Oklahoma Financial Account Transfer to Living Trust

Description

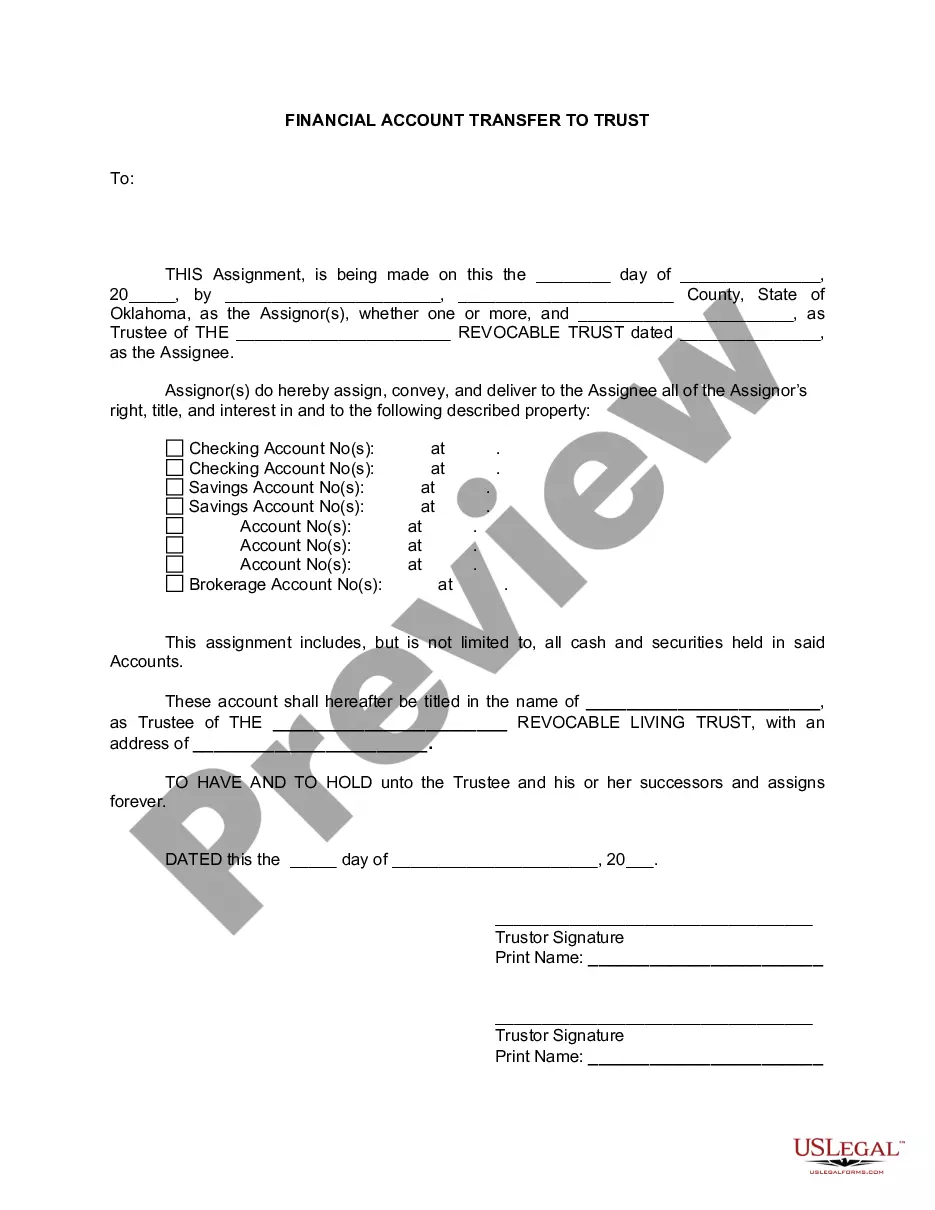

How to fill out Oklahoma Financial Account Transfer To Living Trust?

