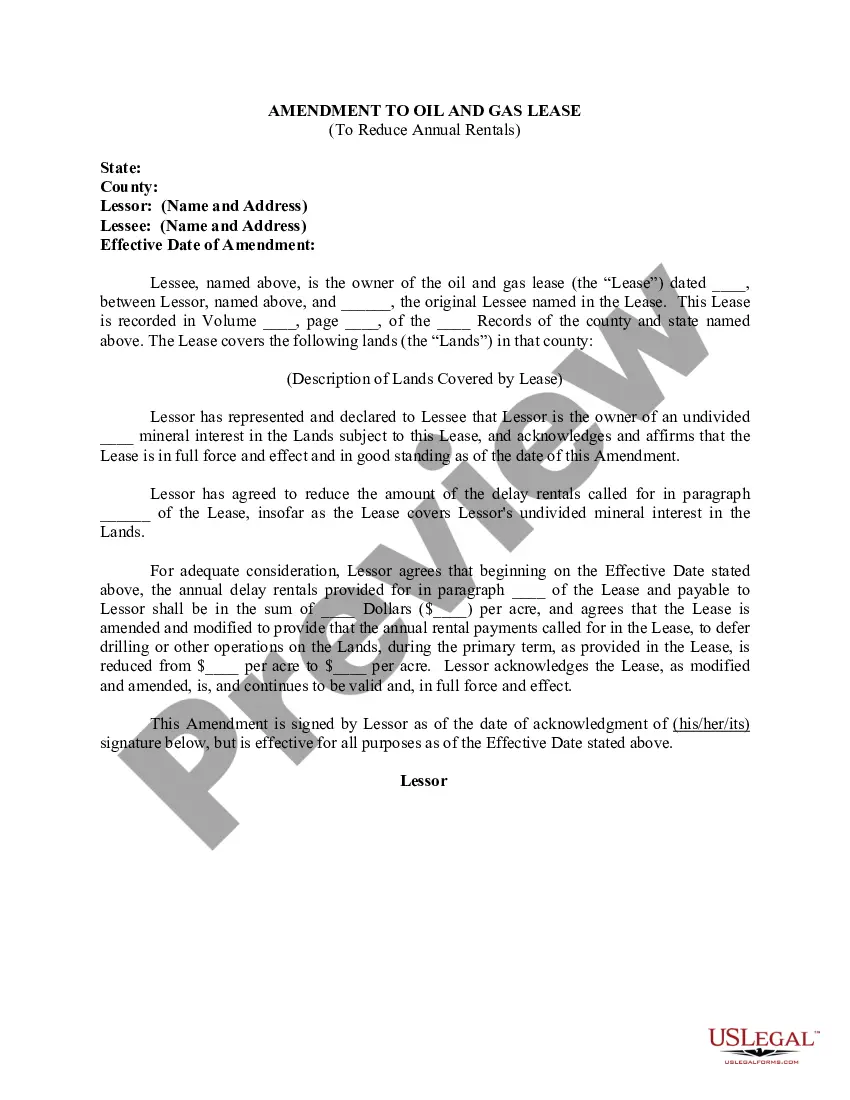

This form is used when the Lessor and Lessee desire to amend the description of the Lands subject to the Lease by dividing the Lands into separate tracts, with each separate tract being deemed to be covered by a separate and distinct oil and gas lease even though all of the lands are described in the one Lease.

Ohio Amendment to Oil and Gas Lease to Reduce Annual Rentals

Description

How to fill out Amendment To Oil And Gas Lease To Reduce Annual Rentals?

Finding the right lawful record template could be a have a problem. Obviously, there are a lot of web templates available on the Internet, but how would you get the lawful develop you will need? Use the US Legal Forms website. The assistance gives thousands of web templates, for example the Ohio Amendment to Oil and Gas Lease to Reduce Annual Rentals, that can be used for enterprise and private needs. Each of the types are checked out by professionals and meet federal and state needs.

If you are presently registered, log in to your bank account and then click the Obtain option to obtain the Ohio Amendment to Oil and Gas Lease to Reduce Annual Rentals. Make use of your bank account to check with the lawful types you have bought earlier. Proceed to the My Forms tab of your bank account and have one more version of the record you will need.

If you are a whole new customer of US Legal Forms, allow me to share easy instructions that you can follow:

- Very first, ensure you have chosen the appropriate develop for your personal metropolis/state. You can look through the form utilizing the Preview option and read the form outline to make certain this is the best for you.

- When the develop fails to meet your needs, utilize the Seach field to obtain the right develop.

- When you are certain that the form would work, click on the Buy now option to obtain the develop.

- Pick the pricing strategy you need and enter the needed information and facts. Design your bank account and purchase the order using your PayPal bank account or bank card.

- Select the data file format and acquire the lawful record template to your product.

- Total, change and print out and signal the obtained Ohio Amendment to Oil and Gas Lease to Reduce Annual Rentals.

US Legal Forms is the largest library of lawful types for which you can find numerous record web templates. Use the service to acquire expertly-produced documents that follow state needs.

Form popularity

FAQ

A proportionate-reduction clause, also known as a lesser-interest clause, is a provision in an oil-and-gas lease that allows the lessee to reduce payments proportionately if the lessor owns less than 100% of the mineral interest.

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

Negotiating an oil and gas lease will require some research upfront. If you're a landowner interested in working with an oil and gas company, you should explore their history and experience. You'll want to work with a reputable company that works in your best interests, holds a high standard, and maintains insurance.

Ingly, when you see the words ?Paid-Up Lease,? this normally means that you will receive an upfront bonus for which the oil and gas company does not have to do anything during the initial or primary term of the lease.

Below are seven of the most important things that you should do to be successful as you work on oil and gas deals with companies. Don't Focus on Price Only. ... Practice Patience. Patience is a virtue, especially when it comes to making a deal in the oil and gas business. ... Never show your hand. ... Delete The Warranty Clause.

These basic lease terms ? bonus, royalty, term, delay rental (if any) and shut-in royalty --are typically the "deal terms" negotiated between the Lessor and Lessee. The Lessor typically wants the highest bonus, delay rental and royalty fraction he can get, and the shortest primary term. The Lessee wants the opposite.

Many owners wonder what's a ?good? oil and gas lease royalty is. It depends on several factors, but in general you should be able to lease your oil and gas mineral rights for between 17% and 25%.