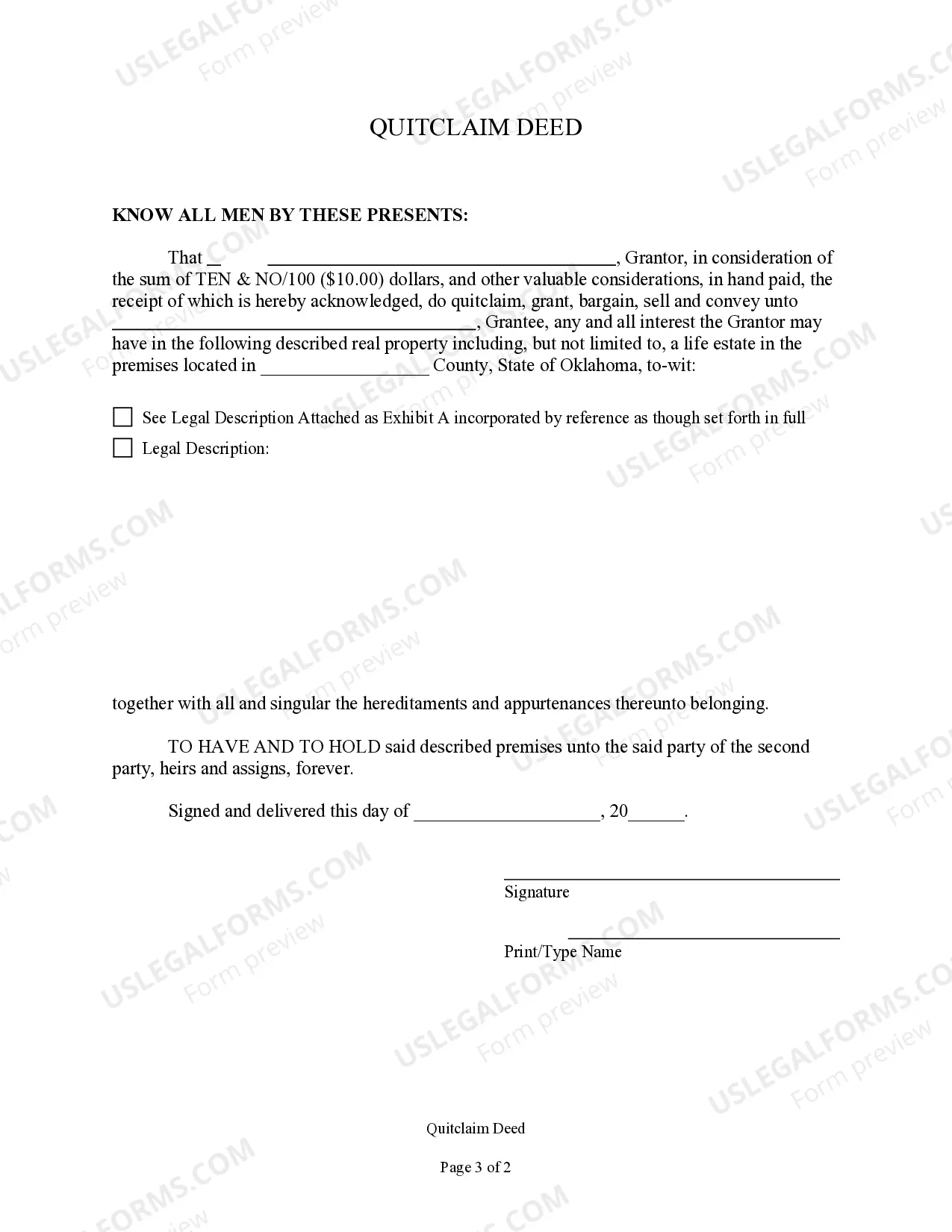

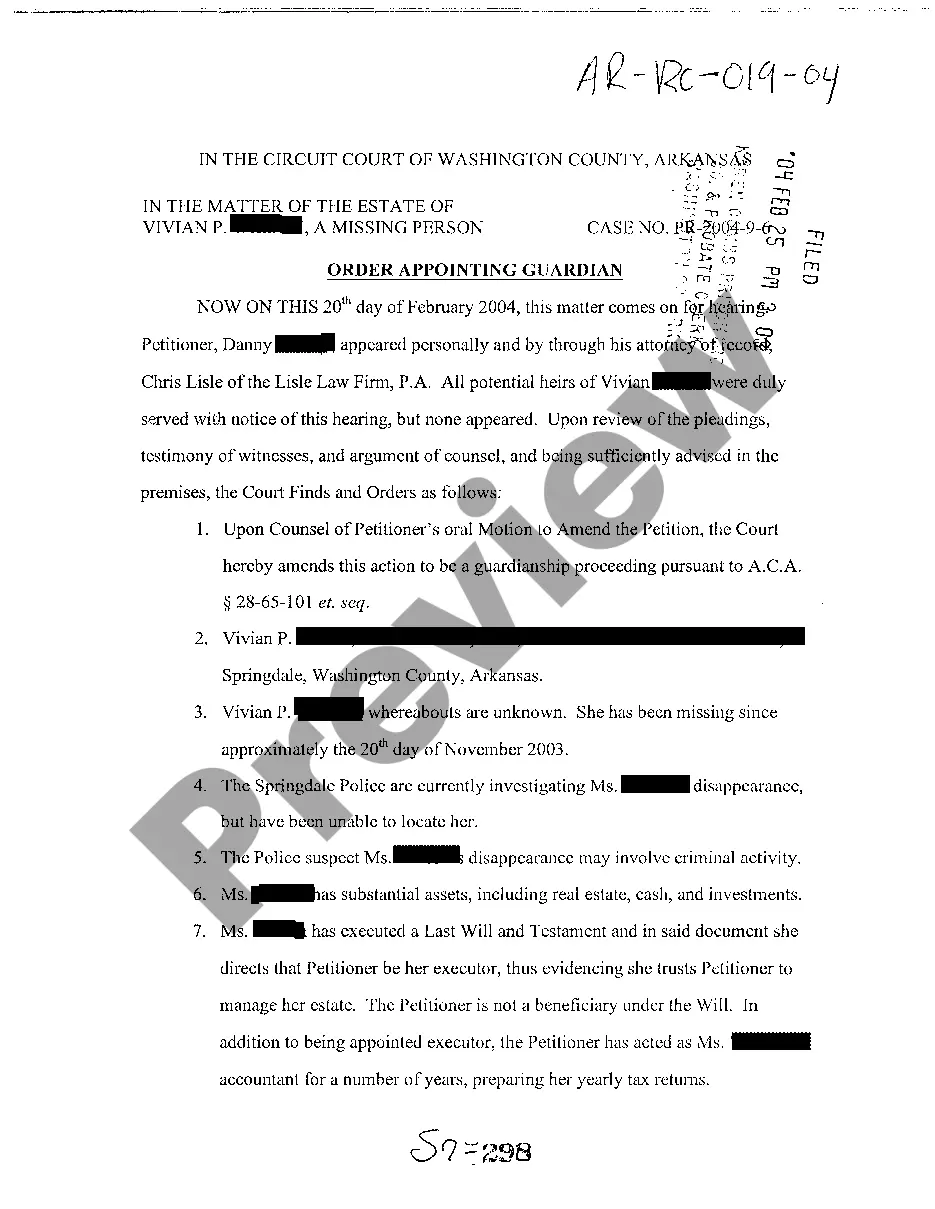

This form is a Quitclaim Deed where the grantor is the holder of a life estate in the real property and the grantee is the holder of the remainder interest. Grantor conveys and quitclaims the life estate to grantee. This deed complies with all state statutory laws.

Oklahoma Quitclaim Deed Releasing Life Estate

Description

How to fill out Oklahoma Quitclaim Deed Releasing Life Estate?

In terms of filling out Oklahoma Quitclaim Deed Releasing Life Estate, you almost certainly think about a long procedure that consists of choosing a suitable form among a huge selection of similar ones after which needing to pay legal counsel to fill it out for you. Generally speaking, that’s a sluggish and expensive choice. Use US Legal Forms and pick out the state-specific form in a matter of clicks.

If you have a subscription, just log in and then click Download to find the Oklahoma Quitclaim Deed Releasing Life Estate sample.

If you don’t have an account yet but need one, follow the point-by-point guide below:

- Be sure the document you’re saving applies in your state (or the state it’s needed in).

- Do so by reading the form’s description and also by clicking the Preview option (if accessible) to find out the form’s content.

- Click Buy Now.

- Pick the suitable plan for your financial budget.

- Sign up to an account and choose how you want to pay: by PayPal or by credit card.

- Download the file in .pdf or .docx format.

- Find the document on your device or in your My Forms folder.

Skilled legal professionals draw up our samples to ensure after downloading, you don't have to worry about enhancing content outside of your personal information or your business’s info. Be a part of US Legal Forms and receive your Oklahoma Quitclaim Deed Releasing Life Estate document now.

