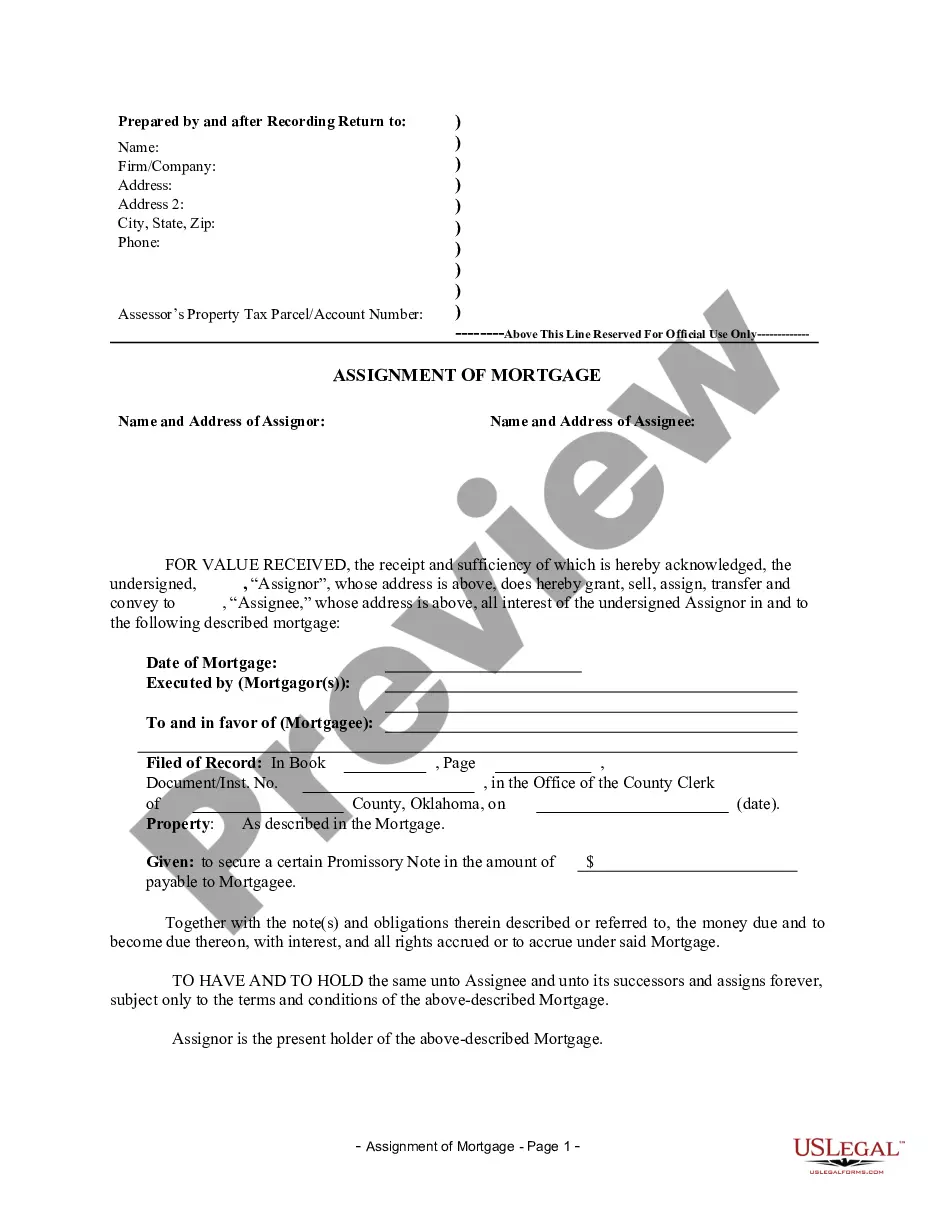

Assignment of Mortgage by Corporate Mortgage Holder

Assignment and Satisfaction

of Mortgages

Assignments Generally:

Lenders, or holders

of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rule

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Oklahoma Law

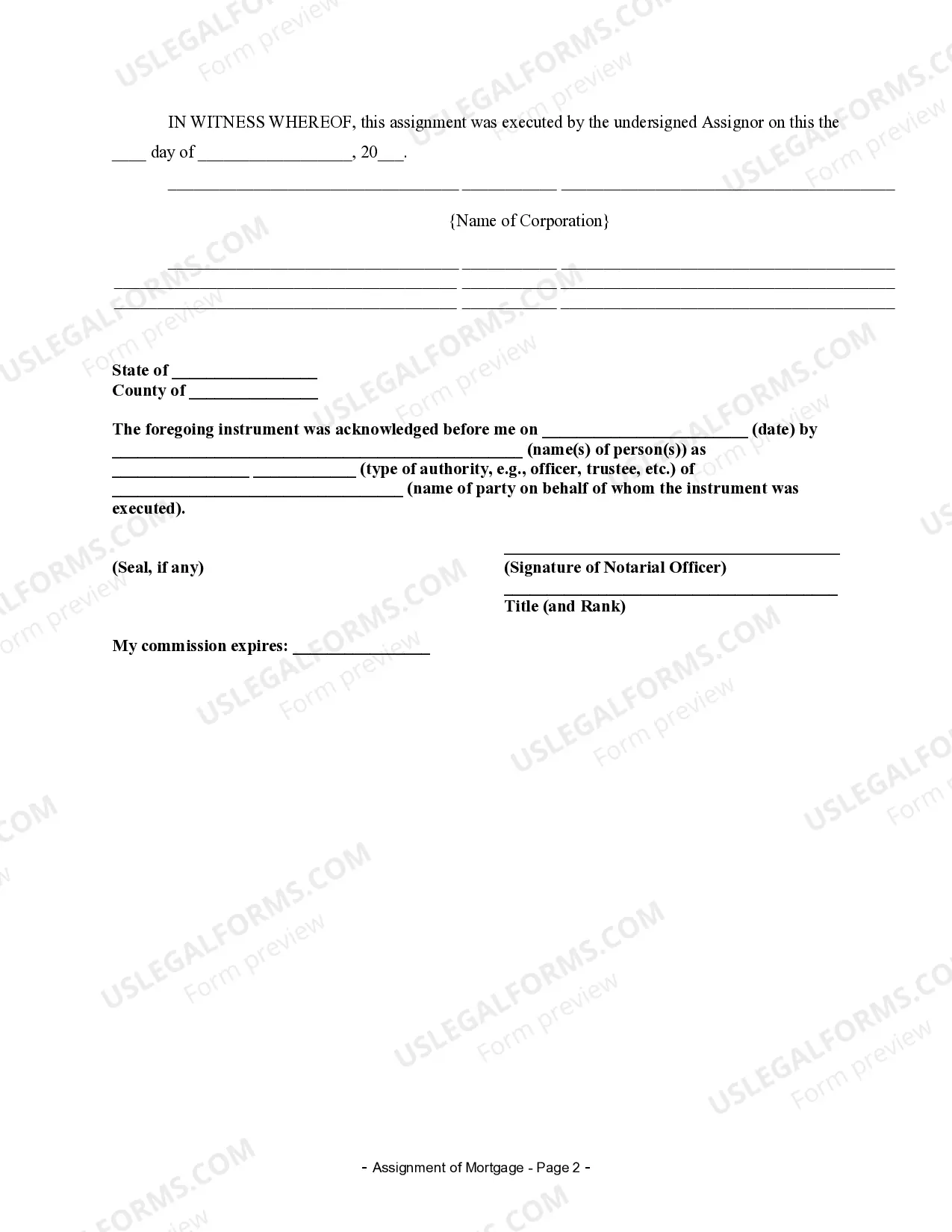

Execution of Assignment or Satisfaction:

An assignment or satisfaction must be signed by the mortgagee or his authorized

agent.

Assignment:

An assignment must be in writing and recorded.

Demand to Satisfy:

If, after 50 days following the satisfaction of the mortgage, the mortgagee has not satisfied the mortgage

of record, then the mortgagor may, in a writing, request that the mortgagee

do so. If the mortgagee fails to do so within 10 days of the written request,

the mortgagee shall then forfeit and pay to the mortgagor a penalty of

one percent (1%) of the principal debt not to exceed One Hundred Dollars

($100.00) for each day the release is not recorded after the ten day period

has expired and the penalty shall be recovered in a civil action in any

court having jurisdiction thereof, but the request for the release shall

be in writing and describe the mortgage and premises with reasonable certainty.

Provided that, the total penalty shall not exceed one hundred percent (100%)

of the total principal debt.

