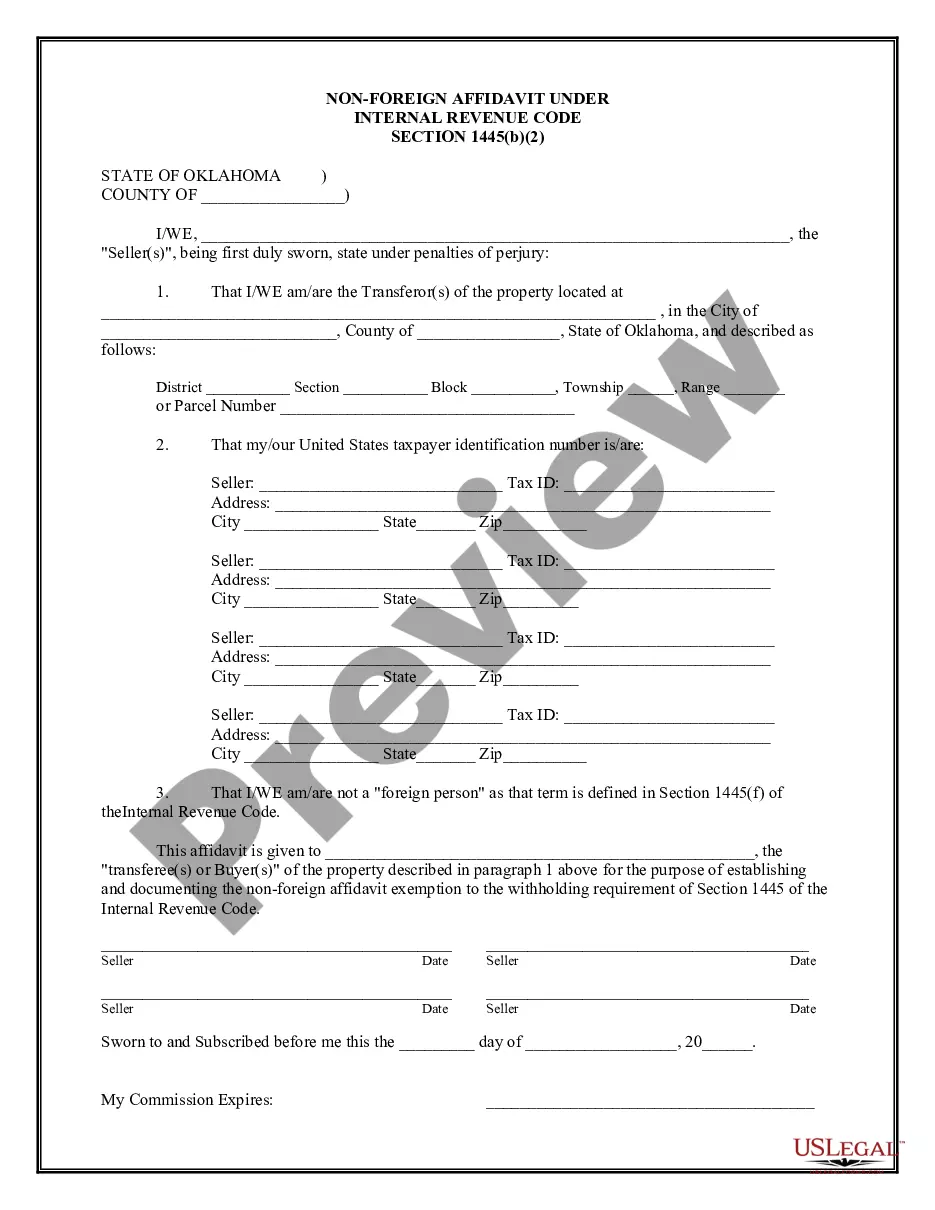

Oklahoma Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Oklahoma Non-Foreign Affidavit Under IRC 1445?

In terms of submitting Oklahoma Non-Foreign Affidavit Under IRC 1445, you most likely imagine an extensive process that requires finding a ideal sample among countless very similar ones then being forced to pay out an attorney to fill it out for you. Generally, that’s a slow and expensive choice. Use US Legal Forms and pick out the state-specific form in just clicks.

For those who have a subscription, just log in and then click Download to have the Oklahoma Non-Foreign Affidavit Under IRC 1445 form.

If you don’t have an account yet but want one, keep to the point-by-point manual below:

- Be sure the document you’re getting is valid in your state (or the state it’s needed in).

- Do so by looking at the form’s description and also by visiting the Preview option (if readily available) to see the form’s content.

- Simply click Buy Now.

- Choose the proper plan for your financial budget.

- Join an account and choose how you would like to pay: by PayPal or by credit card.

- Save the document in .pdf or .docx file format.

- Get the record on your device or in your My Forms folder.

Skilled legal professionals work on drawing up our templates to ensure that after downloading, you don't need to bother about enhancing content outside of your individual info or your business’s information. Join US Legal Forms and receive your Oklahoma Non-Foreign Affidavit Under IRC 1445 example now.

Form popularity

FAQ

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).

You or a member of your family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

FIRPTA Certificate: Certification of Non-Foreign Status - FIRPTA is the Foreign Investment in Real Property Act and Form 8288. It was developed to ensure that foreign sellers of U.S. property be subject to U.S. tax on the sale.

Foreign affidavit is an affidavit involving a matter of concern in one state but taken in another state or country before an officer of that state or country.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.