Oklahoma Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children

Description

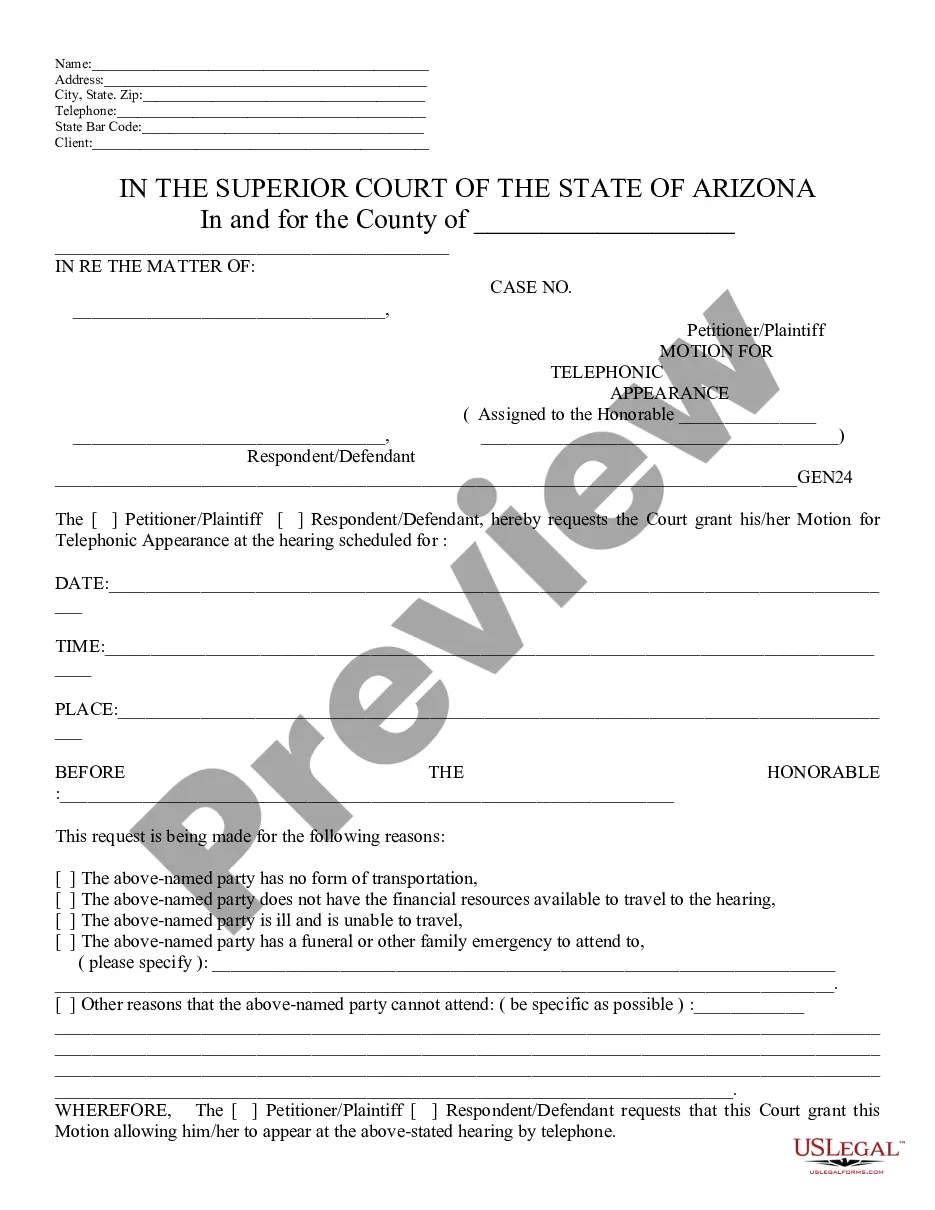

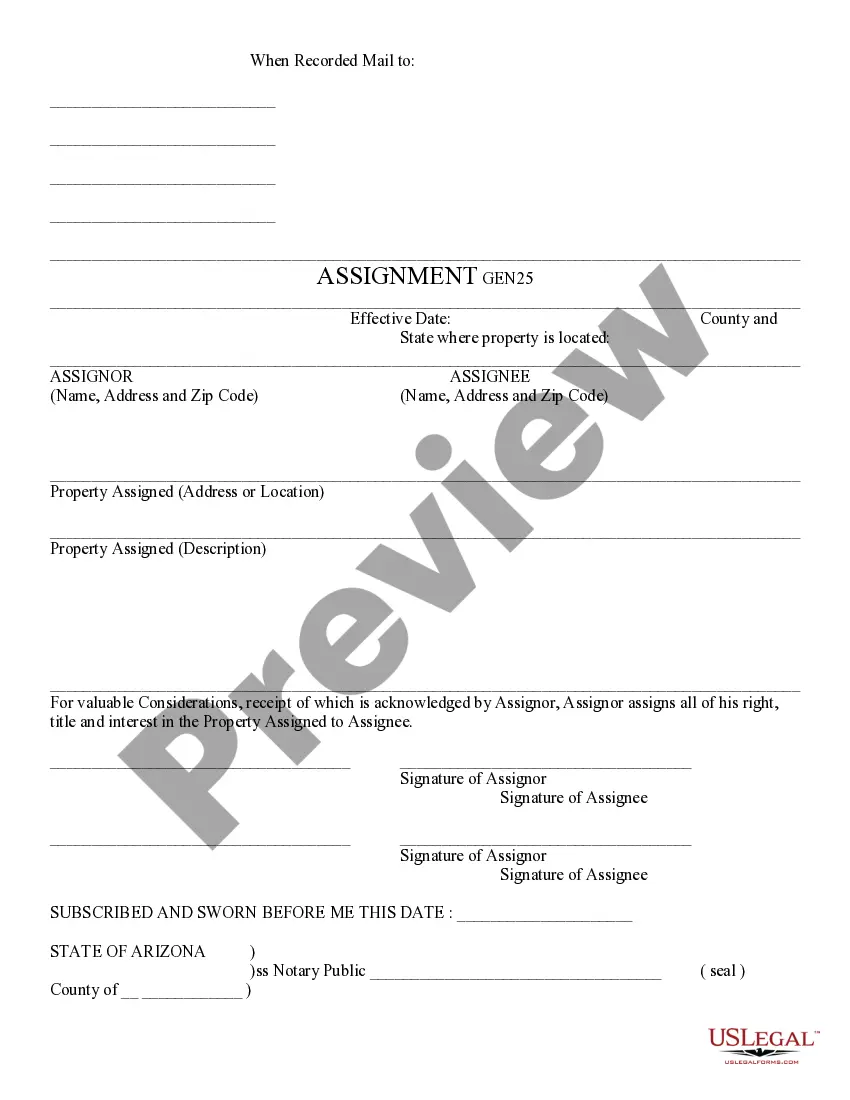

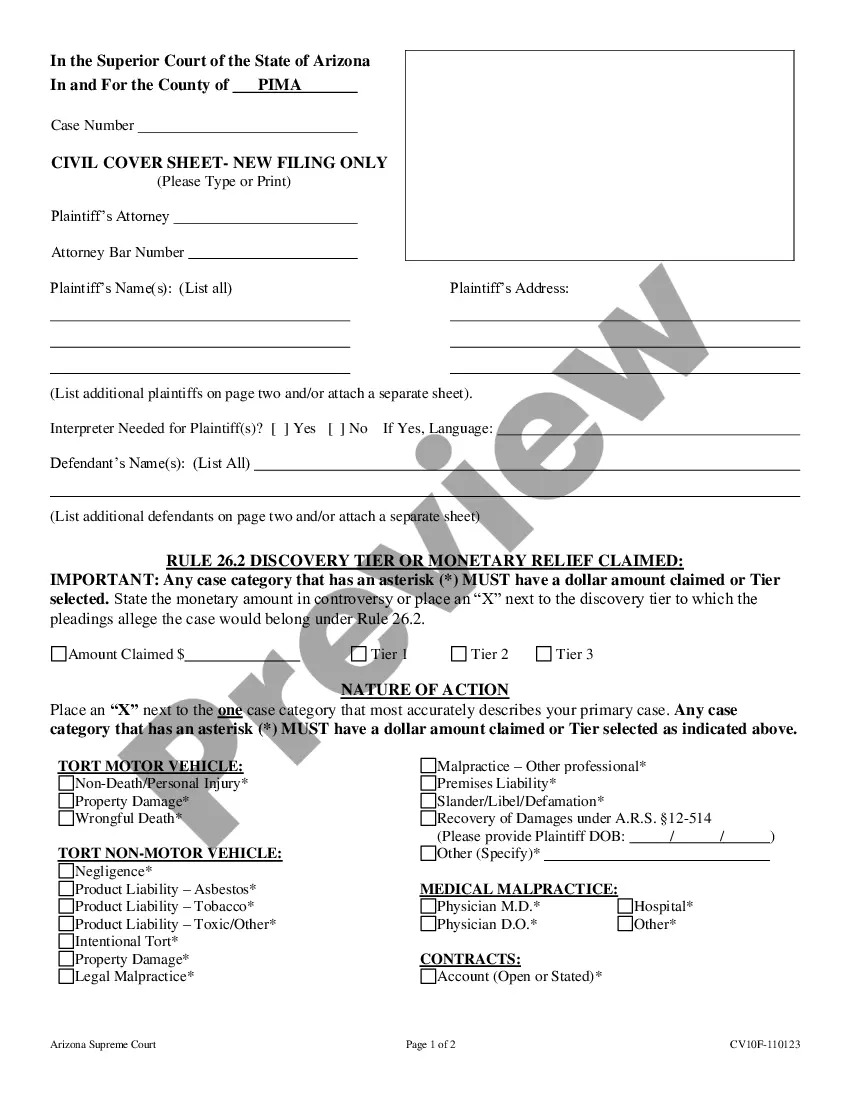

How to fill out Oklahoma Living Trust For Individual As Single, Divorced Or Widow (or Widower) With No Children?

In terms of filling out Oklahoma Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children, you most likely imagine an extensive procedure that requires getting a suitable form among hundreds of very similar ones after which having to pay an attorney to fill it out for you. On the whole, that’s a sluggish and expensive option. Use US Legal Forms and choose the state-specific form within just clicks.

For those who have a subscription, just log in and click on Download button to find the Oklahoma Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children sample.

If you don’t have an account yet but want one, stick to the step-by-step guideline below:

- Be sure the document you’re saving applies in your state (or the state it’s needed in).