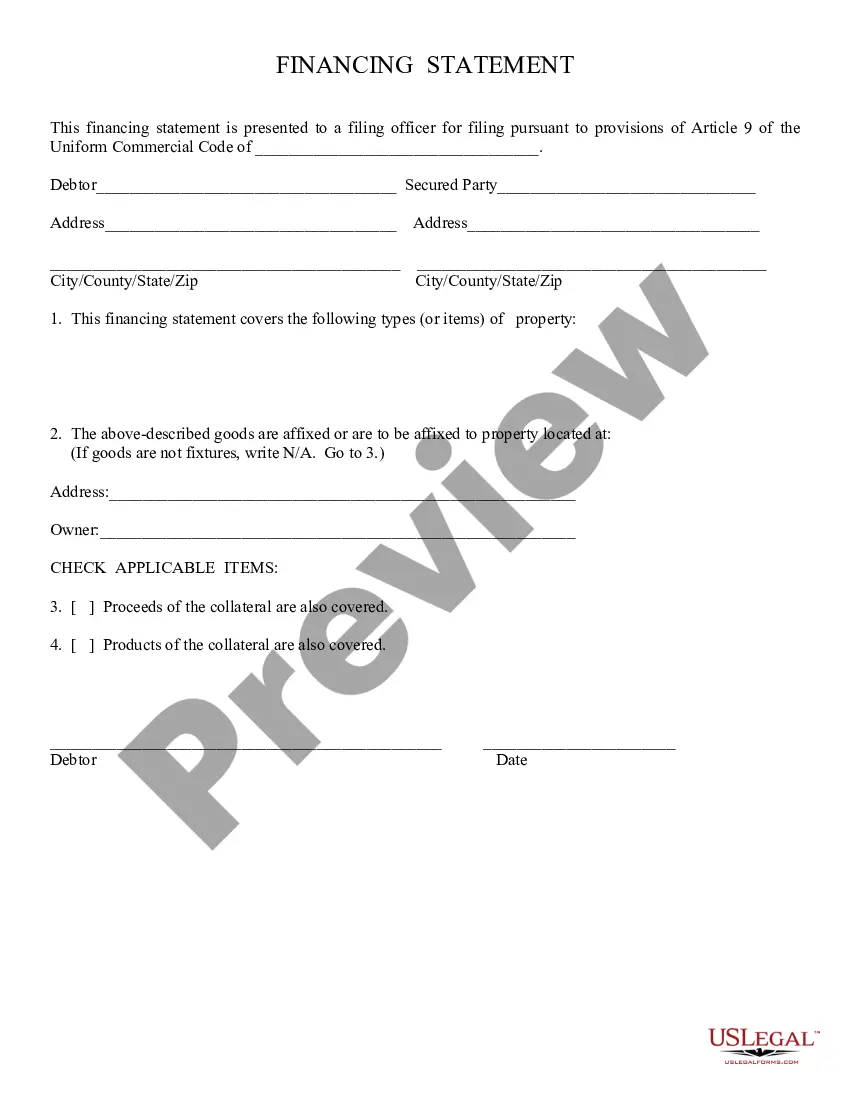

When it comes to completing Oklahoma Financial Account Transfer to Living Trust, you almost certainly visualize a long process that consists of choosing a suitable form among countless very similar ones after which being forced to pay out legal counsel to fill it out for you. Generally speaking, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific template in just clicks.

For those who have a subscription, just log in and click Download to find the Oklahoma Financial Account Transfer to Living Trust form.

In the event you don’t have an account yet but want one, follow the step-by-step manual below:

- Make sure the document you’re saving applies in your state (or the state it’s needed in).

- Do it by looking at the form’s description and by visiting the Preview option (if available) to view the form’s information.

- Simply click Buy Now.

- Choose the suitable plan for your financial budget.

- Sign up to an account and choose how you want to pay out: by PayPal or by credit card.

- Save the file in .pdf or .docx file format.

- Get the file on the device or in your My Forms folder.

Skilled attorneys draw up our templates to ensure that after saving, you don't have to bother about enhancing content outside of your individual information or your business’s info. Join US Legal Forms and get your Oklahoma Financial Account Transfer to Living Trust sample now.

