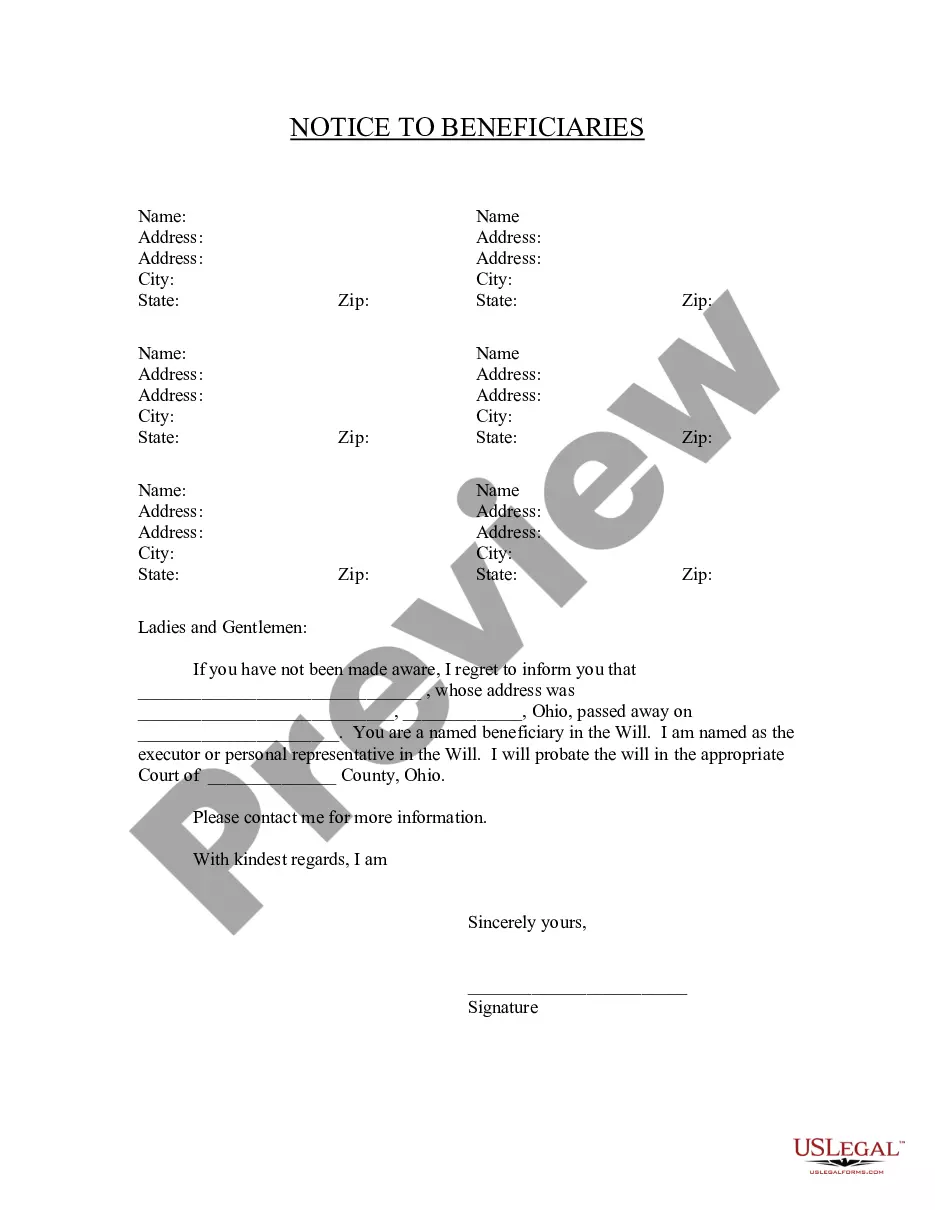

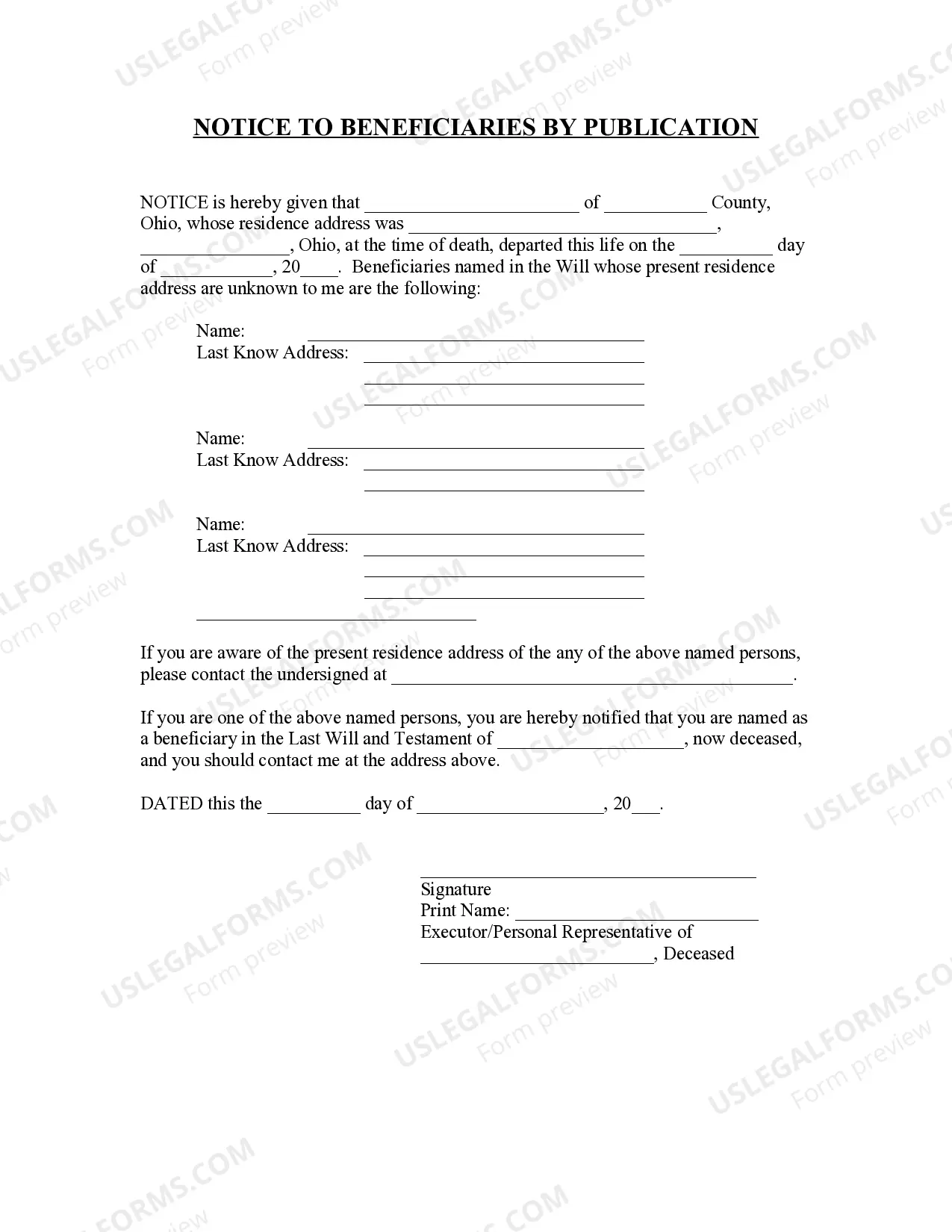

This Notice to Beneficiaries form is for the executor/executrix or personal representative to provide notice to the beneficiaries named in the will of the deceased. A second notice is also provided for publication where the location of the beneficiaries is unknown.

Ohio Notice to Beneficiaries of being Named in Will

Description Beneficiaries Being Named

How to fill out Ohio Notice To Beneficiaries Of Being Named In Will?