- Do it by looking at the form’s description and by clicking the Preview option (if accessible) to view the form’s information.

- Simply click Buy Now.

- Find the proper plan for your budget.

- Subscribe to an account and select how you want to pay: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Find the file on your device or in your My Forms folder.

Skilled legal professionals draw up our templates to ensure that after saving, you don't need to worry about editing and enhancing content material outside of your individual info or your business’s info. Sign up for US Legal Forms and get your Oklahoma Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children document now.

Form popularity

FAQ

In Oklahoma, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Funding a Trust Is Expensive... This is the major drawback to using a revocable living trust for many people, but it's not worth the time, money, and effort to create one if the trust isn't fully funded.

Yes. If the cumulative value of a deceased person's probate personal property (not including real estate) that would otherwise go through probate court is less than $50,000, that probate property can be obtained by the deceased person's successors by the use of a Small Estates Affidavit and thus avoid probate.

In Oklahoma, the person who made the will must state that it is the last will and then sign it at the end of the document in the presence of two witnesses. The witnesses must sign at the end of the will at the request and in the presence of the person who had the will drafted. A will must be probated.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

But probate isn't always necessary, as certain estates are labeled small estates and therefore bypass these proceedings. To become part of this distinction, an estate must be worth less than $50,000 in total value, after debts and liabilities have been removed, according to Oklahoma inheritance laws.

There is no set price tag on setting up a living trust. It can range from just under $100 to more than $1,000. It all depends on how you create it and how complex your estate is. These days, you can shop around and find plenty of living trust software options.