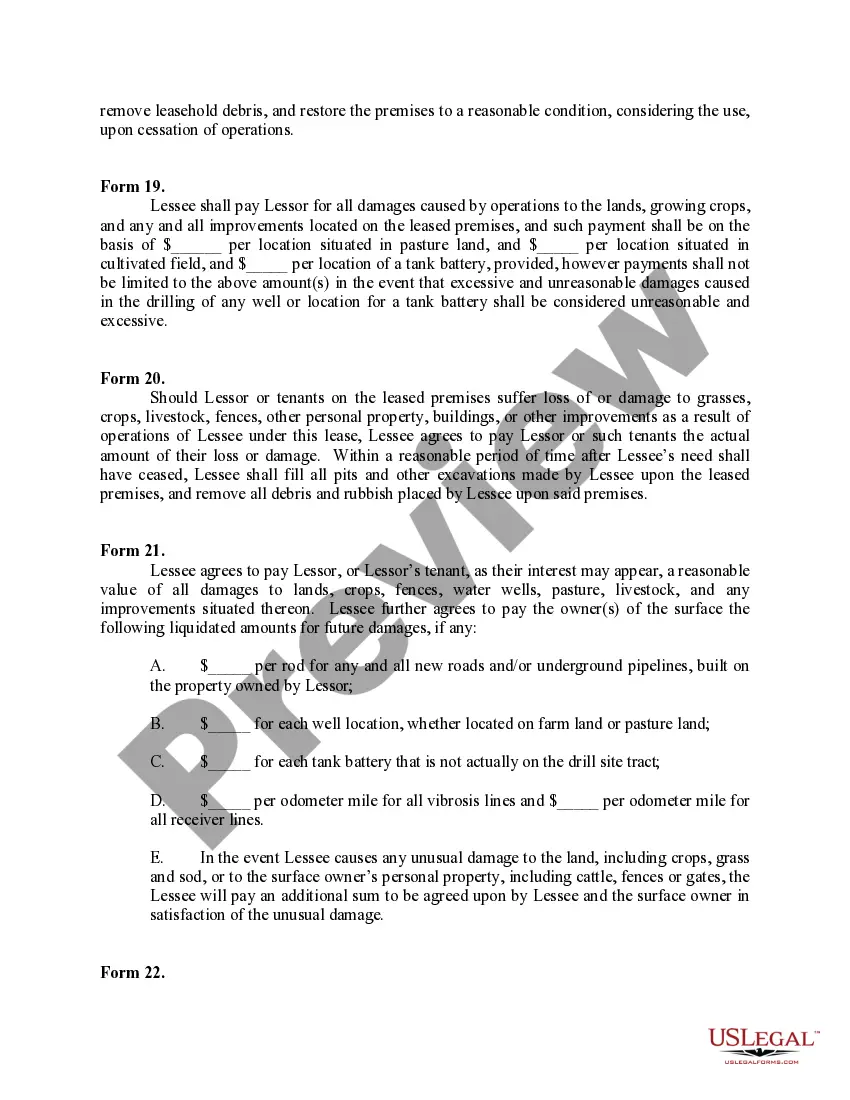

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Ohio Surface Damage Payments

Description

How to fill out Surface Damage Payments?

You may commit time on the web attempting to find the legal document web template which fits the state and federal specifications you will need. US Legal Forms provides a huge number of legal types that are examined by experts. It is possible to obtain or printing the Ohio Surface Damage Payments from our assistance.

If you already possess a US Legal Forms accounts, you can log in and click on the Acquire option. Following that, you can comprehensive, change, printing, or sign the Ohio Surface Damage Payments. Each legal document web template you get is your own eternally. To obtain another duplicate of the acquired type, proceed to the My Forms tab and click on the related option.

If you use the US Legal Forms web site the first time, keep to the easy instructions listed below:

- Initial, ensure that you have chosen the best document web template for your region/area of your choice. See the type outline to ensure you have picked out the appropriate type. If accessible, use the Preview option to appear through the document web template at the same time.

- In order to discover another version in the type, use the Research field to obtain the web template that meets your requirements and specifications.

- When you have discovered the web template you desire, click Buy now to move forward.

- Select the rates program you desire, type your qualifications, and sign up for a free account on US Legal Forms.

- Full the transaction. You should use your bank card or PayPal accounts to purchase the legal type.

- Select the file format in the document and obtain it for your product.

- Make adjustments for your document if needed. You may comprehensive, change and sign and printing Ohio Surface Damage Payments.

Acquire and printing a huge number of document templates using the US Legal Forms website, which provides the largest collection of legal types. Use skilled and condition-distinct templates to tackle your company or personal needs.

Form popularity

FAQ

The federal government does not tax your settlement money since the funds received are intended to compensate you for losses that you endured. This is true both for actual economic damages (such as medical bills and lost wages) and for non-economic damages such as for pain and suffering and emotional distress.

Generally, personal injury awards in California are not subject to taxation because the awards are not considered income. The money a victim receives is theirs to keep, subject to any outstanding liens and limited exceptions.

Some kinds of settlement payments are taxed, while other types of compensation are not. When compensation is subject to tax, it is taxed at the standard income tax brackets. If you receive a large lump sum settlement, you might pay a higher tax rate than you're used to, based on your typical household income.

If you receive a taxable court settlement, you might receive Form 1099-MISC. This form is used to report all kinds of miscellaneous income: royalty payments, fishing boat proceeds, and, of course, legal settlements. Your settlement income would be reported in box 3, for "other income."

Payments for anticipated surface damages (as opposed to payments for loss of surface use) are taxable as ordinary rental income. Easement/right-of-way payments: The tax treatment of these payments can vary depending on the nature of the easement.

Generally, settlement funds and damages received from a lawsuit are taxable income ing to the IRS. Nonetheless, personal injury settlements ? specifically those resulting from car accidents or slip and fall incidents ? are typically exempt from taxes.