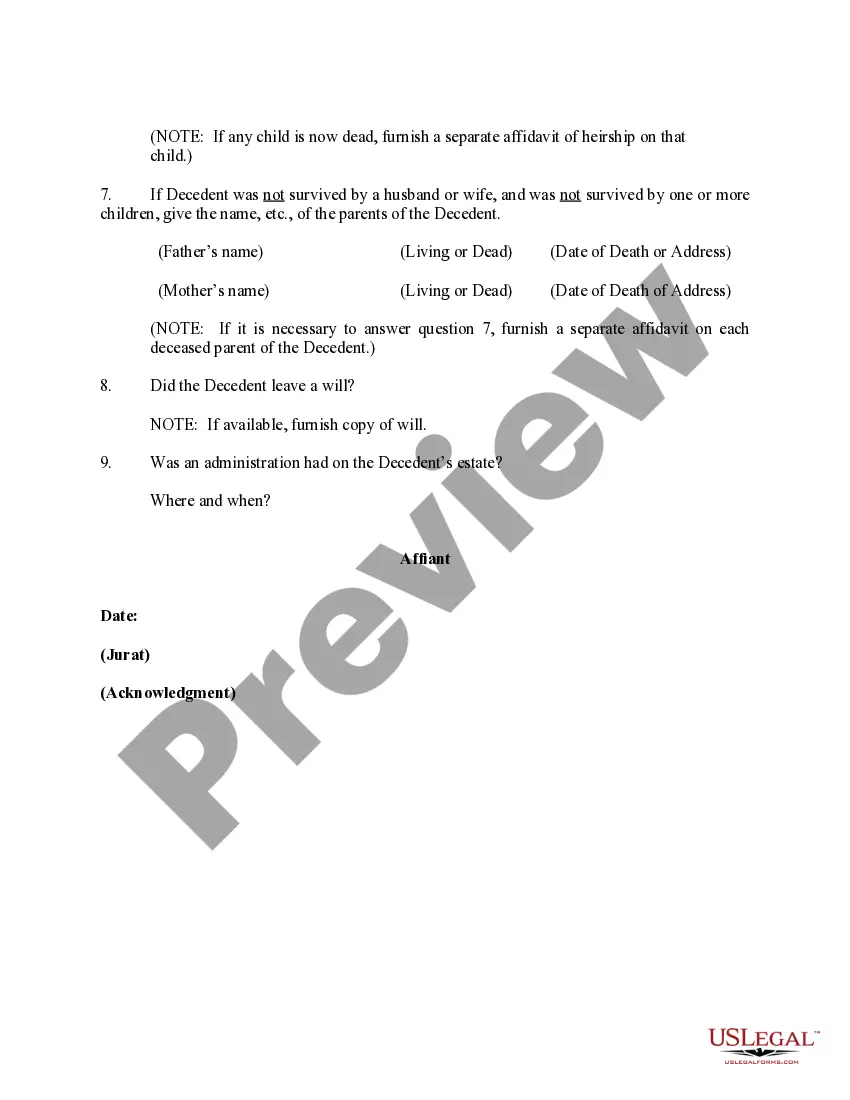

Ohio Affidavit of Heirship for Real Property

Description

How to fill out Affidavit Of Heirship For Real Property?

Choosing the best legitimate papers design might be a battle. Needless to say, there are plenty of web templates available on the net, but how can you find the legitimate type you will need? Use the US Legal Forms website. The assistance offers thousands of web templates, such as the Ohio Affidavit of Heirship for Real Property, which you can use for enterprise and personal requires. Every one of the forms are inspected by experts and fulfill state and federal specifications.

When you are presently registered, log in for your bank account and then click the Download switch to obtain the Ohio Affidavit of Heirship for Real Property. Make use of bank account to look through the legitimate forms you may have purchased formerly. Check out the My Forms tab of your own bank account and have an additional copy in the papers you will need.

When you are a fresh customer of US Legal Forms, here are straightforward recommendations that you should follow:

- Very first, ensure you have selected the appropriate type for your city/area. You can look through the shape utilizing the Preview switch and read the shape information to ensure it is the right one for you.

- If the type will not fulfill your requirements, make use of the Seach area to get the right type.

- When you are certain the shape is suitable, click the Buy now switch to obtain the type.

- Pick the rates prepare you would like and enter the needed information and facts. Design your bank account and purchase an order utilizing your PayPal bank account or bank card.

- Select the submit format and obtain the legitimate papers design for your product.

- Complete, modify and print out and signal the received Ohio Affidavit of Heirship for Real Property.

US Legal Forms is the largest local library of legitimate forms in which you can discover various papers web templates. Use the company to obtain expertly-created files that follow status specifications.

Form popularity

FAQ

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so.

FAQ Download the legal heir certificate form from your local court or from the official website of your state. Read the instructions carefully before filling out the form. Fill out the basic information such as name, address, contact details, and relationship to the deceased.

Unlike the affidavit of heirship, the small estate affidavit only transfers the title of the decedent's homestead. Only a surviving spouse or minor child can inherit property through this affidavit type. The other types of the deceased person's real property cannot be transferred by submitting a small estate affidavit.

In situations, where heirs cannot be easily identified an Heirship Determination has to be filed with the Probate Court. However, for mineral interest rights it is very common to see an affidavit of heirship filed with the County recorder to determine who is entitled to receive oil & gas compensation.

An heir is someone who is set to inherit the property of the deceased when no will or testament has been made. A beneficiary is someone who was chosen by the deceased to inherit their property as laid out in a will or testament. An heir is typically a close living relative whereas a beneficiary can be anyone.

In this situation, an heir can simply file what is called an affidavit of heirship with the court. You may find this form on your state court website or through the court clerk's office, or you may need to have an attorney or legal services firm create one for you.

If no Puerto Rican will exists, then the court will issue a resolution declaring who are the heirs, commonly known as a "Declaratoria de Herederos". There is a possibility that an additional hearing may be needed before the judge can decide who are the heirs. If so, the judge will schedule one.

The Declaration of Heirs aims to legally establish the quality of heirs who succeed in an inheritance, establishing their legitimacy to proceed to the division of that inheritance. As a rule, the declaration is made to designate the heirs; and not some legatees who also succeed in that inheritance.