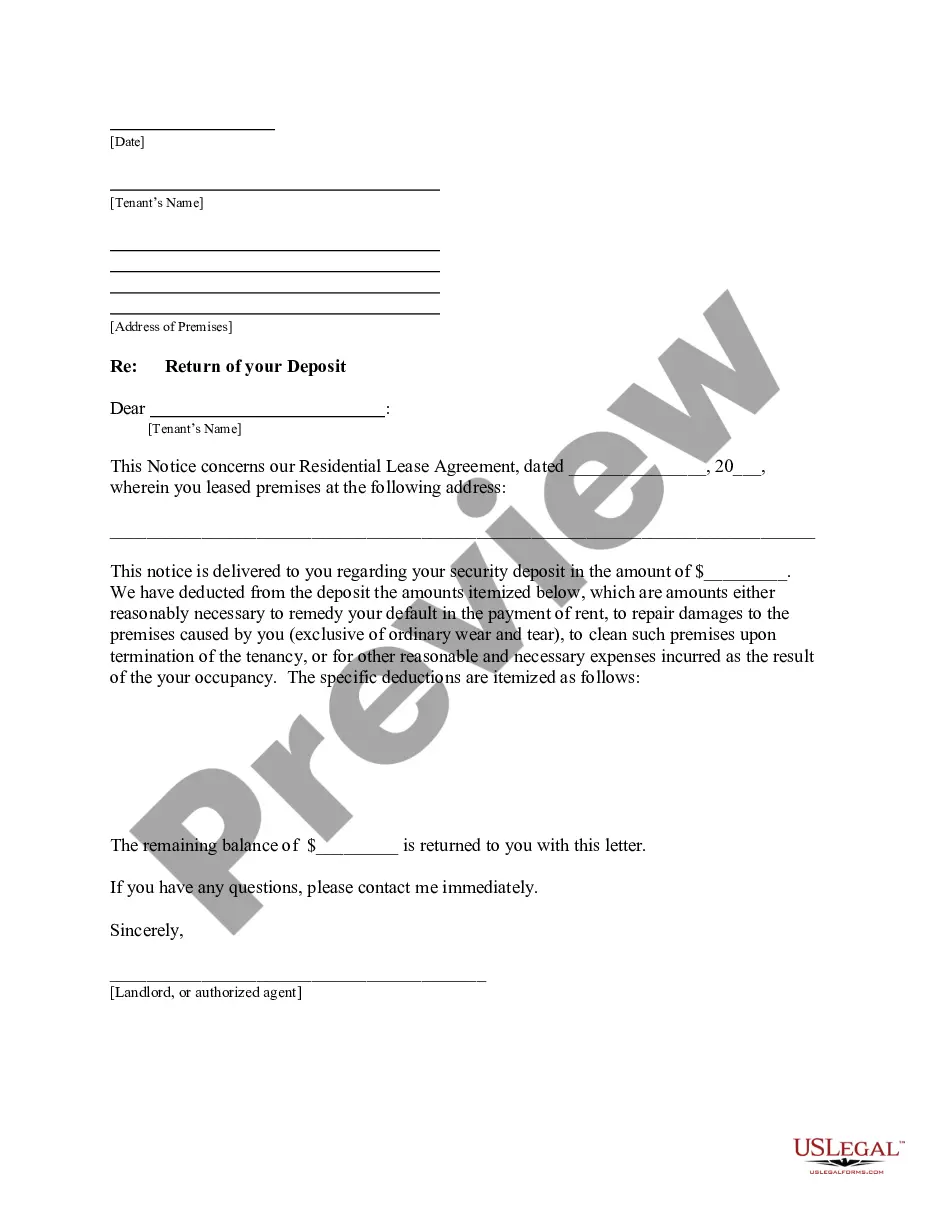

written catering contract gives a clear outline of the obligations, timelines, and payment schedules for both sides entering the agreement. It should include the client's expectations regarding the food service, delivery dates, and menu; and your expectations related to fees and payments.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.

Generally, to be legally valid, most contracts must contain two elements:All parties must agree about an offer made by one party and accepted by the other.Something of value must be exchanged for something else of value. This can include goods, cash, services, or a pledge to exchange these items.

How to write a catering proposal in 6 easy stepsStep 1: Write a cover letter.Step 2: Include Your Menu Items & Cost.Step 3: Add Extra Charges (if any)Step 4: Total Quote.Step 5: Explain Your Policies.Step 6: Signature and Payment Information.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

1099 Worker Defined A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

Key Elements of a Catering ContractFood and Services Provided. To pave the way for a successful event, your catering contract should include a detailed section covering menu-related items and other services the caterer is responsible for, including:Fees and Payment Schedule.Other Terms and Conditions.