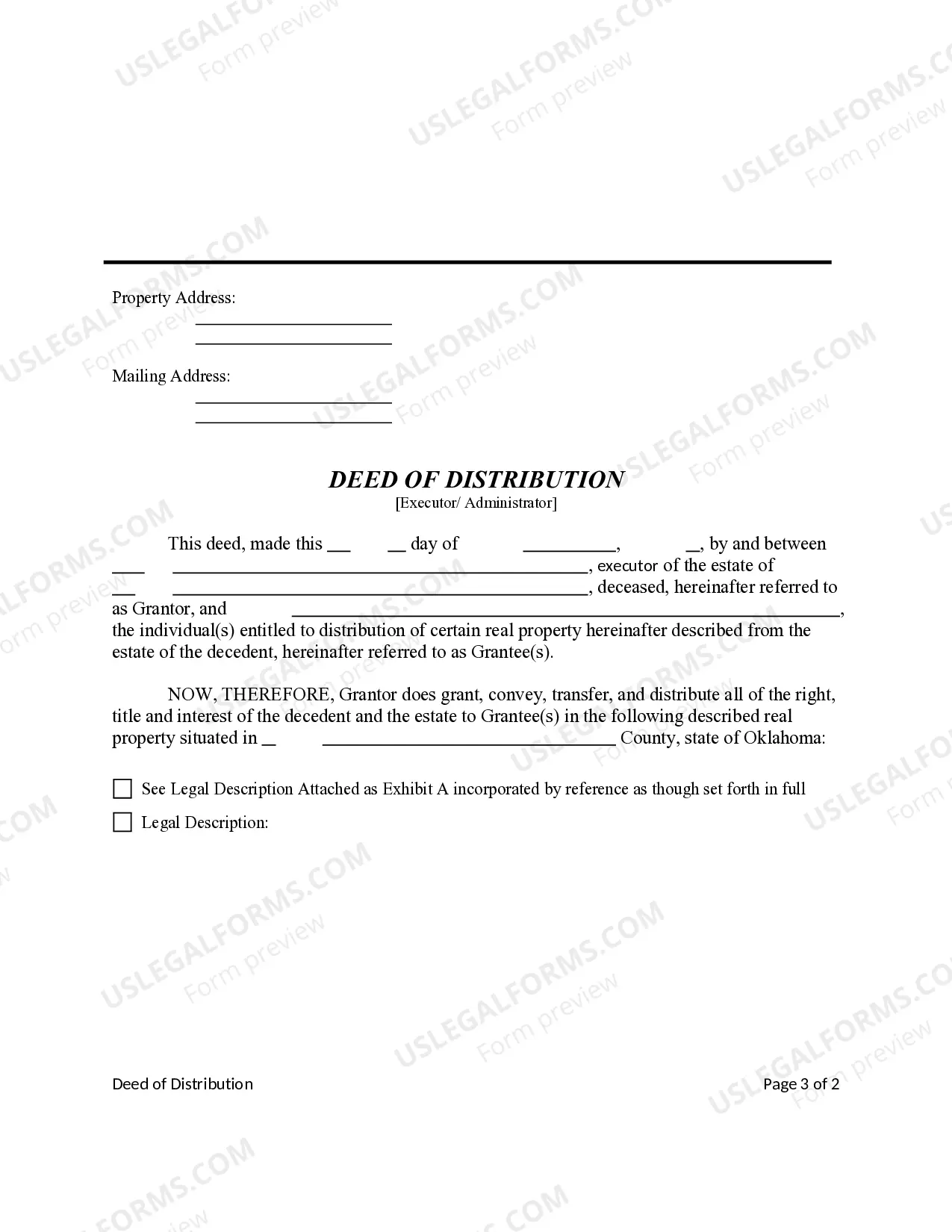

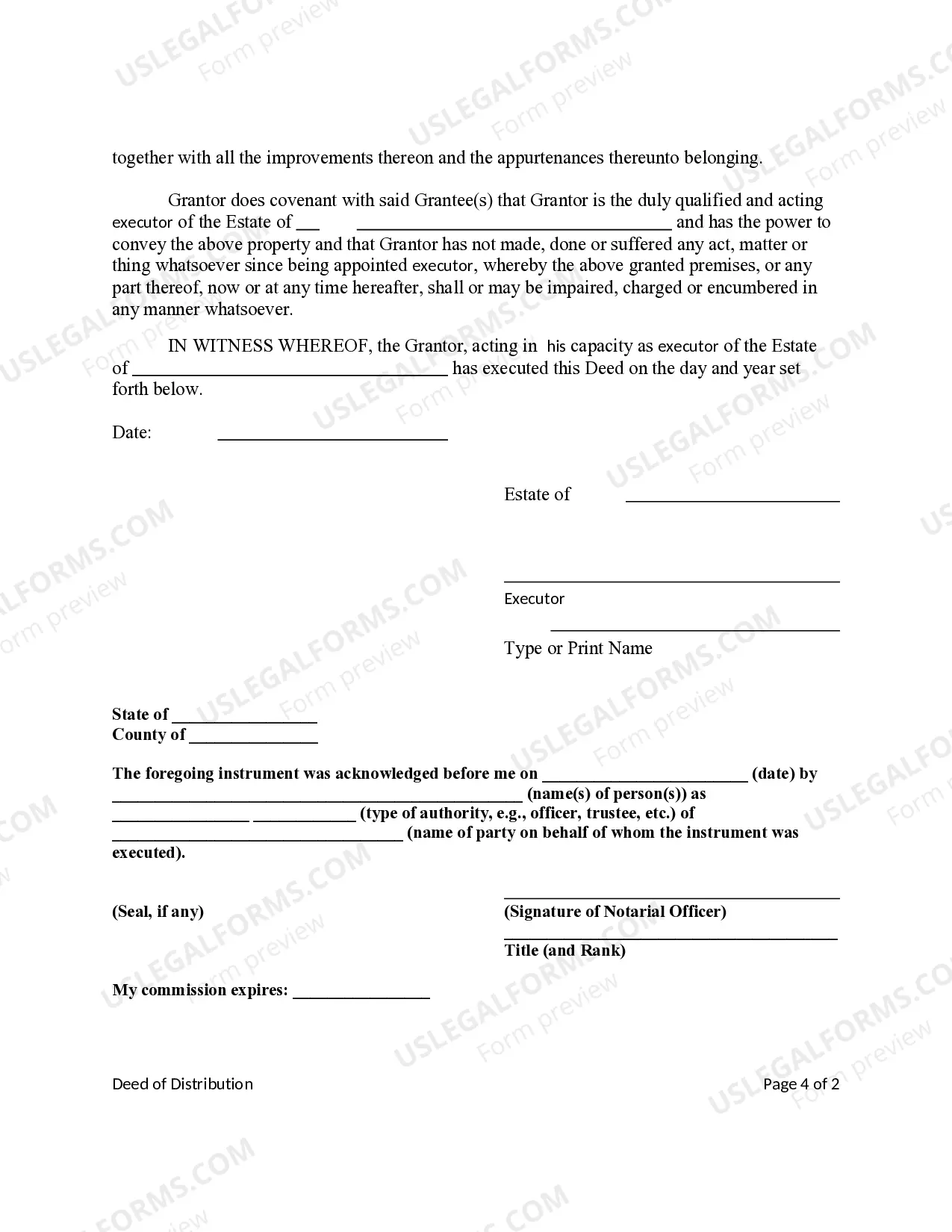

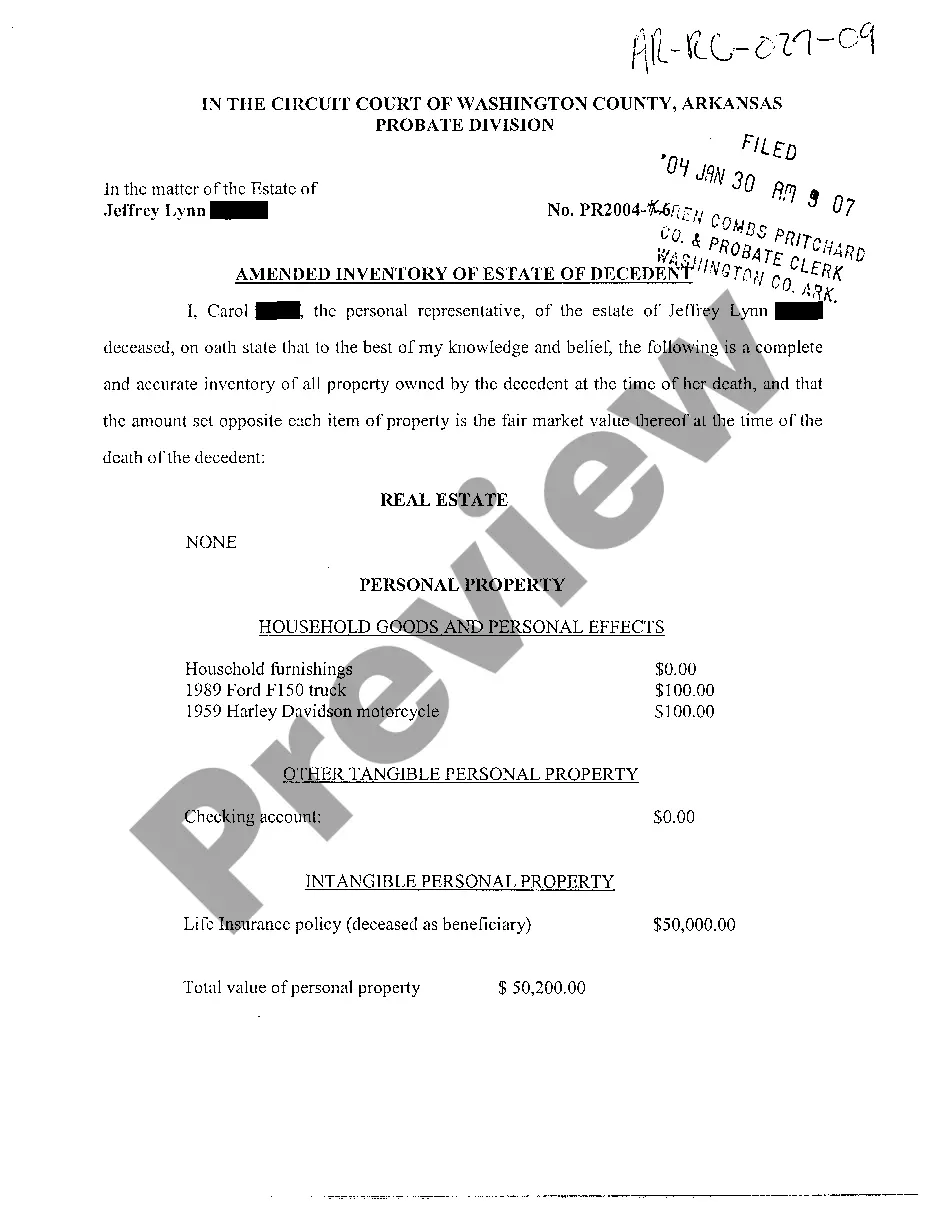

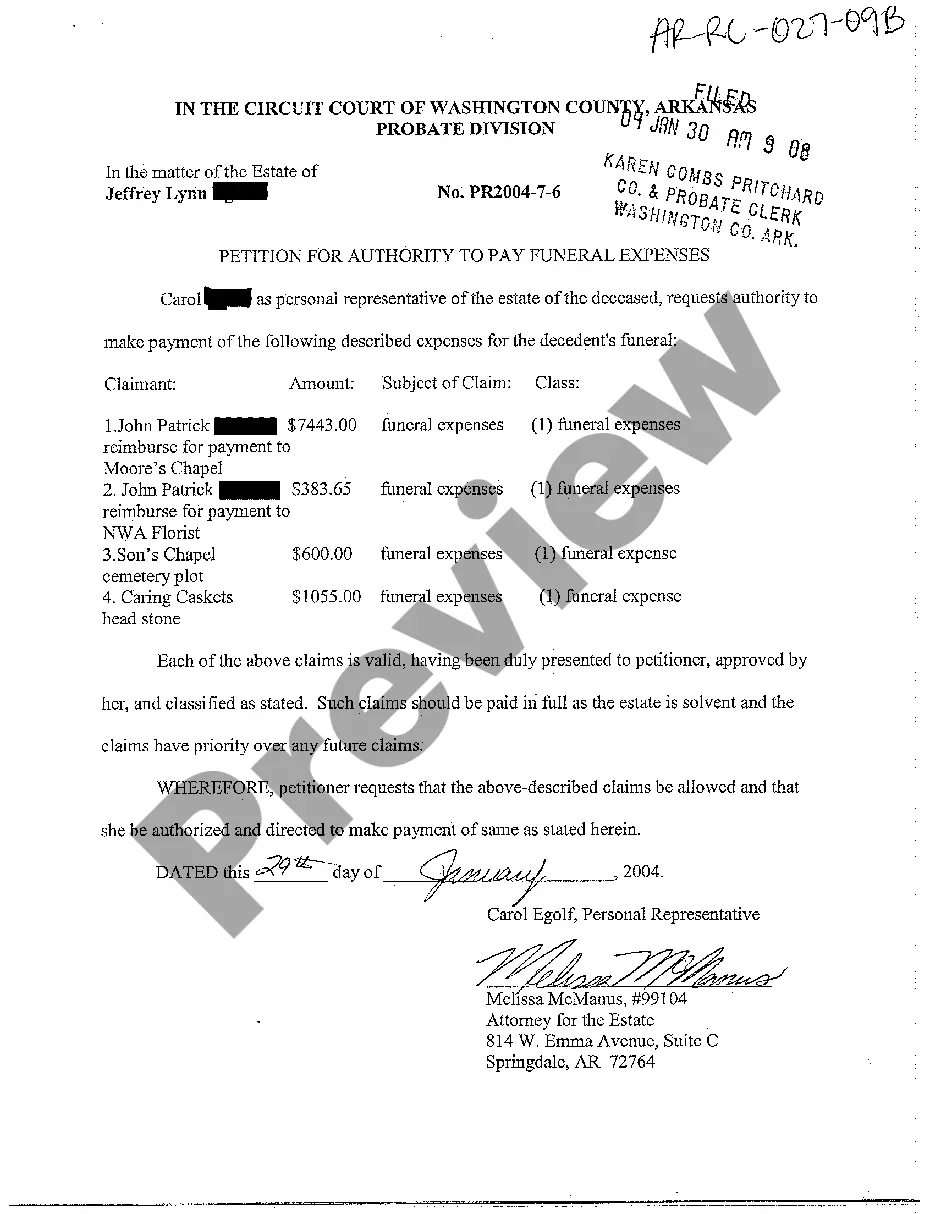

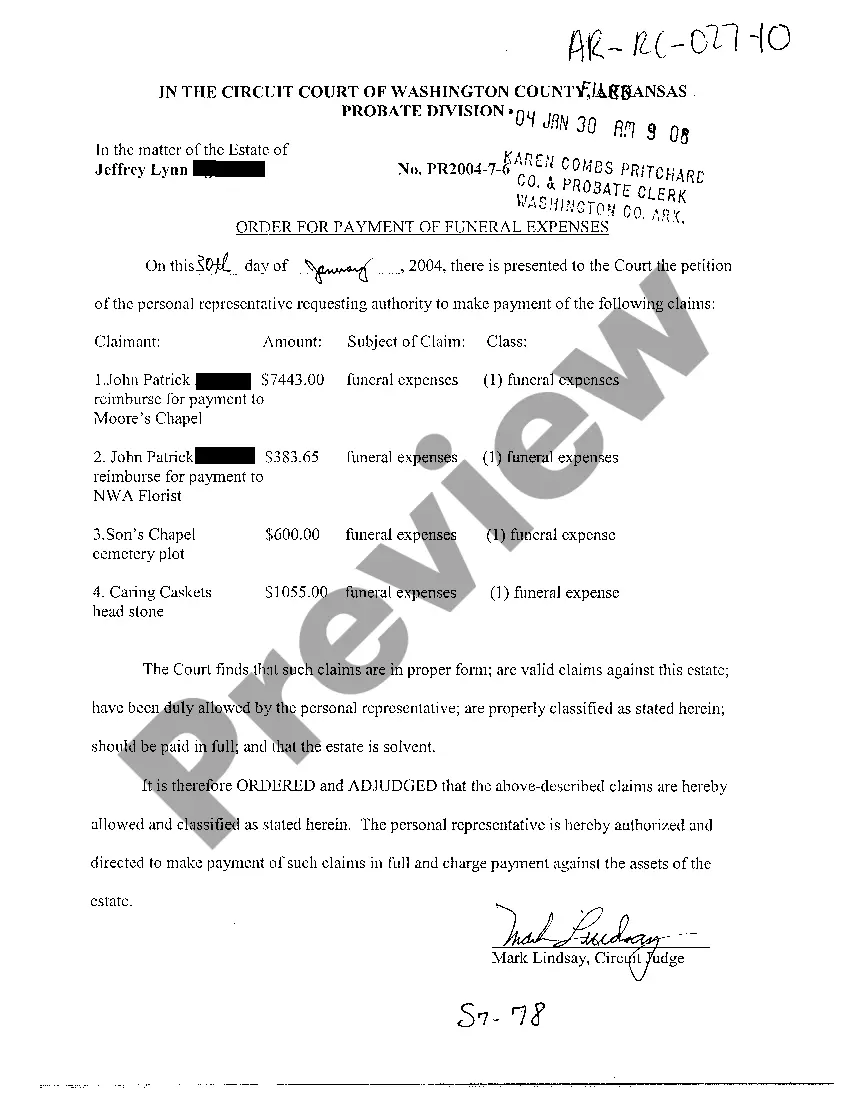

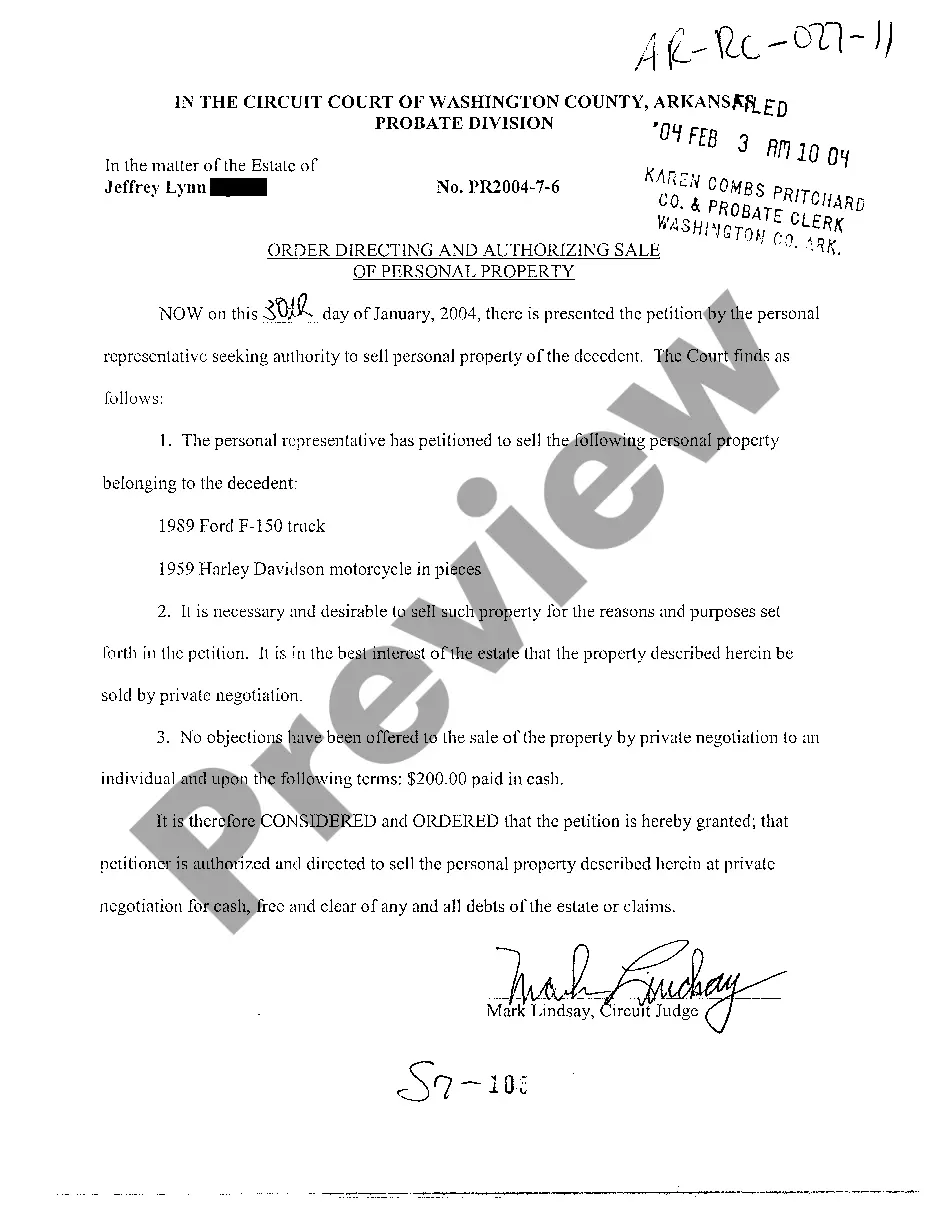

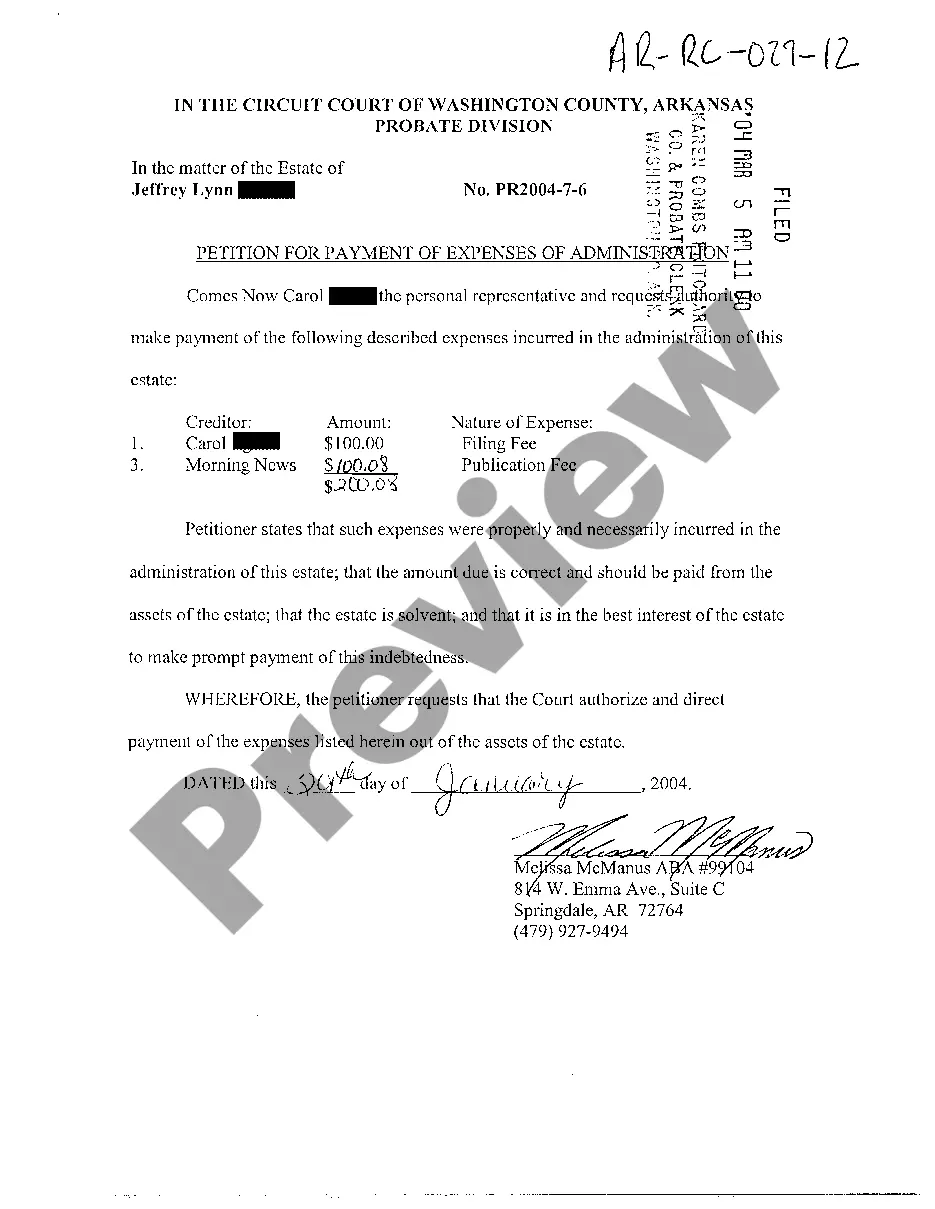

This form is a Deed of Distribution where the grantor is the individual appointed as administrator or executor of an estate and the grantee(s) is/are the individual(s) entitled to receive the property from the estate. Grantor conveys the described property to Grantee(s) and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving in grantors official capacity to encumber the property. This deed complies with all state statutory laws.

Oklahoma Deed of Distribution

Description

How to fill out Oklahoma Deed Of Distribution?

In terms of completing Oklahoma Deed of Distribution, you almost certainly imagine a long process that consists of choosing a appropriate form among hundreds of similar ones and after that being forced to pay a lawyer to fill it out to suit your needs. Generally speaking, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific template in a matter of clicks.

In case you have a subscription, just log in and click Download to get the Oklahoma Deed of Distribution template.

If you don’t have an account yet but want one, stick to the step-by-step manual below:

- Be sure the file you’re saving is valid in your state (or the state it’s needed in).

- Do it by reading through the form’s description and also by clicking on the Preview function (if available) to see the form’s content.

- Click on Buy Now button.

- Find the suitable plan for your financial budget.

- Subscribe to an account and choose how you would like to pay: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Get the file on your device or in your My Forms folder.

Professional attorneys work on creating our samples to ensure that after downloading, you don't need to bother about editing content material outside of your personal details or your business’s info. Be a part of US Legal Forms and receive your Oklahoma Deed of Distribution document now.

Form popularity

FAQ

You can use the simplified small estate process in Oklahoma if the value of the estate is $200,000 or less, if the deceased person has been dead for more than five years, or if he or she resided in another state at the time of death.

A typical probate can be completed in around 4-6 months, but could last much longer depending on the size of the estate, creditor claims and whether there is a challenge to the will or to appointment of the Personal Representative. For small estates, Oklahoma has procedures called summary administration.

Personal representative's deeds are used to transfer real property from both testate (with a will) and intestate (without a will) estates. These documents provide essential information about the specific probate estate and related property transfer in one document.

But probate isn't always necessary, as certain estates are labeled small estates and therefore bypass these proceedings. To become part of this distinction, an estate must be worth less than $50,000 in total value, after debts and liabilities have been removed, according to Oklahoma inheritance laws.

Yes. If the cumulative value of a deceased person's probate personal property (not including real estate) that would otherwise go through probate court is less than $50,000, that probate property can be obtained by the deceased person's successors by the use of a Small Estates Affidavit and thus avoid probate.

If there is no will, the court will name a personal representative in accordance with the intestate laws for Oklahoma. In order to clear title to assets and finalize the decedent's affairs, probate is necessary.

Step 1 Fill in the county in which you are signing the document. Step 2 Write in your name as successor in interest of decedent. Step 3 Write in your relationship to decedent and decedent's name and date of death in Section 1. Make sure to attach a certified death certificate.

In Oklahoma, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).