Ohio Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest

Description

How to fill out Mineral Deed With Grantor Reserving Nonparticipating Royalty Interest?

Are you inside a place in which you need files for either company or person purposes almost every day? There are a variety of legal document themes accessible on the Internet, but finding types you can trust isn`t easy. US Legal Forms offers a huge number of develop themes, like the Ohio Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest, that happen to be published to satisfy state and federal requirements.

If you are already familiar with US Legal Forms website and also have a merchant account, merely log in. Following that, you may down load the Ohio Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest template.

Unless you come with an bank account and need to begin to use US Legal Forms, follow these steps:

- Find the develop you want and ensure it is for your right area/area.

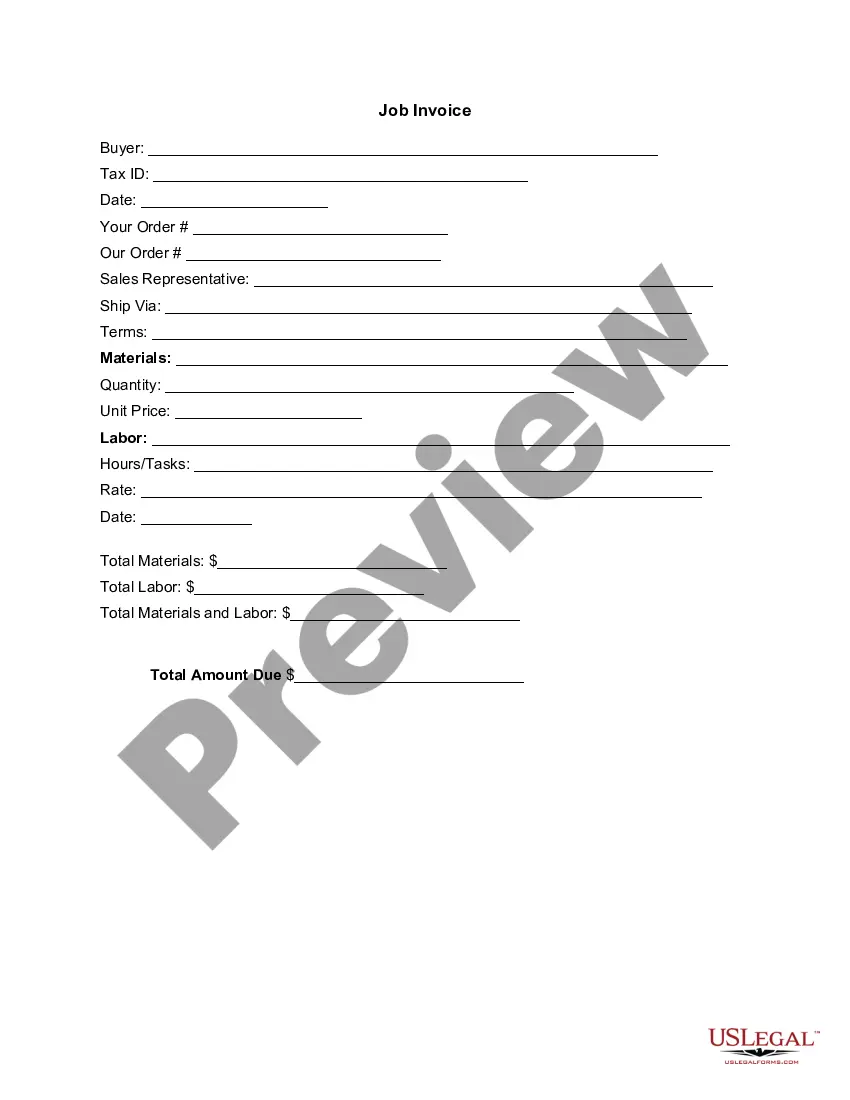

- Take advantage of the Review switch to check the shape.

- Look at the outline to actually have selected the correct develop.

- In case the develop isn`t what you are searching for, take advantage of the Research discipline to obtain the develop that suits you and requirements.

- Once you find the right develop, just click Acquire now.

- Choose the pricing strategy you would like, submit the specified information and facts to generate your money, and purchase the transaction with your PayPal or credit card.

- Select a hassle-free paper structure and down load your version.

Get every one of the document themes you might have bought in the My Forms food list. You can obtain a additional version of Ohio Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest whenever, if required. Just click the required develop to down load or print the document template.

Use US Legal Forms, one of the most extensive collection of legal kinds, to save lots of time as well as prevent blunders. The service offers appropriately made legal document themes that you can use for a variety of purposes. Generate a merchant account on US Legal Forms and commence producing your way of life a little easier.

Form popularity

FAQ

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

Mineral Interest (MI) When the mineral rights are conveyed to another person or entity, they are ?severed? from the land, and a separate chain of title begins. When a person owns less than 100% of the minerals, they are said to own a fractional or undivided mineral interest.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.