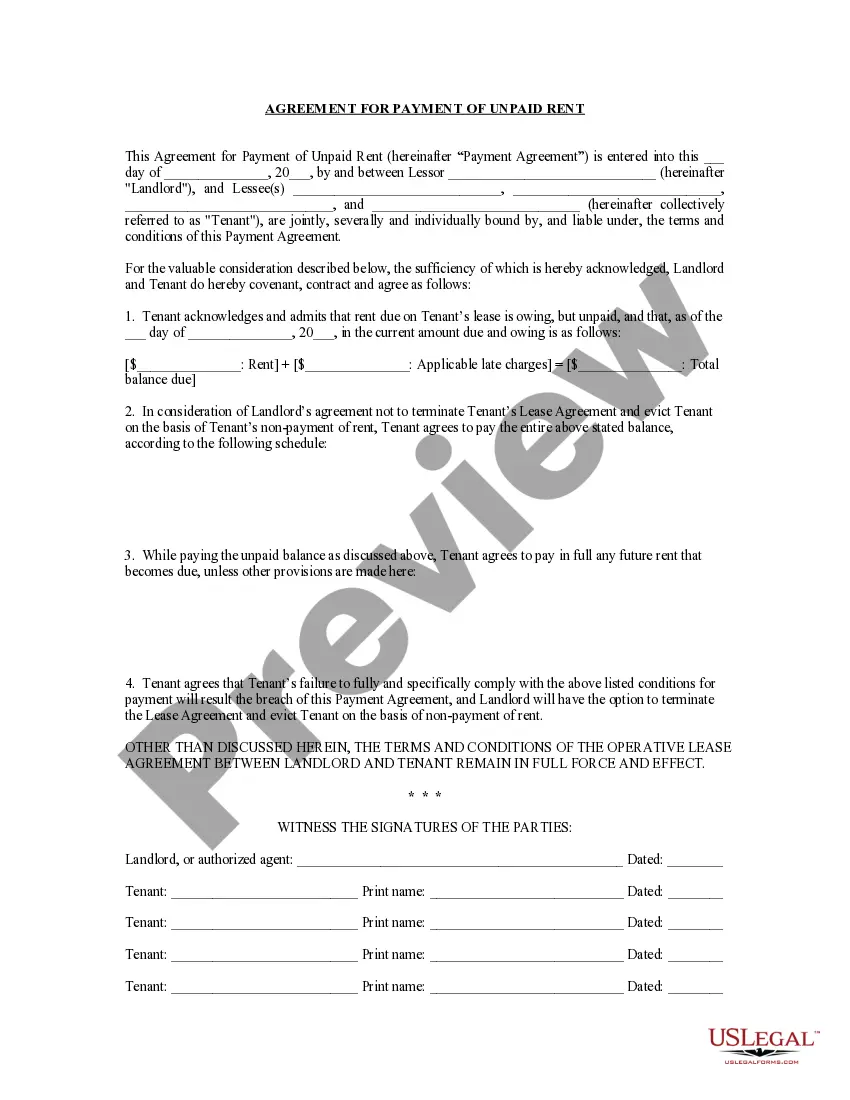

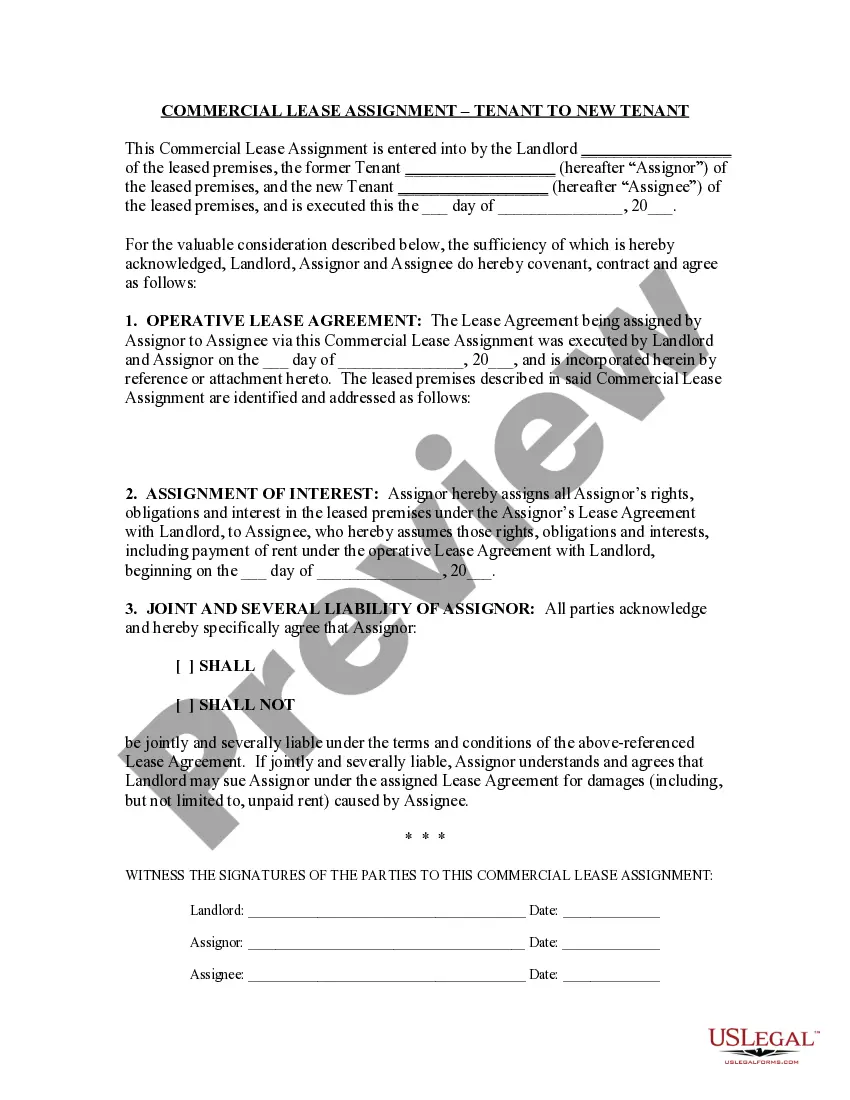

In terms of submitting Ohio Notice to Beneficiaries of being Named in Will, you most likely imagine a long process that involves getting a suitable sample among countless similar ones after which needing to pay out an attorney to fill it out to suit your needs. On the whole, that’s a slow-moving and expensive choice. Use US Legal Forms and select the state-specific template within clicks.

For those who have a subscription, just log in and then click Download to get the Ohio Notice to Beneficiaries of being Named in Will sample.

In the event you don’t have an account yet but want one, keep to the step-by-step guideline listed below:

- Make sure the document you’re saving is valid in your state (or the state it’s needed in).

- Do so by reading the form’s description and also by clicking on the Preview option (if offered) to see the form’s information.

- Click Buy Now.

- Choose the proper plan for your budget.

- Join an account and select how you would like to pay out: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Get the document on your device or in your My Forms folder.

Skilled lawyers work on drawing up our samples so that after saving, you don't have to worry about editing content material outside of your personal information or your business’s information. Be a part of US Legal Forms and get your Ohio Notice to Beneficiaries of being Named in Will sample now.

Address State Ohio Form popularity

Ohio Beneficiaries Will Other Form Names

Will Beneficiary Notification FAQ

If an estate doesn't go through probate and it is a necessary process to transfer ownership of assets, the heirs could sue the executor for failing to do their job. The heirs may not receive what they are entitled to. They may be legally allowed to file a lawsuit to get what they are owed.

