Oklahoma Heirship Affidavit - Descent

Description Heirship Affidavit Ok

How to fill out Ok Heirship Affidavit Descent Deceased?

When it comes to filling out Oklahoma Heirship Affidavit - Descent, you probably visualize an extensive process that consists of finding a ideal form among a huge selection of similar ones after which having to pay out an attorney to fill it out to suit your needs. Generally speaking, that’s a sluggish and expensive choice. Use US Legal Forms and choose the state-specific template within clicks.

For those who have a subscription, just log in and click on Download button to have the Oklahoma Heirship Affidavit - Descent form.

In the event you don’t have an account yet but want one, stick to the step-by-step manual listed below:

- Be sure the document you’re saving applies in your state (or the state it’s needed in).

- Do it by looking at the form’s description and by clicking the Preview function (if available) to find out the form’s information.

- Click on Buy Now button.

- Select the appropriate plan for your budget.

- Sign up to an account and select how you want to pay: by PayPal or by card.

- Download the document in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

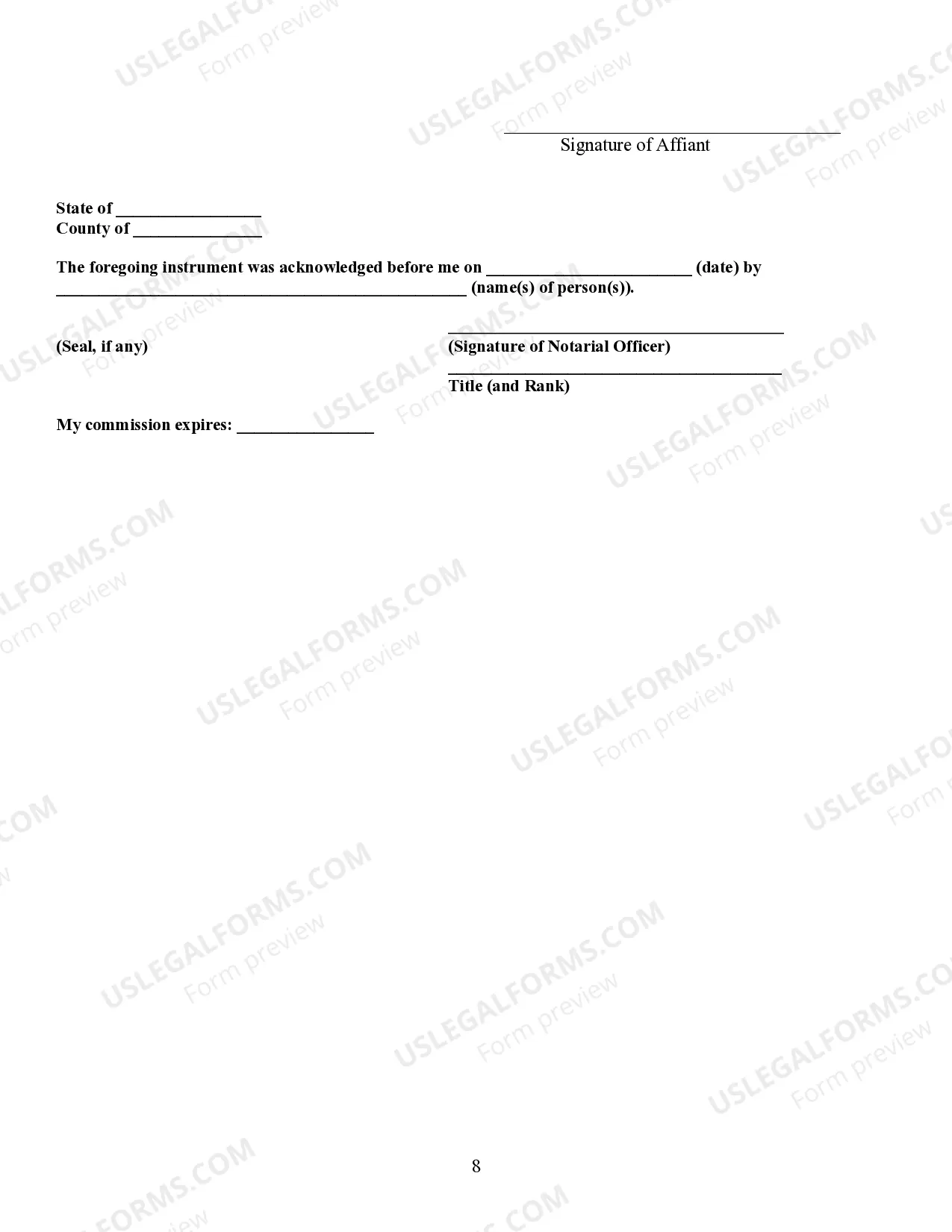

Professional lawyers work on drawing up our samples to ensure that after saving, you don't have to bother about editing content material outside of your personal information or your business’s details. Sign up for US Legal Forms and receive your Oklahoma Heirship Affidavit - Descent sample now.