Form popularity

FAQ

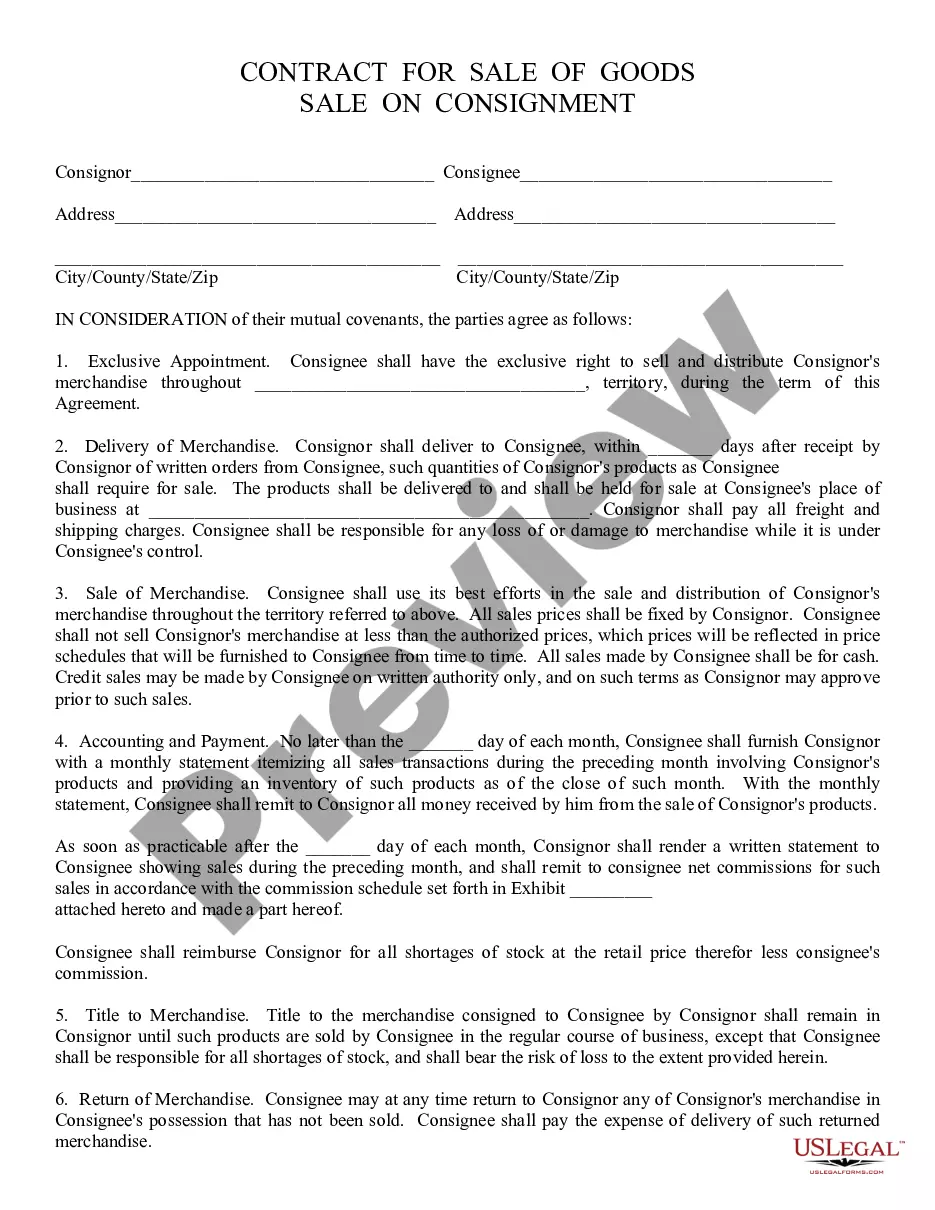

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

To fund a trust with your bank accounts, you will retitle the accounts into your trust's name. You should sign new signature and ownership cards to retitle any accounts or cash equivalents, including treasury bills, money market accounts, and certificates of deposit, into your Trust.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

