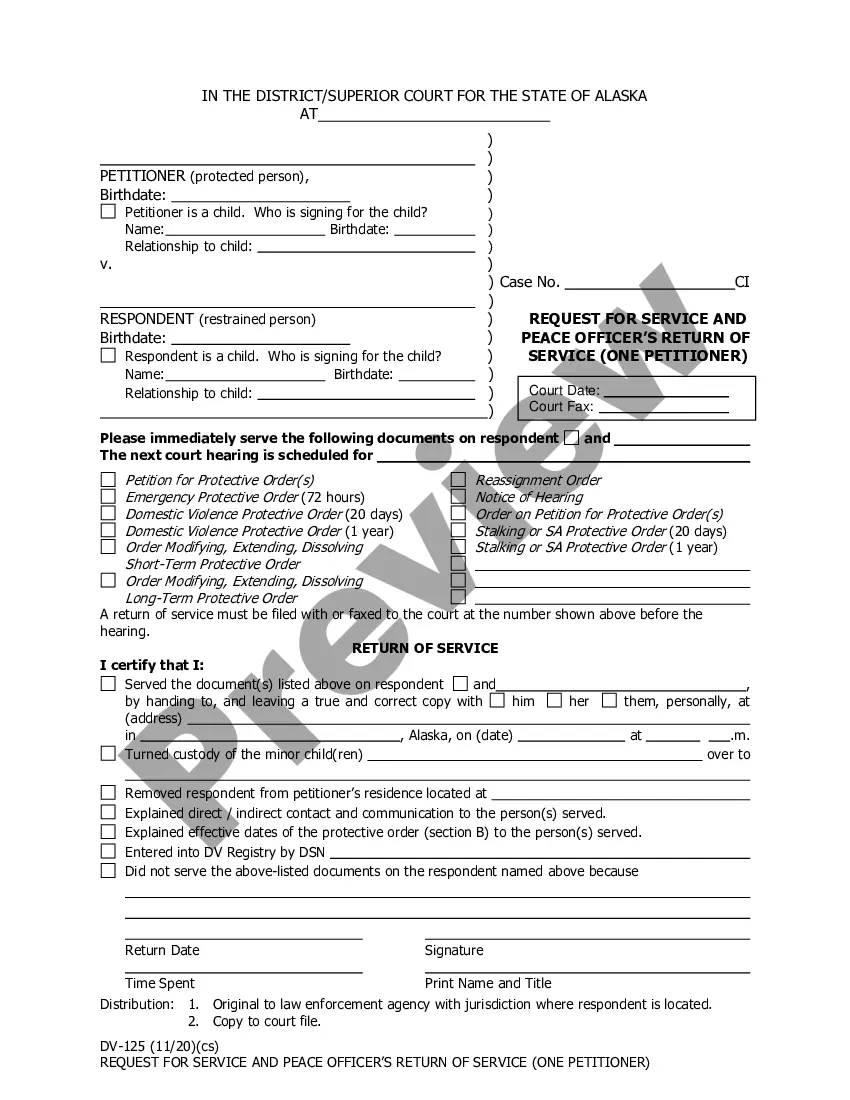

This is an official form from the Oklahoma State Courts Network, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Oklahoma statutes and law.

Oklahoma Post-Judgment General Garnishment Summons

Description Oklahoma Summons Form

How to fill out Oklahoma Post-Judgment General Garnishment Summons?

When it comes to submitting Oklahoma Post-Judgment General Garnishment Summons, you most likely visualize an extensive process that requires finding a appropriate sample among hundreds of very similar ones after which needing to pay legal counsel to fill it out to suit your needs. In general, that’s a slow-moving and expensive choice. Use US Legal Forms and choose the state-specific form in just clicks.

For those who have a subscription, just log in and click Download to find the Oklahoma Post-Judgment General Garnishment Summons form.

If you don’t have an account yet but need one, keep to the point-by-point manual below:

- Make sure the file you’re saving applies in your state (or the state it’s required in).

