Ohio Term Royalty Deed that Terminates Upon Expiration of Lease

Description

How to fill out Term Royalty Deed That Terminates Upon Expiration Of Lease?

Are you currently inside a position in which you require paperwork for possibly enterprise or person uses nearly every day time? There are a variety of authorized record templates available on the Internet, but discovering ones you can rely on isn`t simple. US Legal Forms provides a huge number of type templates, just like the Ohio Term Royalty Deed that Terminates Upon Expiration of Lease, which can be composed to satisfy federal and state demands.

If you are already informed about US Legal Forms web site and possess a merchant account, merely log in. Next, you are able to download the Ohio Term Royalty Deed that Terminates Upon Expiration of Lease design.

Unless you come with an bank account and need to begin to use US Legal Forms, follow these steps:

- Get the type you want and make sure it is for your right area/state.

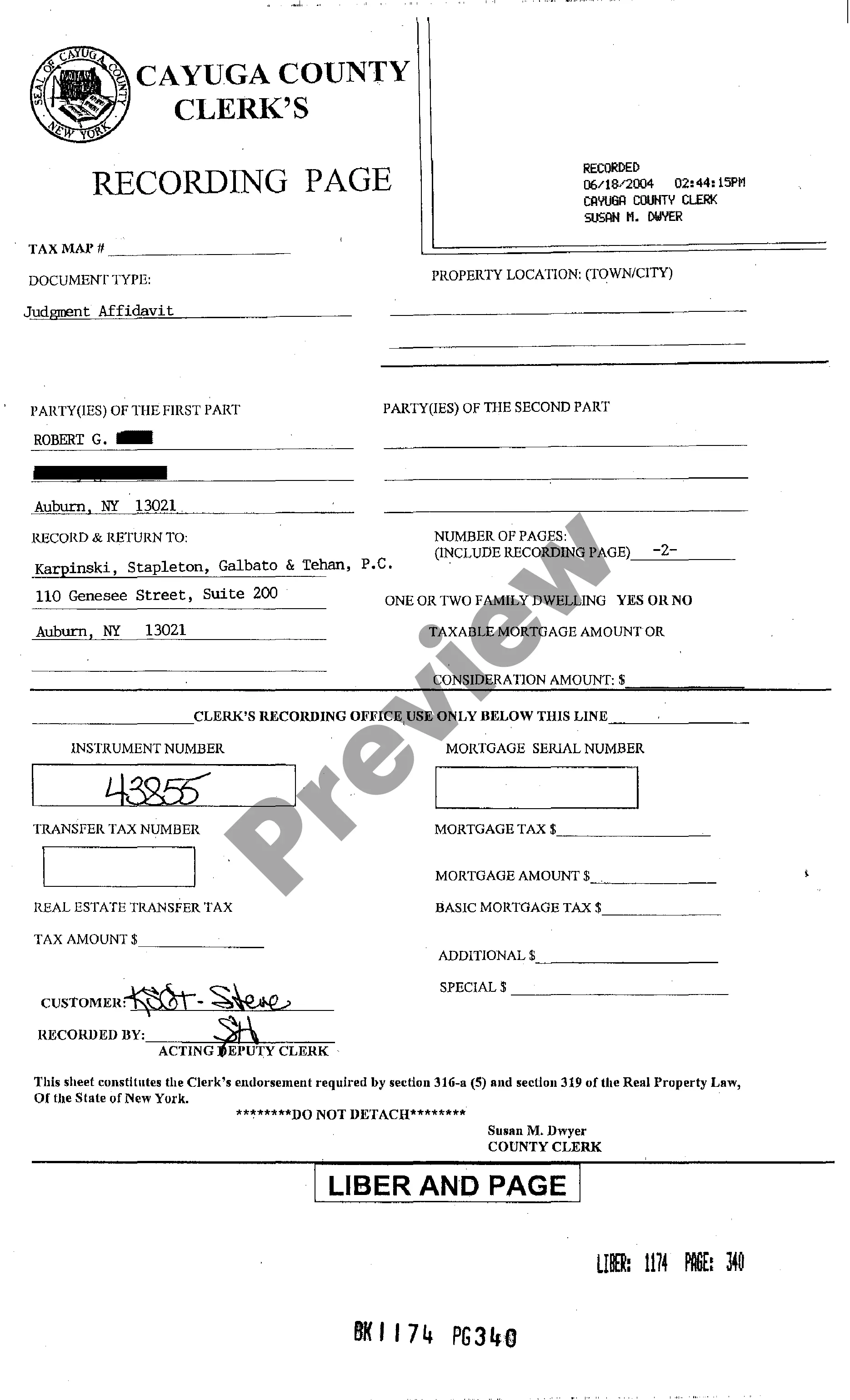

- Make use of the Preview key to analyze the form.

- See the explanation to ensure that you have chosen the right type.

- If the type isn`t what you are searching for, make use of the Look for discipline to discover the type that meets your needs and demands.

- If you discover the right type, just click Acquire now.

- Opt for the costs program you would like, fill out the desired information to create your account, and pay money for an order utilizing your PayPal or charge card.

- Choose a practical data file formatting and download your copy.

Discover each of the record templates you might have purchased in the My Forms menu. You can obtain a extra copy of Ohio Term Royalty Deed that Terminates Upon Expiration of Lease anytime, if necessary. Just select the essential type to download or print out the record design.

Use US Legal Forms, by far the most substantial assortment of authorized varieties, to save lots of some time and prevent mistakes. The support provides professionally manufactured authorized record templates which you can use for a variety of uses. Generate a merchant account on US Legal Forms and start producing your life a little easier.

Form popularity

FAQ

Noun. : a deed by which a landowner authorizes exploration for and production of oil and gas on his land usually in consideration of a royalty.

Oil leases are agreements between an oil and gas company known as the lessee and mineral owners known as a lessor, in which the lessor grants the lessee the permission to explore, drill, and produce those minerals for a specified period known as a primary term or as long as the minerals continue to be productive.

As long as the lessee pays the annual rent, the lease remains in effect. This definite period of time is called the primary term. When a company fails to start production, the lease expires after the primary term. When the company starts drilling for oil and gas, the lease will remain in effect past the primary term.

Will My Federal Lease Be Extended? Like virtually all modern oil and gas leases, federal leases have a fixed primary term (typically 10 years)[1] and a habendum (i.e., ?so long thereafter?) clause.

An oil or gas lease is a legal document where a landowner grants an individual or company the right to extract oil or gas from beneath the landowner's property. Courts generally find leases to be legally binding, so it is very important that you understand all the terms of a lease before you sign it.

Ingly, when you see the words ?Paid-Up Lease,? this normally means that you will receive an upfront bonus for which the oil and gas company does not have to do anything during the initial or primary term of the lease.

These basic lease terms ? bonus, royalty, term, delay rental (if any) and shut-in royalty --are typically the "deal terms" negotiated between the Lessor and Lessee. The Lessor typically wants the highest bonus, delay rental and royalty fraction he can get, and the shortest primary term. The Lessee wants the opposite.

Lease fuel: Natural gas used in well, field, and lease operations, such as gas used in drilling operations, heaters, dehydrators, and field compressors.