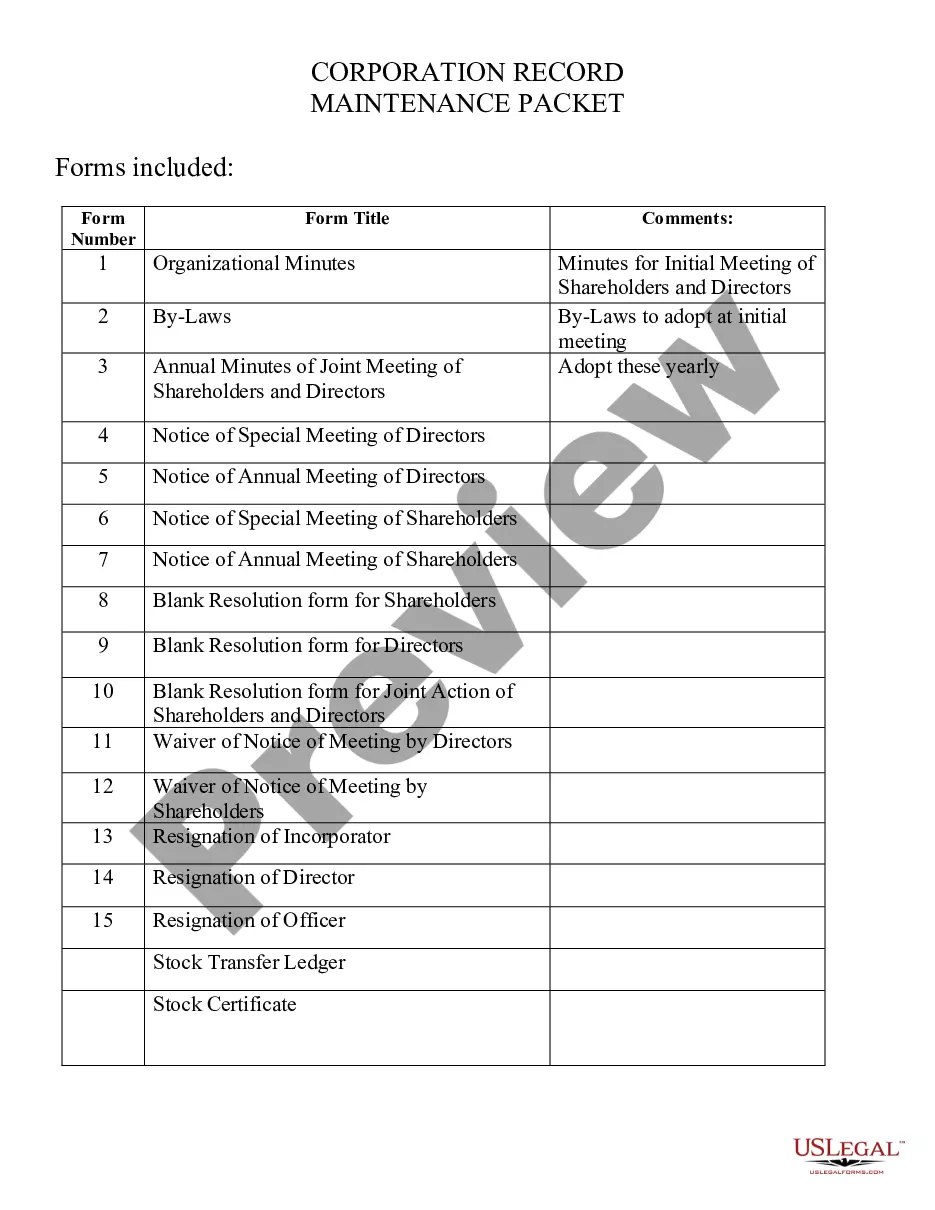

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Oklahoma Business Incorporation Package to Incorporate Corporation

