Ohio Complaint for Wrongful Death - Single Count

Description

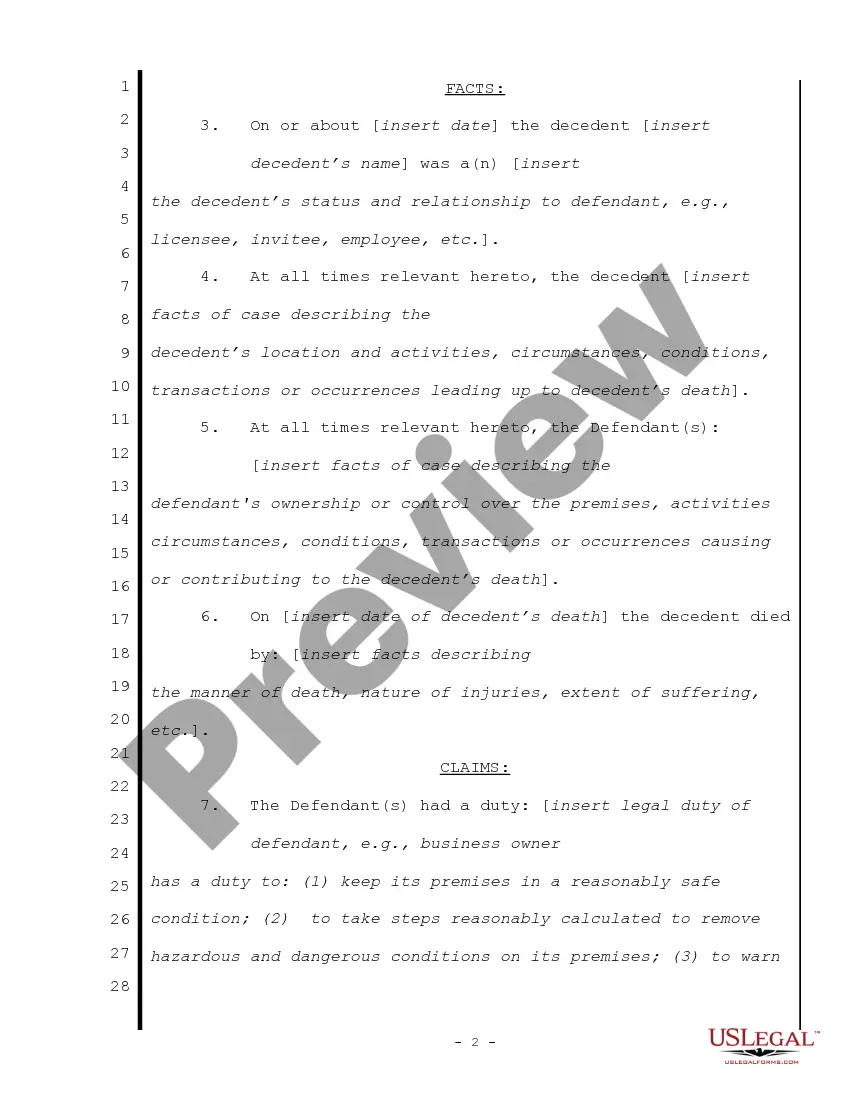

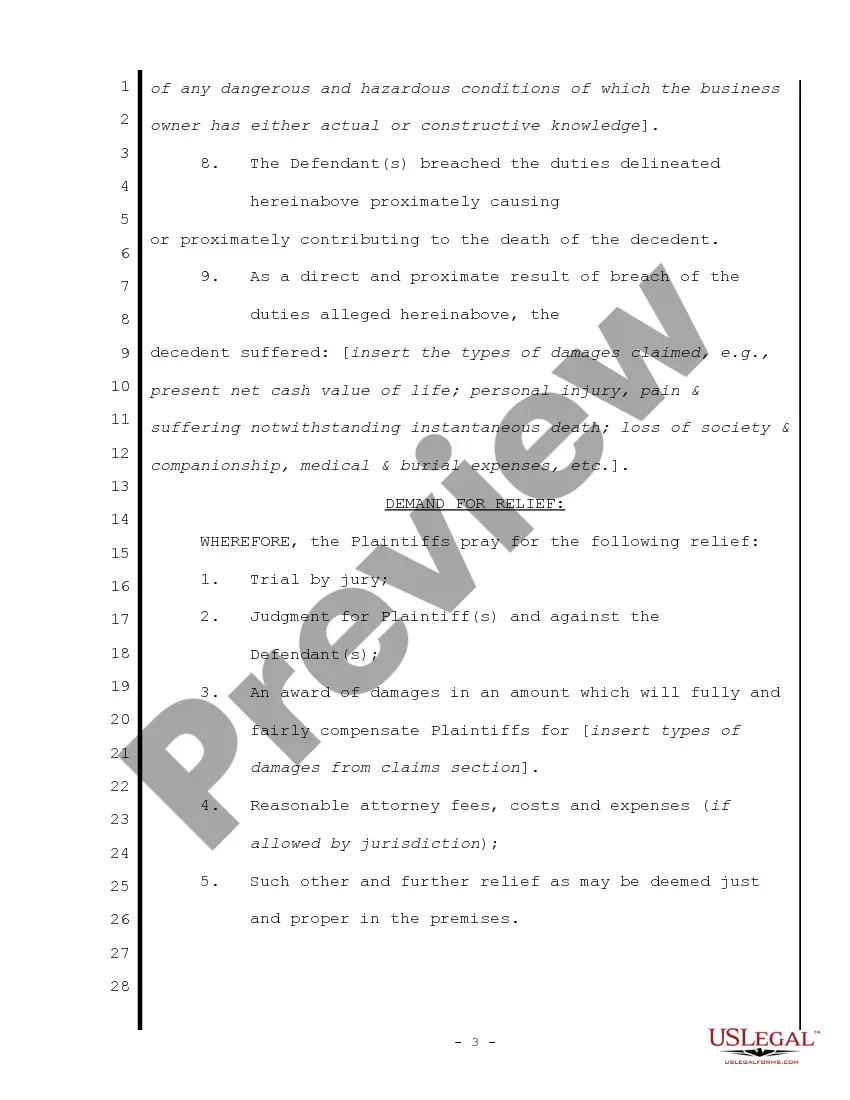

How to fill out Complaint For Wrongful Death - Single Count?

Have you been in a place the place you need to have papers for possibly organization or specific reasons almost every time? There are a lot of lawful file templates available on the net, but getting types you can rely on is not straightforward. US Legal Forms gives a huge number of develop templates, such as the Ohio Complaint for Wrongful Death - Single Count, which can be created to satisfy federal and state specifications.

In case you are previously familiar with US Legal Forms web site and get an account, simply log in. Next, you can obtain the Ohio Complaint for Wrongful Death - Single Count template.

Unless you offer an bank account and want to start using US Legal Forms, follow these steps:

- Find the develop you will need and ensure it is for your appropriate city/area.

- Take advantage of the Preview switch to review the shape.

- Read the description to actually have chosen the proper develop.

- In the event the develop is not what you`re trying to find, make use of the Research field to find the develop that meets your requirements and specifications.

- If you find the appropriate develop, click Purchase now.

- Pick the costs program you would like, fill out the required information to produce your money, and pay money for your order utilizing your PayPal or Visa or Mastercard.

- Select a convenient paper format and obtain your backup.

Find every one of the file templates you have bought in the My Forms menu. You can aquire a additional backup of Ohio Complaint for Wrongful Death - Single Count anytime, if necessary. Just click on the needed develop to obtain or print the file template.

Use US Legal Forms, by far the most substantial selection of lawful types, to save lots of efforts and stay away from mistakes. The assistance gives professionally manufactured lawful file templates that you can use for a selection of reasons. Generate an account on US Legal Forms and commence producing your life easier.

Form popularity

FAQ