Heirship Oklahoma Form popularity

Heirship Affidavit Document Other Form Names

Ok Heirship Paper FAQ

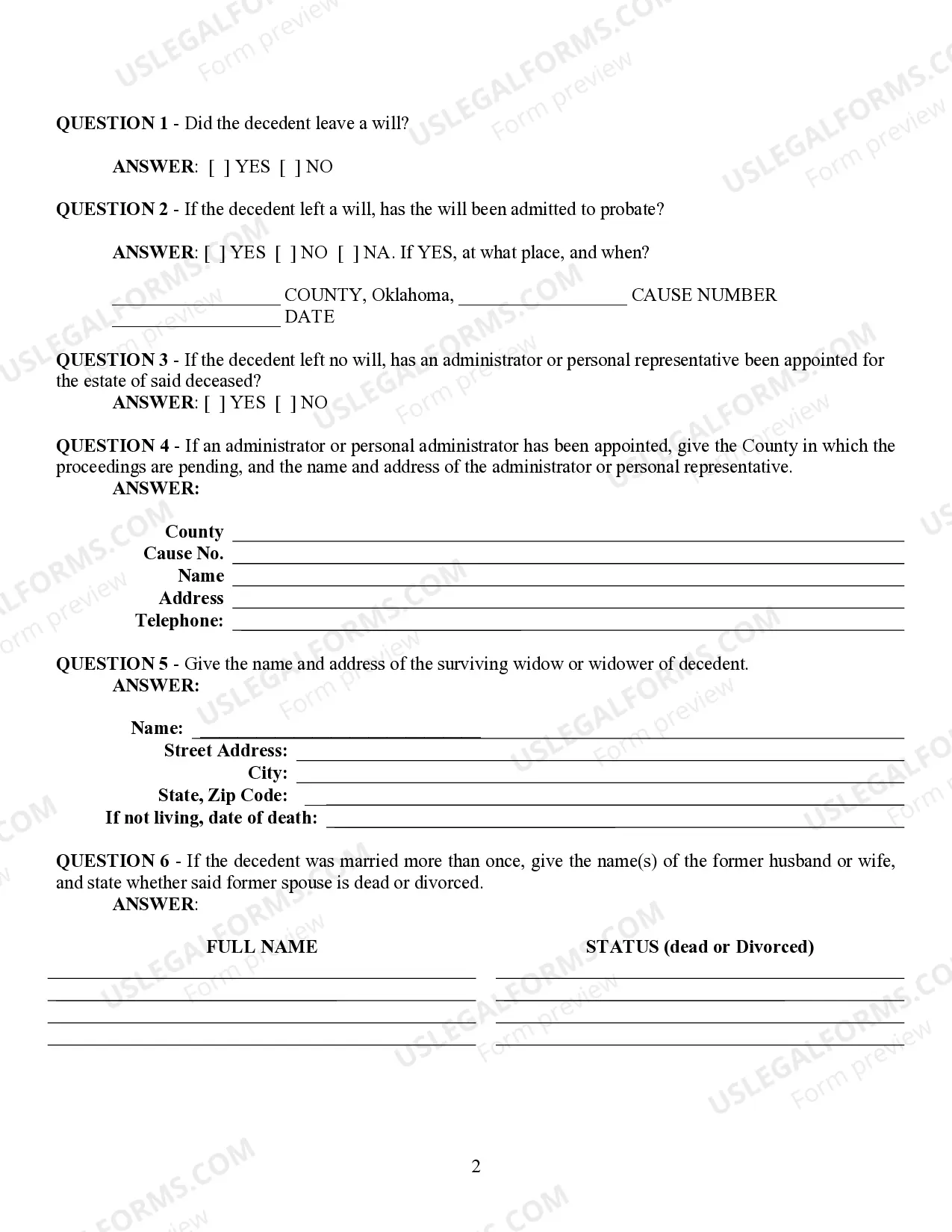

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

