Ohio Assignment of Oil and Gas Leases when Producing with Reservation of Production Payment

Description

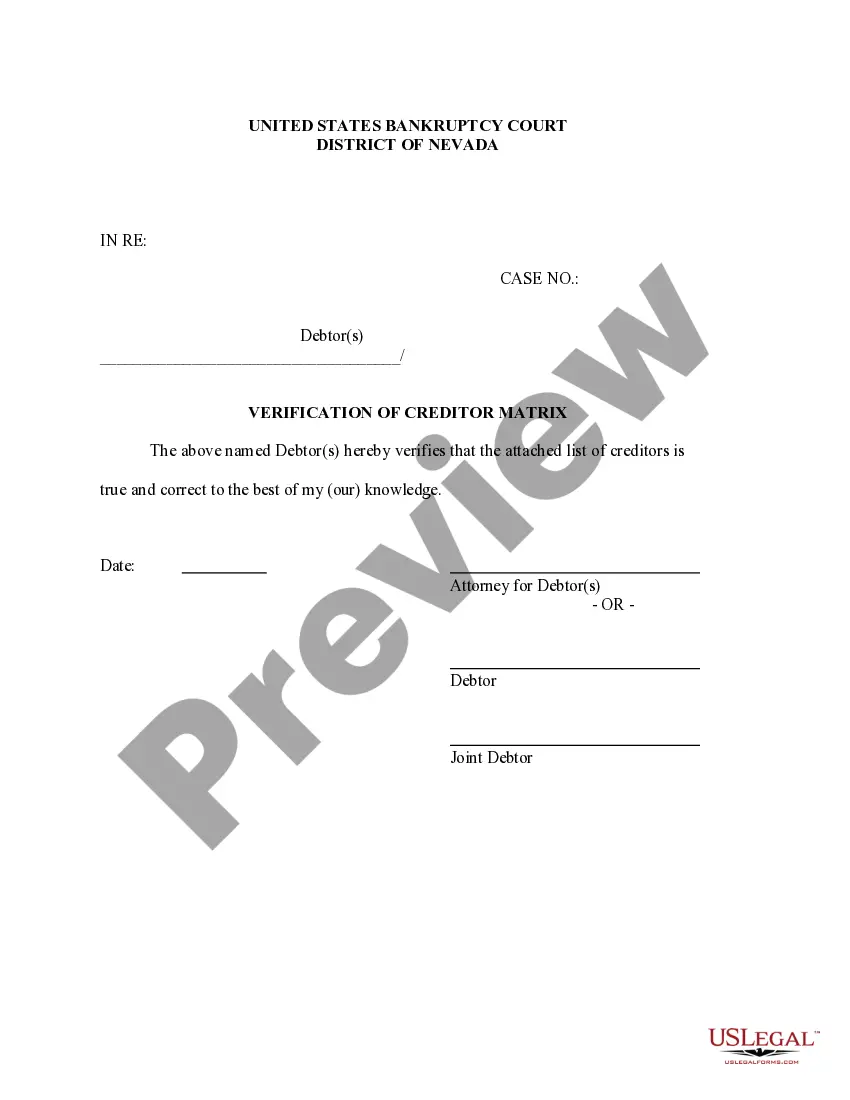

How to fill out Assignment Of Oil And Gas Leases When Producing With Reservation Of Production Payment?

US Legal Forms - one of the largest libraries of lawful varieties in the United States - offers a wide array of lawful document web templates you are able to obtain or printing. Utilizing the internet site, you can find a large number of varieties for enterprise and individual purposes, categorized by categories, suggests, or keywords.You can get the latest models of varieties such as the Ohio Assignment of Oil and Gas Leases when Producing with Reservation of Production Payment within minutes.

If you have a membership, log in and obtain Ohio Assignment of Oil and Gas Leases when Producing with Reservation of Production Payment in the US Legal Forms collection. The Obtain button will show up on every single form you look at. You get access to all previously delivered electronically varieties inside the My Forms tab of your profile.

In order to use US Legal Forms the very first time, allow me to share simple recommendations to help you started off:

- Make sure you have picked the right form for your personal town/region. Click on the Review button to analyze the form`s articles. Look at the form description to actually have chosen the right form.

- In case the form doesn`t satisfy your needs, utilize the Search industry near the top of the screen to find the the one that does.

- Should you be satisfied with the shape, verify your decision by clicking the Acquire now button. Then, choose the prices strategy you prefer and give your accreditations to register for an profile.

- Method the purchase. Utilize your bank card or PayPal profile to complete the purchase.

- Select the formatting and obtain the shape on your own product.

- Make modifications. Complete, revise and printing and sign the delivered electronically Ohio Assignment of Oil and Gas Leases when Producing with Reservation of Production Payment.

Every design you added to your account lacks an expiration day which is yours for a long time. So, in order to obtain or printing another backup, just proceed to the My Forms segment and then click on the form you will need.

Get access to the Ohio Assignment of Oil and Gas Leases when Producing with Reservation of Production Payment with US Legal Forms, the most extensive collection of lawful document web templates. Use a large number of specialist and condition-specific web templates that fulfill your small business or individual requirements and needs.

Form popularity

FAQ

The oil and gas business; assignments are the documents used. to accomplish transfers of lease rights .1./ Although the. common form of assignment may appear to be a rather simple. document, the respective rights and obligations of the parties.

The period of time in the life of an oil & gas lease that begins after the expiration of the primary term. Production, operations, continuous drilling, or shut-in royalty payments are most often used to extend an oil & gas lease into its secondary term.

If the owner of the mortgaged property was entitled to oil and gas royalties before the foreclosure sale, the oil or gas royalties shall be paid to the purchaser of the foreclosed property.

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

The Term of Your Oil and Gas Lease As a starting point, the typical term of an oil and gas lease in West Virginia, Ohio, and Pennsylvania is 5 years. The time starts on this 5 years on the date you sign your lease (even though you will likely have to wait 120 days or more to receive your bonus payment).

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

"Held by production" is a provision in an oil or natural gas property lease that allows the lessee, generally an energy company, to continue drilling activities on the property as long as it is economically producing a minimum amount of oil or gas.