Form popularity

FAQ

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

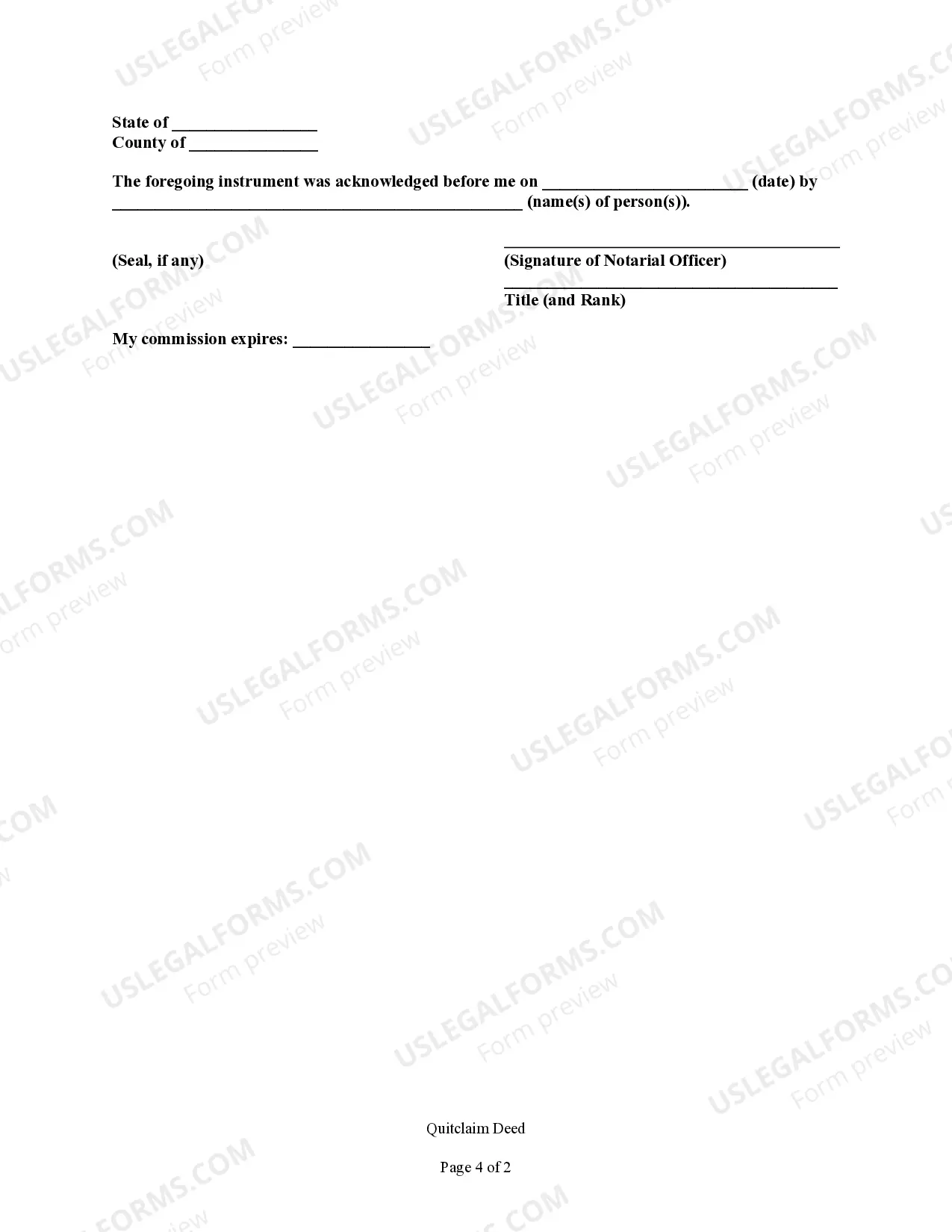

So long as the quitclaim deed is valid (properly notarized, etc.) it can be recorded even after the grantor's death, so property owned by the deceased which has been deeded in that quitclaim deed should not need to pass through probate.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

Even if you sign a quitclaim deed, the mortgage balance will continue to show up on your credit report. This will hurt what is called your debt utilization ratio. This may mean you have too much debt to be qualified for your next mortgage when you want to buy a new home.

Quitclaim Does Not Release Debts Signing a quitclaim deed and giving up all rights to the property doesn't release you from any financial obligations you may have. It only removes you from the title, not from the mortgage, and you are still responsible for making payments.

Once the quitclaim deed is signed and notarized, it is a valid legal document. But the grantee must also have the quitclaim deed recorded in the county recorder's office, or with the county clerk -- whoever has the authority to record deeds and property transfers.