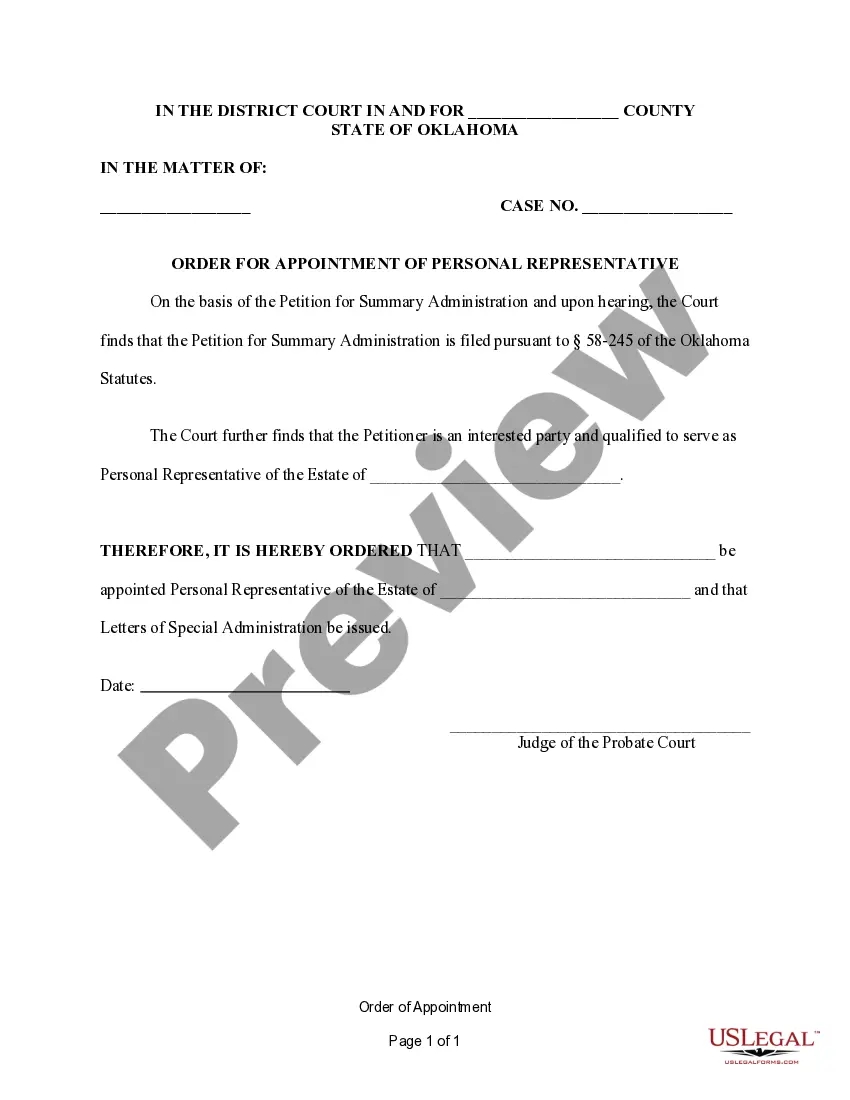

Oklahoma Order for Appointment of Personal Representative

Description Oklahoma Petition For Summary Administration Form

How to fill out Oklahoma Order For Appointment Of Personal Representative?

