Oklahoma Dissolution Package to Dissolve Corporation

CORPORATE DISSOLUTION

- LAW SUMMARY

OKLAHOMA

STATUTORY REFERENCE

OKLAHOMA STATUTES, §§ 1001 througth 1144

(Oklahoma General Corporation Act)

An Oklahoma corporation can be dissolved voluntarily or involuntarily.Â

THIS SUMMARY ADDRESSES ONLY VOLUNTARY DISSOLUTION.

If a corporation has not issued shares or has not commenced the business,

a majority of the incorporators (or, if directors were named in the certificate

of incorporation or have been elected, a majority of the directors) may

surrender all of the corporation's rights and franchises by filing in the

Office of the Secretary of State a certificate of dissolution. The

certificate must be executed and acknowledged by a majority of the incorporators

or directors.

The certificate must state that no shares of stock have been issued

or that the business of the corporation has not begun; that no part of

the capital of the corporation has been paid, or, if some capital has been

paid, that the amount actually paid in for the corporation's shares, less

any part thereof disbursed for necessary expenses, has been returned to

those entitled thereto; that if the corporation has begun business but

it has not issued shares, all debts of the corporation have been paid;

that if the corporation has not begun business but has issued stock certificates

all issued stock certificates, if any, have been surrendered and canceled;

and that all rights and franchises of the corporation are surrendered.

If the board of directors should determine that the corporation should

be dissolved, a majority of the board should adopt a resolution to that

effect. A meeting must be held to consider the resolution of the

board and notice of the meeting must be mailed to each shareholder entitled

to vote.

At the meeting, if a majority of the outstanding stock of the corporation

entitled to vote approves the proposed dissolution, a certificate

of dissolution may be filed with the Secretary of State.

Dissolution may be authorized without action of the directors if all

the shareholders entitled to vote consent in writing.

