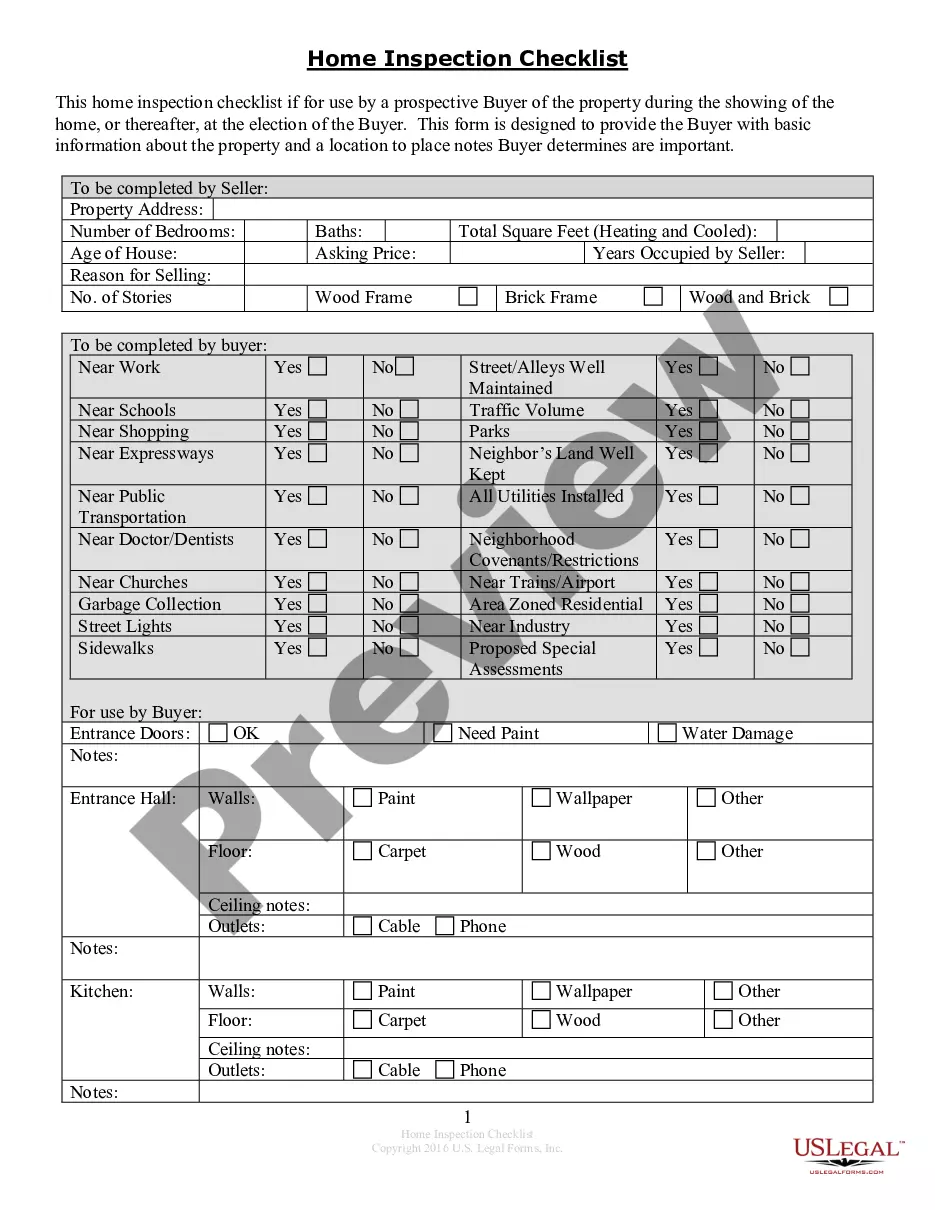

This Buyer's Home Inspection Checklist form is used by the Buyer when initially viewing a home to purchase in Oklahoma. It provides a comprehensive list of items to check or to ask the Seller prior to making an offer on a home. This is an all-inclusive form and not all items may be applicable to the property being viewed.

Oklahoma Buyer's Home Inspection Checklist

Description

- Key Concepts & Definitions

- Home Inspection: A thorough assessment of a property's condition, typically conducted by a certified home inspector to identify any problems before buying a home.

- Inspection Checklist: A list that outlines key areas and items for examination during a home inspection to ensure a comprehensive evaluation of the property.