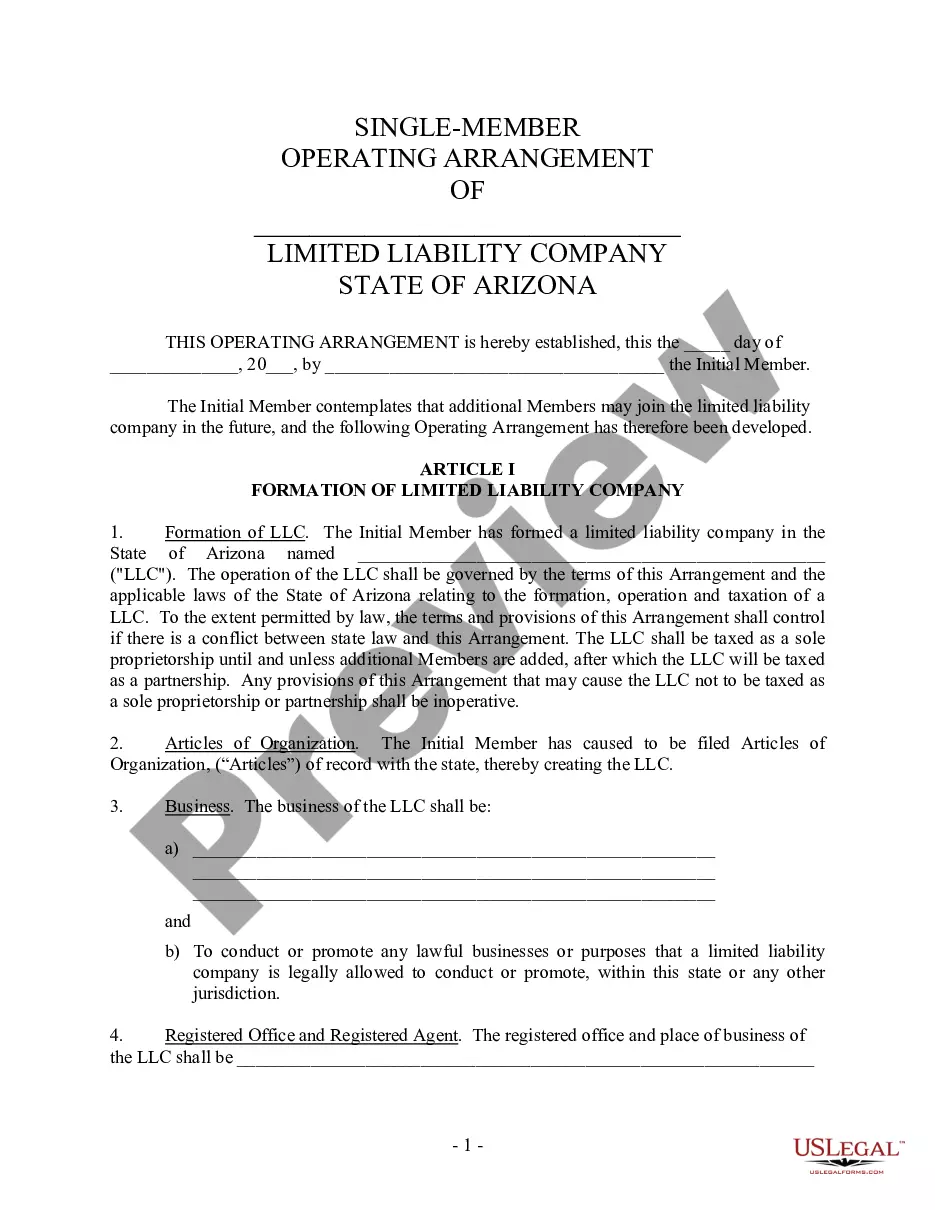

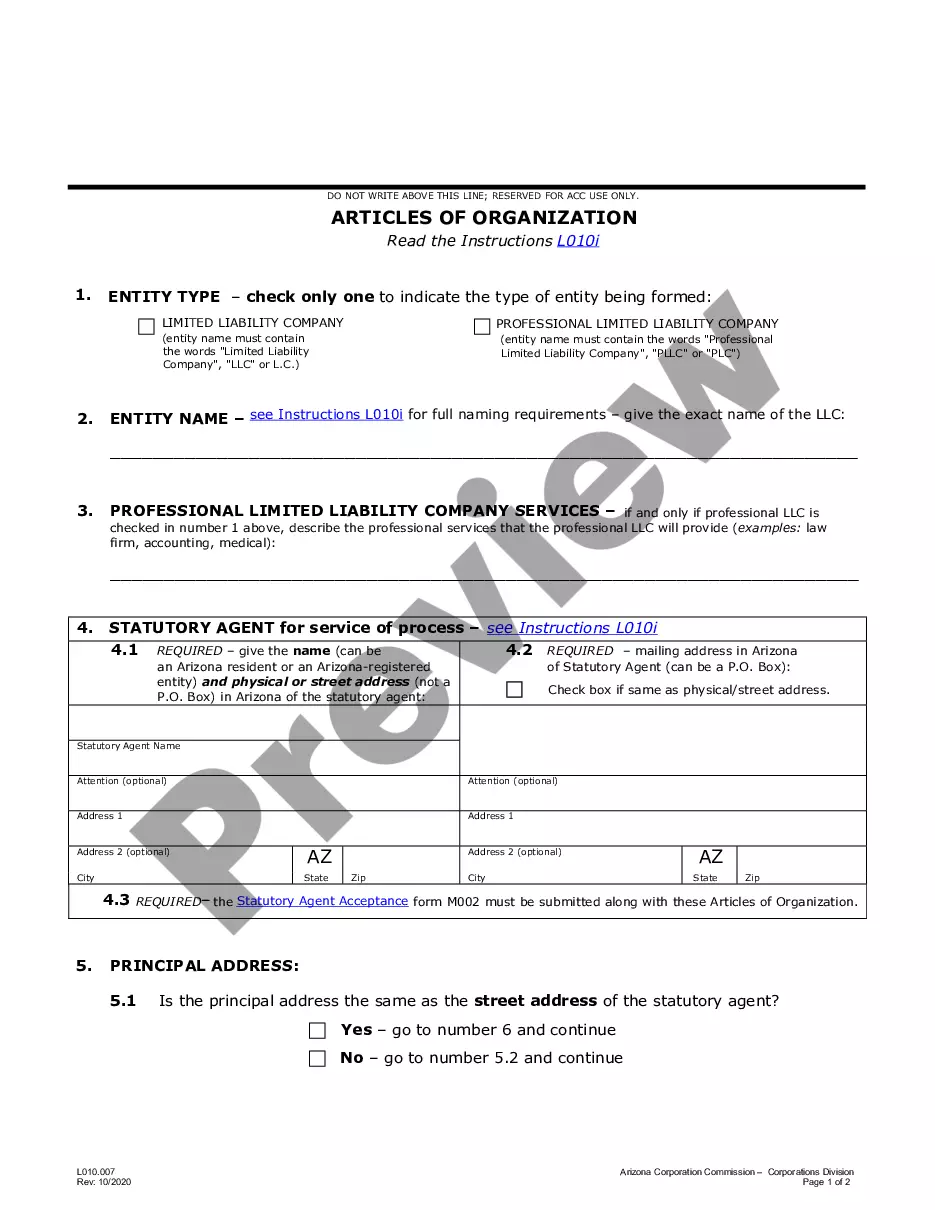

When it comes to filling out Oklahoma Order for Appointment of Personal Representative, you most likely think about an extensive process that requires getting a suitable form among countless similar ones and then being forced to pay out an attorney to fill it out to suit your needs. In general, that’s a slow and expensive choice. Use US Legal Forms and choose the state-specific form in just clicks.

If you have a subscription, just log in and then click Download to get the Oklahoma Order for Appointment of Personal Representative sample.

In the event you don’t have an account yet but need one, follow the point-by-point manual listed below:

- Be sure the document you’re saving is valid in your state (or the state it’s needed in).

- Do it by looking at the form’s description and through visiting the Preview option (if accessible) to see the form’s content.

- Simply click Buy Now.

- Select the appropriate plan for your budget.

- Subscribe to an account and choose how you would like to pay out: by PayPal or by credit card.

- Download the document in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Professional attorneys work on drawing up our samples to ensure after downloading, you don't have to bother about editing content outside of your personal information or your business’s info. Be a part of US Legal Forms and get your Oklahoma Order for Appointment of Personal Representative document now.

Order For Summary Administration Of Estate And Order Appointing Personal Representative Form popularity

Personal Representative Deed Form Other Form Names

FAQ

Locate Documents. Record the preferences of the testator. Check status of property and accounts. Confirm beneficiaries are correct. Make a list of personal possessions. Create a schedule of assets. Make a list of credit cards and debts. Electronic access to information.

