Ohio Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands

Description

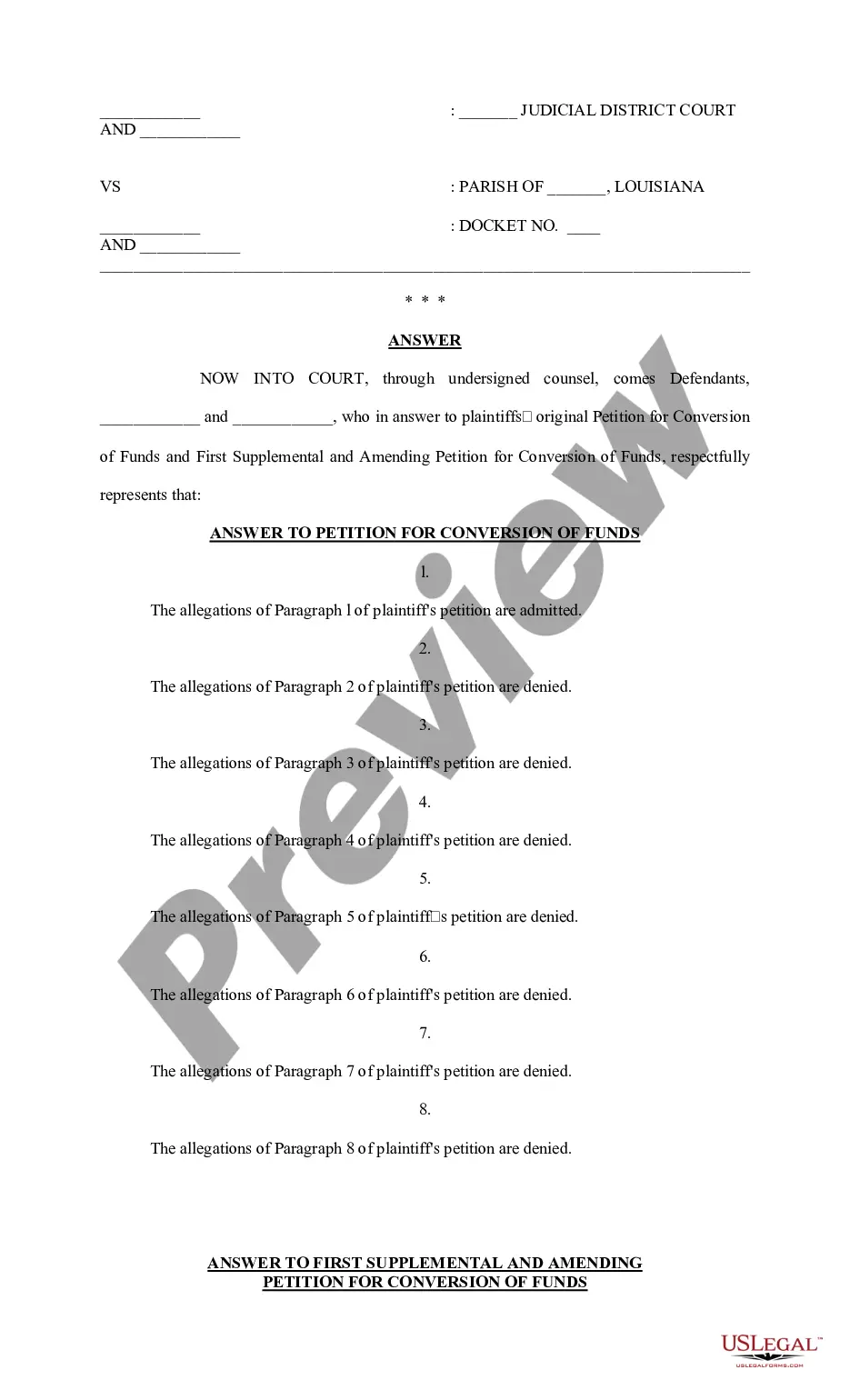

How to fill out Stipulation Of Ownership Of Mineral Interest Of Mineral Ownership In Specific Lands?

US Legal Forms - one of the biggest libraries of legal varieties in the United States - offers an array of legal papers themes you can acquire or produce. Making use of the website, you may get a huge number of varieties for company and personal reasons, sorted by types, states, or keywords and phrases.You can find the newest types of varieties like the Ohio Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands in seconds.

If you already have a subscription, log in and acquire Ohio Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands in the US Legal Forms catalogue. The Obtain key will appear on every single form you see. You have access to all previously acquired varieties in the My Forms tab of the profile.

If you want to use US Legal Forms for the first time, here are simple guidelines to help you get began:

- Be sure to have chosen the proper form for the town/area. Click the Review key to check the form`s information. Look at the form description to ensure that you have chosen the right form.

- If the form does not suit your demands, take advantage of the Lookup industry on top of the display screen to obtain the the one that does.

- Should you be happy with the form, affirm your choice by clicking the Buy now key. Then, pick the pricing strategy you want and give your credentials to sign up to have an profile.

- Method the deal. Make use of your credit card or PayPal profile to accomplish the deal.

- Select the file format and acquire the form on the device.

- Make modifications. Complete, edit and produce and indication the acquired Ohio Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands.

Every single design you added to your account does not have an expiry particular date and it is your own property eternally. So, if you wish to acquire or produce one more duplicate, just check out the My Forms section and click about the form you will need.

Gain access to the Ohio Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands with US Legal Forms, one of the most considerable catalogue of legal papers themes. Use a huge number of specialist and status-certain themes that fulfill your business or personal requires and demands.

Form popularity

FAQ

Similarly, the Ohio Supreme Court found that the Ohio Legislature enacted the Dormant Mineral Act to provide a method to terminate dormant mineral interests and reunify the abandoned mineral interest with the surface interests in order to promote the use of the minerals under the land.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

Under current Ohio law, unless a severed mineral interest is in coal or is coal related, held by a political body, or a savings event has occurred within the 20 preceding years, a mineral interest will be considered abandoned and vested in the owner of the surface lands, so long as the surface landowner complies with ... mineral rights - OSU Farm Office - The Ohio State University osu.edu ? blog-tags ? mineral-rights osu.edu ? blog-tags ? mineral-rights

If you have non-producing mineral rights and do not receive a royalty check, the value is difficult to determine. You could expect anywhere from $750/acre to $3,000+/acre depending on your location in the county. If you are currently leased, that will also play a role in how much your mineral rights are worth. Value of Mineral Rights in Harrison County Ohio marcellusmineralowners.com ? value-of-mineral-r... marcellusmineralowners.com ? value-of-mineral-r...

You can hire a geologist or land surveyor to help you determine if there's something of value on your land. You can also look at mineral rights listings to see if your property has separate mineral rights for sale. How To Understand Your Mineral Rights | Rocket Mortgage rocketmortgage.com ? learn ? mineral-rights rocketmortgage.com ? learn ? mineral-rights

Whether you have an offer on the table or not, you may have good reasons to sell your mineral rights: To pursue other opportunities. If you have a nonproducing property, you might have to wait years for anything to happen ? and nothing may ever happen, even after multiple leases. Should You Sell Your Mineral Rights? - Bessemer Trust bessemertrust.com ? insights ? a-closer-look... bessemertrust.com ? insights ? a-closer-look...

To find out who own mineral rights in Ohio: Determine the property owner's name and address of the property. You can visit the right county auditor's office online or in-person with the above information to verify the ownership of the property before you begin your research at the county's recorder office.