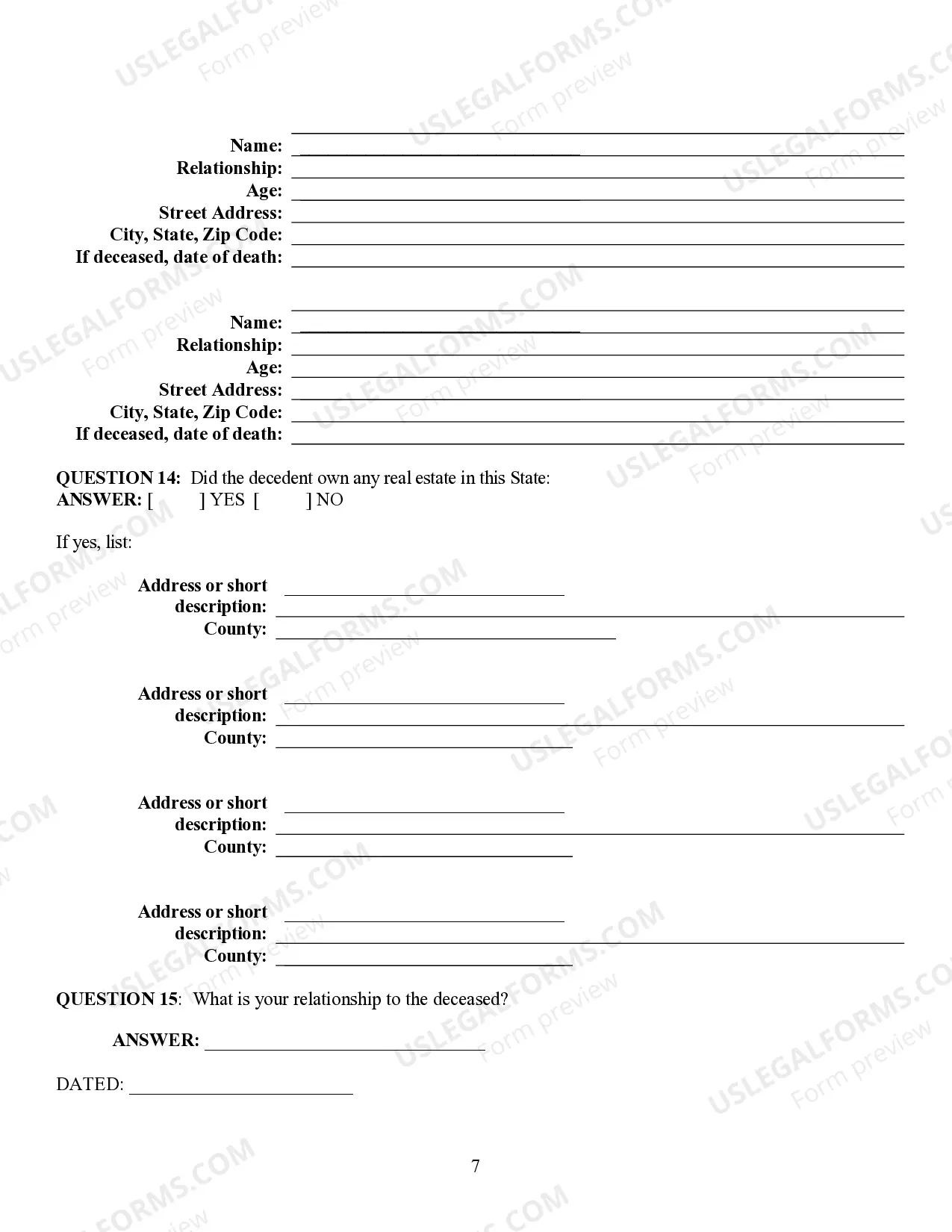

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

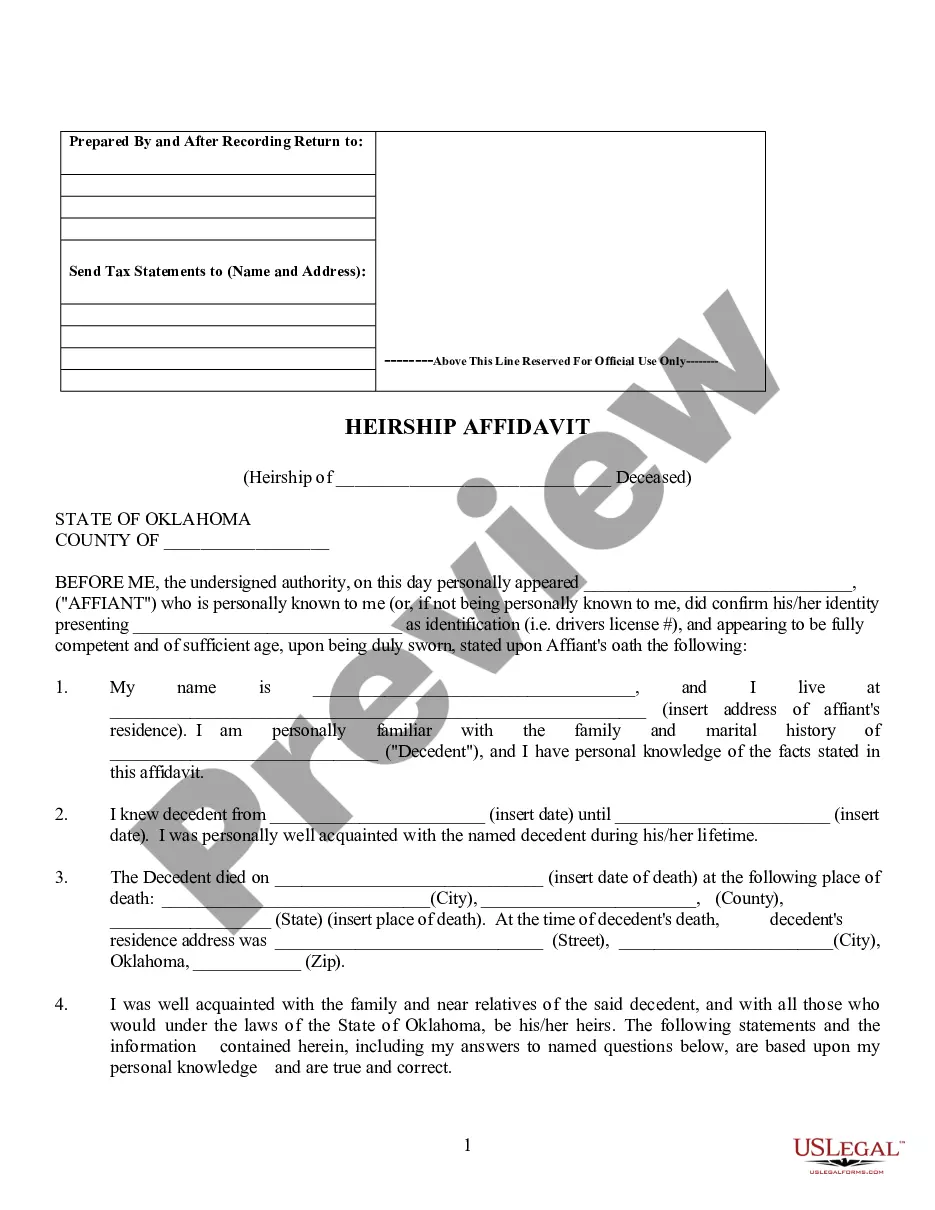

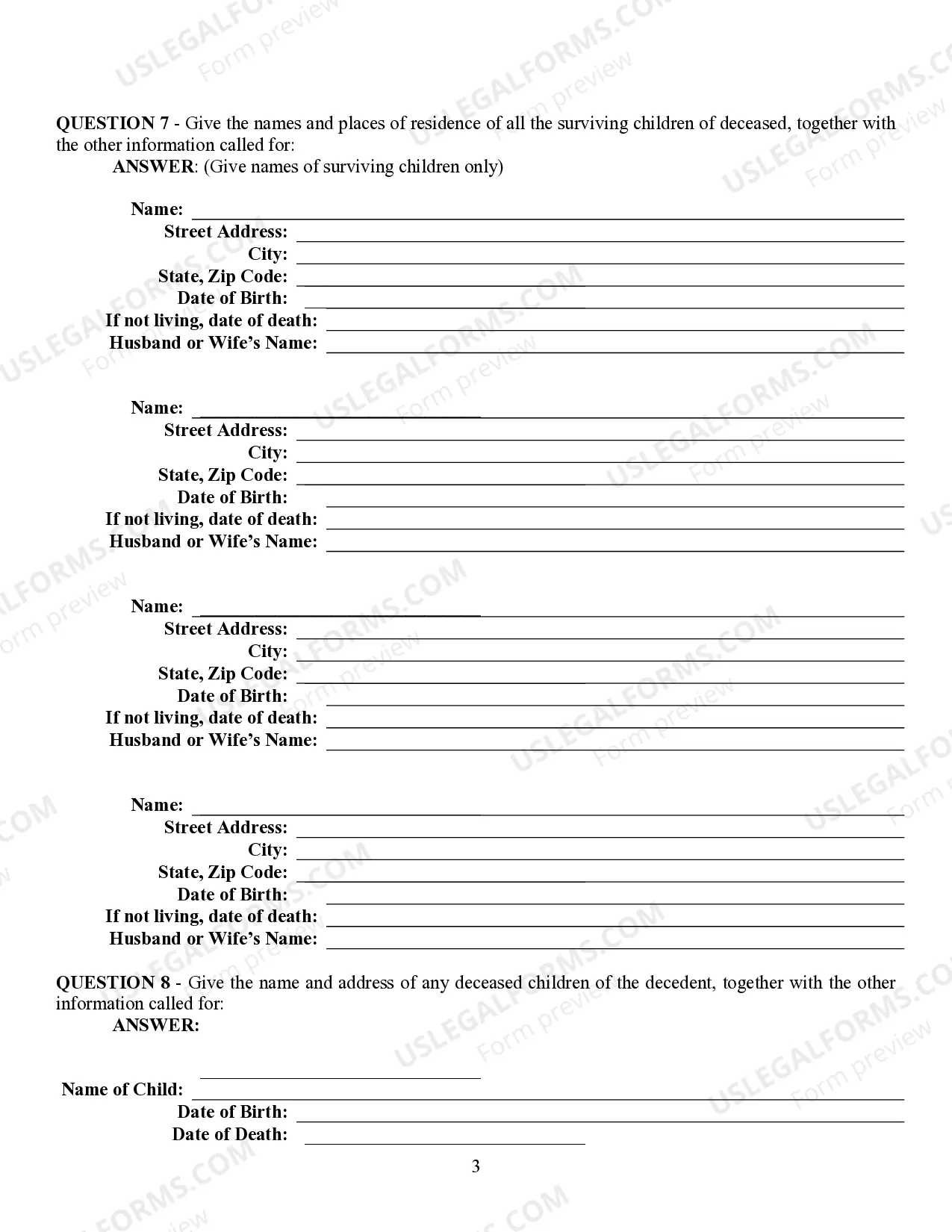

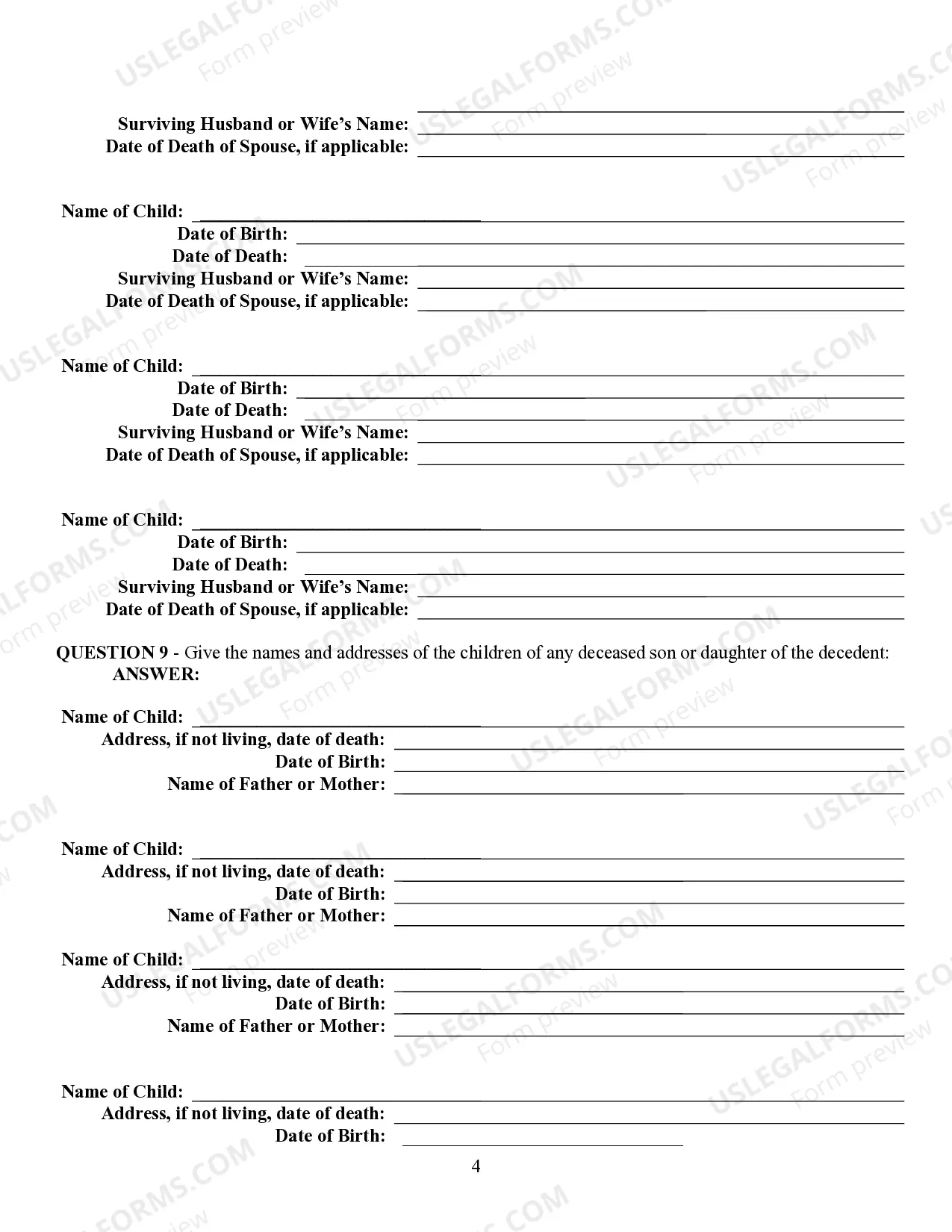