4% of the first $100,000. 3% of the next $100,000. 2% of the next $800,000. 1% of the next $9,000,000. 0.5% of the next $15,000,000. and reasonable compensation as determined by the California Probate Court for any amount above $25,000,000.

Under California Probate Code, the executor typically receives 4% on the first $100,000, 3% on the next $100,000 and 2% on the next $800,000, says William Sweeney, a California-based probate attorney. For an estate worth $600,000 the fee works out at approximately $15,000.

An executor is someone named in your will, or appointed by the court, who is given the legal responsibility to take care of any remaining financial obligations. Typical duties include: Distributing assets according to the will. Maintaining property until the estate is settled (e.g., upkeep of a house)

You can administer an estate even if the deceased died without a will or failed to specify an executor. If your relationship to the deceased doesn't make you the probate court's default choice for administrator, you'll need to get permission from the relatives ahead of you in the priority order.

An administrator is a person who has been appointed by a probate court to manage a deceased person's estate.If you are an executor, you were nominated to serve in the decedent's will and appointed by a probate court. Administrators and executors are commonly referred to as personal representatives.

A personal representative usually is named in a will. However, courts sometimes appoint a personal representative. Usually, whether or not the deceased left a will, the probate court will issue a finding of fact that a will has or has not been filed and a personal representative or administrator has been appointed.

Step 1 Fill in the county in which you are signing the document. Step 2 Write in your name as successor in interest of decedent. Step 3 Write in your relationship to decedent and decedent's name and date of death in Section 1. Make sure to attach a certified death certificate.

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.