Ohio Clauses Relating to Initial Capital contributions

Description

How to fill out Clauses Relating To Initial Capital Contributions?

Are you currently in the place in which you require files for both business or specific purposes just about every day time? There are a lot of legitimate file themes available online, but discovering ones you can rely is not simple. US Legal Forms provides 1000s of develop themes, much like the Ohio Clauses Relating to Initial Capital contributions, that are published in order to meet state and federal needs.

If you are presently informed about US Legal Forms website and get an account, simply log in. Next, you are able to down load the Ohio Clauses Relating to Initial Capital contributions format.

If you do not offer an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you need and make sure it is to the right area/area.

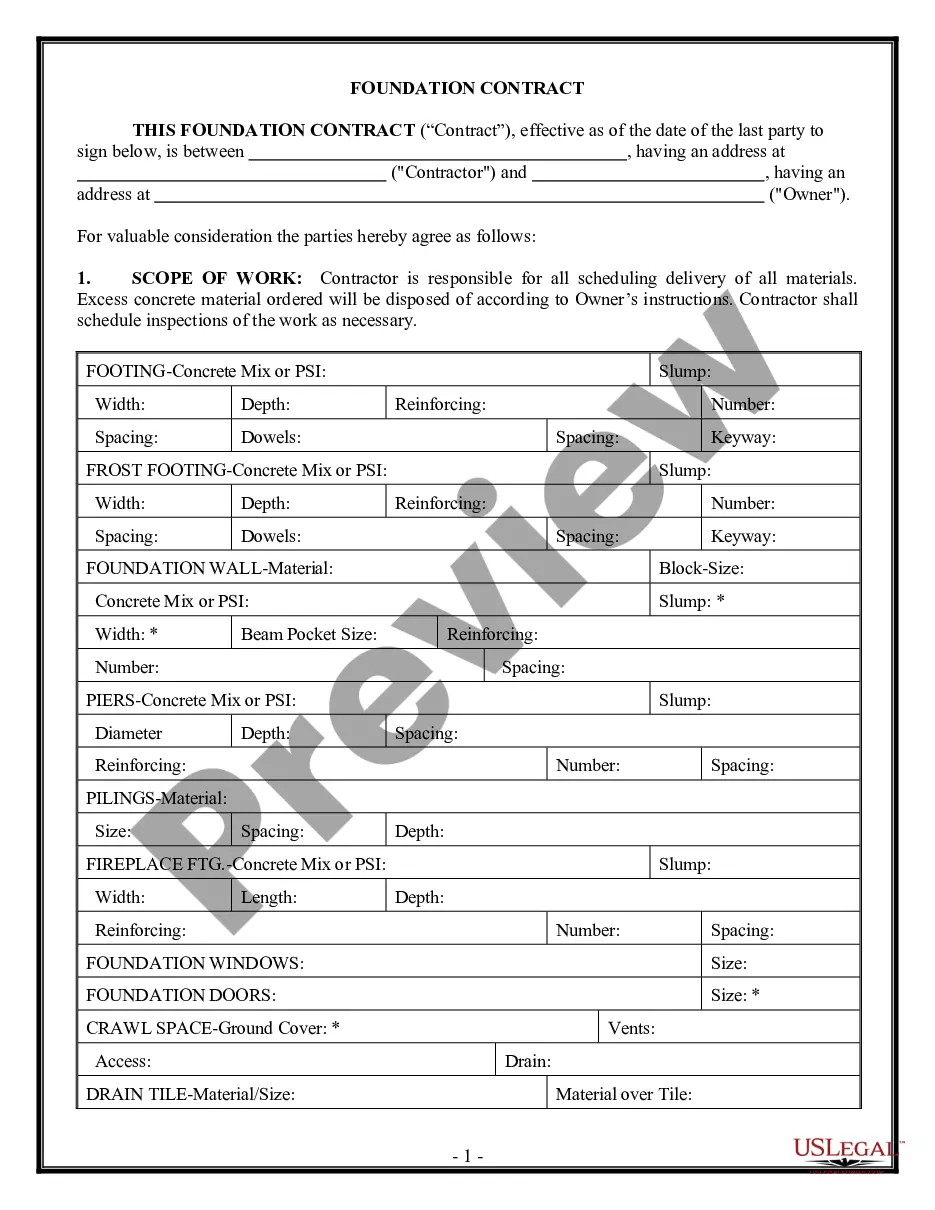

- Take advantage of the Review button to check the shape.

- See the outline to actually have selected the proper develop.

- If the develop is not what you`re searching for, make use of the Look for discipline to obtain the develop that meets your requirements and needs.

- Whenever you get the right develop, simply click Purchase now.

- Choose the pricing plan you would like, fill out the specified information to produce your money, and purchase an order making use of your PayPal or bank card.

- Decide on a hassle-free document format and down load your copy.

Discover each of the file themes you might have bought in the My Forms menu. You can get a further copy of Ohio Clauses Relating to Initial Capital contributions at any time, if needed. Just select the needed develop to down load or print out the file format.

Use US Legal Forms, probably the most extensive assortment of legitimate kinds, to conserve time and avoid faults. The service provides expertly produced legitimate file themes that can be used for a selection of purposes. Create an account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

Ohio Revised Code section 1701.591 requires close corporations to have a close corporation agreement. This agreement must be approved by every single shareholder of the company.

Section 1701.86 | Voluntary dissolution. (A) A corporation may be dissolved voluntarily in the manner provided in this section, provided the provisions of Chapter 1704. of the Revised Code do not prevent the dissolution from being effected.

Harassment is considered any abuse, threats of abuse, stalking, or sexual assault committed by a person that has no familial or romantic attachment with the victim, such as a neighbor, roommate, or friend.

Pursuant to Ohio Revised Code Section 1706.172(D), articles of organization delivered to the Ohio Secretary of State for filing may specify an effective time and a delayed effective date of not more than ninety days following the date of receipt by the Secretary of State.

Pursuant to Ohio Revised Code Section 1706.16, the Secretary of State's office authorizes limited liability companies to conduct business in Ohio. Documents must be filed with the Secretary of State's office before a limited liability company may legally conduct business in Ohio.

Transacting Business without Registration Under the current law, an unregistered limited liability company does not owe a penalty for failing to register with the Ohio Secretary of State, but the entity is prevented from maintaining a lawsuit in Ohio.