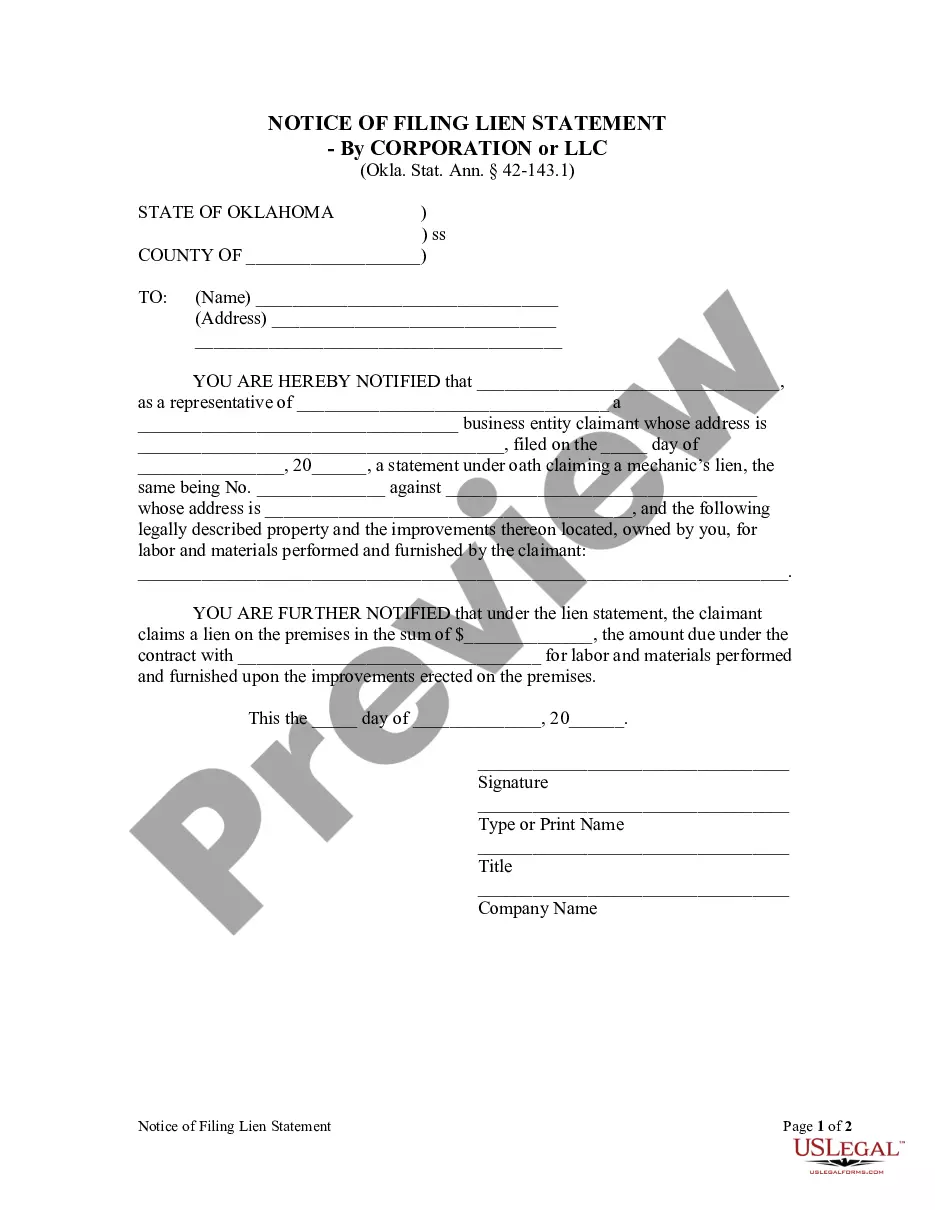

This Notice of Filing Lien Statement form is to be mailed by the county clerk within one business day after the date of filing of the lien statement to the owner of the property on which a lien attaches. This notice provides the claimant's name and address, date of filing, name and address of the person against whom the claim is made, legal description of the property, and the amount claimed.

Oklahoma Notice of Filing Lien Statement - Corporation

Description Statement Of Lien

How to fill out Oklahoma Notice Of Filing Lien Statement - Corporation?

In terms of submitting Oklahoma Notice of Filing Lien Statement - Corporation or LLC, you probably think about a long process that consists of finding a perfect sample among numerous similar ones then needing to pay out a lawyer to fill it out for you. Generally speaking, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific form in a matter of clicks.

In case you have a subscription, just log in and click Download to find the Oklahoma Notice of Filing Lien Statement - Corporation or LLC sample.

In the event you don’t have an account yet but want one, stick to the step-by-step guideline listed below:

- Be sure the document you’re getting applies in your state (or the state it’s required in).

- Do it by reading through the form’s description and also by clicking on the Preview option (if readily available) to view the form’s content.

- Click on Buy Now button.

- Choose the suitable plan for your budget.

- Subscribe to an account and choose how you want to pay: by PayPal or by credit card.

- Download the file in .pdf or .docx format.

- Get the record on the device or in your My Forms folder.

Professional attorneys work on creating our samples to ensure after downloading, you don't need to bother about modifying content material outside of your individual info or your business’s information. Be a part of US Legal Forms and get your Oklahoma Notice of Filing Lien Statement - Corporation or LLC example now.

Form popularity

FAQ

Someone who is owed money is generally not able to just put a lien on property without first securing a judgment. Securing a judgment requires the creditor to sue the debtor. This may be through circuit court in many jurisdictions. If under a certain dollar amount, this suit may be through the small claims court.

To place a lien, you must first demonstrate that you have a valid debt that has not been paid by the property holder for example if you performed construction work as a contractor or subcontractor at company headquarters and the business did not pay your bill.

To perfect a lien on a vehicle, boat or outboard motor, a properly completed Lien Entry Form (MV-21-A), along with proper ownership documentation in the form of either an Application for Oklahoma Certificate of Title (Form 701-6) and the Manufacturer's Statement of Origin (MSO), an Oklahoma title, an out-of-state title

§4223. Limitation of time. A lien is extinguished by the mere lapse of the time within which, under the provisions of civil procedure, an action can be brought upon the principal obligation.

When your efforts to collect a bill from a business that owes you money have been unsuccessful, you can place a lien on the assets of the business. As a lienholder, you gain legal rights to the company's property and the authority to sell the property and use the proceeds to repay what is owed to you.

Avoid harassing the people that owe you money. Keep phone calls short. Write letters. Get a collection agency to write demand letters. Offer to settle for less than is due. Hire a collection agency. Small claims court. File a lawsuit.

Any person who performs labor or furnishes material may file a lien on the real estate that received the labor or materials. You must serve a pre-lien notice if the amount is over $10,000. You must serve your pre-lien notice within 75 days. You must file your lien within 120 days.

To attach the lien, the creditor files the Statement of Judgment with the county clerk in any Oklahoma county where the debtor has property now or may have property in the future.

For a Lien only: $10.00 Lien fee plus $1.55 Mail fee. 3. The MLA will stamp and record the date, time and receipt number on the face of the titling documentation and attach one copy of the MV-21-A and one copy of the lien fee receipt.