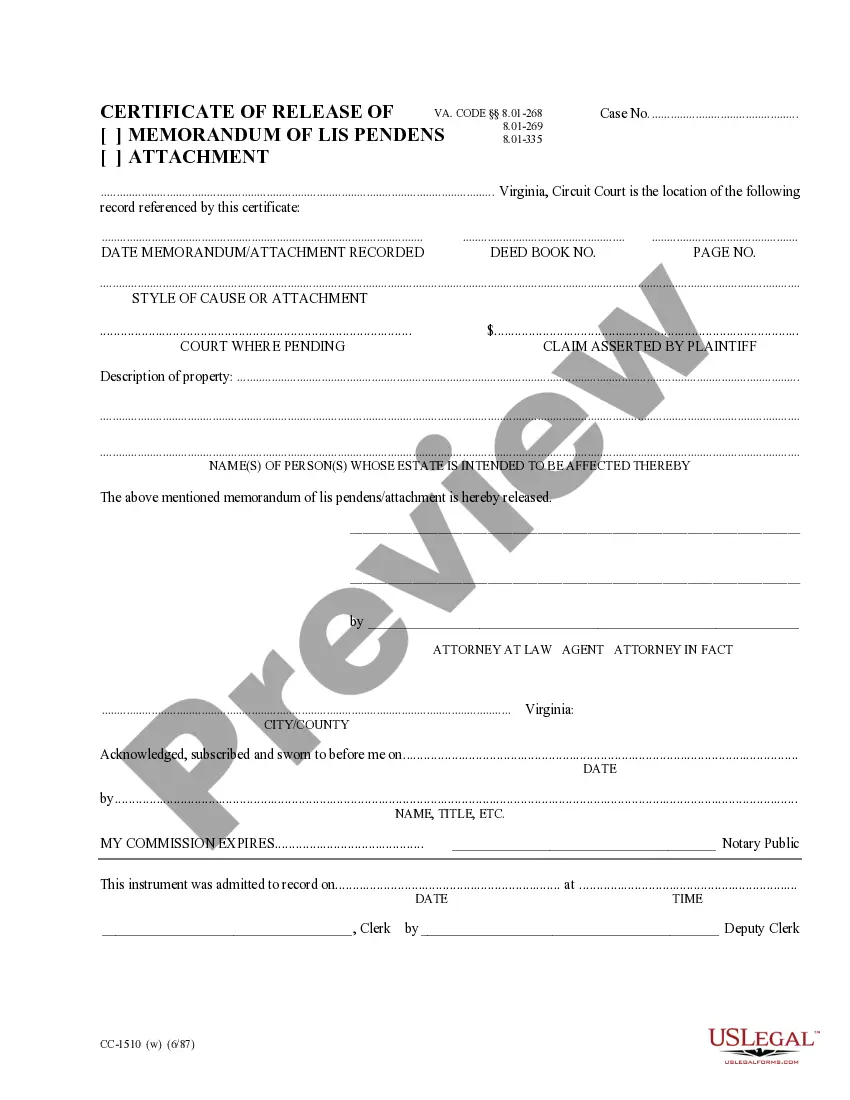

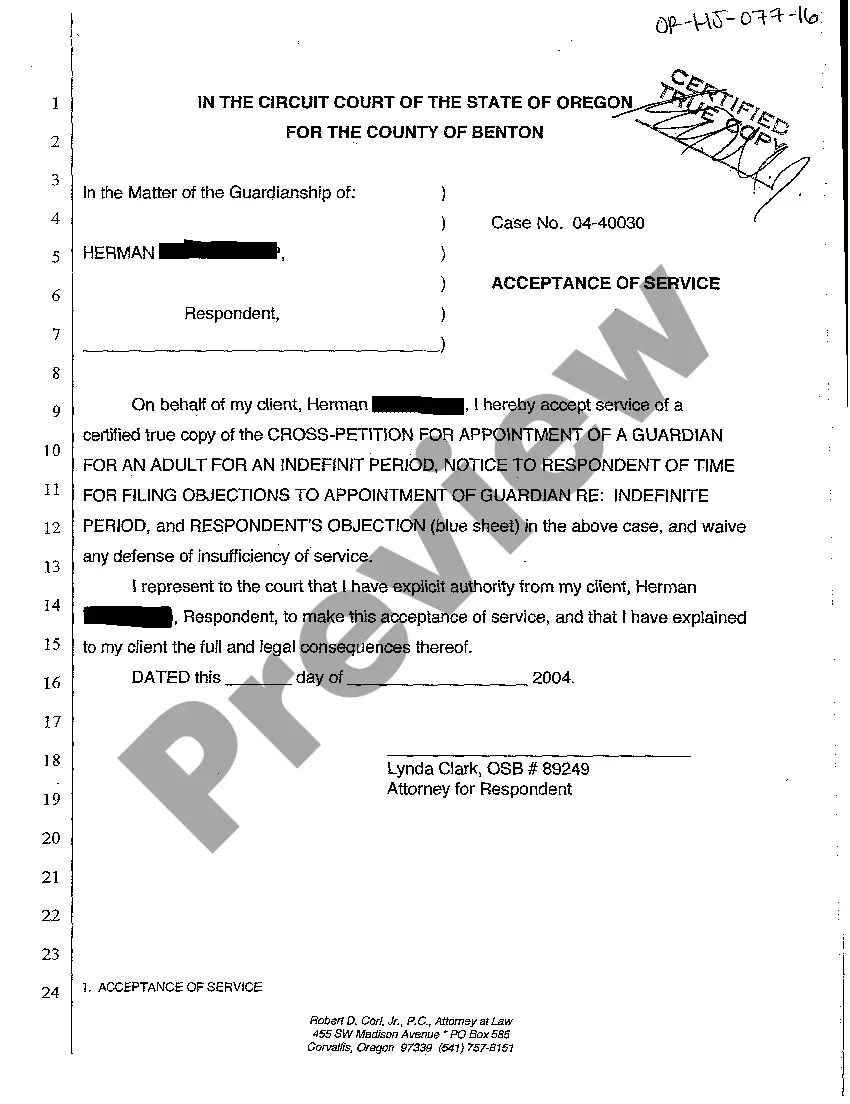

- Do it by reading the form’s description and by clicking on the Preview option (if readily available) to find out the form’s content.

- Click on Buy Now button.

- Select the suitable plan for your budget.

- Sign up for an account and choose how you want to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx file format.

- Get the file on the device or in your My Forms folder.

Professional lawyers draw up our samples to ensure after saving, you don't have to worry about modifying content outside of your personal info or your business’s information. Join US Legal Forms and receive your Oklahoma Post-Judgment General Garnishment Summons example now.

Form popularity

FAQ

Oklahoma law limits the amount that a creditor can garnish (take) from your wages for repayment of debts. The Oklahoma wage garnishment laws (also called wage attachments) protect the same amount of wages as the federal wage garnishment laws. For the most part, creditors with judgments can take only 25% of your wages.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

If you make $500 per week after all taxes and allowable deductions, 25% of your disposable earnings is $125 ($500 × . 25 = $125). The amount by which your disposable earnings exceed 30 times $7.25 is $282.50 ($500 2212 30 A $7.25 = $282.50).

