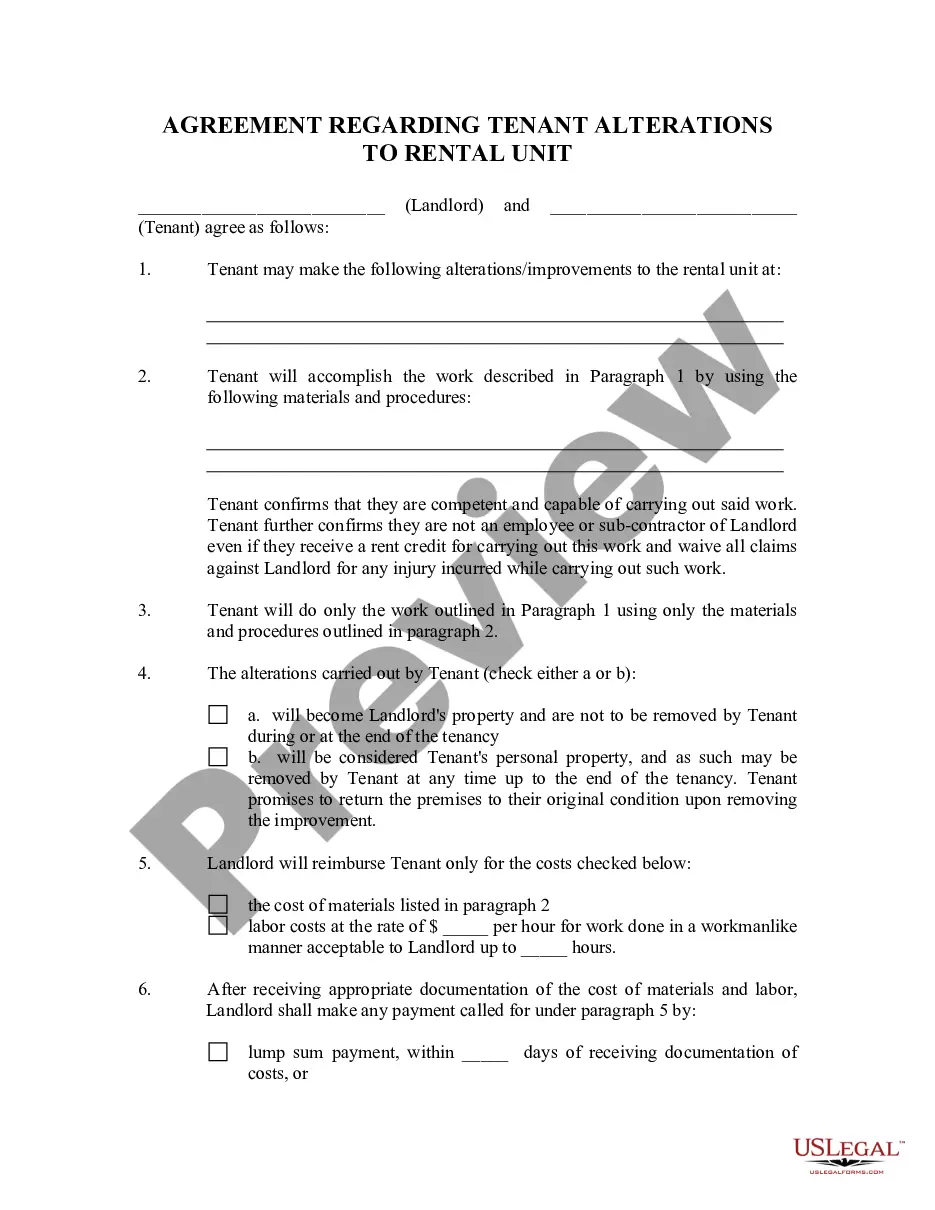

Oklahoma Landlord Agreement to allow Tenant Alterations to Premises

Description

How to fill out Oklahoma Landlord Agreement To Allow Tenant Alterations To Premises?