- Real Estate: Refers to the land along with any permanent improvements attached to the land, whether natural or man-made, including water, trees, minerals, buildings, homes, fences, and bridges.

- Mortgage Rates: The interest rate charged on a mortgage that significantly affects the cost of purchasing a home and the monthly payments.

- Financial Assistance: Various forms of funding provided to homebuyers, typically aimed to help with down payments and closing costs. Often provided by government programs or private organizations.

- Insurance Companies: Organizations that offer coverage to homebuyers to protect against specific potential house-related risks like fire, flood, or theft.

- Refinance Mortgage: The process of replacing an existing mortgage with a new one, typically to get better mortgage terms or to consolidate debt.

- Step-by-Step Guide

- Secure Financial Documents: Ensure you have all necessary documents, which your credit advisor will review, to assess your financial health.

- Hire a Home Inspector: Contract a licensed home inspector with positive reviews and ample experience in residential inspections.

- Review the Inspection Checklist: Go through the checklist to understand areas that will be inspected and to suggest any specific concerns you might have.

- Attend the Home Inspection: Participate in the inspection to gain firsthand knowledge of the home's condition and to ask questions as you go along.

- Analyze the Inspection Report: After the inspection, review the report meticulously to identify any necessary repairs or issues which might influence your purchase decision or mortgage rates.

- Assess Insurance Needs: Contact insurance companies based on the inspection outcomes, to ensure adequate coverage is purchased.

- Evaluate Mortgage Options: Discuss with a credit advisor whether it's a favorable time to lock in mortgage rates or consider options for refinancing the mortgage if you are already a homeowner seeking improvements.

- Risk Analysis

- Skipping Inspections: Avoiding a home inspection can lead to unforeseen repair costs and issues that could have been identified before purchasing.

- Inadequate Coverage: Inadequate insurance coverage can expose homeowners to high out-of-pocket costs in the event of property damage.

- Unstable Mortgage Rates: Fluctuating mortgage rates can affect monthly payments and overall loan cost. Locking in a good rate can be crucial.

- Ignored Recommendations: Not following recommendations from inspections can lead to major costs and impacts on property value and safety.

- FAQ

- What is the purpose of a home inspection? To identify any potential issues with a property before the finalization of a home purchase, ensuring buyers are aware of any risks or necessary repairs.

- Who pays for the home inspection? Typically, the buyer pays for the home inspection, though sometimes costs can be negotiated within purchase agreements to be paid by the seller.

- Can I negotiate home price based on inspection findings? Yes, buyers often use the information from home inspections to negotiate lower sale prices or to have sellers cover repair costs.

- Is it mandatory to have all items on the inspection checklist inspected? While not all items are compulsory, it's advisable to inspect all items for a thorough understanding of the property's condition.

How to fill out Oklahoma Buyer's Home Inspection Checklist?