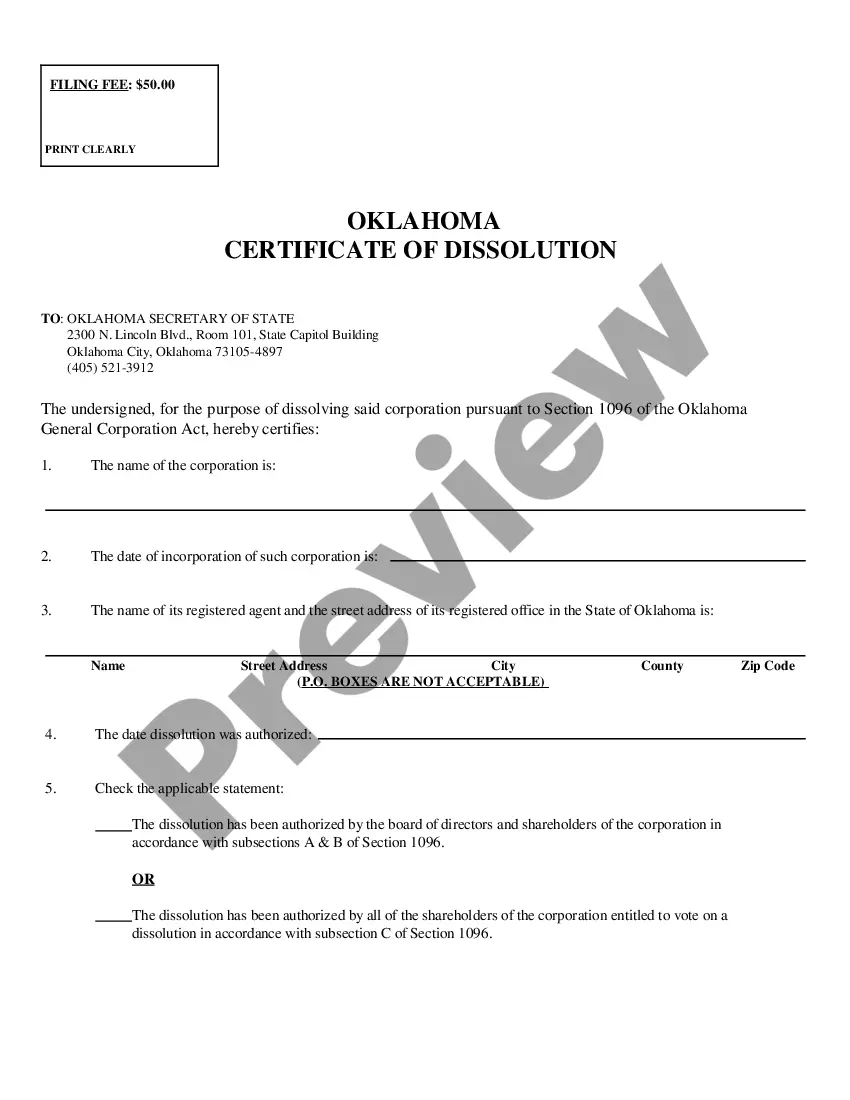

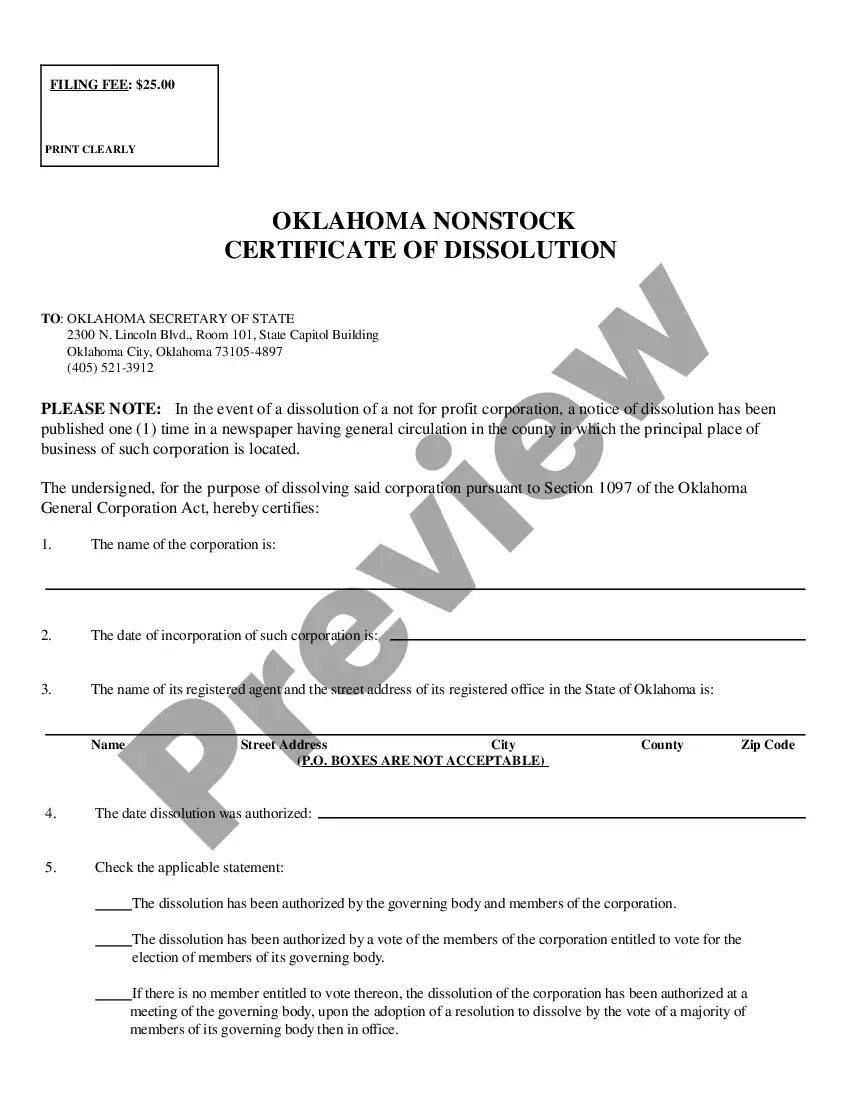

A Certificate of Dissolution must set forth:

1. the name of the corporation;

2. the date dissolution was authorized;

3. that the dissolution has been authorized by the board of directors

and shareholders of the corporation, in accordance with subsections A and

B of this section, or that the dissolution has been authorized by all of

the shareholders of the corporation entitled to vote on a dissolution,

in accordance with subsection C of this section; and

4. the names and addresses of the directors and officers of the corporation.

Upon a certificate of dissolution becoming effective, the corporation is

dissolved.

All dissolved corporations continue in existence for a term of three

years from dissolution (or for such longer period as a district court may

direct) for the purpose of prosecuting and defending suits and of enabling

the corporation to gradually settle and close the corporation's business,

to dispose of and convey property, to discharge liabilities, and to distribute

to shareholders any remaining assets. During this period, the corporation

may not continue the business for which the corporation was organized.

With respect to any action, suit, or proceeding begun by or against

the corporation either prior to or within three years after the date of

dissolution, the action does not abate by reason of the expiration or dissolution

of the corporation. The corporation, solely for the purpose of such action,

suit or proceeding, is continued as a body corporate beyond the three-year

period and until any judgments, orders or decrees therein shall be fully

executed, without the necessity for any special direction to that effect

by a district court.

After a corporation has been dissolved, the corporation or any successor

entity may give notice of the dissolution requiring all persons having

a claim against the corporation other than a claim against the corporation

in a pending action, suit, or proceeding to which the corporation is a

party to present their claims against the corporation in accordance with

the notice. The notice shall state:

a. that all claims must be presented in writing and must contain

sufficient information reasonably to inform the corporation or successor

entity of the identity of the claimant and the substance of the claim;

b. the mailing address to which a claim must be sent;

c. the date by which a claim must be received by the corporation or

successor entity, which date shall be no earlier than sixty (60) days from

the date of the notice; and

d. that the claim will be barred if not received by the deadline;

e. that the corporation or a successor entity may make distributions

to other claimants and the corporation's shareholders or persons interested

as having been such without further notice to the claimant, and

f. the aggregate amount, on an annual basis, of all distributions made

by the corporation to its shareholders for each of the three (3) years

prior to the date the corporation dissolved.

The notice must also be published at least once a week for two consecutive

weeks in a newspaper of general circulation in the county in which the

office of the corporation's last registered agent in this state is located

and in the corporation's principal place of business and, in the case of

a corporation having Ten Million Dollars ($10,000,000.00) or more in total

assets at the time of its dissolution, at least once in an Oklahoma newspaper

having a circulation of at least two hundred fifty thousand (250,000).

On or before the date of the first publication of the notice, the corporation

must mail a copy of the notice by certified or registered mail, return

receipt requested, to each known claimant of the corporation, including

persons with claims asserted against the corporation in a pending action,

suit, or proceeding to which the corporation is a party.

A claim against the corporation is barred if the claimant who was given

actual notice does not present the claim to the dissolved corporation or

successor entity by the deadline.

A corporation may reject, in whole or in part, any claim made by a claimant

by mailing notice of rejection by certified or registered mail return receipt

requested to the claimant within ninety (90) days after receipt of the

claim and, in all events, at least one hundred fifty (150) days before

the expiration of the statutory period.

The notice of rejection of a claim must state that a rejected claim

will be barred if an action, suit, or proceeding with respect to the claim

is not commenced within one hundred twenty (120) days of the date of the

rejection. The notice of rejection must include a copy of §§

1099 through 1100.3 of the Oklahoma General Corporation Act.

