Proof of Loss for Spouse and Children (Lump Sum Benefits) - This is an official form from the Oklahoma Workers Compensation Court, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Oklahoma statutes and law.

Oklahoma Proof of Loss for Spouse and Children (Lump Sum Benefits)

Description

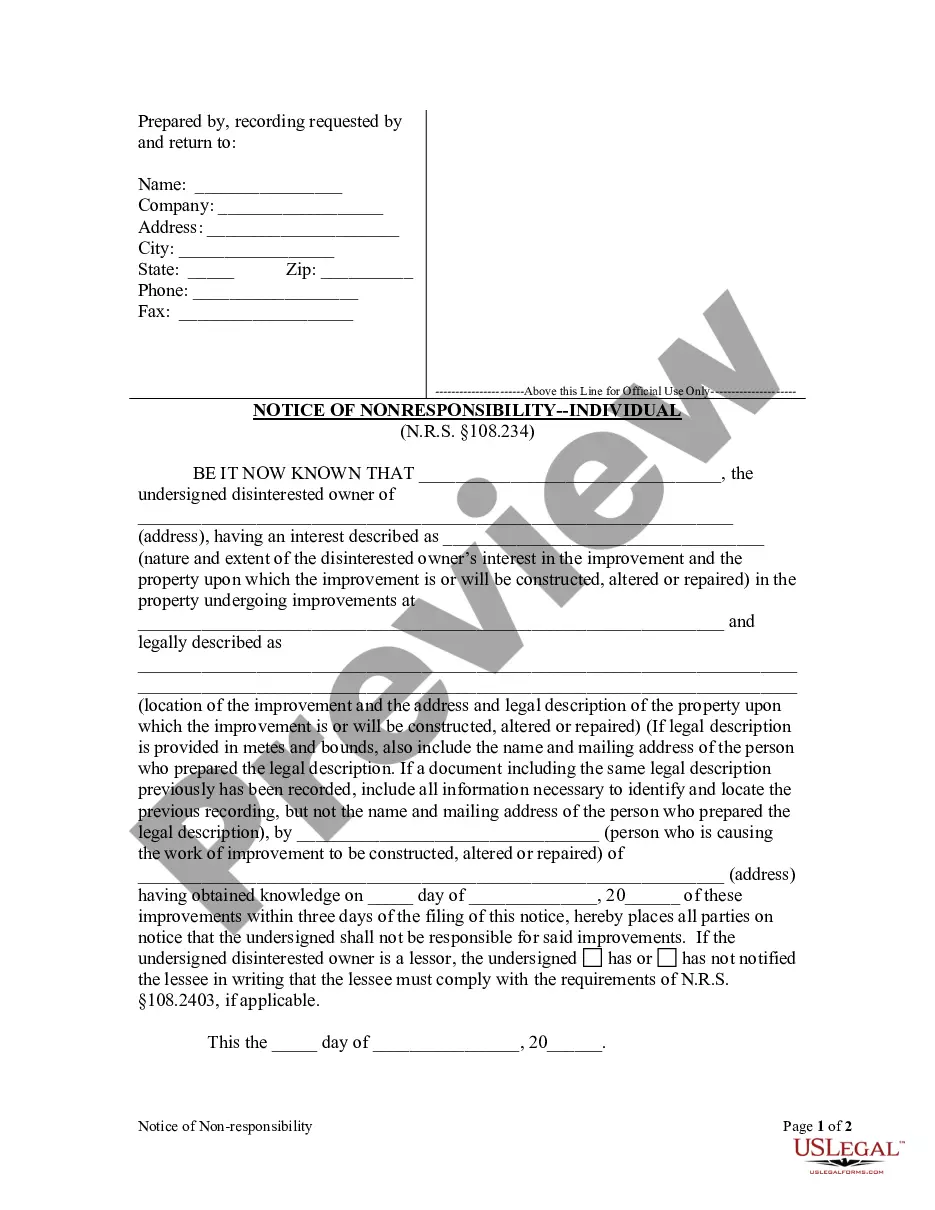

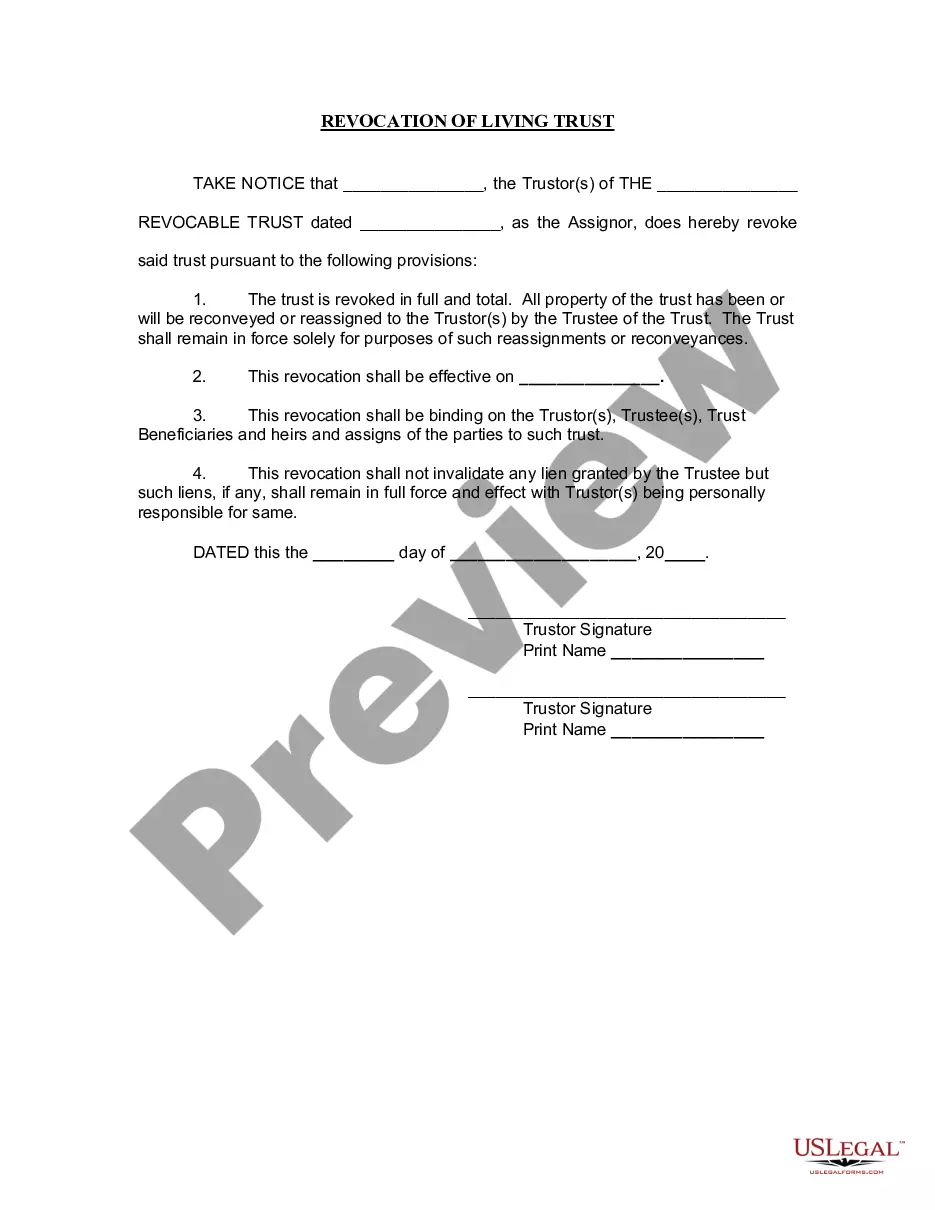

How to fill out Oklahoma Proof Of Loss For Spouse And Children (Lump Sum Benefits)?

In terms of completing Oklahoma Proof of Loss for Spouse and Children (Lump Sum Benefits), you most likely think about a long process that consists of getting a perfect sample among numerous similar ones then having to pay an attorney to fill it out for you. Generally speaking, that’s a sluggish and expensive option. Use US Legal Forms and choose the state-specific template within just clicks.

For those who have a subscription, just log in and click on Download button to get the Oklahoma Proof of Loss for Spouse and Children (Lump Sum Benefits) sample.

In the event you don’t have an account yet but need one, stick to the step-by-step guide listed below:

- Make sure the document you’re downloading applies in your state (or the state it’s required in).

- Do this by reading the form’s description and also by visiting the Preview function (if accessible) to see the form’s information.

- Click Buy Now.

- Choose the appropriate plan for your financial budget.

- Join an account and choose how you want to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx file format.

- Find the record on your device or in your My Forms folder.

Professional attorneys work on drawing up our samples so that after saving, you don't need to worry about editing and enhancing content outside of your individual information or your business’s info. Sign up for US Legal Forms and receive your Oklahoma Proof of Loss for Spouse and Children (Lump Sum Benefits) sample now.

