Oklahoma Closing Statement

Description Oklahoma Closing

How to fill out Oklahoma Statement Online?

When it comes to submitting Oklahoma Closing Statement, you probably visualize an extensive process that requires finding a appropriate sample among a huge selection of similar ones after which having to pay legal counsel to fill it out to suit your needs. Generally, that’s a slow-moving and expensive choice. Use US Legal Forms and pick out the state-specific template within just clicks.

In case you have a subscription, just log in and click on Download button to find the Oklahoma Closing Statement template.

In the event you don’t have an account yet but want one, stick to the point-by-point manual listed below:

- Make sure the document you’re getting is valid in your state (or the state it’s needed in).

- Do it by looking at the form’s description and through visiting the Preview function (if readily available) to find out the form’s information.

- Click Buy Now.

- Choose the appropriate plan for your budget.

- Sign up for an account and select how you would like to pay out: by PayPal or by card.

- Download the document in .pdf or .docx format.

- Get the record on your device or in your My Forms folder.

Skilled lawyers work on creating our templates to ensure after downloading, you don't have to worry about editing content outside of your personal info or your business’s details. Sign up for US Legal Forms and receive your Oklahoma Closing Statement document now.

Closing Settlement Form Statement Form popularity

Oklahoma Closing Settlement Form Complete Other Form Names

Oklahoma Closing Settlement Form Print FAQ

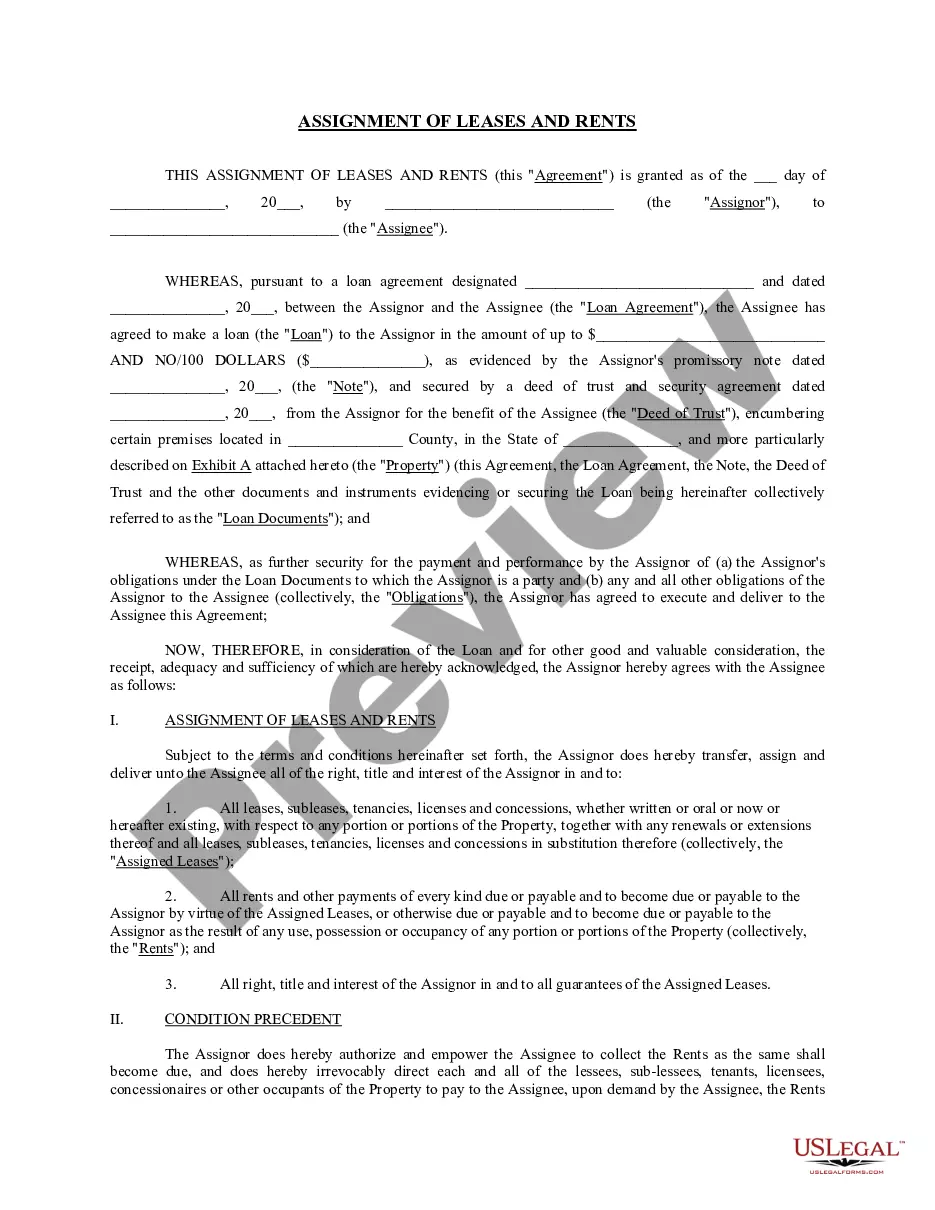

The Mortgage Promissory Note. The Mortgage / Deed of Trust / Security Instrument. The deed (for property transfer). The Closing Disclosure. The initial escrow disclosure statement. The transfer tax declaration (in some states)

A settlement statement is also known as a HUD-1 form or a closing statement. Until 2015, when the rules changed, this form was provided twice. First, within three business days of applying for a mortgage loan, the borrower receives one in the mail with the person's estimated closing costs.