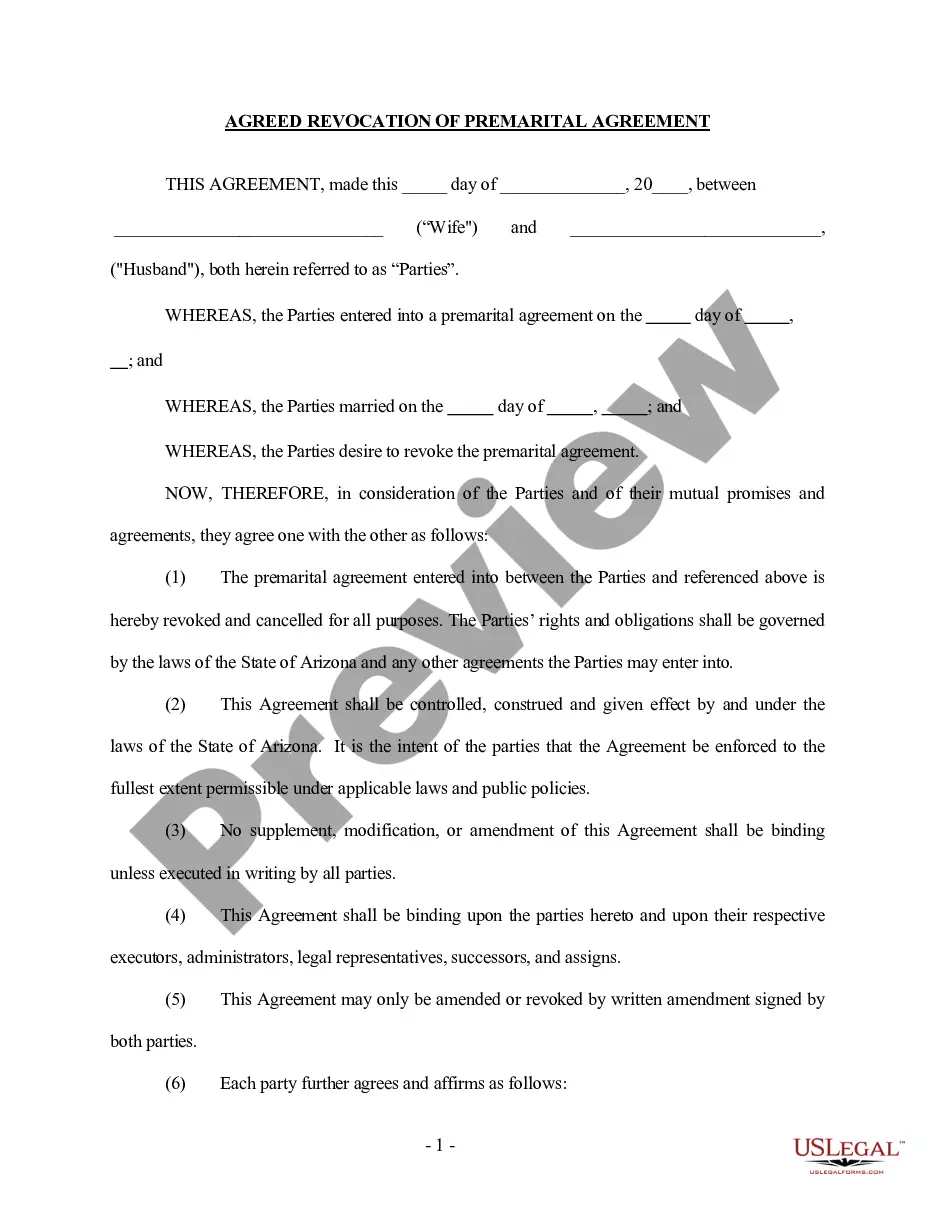

When it comes to submitting Oklahoma Landlord Agreement to allow Tenant Alterations to Premises, you most likely think about a long process that consists of finding a ideal form among hundreds of similar ones and after that needing to pay an attorney to fill it out to suit your needs. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific form in just clicks.

In case you have a subscription, just log in and click Download to find the Oklahoma Landlord Agreement to allow Tenant Alterations to Premises template.

