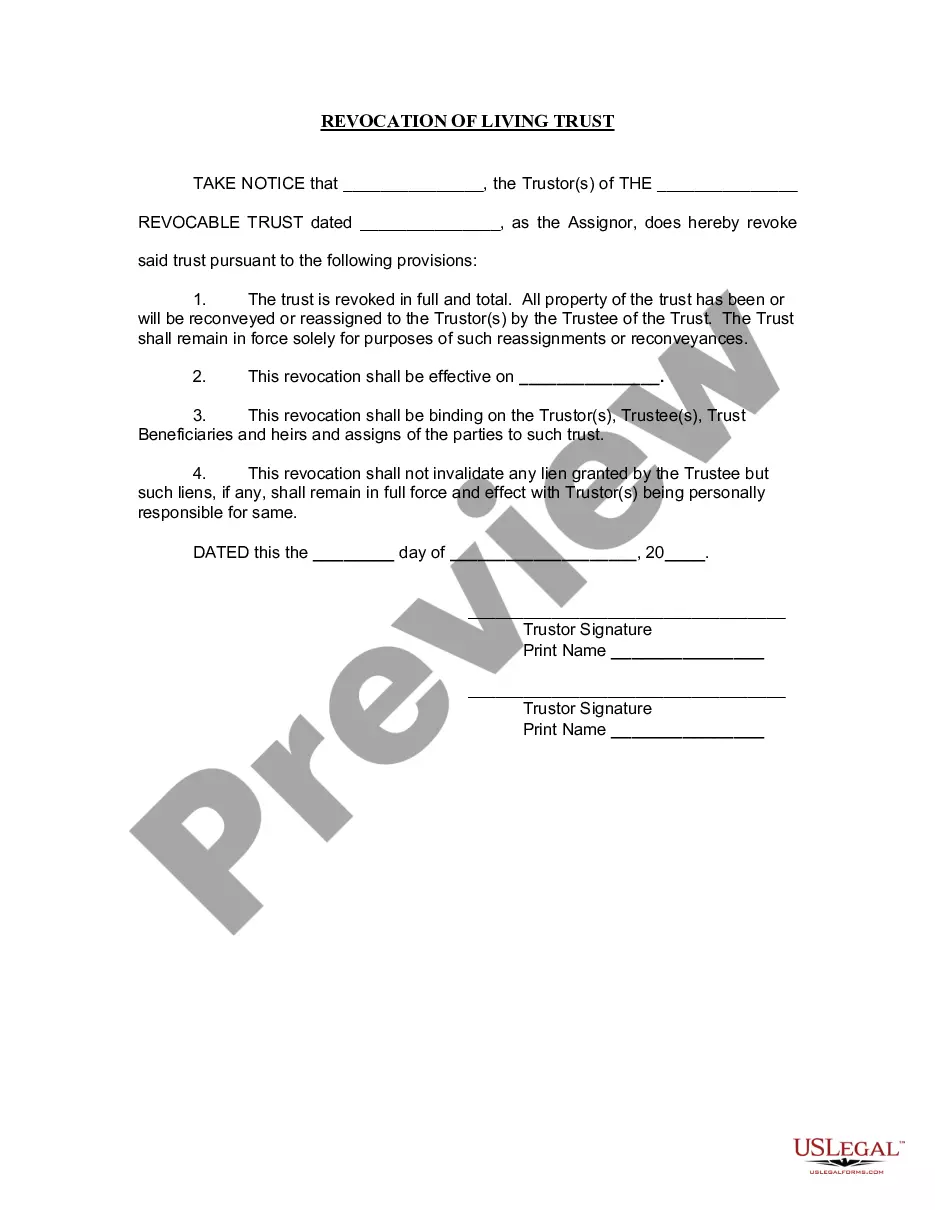

Oklahoma Revocation of Living Trust

Description Oklahoma Living Trust

How to fill out Oklahoma Revocation Of Living Trust?

In terms of completing Oklahoma Revocation of Living Trust, you almost certainly think about an extensive procedure that involves finding a ideal sample among countless very similar ones then needing to pay a lawyer to fill it out for you. On the whole, that’s a slow and expensive choice. Use US Legal Forms and choose the state-specific form within clicks.

For those who have a subscription, just log in and then click Download to have the Oklahoma Revocation of Living Trust sample.

In the event you don’t have an account yet but want one, stick to the point-by-point manual below:

- Make sure the file you’re saving applies in your state (or the state it’s required in).

- Do it by looking at the form’s description and through clicking the Preview option (if offered) to find out the form’s information.

- Click Buy Now.

- Pick the appropriate plan for your budget.

- Sign up for an account and choose how you want to pay out: by PayPal or by card.

- Save the file in .pdf or .docx file format.

- Get the document on your device or in your My Forms folder.

Professional attorneys work on creating our samples to ensure after saving, you don't need to bother about enhancing content outside of your individual info or your business’s info. Be a part of US Legal Forms and receive your Oklahoma Revocation of Living Trust document now.

