This Operating Agreement is for a Limited Liability Company with only one Member. This form may be perfect for an LLC started by one person. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

Oklahoma Single Member Limited Liability Company LLC Operating Agreement

Description

Key Concepts & Definitions

Single Member Limited Liability Company (LLC): A business structure allowed by state statute where one individual owns the entire interest in the company, providing liability protection similar to a corporation but with the tax benefits of a sole proprietorship. Limited Liability refers to the owner's protection from the company's debts and liabilities. This entity is commonly abbreviated as a singlemember LLC.

Step-by-Step Guide to Forming a Single Member LLC

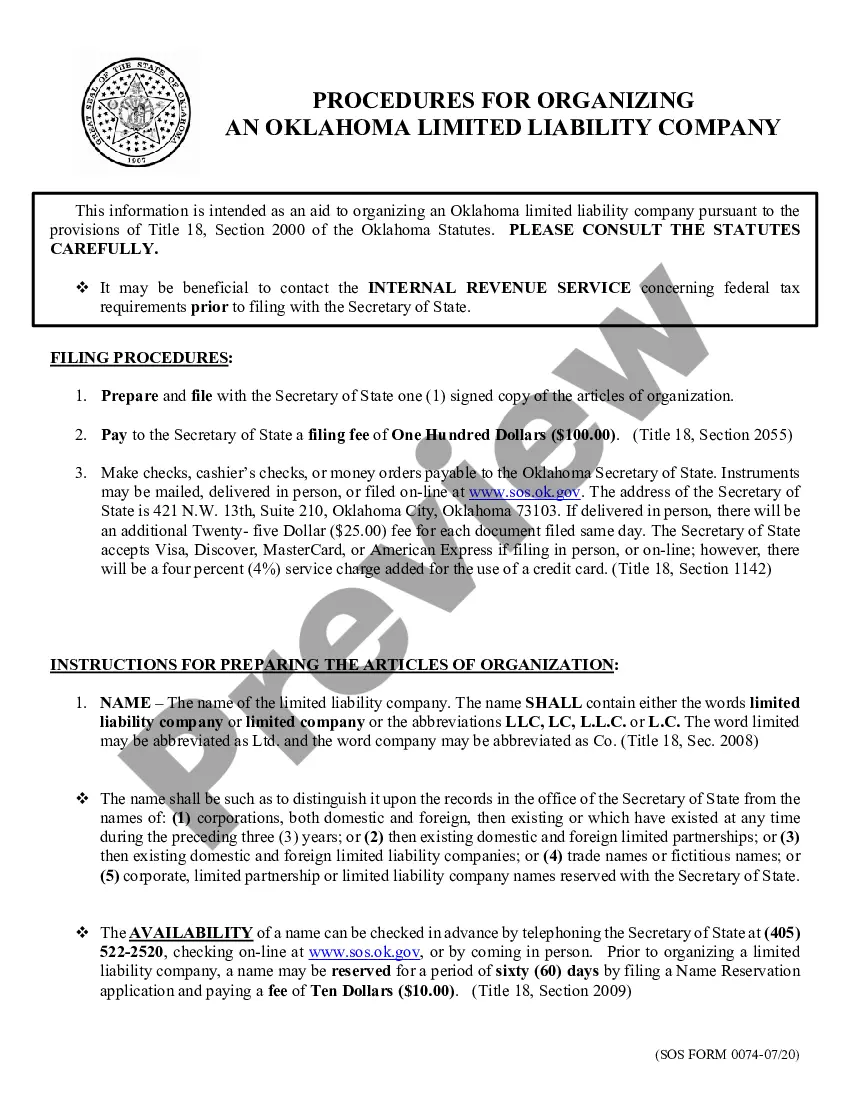

- Choose a Business Name: Ensure the name is unique and complies with your states LLC regulations.

- File the Articles of Organization: This is the primary document to establish an LLC with the Secretary of State, detailing key aspects of your business.

