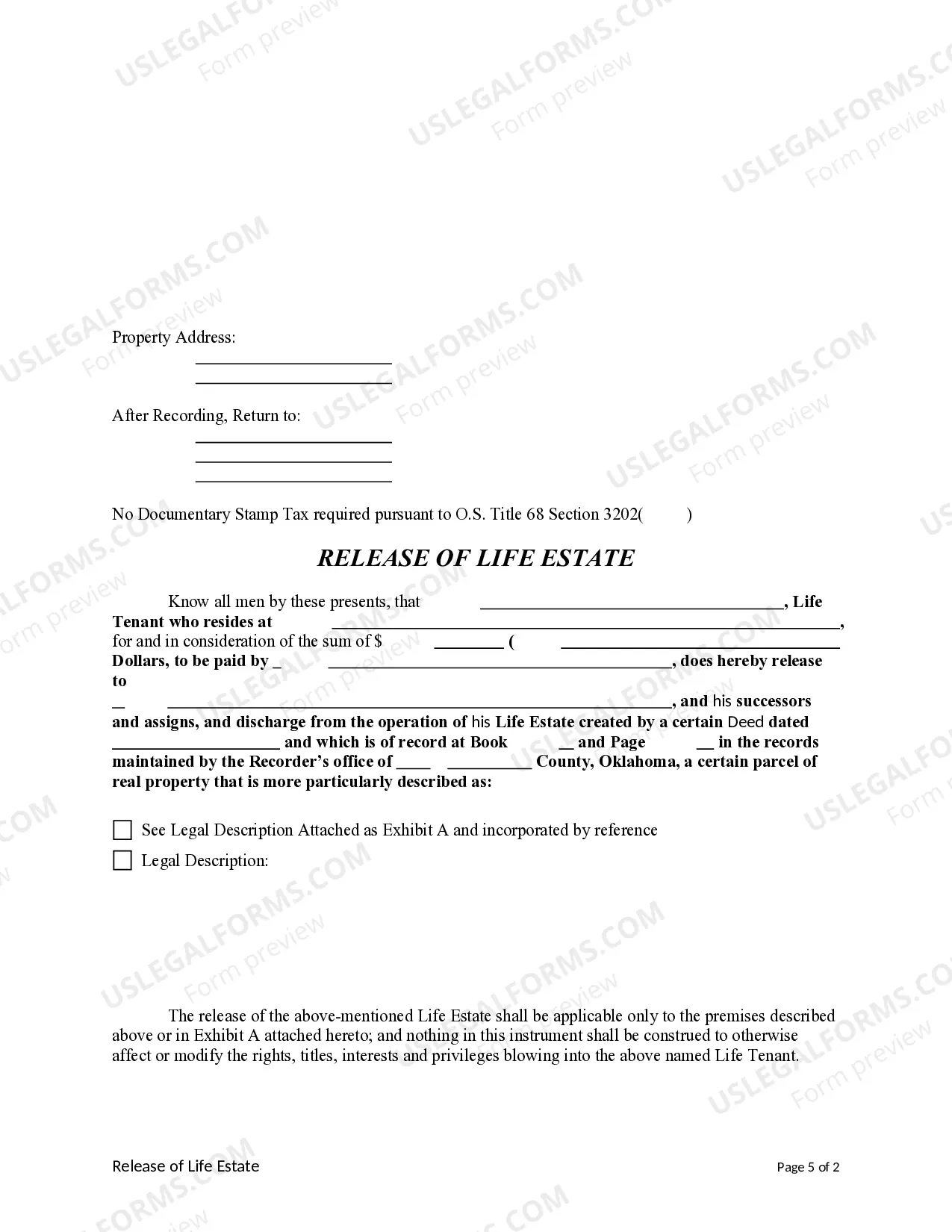

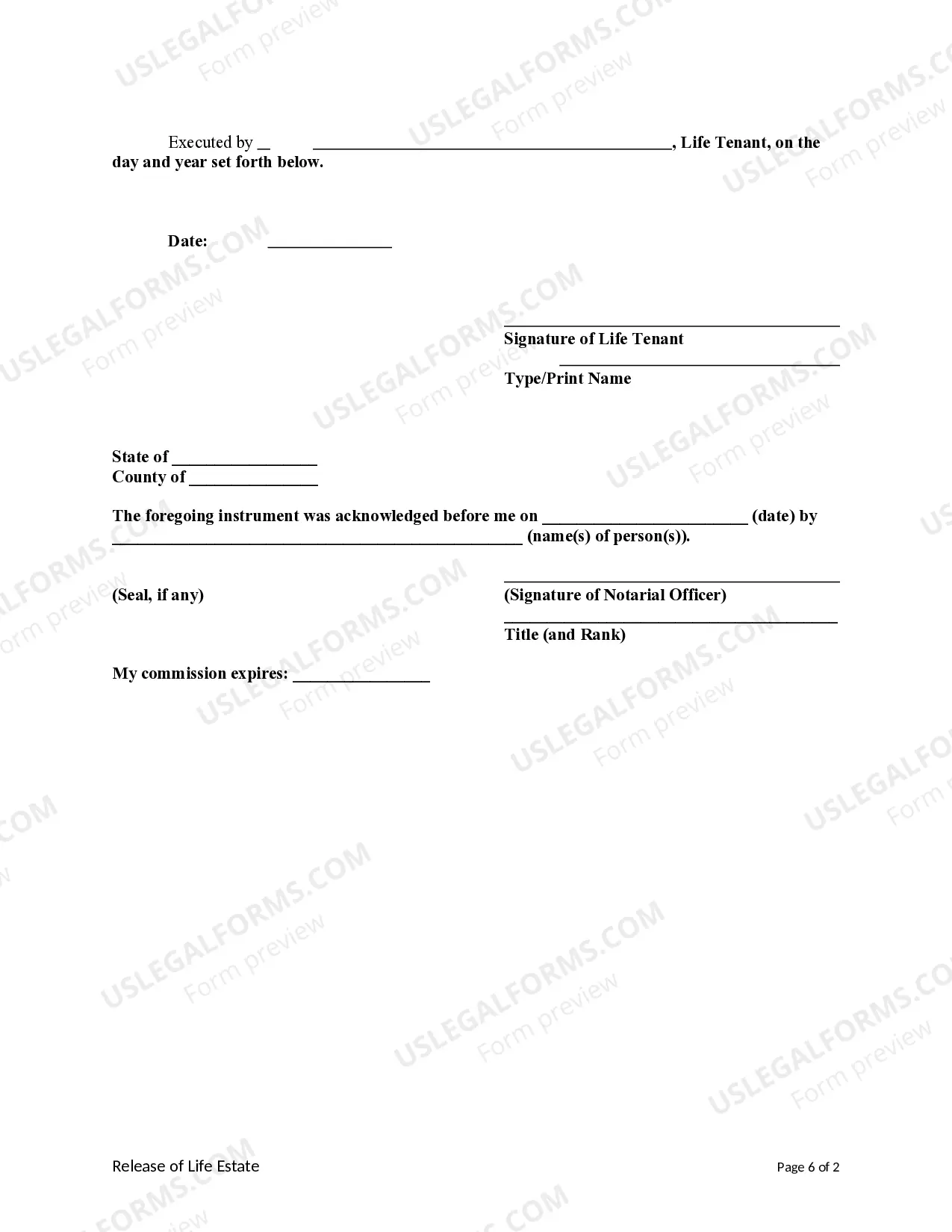

This form is a Release of Life Estate by an individual Life Tenant

Oklahoma Release of Life Estate

Description

How to fill out Oklahoma Release Of Life Estate?

In terms of submitting Oklahoma Release of Life Estate, you most likely imagine an extensive procedure that requires getting a perfect form among countless similar ones and then needing to pay out legal counsel to fill it out to suit your needs. Generally speaking, that’s a sluggish and expensive option. Use US Legal Forms and pick out the state-specific template in just clicks.

If you have a subscription, just log in and click Download to get the Oklahoma Release of Life Estate sample.

In the event you don’t have an account yet but want one, follow the point-by-point guide listed below:

- Make sure the file you’re downloading applies in your state (or the state it’s required in).

- Do this by reading through the form’s description and also by visiting the Preview function (if accessible) to view the form’s information.

- Simply click Buy Now.

- Pick the proper plan for your budget.

- Subscribe to an account and select how you want to pay: by PayPal or by credit card.

- Download the file in .pdf or .docx file format.

- Get the file on the device or in your My Forms folder.

Skilled legal professionals work on drawing up our samples to ensure that after downloading, you don't have to bother about modifying content outside of your individual info or your business’s info. Be a part of US Legal Forms and receive your Oklahoma Release of Life Estate example now.

Form popularity

FAQ