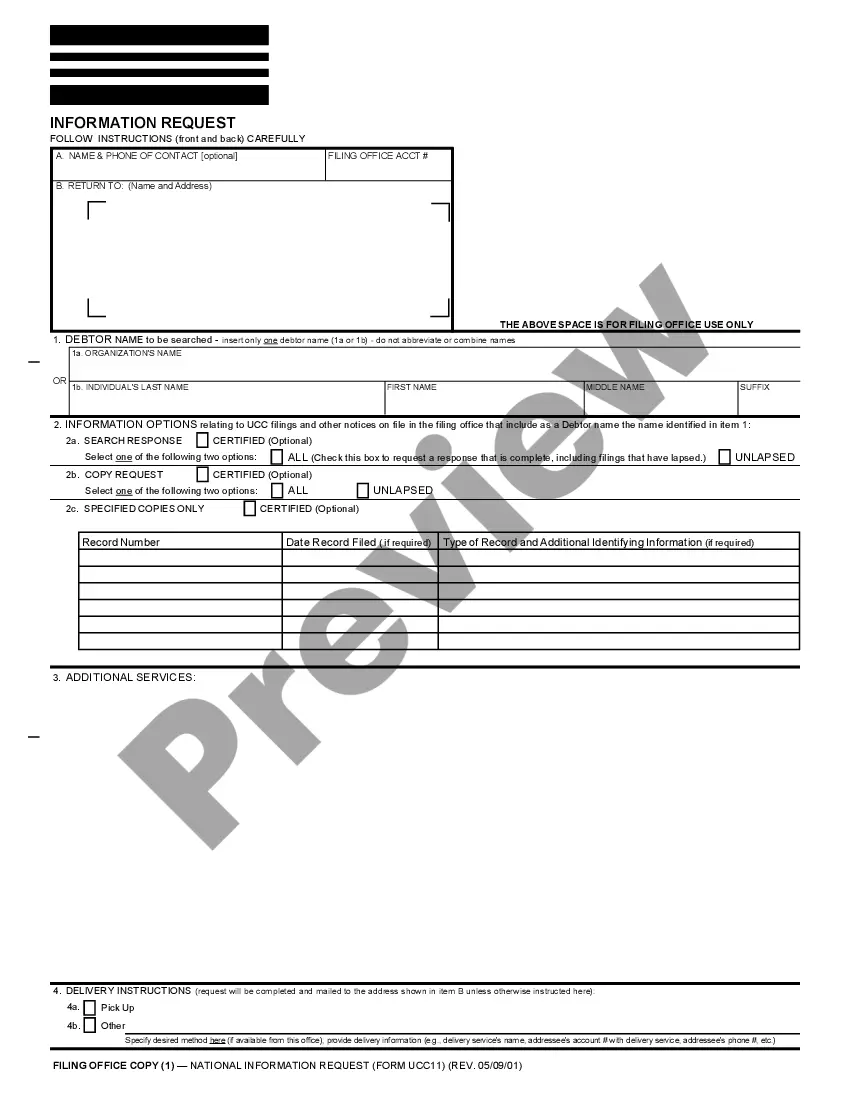

In the event you don’t have an account yet but need one, stick to the point-by-point manual below:

- Be sure the file you’re saving applies in your state (or the state it’s needed in).

- Do this by reading the form’s description and also by visiting the Preview function (if accessible) to find out the form’s information.

- Click on Buy Now button.

- Pick the suitable plan for your budget.

- Sign up for an account and choose how you want to pay out: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Get the file on the device or in your My Forms folder.

Professional legal professionals work on creating our templates to ensure that after downloading, you don't need to bother about enhancing content outside of your personal info or your business’s info. Be a part of US Legal Forms and get your Oklahoma Landlord Agreement to allow Tenant Alterations to Premises sample now.