Trust Revocation Form Form popularity

FAQ

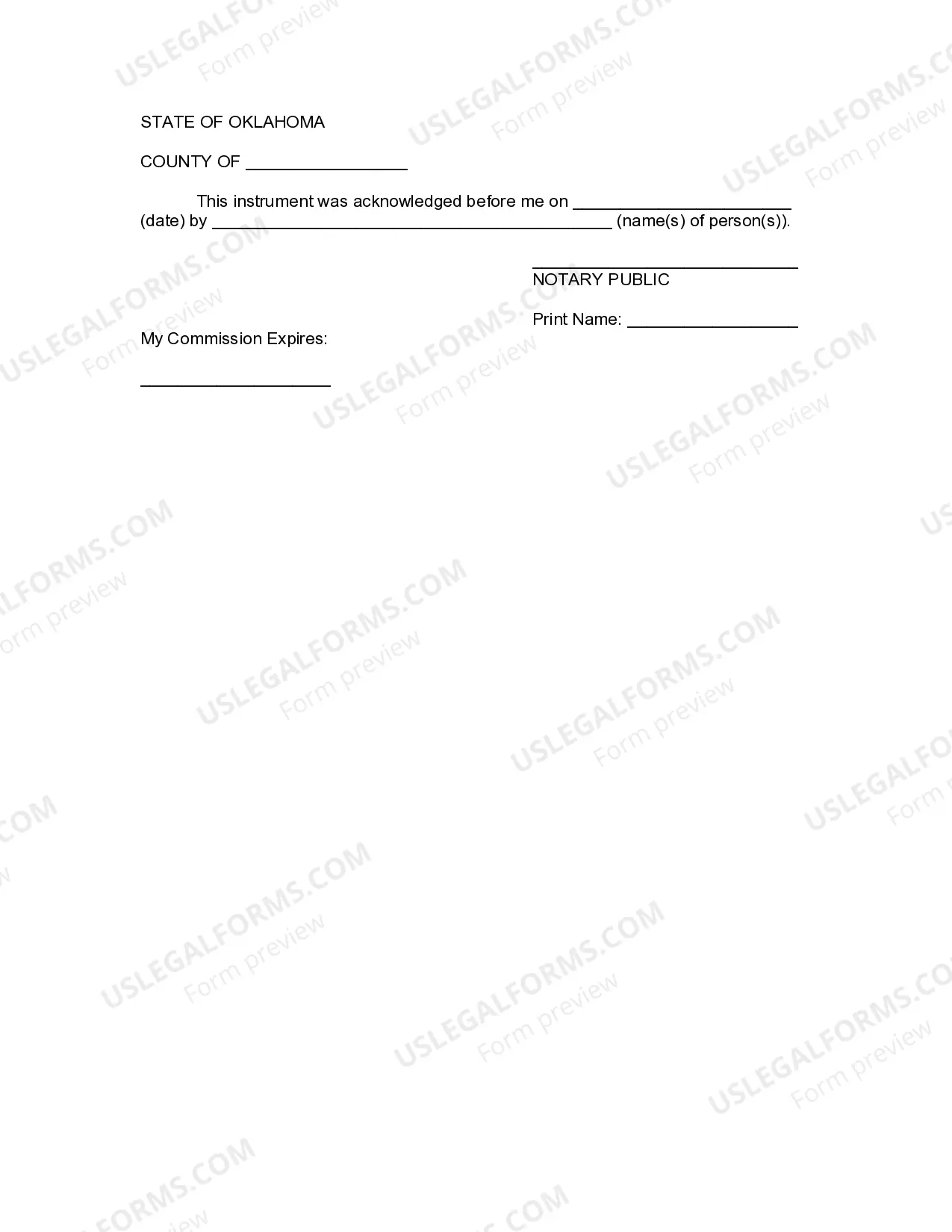

Begin an amendment for your living trust. Sign the amendment. Visit a notary public, and have your amendment notarized. Attach the notarized amendment to the original living trust. Restate the living trust.

A revocable trust, or living trust, is a legal entity to transfer assets to heirs without the expense and time of probate.A living trust also can be revoked or dissolved if there is a divorce or other major change that can't be accommodated by amending the trust.

Read the Documents Carefully. Some agreements contain language that allows a trustee to dissolve the trust if its purpose is no longer feasible. Petition the Court. In some cases, a court agrees to break an irrevocable trust if the trustee or beneficiaries petition for assistance. Dispose of the Trust's Assets.

How can I dissolve my trust? You can dissolve a trust by bringing forward its final distribution date. This can be done by the trustees or settlor if the trust deed says they can, or by the combined consent of the beneficiaries.

If you want to revoke your trust, you must formally take all of the trust assets out of the living trust and transfer title back to you. Basically, you must reverse the process you followed when you transferred ownership of the property to yourself as trustee.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.

Key Takeaways. Revocable trusts, as their name implies, can be altered or completely revoked at any time by their grantorthe person who established them. The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it.

Whether your trust closes immediately after your death or lives on for a while to serve your intentions, it must eventually close. This typically involves payment of any outstanding debts or taxes before the trustee distributes the trust's assets and income to your named beneficiaries.

A revocable trust, or living trust, is a legal entity to transfer assets to heirs without the expense and time of probate.A living trust also can be revoked or dissolved if there is a divorce or other major change that can't be accommodated by amending the trust.