If the deceased was sole owner, or co-owned the property without right of survivorship, title passes according to his will. Whoever the will names as the beneficiary to the house inherits it, which requires filing a new deed confirming her title. If the deceased died intestate -- without a will -- state law takes over.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

If it was inherited, succession law comes into play. Once the beneficiaries and their shares, rights and liabilities are decided, the property has to be transferred in their names. For this you need to apply for property transfer at the sub-registrar's office.

When a person dies, beneficiaries might learn that the decedent made a deed that conflicts with the specific wording in his will. Generally, a deed will override the will. However, which legal document prevails also depends on state property laws and whether the state has adopted the Uniform Probate Code.

What happens to a life estate after someone dies? Upon the life tenant's death, the property passes to the remainder owner outside of probate.They can sell the property or move into and claim it as their primary residence (homestead). Property taxes will not be reassessed.

Get a copy of the probated will. Obtain a certified copy of the death certificate. Draft a new deed that names you as the property owner. Sign the new deed and have it notarized.

Property held in joint tenancy, tenancy by the entirety, or community property with right of survivorship automatically passes to the survivor when one of the original owners dies. Real estate, bank accounts, vehicles, and investments can all pass this way. No probate is necessary to transfer ownership of the property.

To dissolve a life estate, the life tenant can give their ownership interest to the remainderman. So, if a mother has a life estate and her son has the remainder, she can convey her interest to him, and he will then own the entire interest in the property.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.