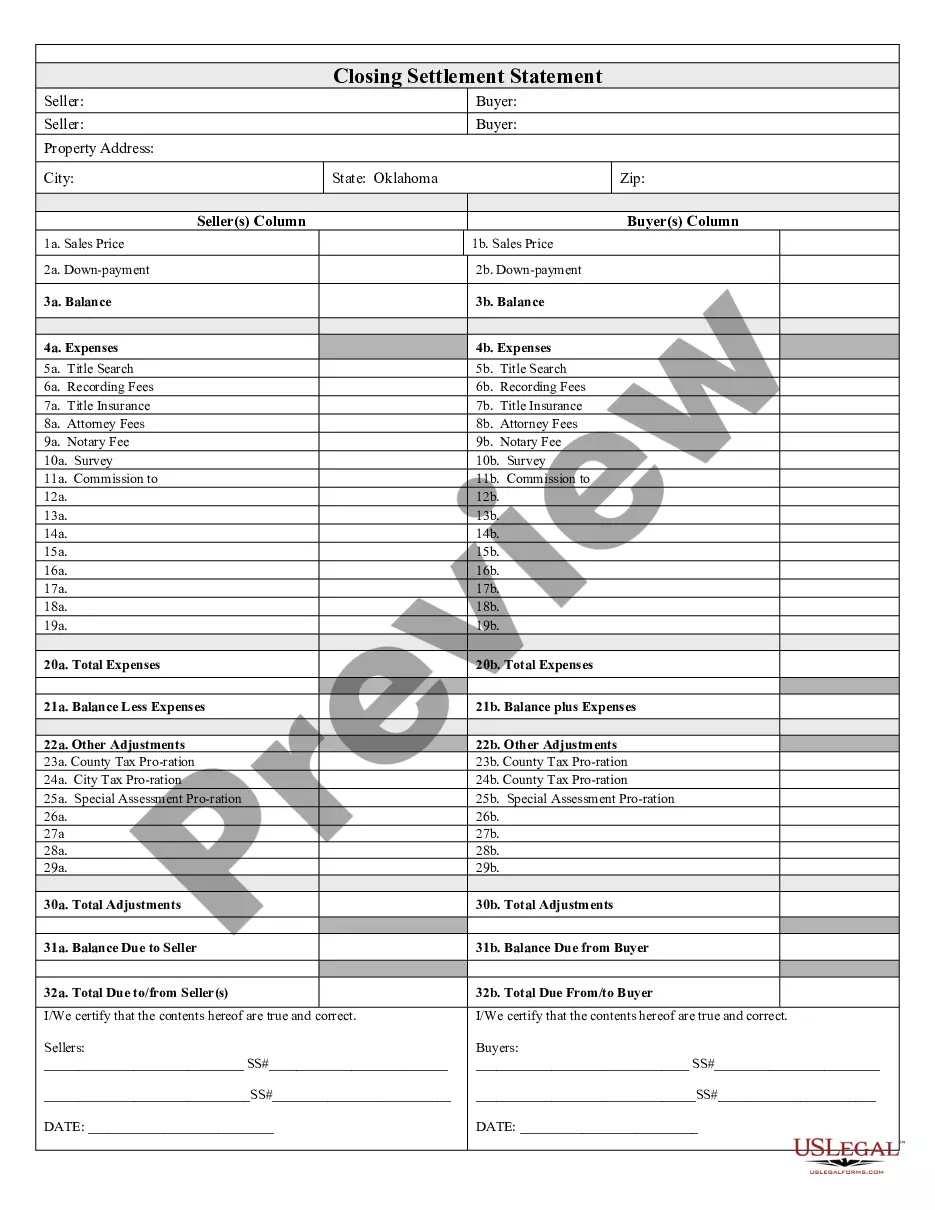

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

The HUD-1 settlement statement. The closing agent prepares this accounting of all the money involved in the transaction. Certificate of title. The deed. Loan payoff. Mechanic's liens. Bill of sale. Statement of closing costs. Statement of information.

The most important originals are the purchase agreement, deed, and deed of trust or mortgage. In the event originals are destroyed, you might be able to get certified copies of these documents from the lender or closing company, but you don't want to rely on others' recordkeeping systems unless you have to.

Double-check the loan amount, loan type, loan term, interest rate, monthly payment amount, whether there is a prepayment penalty, whether you are paying points or receiving credits, and other key details. Compare the Annual Percentage Rate (APR) on the Closing Disclosure to the APR listed on your Loan Estimate.

If you live where a title or escrow company agent handles closing and there are two meetings, it's likely that the seller and the seller's agent or attorney will sign paperwork at one meeting and the buyer, accompanied by her agent or attorney, will sign at a separate meeting.

The Deed: public record of the ownership of the property It often includes a description of the property and signed by both parties. Deeds are the most important documents in your closing package because they contain the statement that the seller transfers all rights and stakes in the property to the buyer.

Keys, codes, and garage door openers to the house. Cashier's checks for closing costs and repair credits. Personal checkbook. Time, date, and location of the closing. Government-issued identification. Your writing hand (and maybe your lucky pen)