Probate is the legal process of administering certain property of a person who has died. Probate will be required any time there is property owned in the sole name of the deceased person, also known as the decedent.Probate is required regardless of the value of the estate.

The Waiver of Notice of Probate of Will is to limit the paperwork necessary in the administration of an estate. If you have absolute confidence in the Executor and the attorney representing him or her, you should sign it to save time, aggravation and...

The time to contest a will in Ohio can be short. If you have received or waived the right to receive the notice of the admission of the will to probate, you have three months after the filing of the certificate of giving notice or waiver of notice to file a will contest.

Will a Probate Proceeding Be Necessary? Generally, only assets that the deceased person owned in his or her name alone go through probate. Everything else can probably be transferred to its new owner without probate court approval. Many common assets do not need to go through probate.

How Long Does Formal Probate Take? Most straightforward probate cases can be wrapped up within about nine months after the executor or administrator is appointed. Creditors have six months to file a claim, so probate must last at least that long.

According to Ohio law and case history, a will is valid if it meets the following requirements: The testator (the person who is leaving the will) must be 18 years of age or older. The testator must be of sound mind. The testator must not otherwise be under restraint or under the undue influence of another person.

In Ohio, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

There is no requirement that a will or property go through probate, but if the decedent owned property that is not arranged specifically to avoid probate, there is no way for the beneficiaries to obtain legal ownership without it.