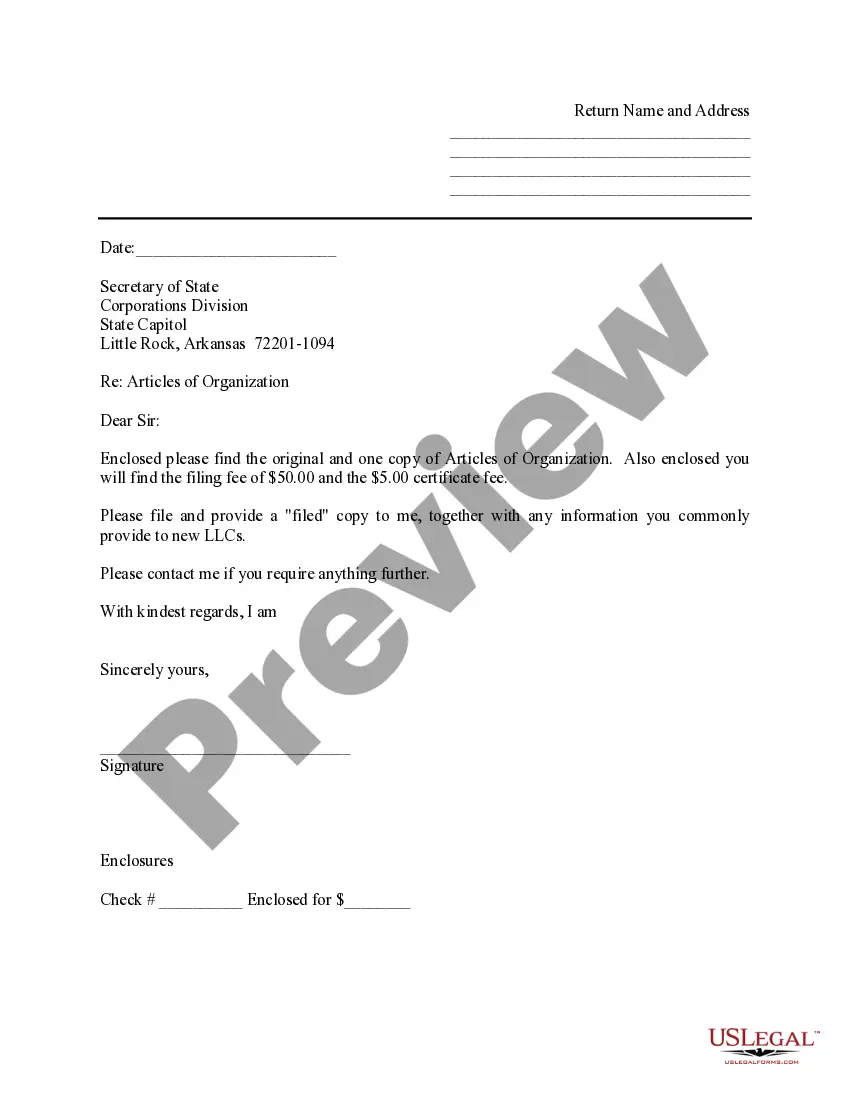

Among lots of paid and free samples that you’re able to find on the internet, you can't be sure about their reliability. For example, who made them or if they’re skilled enough to take care of what you require those to. Keep calm and utilize US Legal Forms! Get Oklahoma Buyer's Home Inspection Checklist samples developed by skilled legal representatives and get away from the expensive and time-consuming process of looking for an attorney and after that paying them to write a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the form you’re seeking. You'll also be able to access all of your earlier downloaded documents in the My Forms menu.

If you’re making use of our platform the first time, follow the instructions below to get your Oklahoma Buyer's Home Inspection Checklist easily:

- Make sure that the document you find is valid in the state where you live.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or find another sample utilizing the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

Once you have signed up and paid for your subscription, you can use your Oklahoma Buyer's Home Inspection Checklist as often as you need or for as long as it remains active where you live. Edit it in your favored offline or online editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

A home inspector will look at things like a home's foundation, structural components, roof, HVAC, plumbing, and electrical systems, then provide a written home inspection report with results.Buyers should attend the inspection so they can explore their new home in detail and ask questions during the process.

Chimney Inspections. Electrical Inspections. Lead-Based Paint. Heating and Air Conditioning. Wood Damage. Foundation Inspections. Pool and Spa Inspections. Roof Inspections.

Problem #1: Rundown roofing. Problem #2: Drainage issues. Problem #3: Faulty foundation. Problem #4: Plumbing problems. Problem #5: Pest infestations. Problem #6: Hidden mold. Problem #7: Failing heating systems. Problem#8: Electrical wiring.

Ask the seller to make the repairs themselves. Ask for credits toward your closing costs. Ask the seller to reduce the sales price to make up for the repairs. Back out of the transaction (if you have an inspection contingency in place) Move forward with the deal.

Top reasons home inspections fail Electrical problems: The most common electrical issues include wiring that's not up to code, frayed wiring, or improperly wired electrical panels. Plumbing issues: Leaky pipes (and resulting water damage), failing water heaters, and sewer system problems are some of the most expensive.

It's a good idea for the buyer to attend the home inspection because it'll be the perfect chance to ask the inspector how the home's various systems work and hear about maintenance. I always encourage the buyer at the beginning of the inspection to share anything that they have questions about, Pretty says.

Common repairs needed after a home inspection Plumbing issues like poor water pressure or leaks. Broken appliances. Roofing (if not categorized as a structural hazard) Drainage issues.

Potential red flags that can arise during a property home inspection include evidence of water damage, structural defects, problems with the plumbing or electrical systems, as well as mold and pest infestations. The presence of one or more of these issues could be a dealbreaker for some buyers.