Form popularity

FAQ

File as if both the resident and the nonresident civilian were Oklahoma residents on Form 511. Use the married filing joint filing status, and report all income. A tax credit (Form 511TX) may be used to claim credit for taxes paid to another state, if applicable.

Oklahomans can call 405-521-6099 or visit the Employment Security Commission (oklahoma.gov) website and utilize the Virtual Agent feature found at the bottom right of the screen.

Oklahoma Residents If you filed a federal return as an Oklahoma resident or if you earned more than $12,500 (married, filing separately), $15,000 (single), $19,000 (head of household), or $25,000 (married, filing jointly), you are required to file an Oklahoma state income tax return.

Contact the Section by phone at (405) 521-3126, fax at (405) 522-3283, or by mail at Oklahoma Tax Commission, Corporate-Compliance Division, PO Box 269054, Oklahoma City OK 73126-9054.

To make a correction to the Oklahoma return you have filed, print and complete Form 511X with the necessary changes. Your amended return can then be mailed with all accompanying schedules and payment to Oklahoma Tax Commission, P.O. Box 269045, Oklahoma City, OK 73126-9045.

Non-residents: If you have gross income from Oklahoma sources of $1,000 or more you are required to file an Oklahoma return, unless otherwise provided for in the Pass-Through Entity Tax Equity Act of 2019. You are allowed $1,000 per exemption.

You can now submit the Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products. Only tax year 2019 Forms 1040 and 1040-SR returns can be amended electronically.

The Oklahoma taxable income of a part-year individual or nonresident individual shall be calculated as if all income were earned in Oklahoma, using Form 511NR.After the taxable income is calculated, it is prorated using a percentage of the AGI from Oklahoma sources divided by the AGI from all sources.