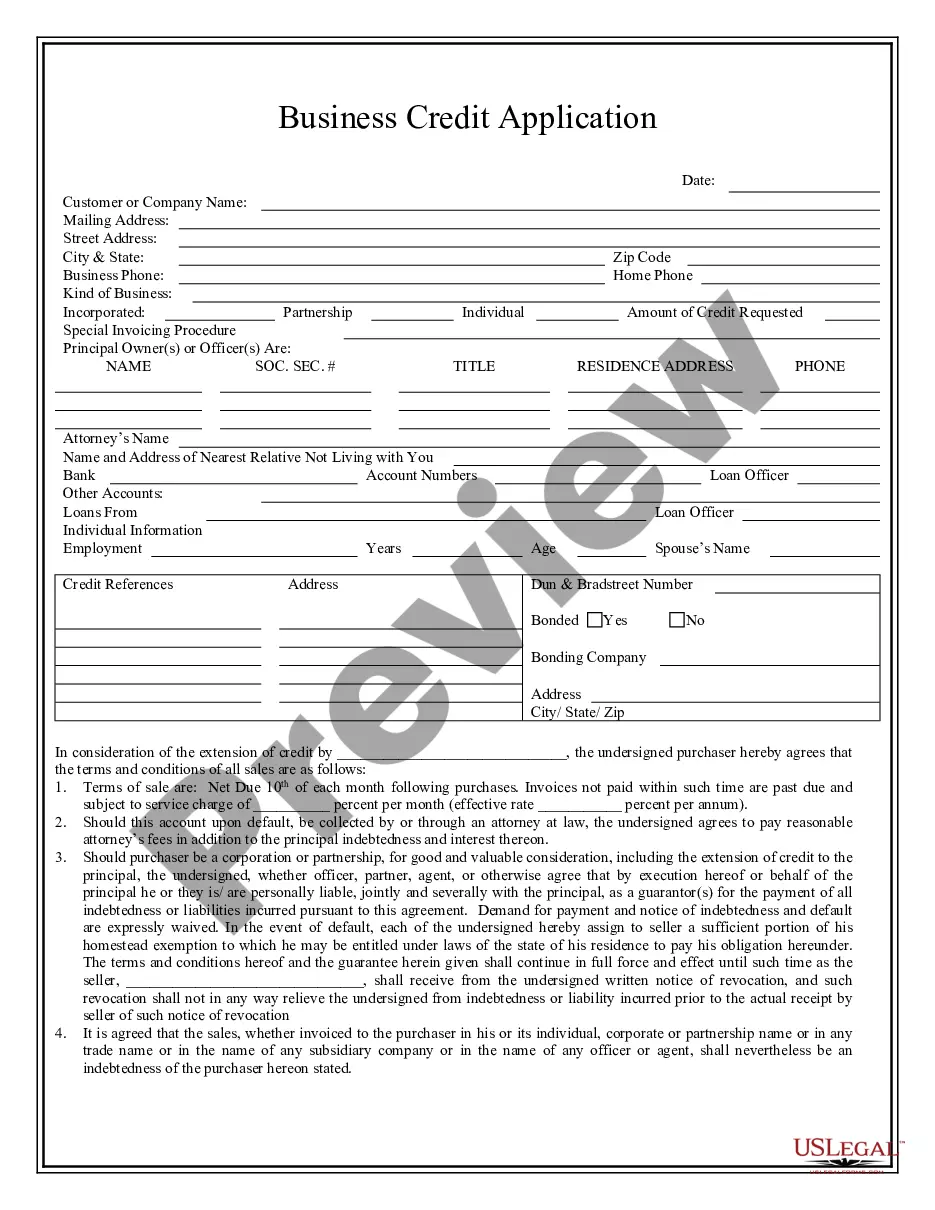

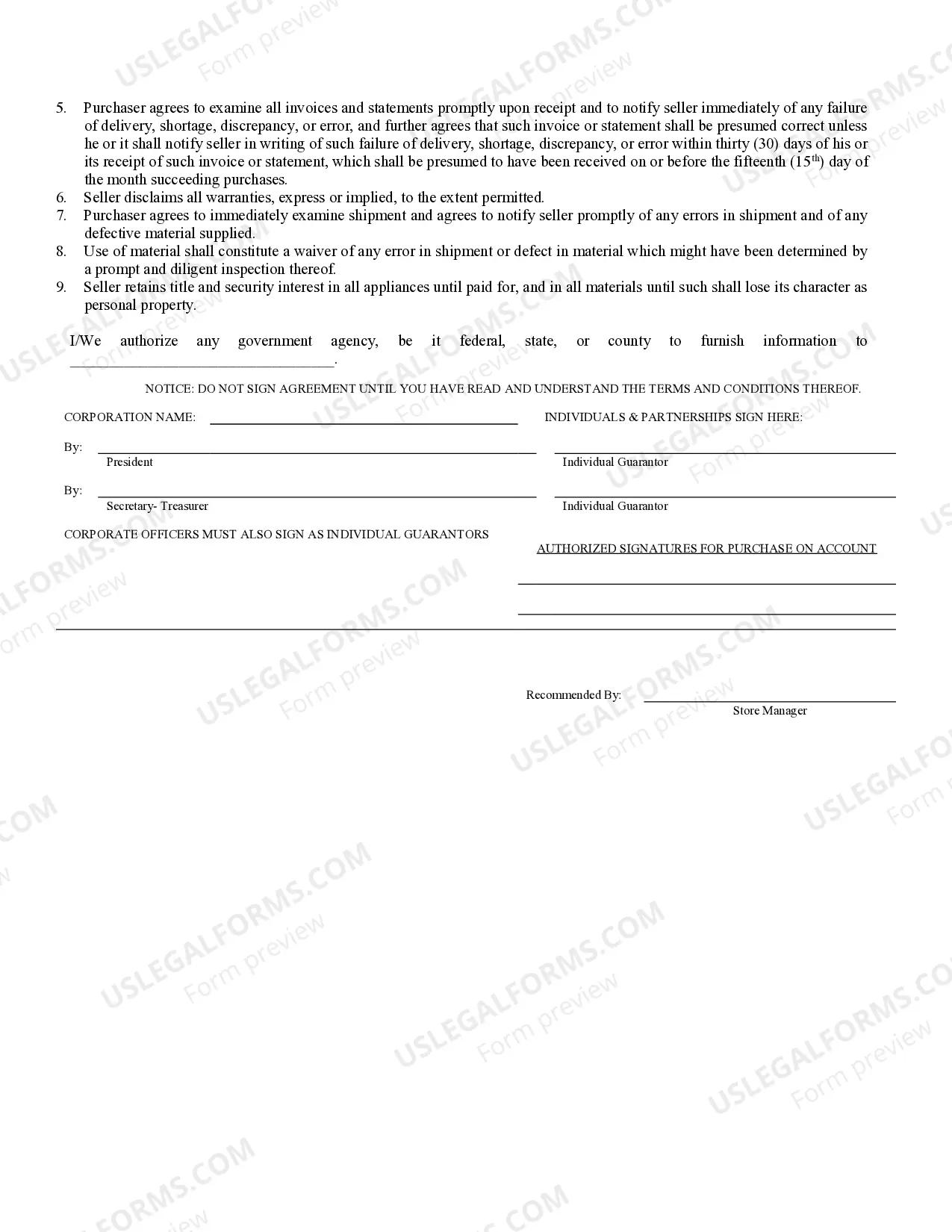

Oklahoma Business Credit Application

Description

How to fill out Oklahoma Business Credit Application?

When it comes to submitting Oklahoma Business Credit Application, you almost certainly think about an extensive procedure that requires finding a appropriate form among hundreds of similar ones then needing to pay legal counsel to fill it out for you. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific form within clicks.

In case you have a subscription, just log in and click Download to find the Oklahoma Business Credit Application sample.

If you don’t have an account yet but need one, stick to the step-by-step guide below:

- Make sure the file you’re downloading is valid in your state (or the state it’s required in).

- Do it by looking at the form’s description and by visiting the Preview option (if readily available) to view the form’s information.

- Click on Buy Now button.

- Pick the proper plan for your financial budget.

- Join an account and select how you want to pay: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Get the document on your device or in your My Forms folder.

Skilled legal professionals draw up our samples to ensure that after downloading, you don't have to worry about editing content outside of your individual details or your business’s information. Join US Legal Forms and get your Oklahoma Business Credit Application example now.

Form popularity

FAQ

The business credit application is your opportunity to prove that your business is an appropriate credit risk.These reports and business credit scores are used to decide not only if your business should be approved, but also what the terms of the loan or credit line will be if approved.

The business credit application is your opportunity to prove that your business is an appropriate credit risk.These reports and business credit scores are used to decide not only if your business should be approved, but also what the terms of the loan or credit line will be if approved.

