Ohio Telephone Systems Service Contract - Self-Employed

Description

How to fill out Ohio Telephone Systems Service Contract - Self-Employed?

Choosing the best legitimate papers template could be a struggle. Of course, there are tons of web templates available on the Internet, but how do you find the legitimate kind you need? Use the US Legal Forms internet site. The assistance provides a large number of web templates, including the Ohio Telephone Systems Service Contract - Self-Employed, which you can use for enterprise and private requires. Each of the varieties are examined by specialists and satisfy federal and state requirements.

Should you be currently authorized, log in to your bank account and click on the Down load key to get the Ohio Telephone Systems Service Contract - Self-Employed. Make use of your bank account to check through the legitimate varieties you possess bought in the past. Proceed to the My Forms tab of the bank account and acquire one more backup of the papers you need.

Should you be a whole new user of US Legal Forms, listed below are simple recommendations for you to adhere to:

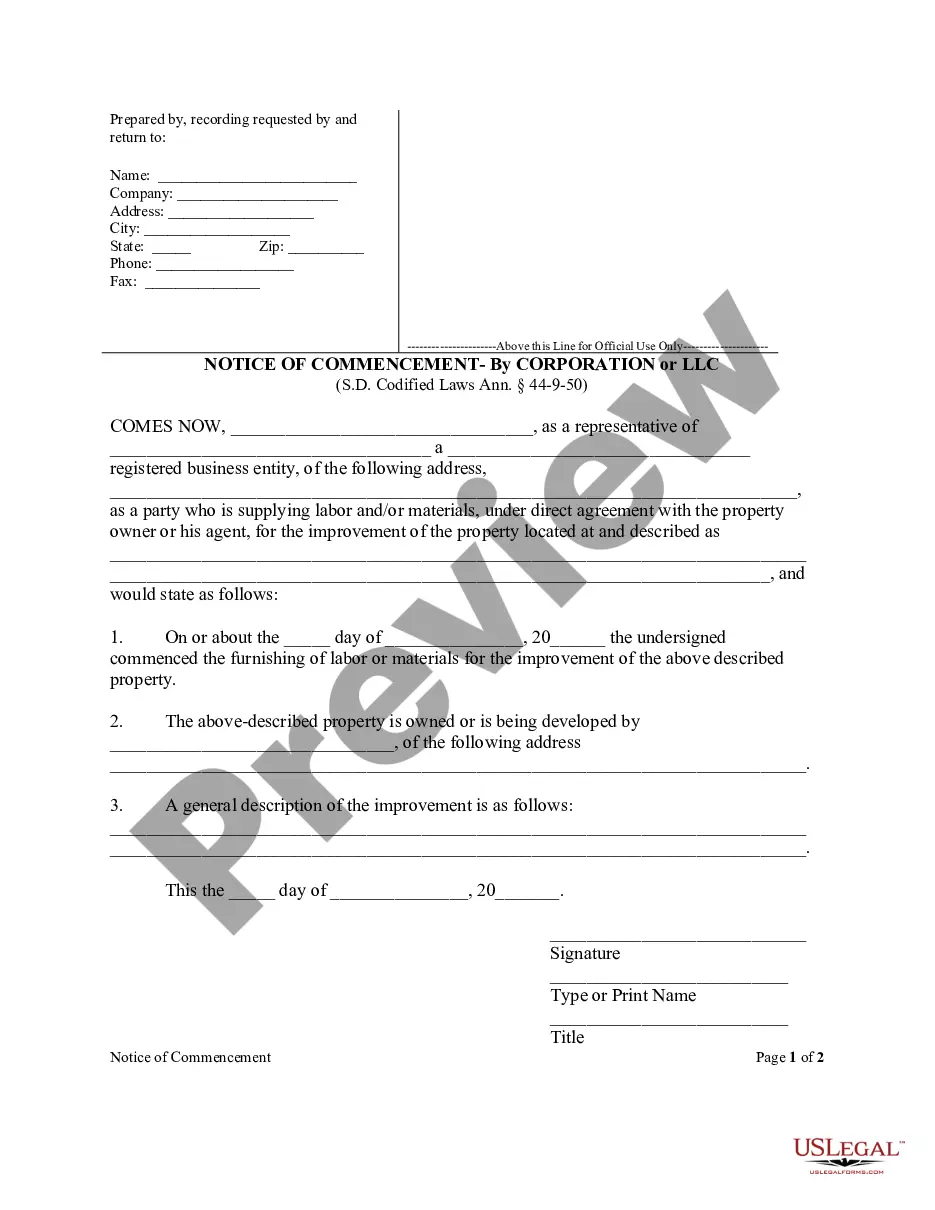

- Initially, be sure you have selected the right kind for your city/area. You are able to examine the form utilizing the Review key and read the form explanation to make sure it is the right one for you.

- If the kind fails to satisfy your requirements, utilize the Seach area to discover the proper kind.

- When you are certain the form is acceptable, click on the Acquire now key to get the kind.

- Opt for the prices plan you want and enter in the needed info. Make your bank account and buy an order using your PayPal bank account or Visa or Mastercard.

- Opt for the submit format and down load the legitimate papers template to your product.

- Comprehensive, modify and print and indication the attained Ohio Telephone Systems Service Contract - Self-Employed.

US Legal Forms may be the largest local library of legitimate varieties that you can discover numerous papers web templates. Use the service to down load appropriately-made paperwork that adhere to express requirements.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Write the contract in six stepsStart with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.