- Create an Operating Agreement: Even for singlemember LLCs, this document is crucial for outlining the management structure and operations.

- Obtain Licenses and Permits: Required licenses depend on your business type and location.

- Register for Taxes: Apply for an EIN (Employer Identification Number) and set up tax accounts as needed for state and local taxes.

Risk Analysis for Single Member LLCs

- Personal Asset Protection: Limited liability may not fully shield personal assets from lawsuits against the company, especially in cases of fraud or non-compliance.

- Tax Flexibility Risks: The option to choose between different tax treatments (e.g., disregarded entity, corporation) presents risks linked to tax compliance and reporting.

- Operational Risks: The absence of a multi-member board may impact decision-making and operational resilience.

Key Takeaways

- A single member LLC combines the limited liability of a corporation with the tax benefits of a sole proprietorship.

- An operating agreement is essential even for one owner to establish the structure and operations formally.

- Proper compliance with both state and federal law, such as creating a strong separation between business and personal finances, is crucial to maintain limited liability protections.

Best Practices for Managing a Single Member LLC

- Keep Detailed Records: Maintain rigorous financial and corporate records to ensure personal liability protection.

- Stay Compliant With Local Laws: Regularly review and adhere to local, state, and federal regulations, including business renewals and tax filings.

- Use Personal Loans Carefully: When acquiring personal loans, ensure they are clearly separated from business finances to avoid complications for tax purposes or potential audits.

FAQ

- How does a single member LLC differ from a sole proprietorship? A single member LLC provides limited liability protection, separating business liabilities from personal assets, unlike a sole proprietorship.

- What is the importance of an operating agreement for a single member LLC? It helps in establishing clear rules for the business and is vital for legal and tax purposes, potentially including issues related to child support or division of assets.

- Can a single member LLC help in protecting personal assets from business debts? Yes, typically the structure offers protection of personal assets, but it is essential to maintain corporate formalities.

How to fill out Oklahoma Single Member Limited Liability Company LLC Operating Agreement?

In terms of submitting Oklahoma Single Member Limited Liability Company LLC Operating Agreement, you most likely think about a long procedure that consists of finding a perfect sample among a huge selection of very similar ones and then needing to pay out an attorney to fill it out for you. Generally speaking, that’s a slow and expensive choice. Use US Legal Forms and pick out the state-specific document within just clicks.

In case you have a subscription, just log in and click Download to get the Oklahoma Single Member Limited Liability Company LLC Operating Agreement template.

If you don’t have an account yet but need one, stick to the step-by-step manual listed below:

- Be sure the document you’re getting applies in your state (or the state it’s required in).

- Do this by reading the form’s description and through clicking the Preview function (if offered) to find out the form’s information.

- Click Buy Now.

- Select the suitable plan for your budget.

- Subscribe to an account and select how you want to pay out: by PayPal or by card.

- Save the file in .pdf or .docx file format.

- Find the record on the device or in your My Forms folder.

Skilled legal professionals work on creating our samples to ensure that after saving, you don't have to bother about enhancing content material outside of your individual information or your business’s information. Join US Legal Forms and receive your Oklahoma Single Member Limited Liability Company LLC Operating Agreement sample now.

Form popularity

FAQ

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.

A limited liability company (LLC) is not required to have bylaws. Bylaws, which are only relevant to businesses structured as corporations, include rules and regulations that govern a corporation's internal management.Alternatively, LLCs create operating agreements to provide a framework for their businesses.

Oklahoma Statutes, § 18-2012.2, state that every Oklahoma LLC may adopt an operating agreement, but it isn't required by the Secretary of State. Despite it not being required, there are several reasons it is recommended to have one.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.

An operating agreement is mandatory as per laws in only 5 states: California, Delaware, Maine, Missouri, and New York. LLCs operating without an operating agreement are governed by the state's default rules contained in the relevant statute and developed through state court decisions.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.