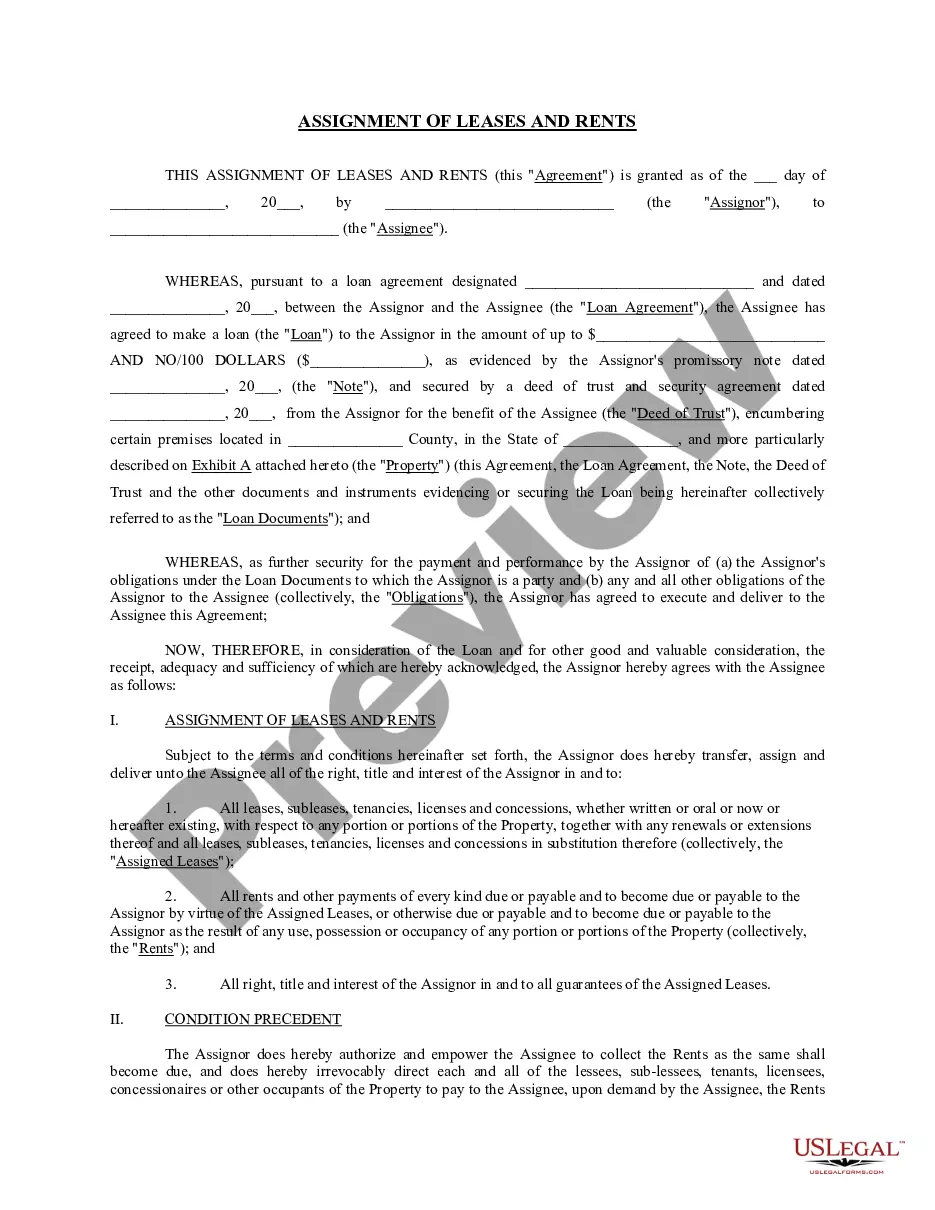

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

One method is to request the court issue a garnishment summons to a financial institution that is in possession of the debtor's funds. The procedure involves filing a Garnishment Affidavit with the court clerk. The Garnishment Affidavit should state who the parties are and the outstanding balance of the judgment.

Generally, the garnishment rules in Alberta are such that you keep the first $800 of your net income, then creditors may garnish up to 50% of your income between $800 and $2400, and 100% of any net income over $2400. The exemption amount may be increased depending on how many dependants you have.

The journal entry will be Debit Gross Wages, and Credit "Child Support Liability account." When you write the check to pay the garnishment, on the Expenses tab, you list the Child Support Liability account.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

Limits on Wage Garnishments 25% of the debtor's disposable earnings (what's left after mandatory deductions), or the amount by which the debtor's wages exceed 30 times the minimum wage, whichever is lower.