LLC SBA Loan That creates conditions where LLCs can get some of the absolute best interest rates, loan amounts, loan repayment terms, and so on. Since they're so desirable and have such high demand, SBA loans for LLC also have tougher qualification criteria when compared with other types of LLC business loans.

In Oklahoma, there is no general license required to start or own a business. However, for specific types of businesses and occupations, licenses, permits, or special registrations and filings may be required before opening or operating.

To start an LLC in Oklahoma you will need to file the Articles of Organization with the Oklahoma Secretary of State, which costs $100. You can apply online, by mail, or in-person. The Articles of Organization is the legal document that officially creates your Oklahoma Limited Liability Company.

In Oklahoma, there is no general license required to start or own a business. However, for specific types of businesses and occupations, licenses, permits, or special registrations and filings may be required before opening or operating.

Incorporate your business. Obtain a federal tax identification number (EIN). Open a business bank account. Establish a business phone number. Open a business credit file. Obtain business credit card(s). Establish a line of credit with vendors or suppliers.

Legal business name. Business address. Type of business. Business phone number. Tax identification number. Annual business revenue. Years in business. Monthly business expenses.

To form a corporation, the Certificate of Incorporation need to be filed with the Secretary of State. The initial cost to form the Articles of Incorporation in Oklahoma is a minimum of $50. The fee is one-tenth of one percent (1/10 of 1%) of the Total Authorized Capital (TAC).