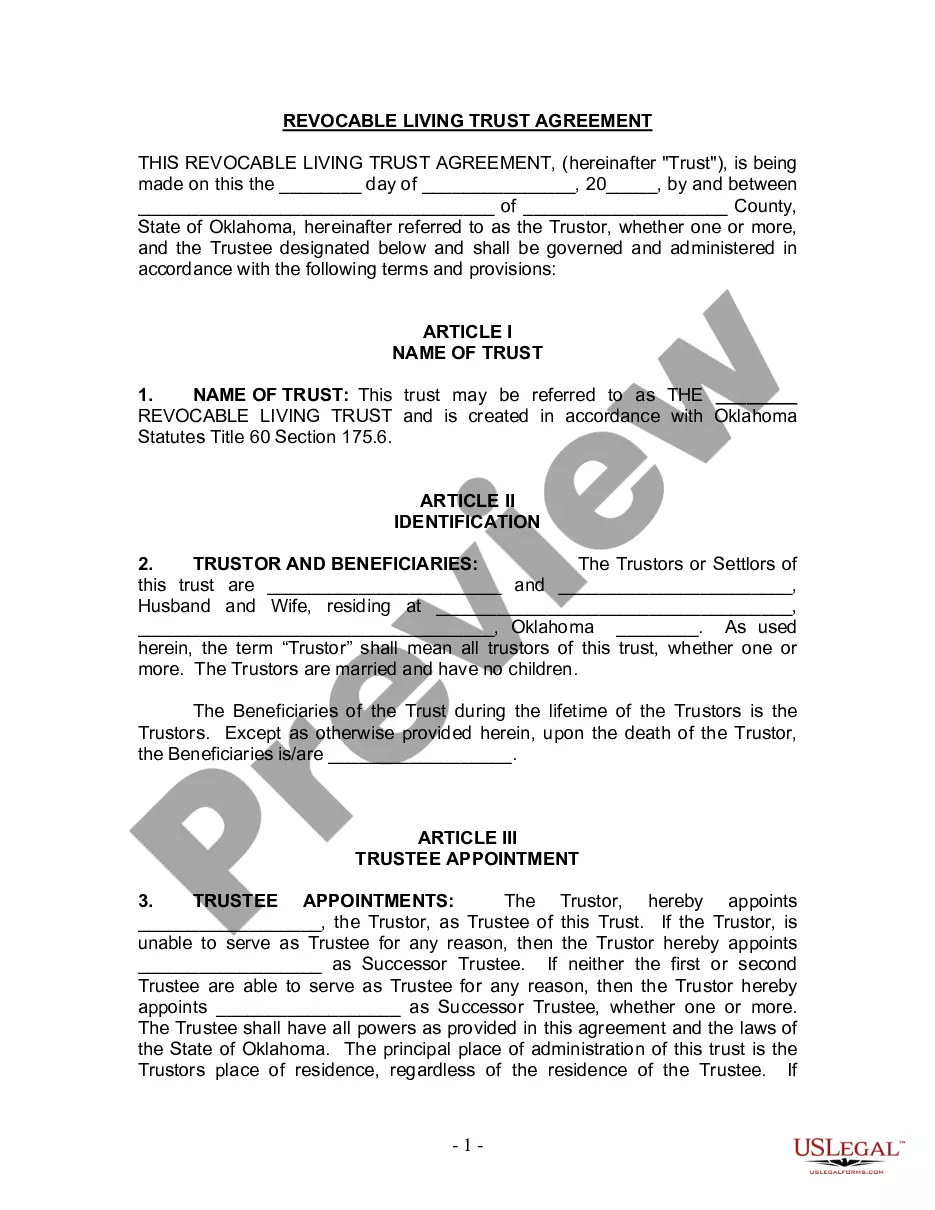

Oklahoma Living Trust for Husband and Wife with No Children

Description

How to fill out Oklahoma Living Trust For Husband And Wife With No Children?

When it comes to completing Oklahoma Living Trust for Husband and Wife with No Children, you most likely visualize a long procedure that requires choosing a ideal sample among hundreds of very similar ones after which being forced to pay an attorney to fill it out to suit your needs. Generally speaking, that’s a sluggish and expensive choice. Use US Legal Forms and pick out the state-specific document within just clicks.

If you have a subscription, just log in and click Download to get the Oklahoma Living Trust for Husband and Wife with No Children sample.

If you don’t have an account yet but want one, follow the step-by-step manual listed below:

- Be sure the document you’re getting is valid in your state (or the state it’s required in).

- Do so by reading the form’s description and through visiting the Preview function (if offered) to find out the form’s content.

- Click Buy Now.

- Pick the appropriate plan for your financial budget.

- Sign up for an account and select how you want to pay out: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Find the record on your device or in your My Forms folder.

Skilled attorneys draw up our samples to ensure after downloading, you don't have to bother about editing content material outside of your personal info or your business’s information. Be a part of US Legal Forms and get your Oklahoma Living Trust for Husband and Wife with No Children document now.

Form popularity

FAQ

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

The national average cost for a living trust for an individual is $1,100-1,500 USD. The national average cost for a living trust for a married couple is $1,700-2,500 USD. Part of the reason for this range in prices is the range of services that are available from various estate planning attorneys.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.

If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

There is no set price tag on setting up a living trust. It can range from just under $100 to more than $1,000. It all depends on how you create it and how complex your estate is. These days, you can shop around and find plenty of living trust software options.

If you die without a will in Oklahoma, your children will receive an intestate share of your property.For children to inherit from you under the laws of intestacy, the state of Oklahoma must consider them your children, legally.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document.

Intestacy refers to the condition of an estate of a person who dies without a will, and owns property with a total value greater than that of their outstanding debts.Typically, property goes to a surviving spouse first, then to any children, then to extended family and descendants, following common law.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.