Whether the death of your family member is due to a motor vehicle accident, medical malpractice or any other cause, these principles apply. Also, the amount a jury can award in a wrongful death case is not capped by statute; the Ohio Constitution prohibits caps in wrongful death cases.

Heirs and family members who file the wrongful death claim make a joint decision regarding each person's amount. Any children or surviving spouses are entitled to the majority of the settlement proceeds. A dependent parent may also receive a share. How Is a Wrongful Death Settlement Divided Under California Law? ehlinelaw.com ? blog ? how-is-a-wrongful-death-... ehlinelaw.com ? blog ? how-is-a-wrongful-death-...

Are Wrongful Death Settlements Taxable? In most cases, your settlement is not considered taxable income. However, you may have to pay taxes for the portion of your settlement concerning compensation received for: Medical expenses you have deducted in previous tax years. Wrongful Death Lawsuits in Ohio cfbjs.com ? our-blog ? march ? wrongful-d... cfbjs.com ? our-blog ? march ? wrongful-d...

Gathering strong, convincing evidence like medical records, autopsy reports, witness testimonies, and financial documents is key in a wrongful death case.

Ohio law governs the distribution of wrongful death compensation. This statute ensures that the surviving family members receive a fair and equitable share of the damages. Typically, the compensation is distributed to the surviving beneficiaries, presumably the spouse, children, and parents of the deceased. What Is the Average Wrongful Death Settlement In Ohio? bensingerlegal.com ? legal-blog ? average-wrongf... bensingerlegal.com ? legal-blog ? average-wrongf...

Ohio law requires the personal representative of the deceased person's estate to file a wrongful death action in court. The probate court may appoint someone to handle the estate. This is true unless the decedent named a personal representative in his or her will.

You do not have to prove wrongful death beyond a reasonable doubt. Instead, you must prove it is at least 51 percent likely the death was wrongful; this burden of proof is called the ?preponderance of the evidence.? What Are The Elements of a Successful Wrongful Death Claim? gjel.com ? wrongful-death-lawyers ? the-ele... gjel.com ? wrongful-death-lawyers ? the-ele...