Recording Satisfaction:

Any mortgage on real estate shall be released by the holder of any such mortgage within

fifty (50) days of the payment of the debt secured by the mortgage and

the holder of the mortgage shall file the release of the mortgage with

the county clerk where the mortgage is recorded.

Penalty:

See above text under Demand to Satisfy.

Acknowledgment:

An assignment or satisfaction must contain a proper Oklahoma acknowledgment, or other acknowledgment

approved by Statute.

Oklahoma Statutes

§46-15. Holder must release - Penalty - Mortgagor

defined.

A. Any mortgage on real estate shall be released by the

holder of any such mortgage within fifty (50) days of the payment of the

debt secured by the mortgage and the holder of the mortgage shall file

the release of the mortgage with the county clerk where the mortgage is

recorded. If, at the end of the fifty-day period, the holder has

failed to release the mortgage, the mortgagor may at any time request in

writing the holder of the mortgage to release the mortgage and the holder

of the mortgage shall have ten (10) days from the date of the request to

release such mortgage. If the holder of the mortgage fails to release

the mortgage by the end of such ten-day period, he shall then forfeit and

pay to the mortgagor a penalty of one percent (1%) of the principal debt

not to exceed One Hundred Dollars ($100.00) per day each day the release

is not recorded after the ten-day period has expired and the penalty shall

be recovered in a civil action in any court having jurisdiction thereof,

but the request for the release shall be in writing and describe the mortgage

and premises with reasonable certainty. Provided that, the total penalty

shall not exceed one hundred percent (100%) of the total principal debt.

B. For purposes of this section, "mortgagor" shall include

any subsequent purchaser of the mortgaged real estate.

§46-16. How released.

A mortgage on real property may be released by written instrument,

duly signed and acknowledged and recorded in the office of the county clerk

as register of deeds.

§46-14. Release by attorney.

Any agent or attorney duly authorized to collect the debt secured

thereby shall have power and authority to release a mortgage.

§46-13. Assignments of existing mortgages - Recording

within four months - Mortgages on record for six months.

All assignments of mortgages at present existing, bearing date prior

to the taking effect of this act, shall within four (4) months next succeeding

the taking effect of this act be recorded in the proper county of this

state, in accordance with the provisions of Section 1, of this act, whether

such assignments be acknowledged or not, and in case such assignments are

not recorded within the time herein provided, the payment of any interest

or principal on the debts secured by such mortgages to the mortgagees or

the assignees whose assignments appear last of record after the expiration

of the time herein provided, and before the recording of such assignments,

shall be and constitute a complete defense to any action on such mortgage

or note or other evidence of indebtedness secured thereby as against the

mortgagor, his heirs, personal representatives, or assigns: Provided, however,

that the last assignee of an unrecorded assignment shall have a right of

action against the assignor to whom such interest or principal is paid;

and provided further, that where the mortgagor, his heirs, personal representatives,

or assigns have actual notice or knowledge of such assignment or transfer,

then in such case such payment shall constitute no defense, and none of

the provisions of this act shall apply. Provided, this section applies

only to mortgages which have been on record six (6) months or more.

§46-12. Assignment - Unrecorded - Payment.

In cases where assignments of real estate mortgages are made after

the passage of this act, if such assignments are not recorded, the mortgagor,

his heirs, personal representatives, or assigns, may pay all matured interest

or the principal debt secured thereby, prior to the recording of such assignment

to the mortgagee, or if any assignment of such mortgage has been made that

duly appears of record, then such payment may be made to the last assignee

whose assignment is recorded in accordance with the provisions of this

act, and such payment shall be effectual to extinguish the debt secured

by such mortgage and all claims against such mortgagor, his heirs, personal

representatives, and assigns, for or on account of such interest or such

principal indebtedness; and no transfer of any note, bond or other evidence

of indebtedness, by endorsement or otherwise, where such indebtedness is

secured by mortgage on real estate within this state, shall prevent or

operate to defeat the defense of payment of such interest or principal

by the mortgagor, his heirs, personal representatives, or assigns, where

such payment has been made to the mortgagee or to the assignee whose assignment

appears last of record under the provisions of this act: Provided,

however, that in all such cases the assignee who may hold such unrecorded

assignment shall have a right of action against his assignor to recover

the amount of any such payment of interest or principal made to such assignor

as upon an account for money had and received for the use of such assignee:

Provided, this section applies only to mortgages which have been on record

six (6) months or more.