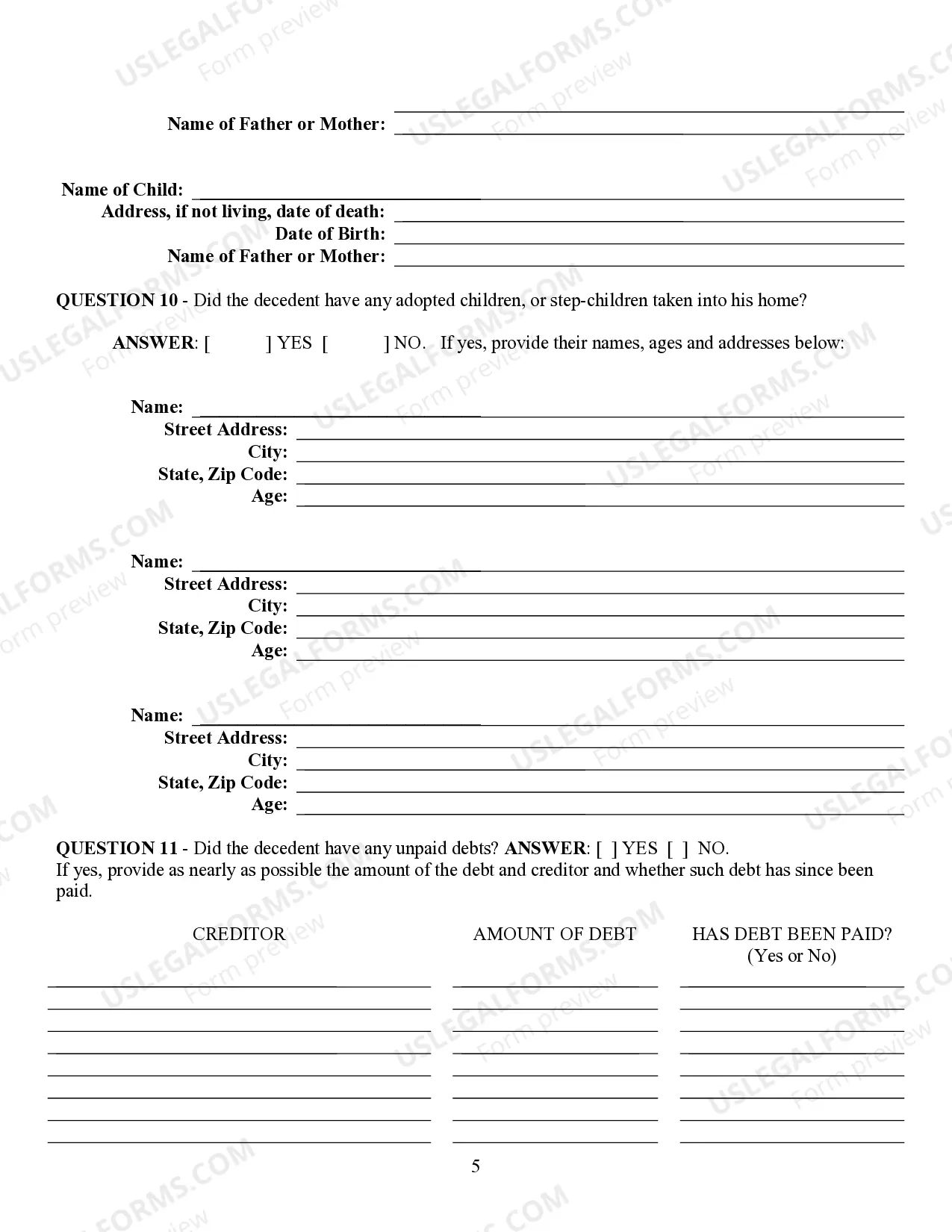

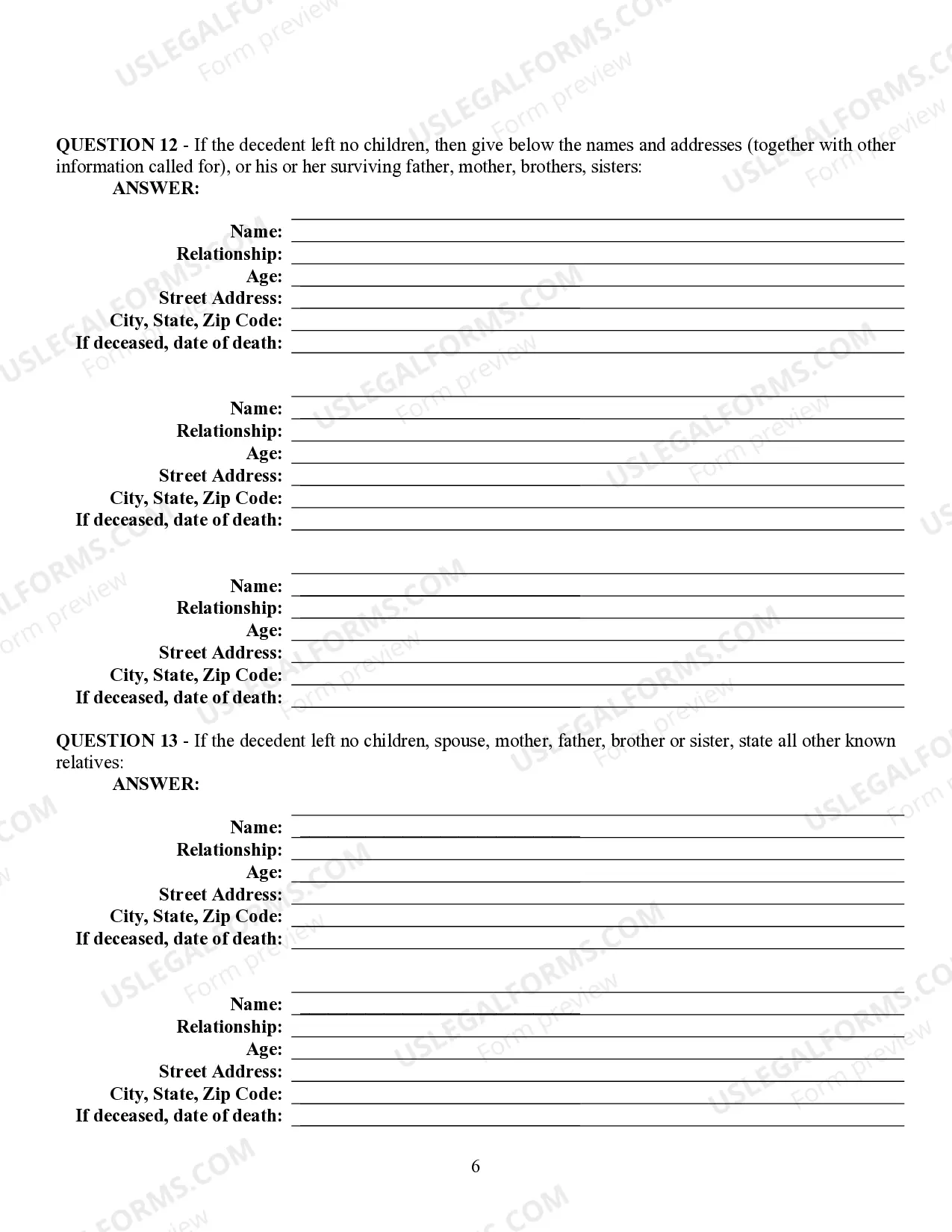

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

An affidavit of heirship is needed to transfer a deceased person's interest in real or personal property to his or her heirs when the decedent dies without leaving a last will and testament or without disposing of all of his or her property in a will.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor). Create the new deed. Sign and notarize the deed. File the deed in the county land records.

Step 1 At the top, write in the name of the decedent. Step 2 Under Section 1, write in the date of birth, the date of death, the residential address of decedent. Step 3 In Section 2, check the box that describes you as the person filling out the affidavit.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

The transfer by affidavit process can be used to close a person's estate when the deceased has $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.