Description

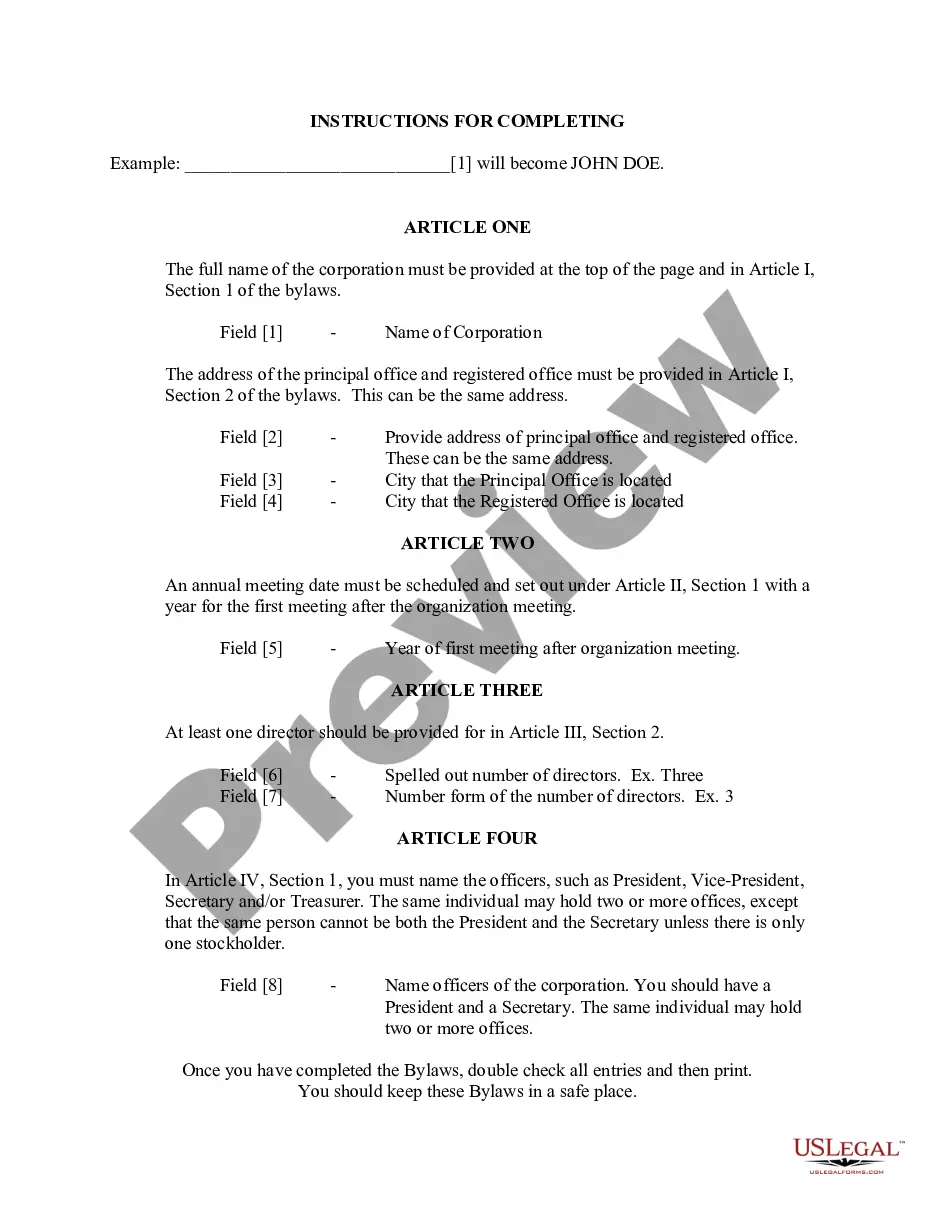

How to fill out Oklahoma Business Incorporation Package To Incorporate Corporation?

When it comes to completing Oklahoma Business Incorporation Package to Incorporate Corporation, you most likely imagine a long process that requires getting a perfect sample among a huge selection of similar ones and after that being forced to pay a lawyer to fill it out for you. In general, that’s a sluggish and expensive choice. Use US Legal Forms and choose the state-specific form in just clicks.

In case you have a subscription, just log in and then click Download to have the Oklahoma Business Incorporation Package to Incorporate Corporation sample.

If you don’t have an account yet but need one, stick to the step-by-step manual listed below:

- Be sure the document you’re getting is valid in your state (or the state it’s needed in).

- Do it by reading through the form’s description and by clicking the Preview function (if offered) to see the form’s information.

- Click Buy Now.

- Choose the proper plan for your budget.

- Sign up to an account and choose how you want to pay out: by PayPal or by credit card.

- Download the file in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Skilled legal professionals draw up our samples to ensure after saving, you don't need to bother about enhancing content material outside of your individual info or your business’s information. Join US Legal Forms and receive your Oklahoma Business Incorporation Package to Incorporate Corporation document now.

Form popularity

FAQ

The word "incorporated" indicates that a business entity is a corporation.A corporation or "Inc." is an entirely separate entity from its owners and shareholders. This is an important legal distinction since an incorporated business essentially becomes a separate "person" under the law.

