Ohio Letter Confirming Nonconfidentiality of Information

Description

How to fill out Ohio Letter Confirming Nonconfidentiality Of Information?

Discovering the right lawful record web template could be a have a problem. Needless to say, there are tons of layouts available on the Internet, but how would you discover the lawful type you want? Make use of the US Legal Forms website. The support delivers 1000s of layouts, for example the Ohio Letter Confirming Nonconfidentiality of Information, which you can use for enterprise and personal requires. All of the types are checked out by specialists and satisfy state and federal requirements.

In case you are presently registered, log in to the accounts and then click the Download key to have the Ohio Letter Confirming Nonconfidentiality of Information. Make use of accounts to check through the lawful types you have bought previously. Visit the My Forms tab of your own accounts and have an additional backup of your record you want.

In case you are a fresh consumer of US Legal Forms, here are easy directions that you should adhere to:

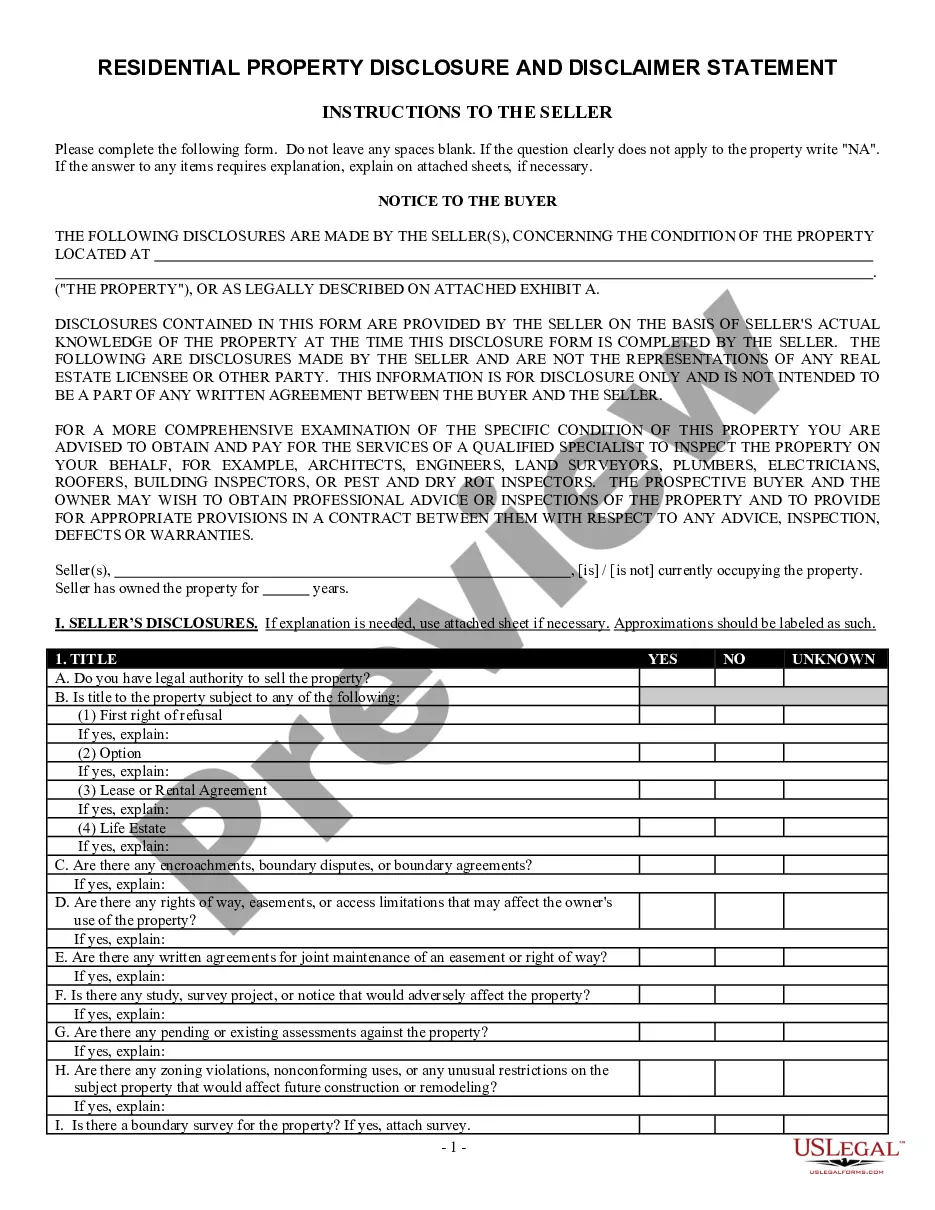

- Initially, ensure you have chosen the correct type to your city/county. It is possible to check out the form utilizing the Review key and read the form information to guarantee it will be the best for you.

- If the type fails to satisfy your preferences, use the Seach field to discover the proper type.

- Once you are sure that the form would work, select the Purchase now key to have the type.

- Choose the costs prepare you would like and type in the needed information and facts. Make your accounts and pay for your order with your PayPal accounts or bank card.

- Select the document structure and download the lawful record web template to the gadget.

- Full, revise and printing and indicator the attained Ohio Letter Confirming Nonconfidentiality of Information.

US Legal Forms will be the most significant collection of lawful types for which you can discover various record layouts. Make use of the company to download expertly-manufactured paperwork that adhere to state requirements.

Form popularity

FAQ

The Identity Confirmation Quiz is one of the tools the Department has implemented. You may also mail all requested information that is applicable to your return. Refer to your Quiz letter. Note: The quiz verifies your identity and confirms the return we received was filed by you or on your behalf.

Ohio Income Tax Tables. For tax year 2022, Ohio's individual income tax brackets have been modified so that individuals with Ohio taxable nonbusiness income of $26,050 or less are not subject to income tax. Additionally, Ohio taxable nonbusiness income in excess of $115,300 is taxed at 3.99%.

NOTE: For information on paying a tax debt or other debt owed to the state of Ohio, please contact the Attorney General's Collections Enforcement Section online or by calling 877-607-6400.

You'll know that another person filed a tax return in your name if you try to file and the IRS rejects your return. The IRS will explain in the rejection that a return associated with your Social Security Number has already been filed. Why would someone do this? In extremely rare cases, it could be accidental.

The Ohio Department of Taxation provides a tool that allows you to check the status of your income tax refund online. You can also call the department's individual taxpayer helpline at 1-800-282-1784.

The Ohio Department of Taxation provides a tool that allows you to check the status of your income tax refund online. You can also call the department's individual taxpayer helpline at 1-800-282-1784.

Whether you file your returns electronically or by paper, you can pay by electronic check or credit/debit card via ODT's OH|TAX eServices (registration is required) or Guest Payment Service (no registration is required).

You received an identity verification letter because an Ohio income tax return was filed OR an OH|TAX eServices account was created using your SSN. You should check with your spouse or tax preparer to ensure an Ohio return was not legitimately filed or an OH|TAX eServices account was not created on your behalf.