Form popularity

FAQ

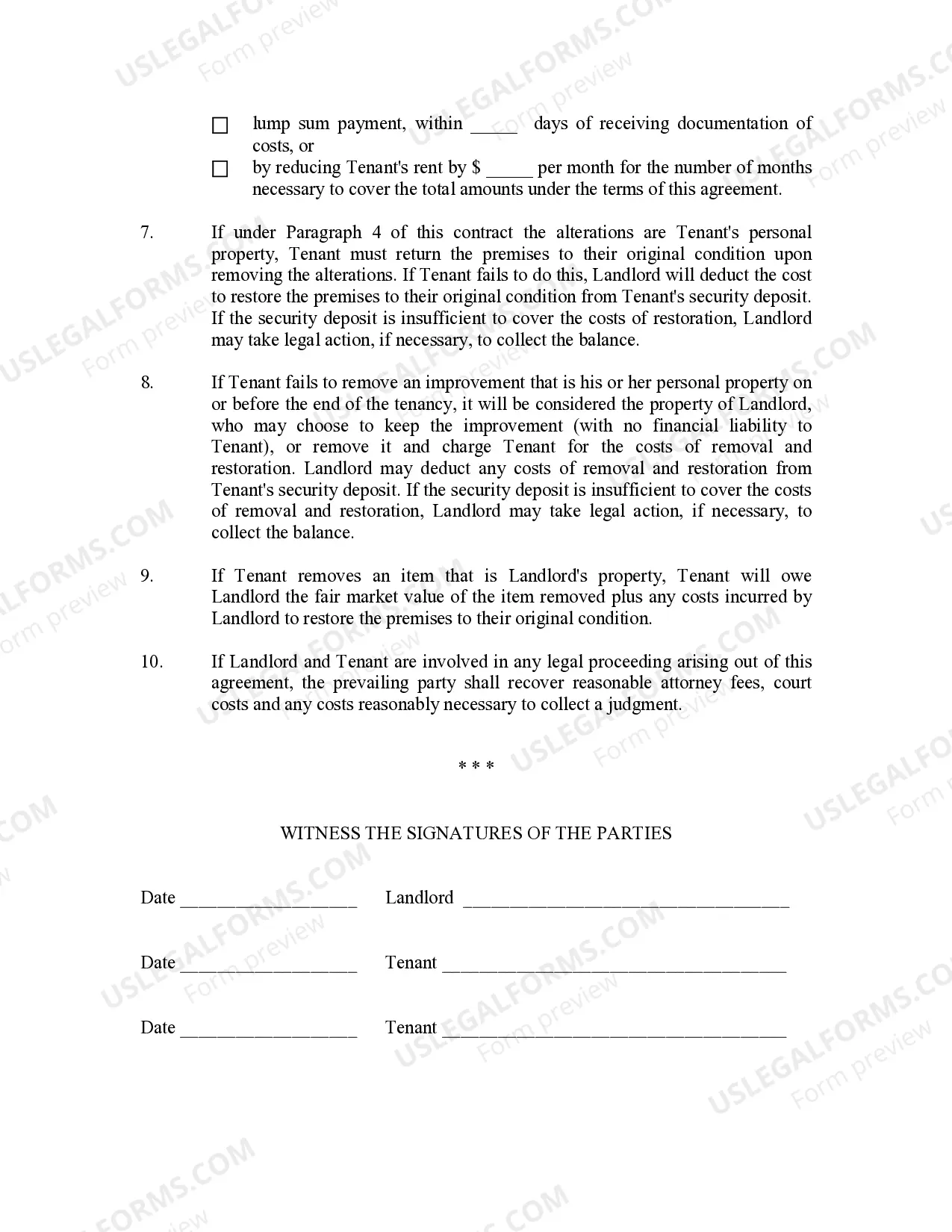

If you think your landlord is violating the Fair Housing Act, you can get that landlord in trouble by filing a complaint at HUD.gov. Your remedy for breach of quiet enjoyment is to terminate the lease and move or sue in small claims court.

The Tenant Doesn't Make Enough Income. The Tenant Smokes. The Tenant Has a Pet. The Tenant's Income Isn't Verified. The Tenant Has Been Convicted of a Crime. The Tenant Does Not Have Rental History. The Tenant Has a History of Damaging Property and Not Paying Rent. The Tenant Provides False Information.

Tenants also have certain rights under federal, state, and some local laws. These include the right to not be discriminated against, the right to a habitable home, and the right to not be charged more for a security deposit than is allowed by state law, to name just a few.

If the tenant pays for leasehold improvements, the capital expenditure is recorded as an asset on the tenant's balance sheet. Then the expense is recorded on income statements as amortization over either the life of the lease or the useful life of the asset, whichever is shorter.

Can a tenant claim for improvements made during the lease? The position differs in the case of immovable and movable property. Tenant can claim for:The claim arises only once the lease is terminated and lessee vacated the property.

Often, landlords will provide a 'leasehold improvement allowance' for their tenants which is merely a set amount they agree to pay for. If the improvements you want cost more than the allowance, you will be responsible for those extra costs.

Leasehold improvements are any changes made to a rental property in order to customize it for the particular needs of a tenant. These can include alterations such as painting, installing partitions, changing the flooring, or putting in customized light fixtures.

In cases like this, landlords are entitled to deduct the remaining tax basis in capitalized leasehold improvements made for a particular tenant upon termination of the lease if such improvements are irrevocably disposed of or abandoned and won't be used by a subsequent tenant.

A: Except in the case of a single family residence, your landlord must keep all common areas used by more than one tenant safe and clean; keep your premises in a safe, livable condition; keep all electrical, plumbing, sanitary, heating, ventilation, air-conditioning and other facilities and appliances supplied by the