Inc. is the abbreviation for incorporated. An incorporated company, or corporation, is a separate legal entity from the person or people forming it. Directors and officers purchase shares in the business and have responsibility for its operation. Incorporation limits an individual's liability in case of a lawsuit.

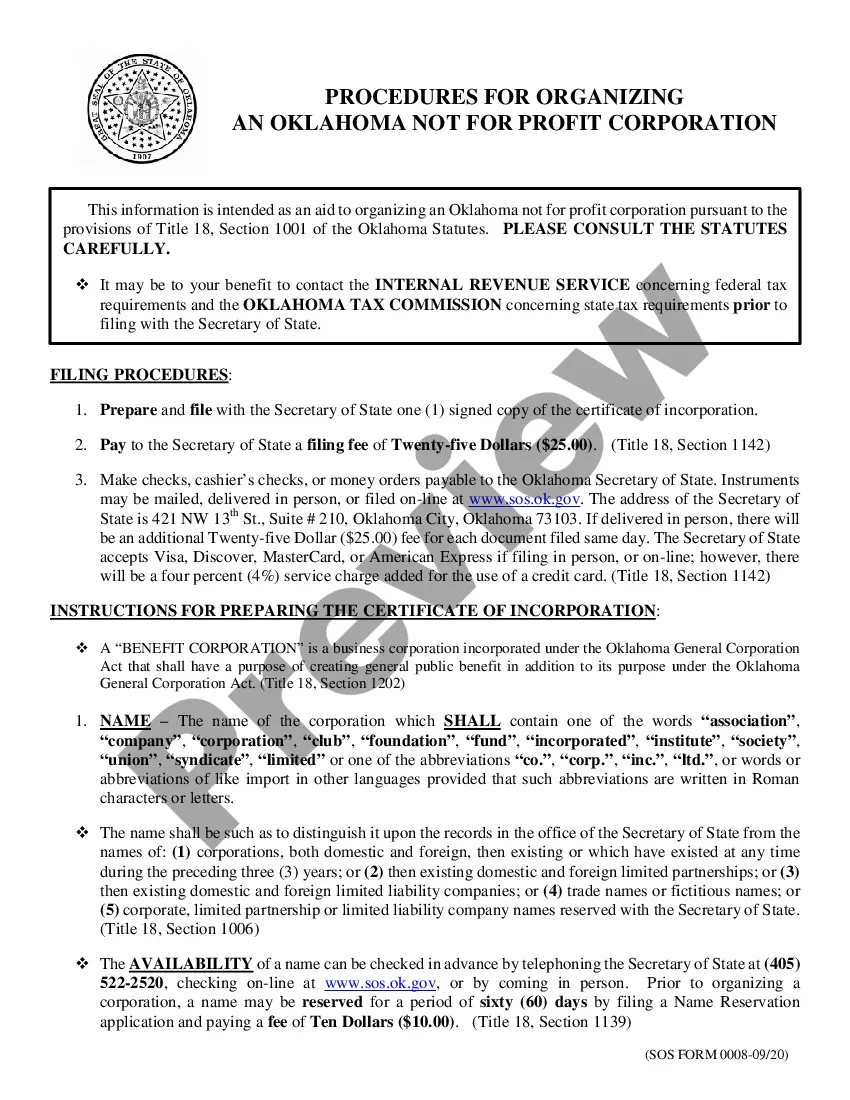

To form a corporation in Oklahoma, you must file a certificate of incorporation with the Secretary of State and pay a filing fee. The corporation's existence begins when you file the certificate. The minimum information that must be included in the certificate of incorporation is as follows: Name of the corporation.

Registered Office. Business Activity. Director's Details. Shareholders' Details. Shareholders' Details. Secretary Details (Not Compulsory) Person with Significant Control (PSC) Details Where the person is not a director, shareholder or secretary.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

Business Name Reservation Form (Corps and LLCs) Articles of Incorporation (Corps only) Articles of Organization (LLCs only) Corporate Bylaws (Corps only) Operating Agreement (LLCs only)

Under Domestic Organizations, select Domestic Profit Corporation. Enter your name and email address. Complete the Oklahoma Certificate of Incorporation. Submit and pay the filing fee.

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

If you incorporate your small business, you can determine when and how you receive income from the business, which is a real tax advantage. Instead of taking a salary from the business when the business receives income, being incorporated allows you to take your income at a time when you'll pay less in tax.