This form is used when the Assignor transfers, assigns, and conveys to Assignee, as a production payment, a percentage of 8/8 of all oil, gas, and other minerals produced and saved from the Lands under the terms of the Lease and any renewals or extensions of the Lease which are obtained by Assignor or Assignor's successors and/or assigns.

Ohio Assignment of Production Payment by Lessee to Third Party

Description

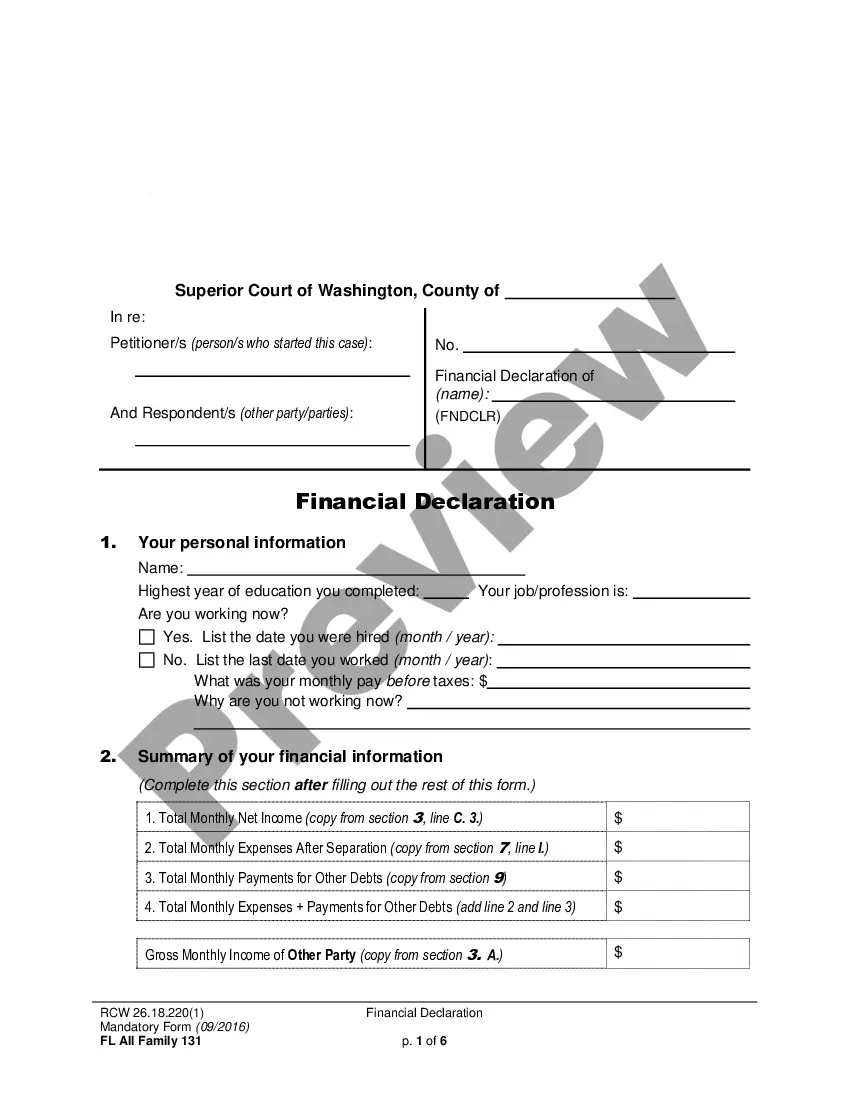

How to fill out Assignment Of Production Payment By Lessee To Third Party?

Have you been in the placement in which you need paperwork for possibly enterprise or personal reasons almost every day? There are a lot of legal document web templates available online, but discovering ones you can depend on is not straightforward. US Legal Forms provides a large number of develop web templates, much like the Ohio Assignment of Production Payment by Lessee to Third Party, that are composed to satisfy state and federal requirements.

Should you be previously informed about US Legal Forms web site and get a merchant account, simply log in. Afterward, it is possible to download the Ohio Assignment of Production Payment by Lessee to Third Party template.

Should you not come with an profile and need to begin to use US Legal Forms, follow these steps:

- Find the develop you will need and ensure it is to the correct city/county.

- Make use of the Preview option to review the form.

- Look at the description to actually have chosen the appropriate develop.

- If the develop is not what you are trying to find, use the Search discipline to discover the develop that fits your needs and requirements.

- Whenever you obtain the correct develop, simply click Purchase now.

- Opt for the prices strategy you desire, submit the desired info to produce your money, and pay money for an order utilizing your PayPal or charge card.

- Choose a hassle-free data file file format and download your version.

Get all of the document web templates you have bought in the My Forms menu. You can aquire a more version of Ohio Assignment of Production Payment by Lessee to Third Party at any time, if required. Just select the needed develop to download or printing the document template.

Use US Legal Forms, the most extensive selection of legal varieties, in order to save some time and stay away from blunders. The support provides skillfully made legal document web templates that you can use for a selection of reasons. Generate a merchant account on US Legal Forms and begin making your daily life easier.

Form popularity

FAQ

Total operated basis: The total reserves or production associated with the wells operated by an individual operator. This is also commonly known as the "gross operated" or "8/8ths" basis.

ASSIGNMENT: The legal instrument whereby Oil and Gas Leases or Overriding Royalty interests are assigned or conveyed. ASSIGNMENT CLAUSE: A clause in any legal instrument that allows either party to the contract to assign all or part of his or her interest to others.

Wellbore. An assignment can be limited to the wellbore of a well. A wellbore limitation means that the assignor is assigning only those rights to production from the wellbore of a certain well, arguably at the total depth it existed at the time of the assignment.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

Lessor may sell or assign its rights and interests or grant a security interest in this Lease and the Equipment for purposes of securing loans to Lessor or otherwise, and may also sell and assign its title and interest as owner of the Equipment and/or as Lessor under this Lease.

Any partial assignment of any lease shall segregate the assigned and retained portions thereof, and as above provided, release and discharge the assignor from all obligations thereafter accruing with respect to the assigned lands; and such segregated leases shall continue in full force and effect for the primary term ...