Ohio UCC1 Financing Statement

Description Ohio Ucc 1 Form

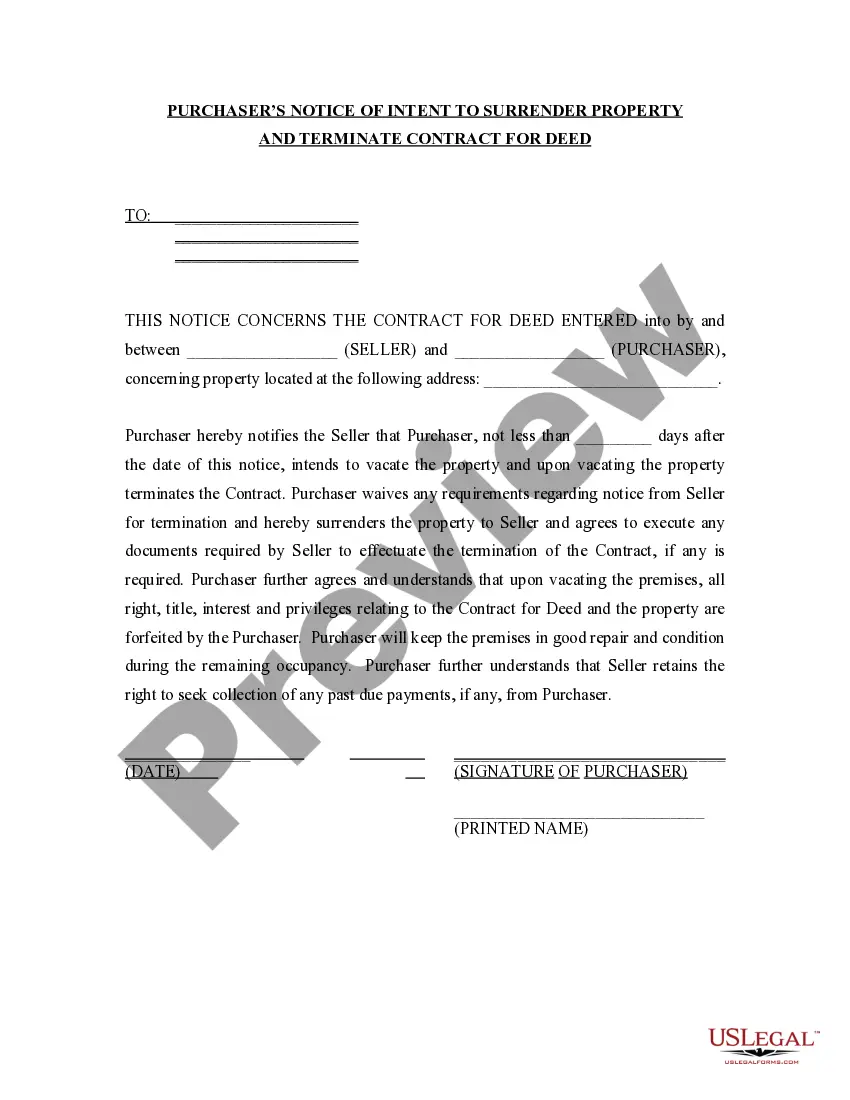

How to fill out What Is Ohio Ucc Statement Request Form?

When it comes to filling out Ohio UCC1 Financing Statement, you almost certainly imagine a long process that consists of finding a perfect sample among a huge selection of similar ones then having to pay legal counsel to fill it out to suit your needs. On the whole, that’s a sluggish and expensive option. Use US Legal Forms and select the state-specific document in a matter of clicks.

For those who have a subscription, just log in and click on Download button to get the Ohio UCC1 Financing Statement template.

If you don’t have an account yet but want one, follow the point-by-point manual listed below:

- Be sure the document you’re saving applies in your state (or the state it’s required in).

- Do so by looking at the form’s description and by clicking on the Preview function (if accessible) to find out the form’s content.

- Simply click Buy Now.

- Find the suitable plan for your financial budget.

- Sign up to an account and select how you want to pay: by PayPal or by card.

- Download the file in .pdf or .docx format.

- Get the record on the device or in your My Forms folder.

Skilled legal professionals draw up our templates to ensure that after saving, you don't need to bother about enhancing content outside of your personal information or your business’s details. Sign up for US Legal Forms and receive your Ohio UCC1 Financing Statement example now.

Ucc Filing Form popularity

Ohio Ucc Search Other Form Names

State Of Ohio Ucc Search FAQ

After receiving your request, the lender has 20 days to terminate the UCC filing.

The notices of the UCC lien filing are public record and often published in the local newspapers, giving notice of the lien. The UCC filing is active for five years, which means that a lender needs to renew the filing to keep interests protected for loan terms extending longer than five years.

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.

UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

UCC-1 Financing Statements are commonly referred to as simply UCC-1 filings. UCC-1 filings are used by lenders to announce their rights to collateral or liens on secured loans and are usually filed by lenders with your state's secretary of state office when a loan is first originated.

Enter your information. The type of information you can use to search UCC filings varies among states. Retrieve your results. The website will return results based on the information you entered. Record financial statement numbers.

A UCC-1 filing is good for five years. After five years, it is considered lapsed and no longer valid.

You can always check the status of UCC filings against your business through your business credit report or searching UCC lien public records.