A claim against a corporation is barred if a claimant whose claim is

rejected does not commence an action, suit, or proceeding with respect

to the claim within one hundred twenty (120) days after the mailing of

the rejection notice.

A corporation electing to follow the statutory notice procedures must

also give notice of the dissolution of the corporation to persons with

contractual claims contingent upon the occurrence or nonoccurrence of future

events or otherwise conditional or unmatured, and request that those persons

present their claims in accordance with the terms of the notice. "Contractual

claims" does not include any implied warranty as to any product manufactured,

sold, distributed, or handled by the dissolved corporation. The notice

must be in substantially the form, and sent and published in the same manner,

as for the notice to creditors.

The corporation must offer any claimant whose claim is contingent, conditional

or unmatured, such security as the corporation determines is sufficient

to provide compensation to the claimant if the claim matures. The corporation

must mail the offer to the claimant by certified or registered mail, return

receipt requested, within ninety days of receipt of the claim and, in all

events, at least one hundred fifty days before the expiration of the statutory

period.

If the claimant offered security does not deliver in writing to the

corporation a notice rejecting the offer within one hundred twenty (120)

days after receipt of the offer for security, the claimant is deemed to

have accepted the security as the sole source from which to satisfy his

claim against the corporation.

A corporation which has given notice in accordance with the statutory

provisions must petition the district court to determine the amount and

form of security that will be sufficient to provide compensation to any

claimant who has rejected the offer for security.

The giving of any notice or making of any offer pursuant to the provisions

of this section does not revive any claim then barred or constitute acknowledgment

by the corporation that any person to whom the notice is sent is a proper

claimant and does not operate as a waiver of any defense or counterclaim

in respect of any claim asserted by any person to whom the notice is sent.

If there are sufficient assets, claims must be paid in full and any

provision for payment must be for payment in full if there are sufficient

assets. If there are insufficient assets, claims must be paid or provided

for according to their priority, and, among claims of equal priority, ratably

to the extent of assets available for payment. Any remaining assets

must be distributed to the shareholders of the dissolved corporation.Â

However, this distribution may not be made before the expiration of one

hundred fifty (150) days from the date of the last notice of rejections.

In the absence of actual fraud, the judgment of the directors of the

dissolved corporation as to the provision made for the payment of all obligations

is conclusive.

A dissolved corporation which has not followed the statutory procedures

described in the Oklahoma General Corporation Act must, prior to the expiration

of the period described in §1099, adopt a plan of distribution pursuant

to which the dissolved corporation or successor entity:

Directors of a dissolved corporation are not personally liable to the

claimants of the dissolved corporation.

A shareholder of a dissolved corporation the assets of which were distributed

pursuant to the Oklahoma General Corporation Act are not liable for any

claim against the corporation in an amount in excess of the shareholder's

pro rata share of the claim or the amount distributed to the shareholder,

whichever is less.

The aggregate liability of any shareholder of a dissolved corporation

for claims against the dissolved corporation cannot exceed the amount distributed

to the shareholder in dissolution.

When the officers, directors or shareholders of any corporation is liable

by the provisions of the Oklahoma General Corporation Act to pay the debts

of the corporation, any person to whom they are liable may have an action,

at law or in equity, against any one or more of them, and the petition

must state the claim against the corporation and the ground on which the

plaintiff expects to charge the defendants personally.

No suit may be brought against any officer, director or shareholder

for any debt of a corporation of which he is an officer, director or shareholder

until judgment is obtained against the corporation and execution thereon

returned unsatisfied.

When any officer, director or shareholder pays any debt of a corporation

for which he is made liable by the provisions of the Oklahoma General Corporation

Act, he may recover the amount paid in an action against the corporation

for money paid for its use. In such action only the property of a

corporation is liable to be taken and not the property of any shareholder.

Note: All Information and Previews are subject to the Disclaimer

located on the main forms page, and also linked at the bottom of all search

results.