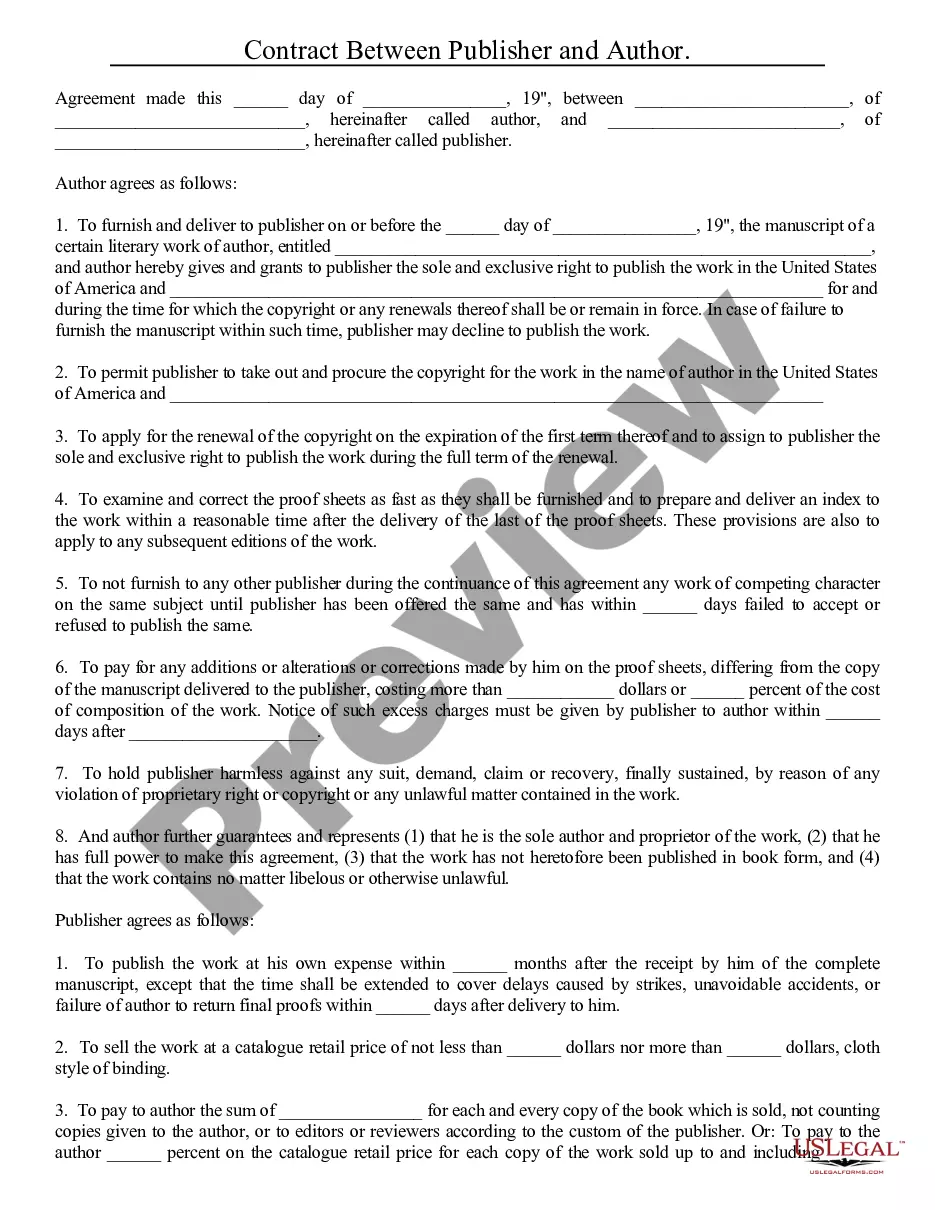

Putting money in a trust lets you pass property to someone in a structured way, where you can impose rules. For example, you might say that your beneficiary can't use these funds to pay off debt. Or, you might impose rules on how old the beneficiary needs to be before she gains control over the money.

You cannot put your own money into most SNTs. If someone you know wants to leave assets for you in their will, they must state the name of the SNT in their will, not your name.

Take your trust documents to a bank or financial institution and open a trust fund bank account with the same name as the trust. You will need to provide the names and contact information of the trustees. You can either deposit a lump sum or pay into the trust over time.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.