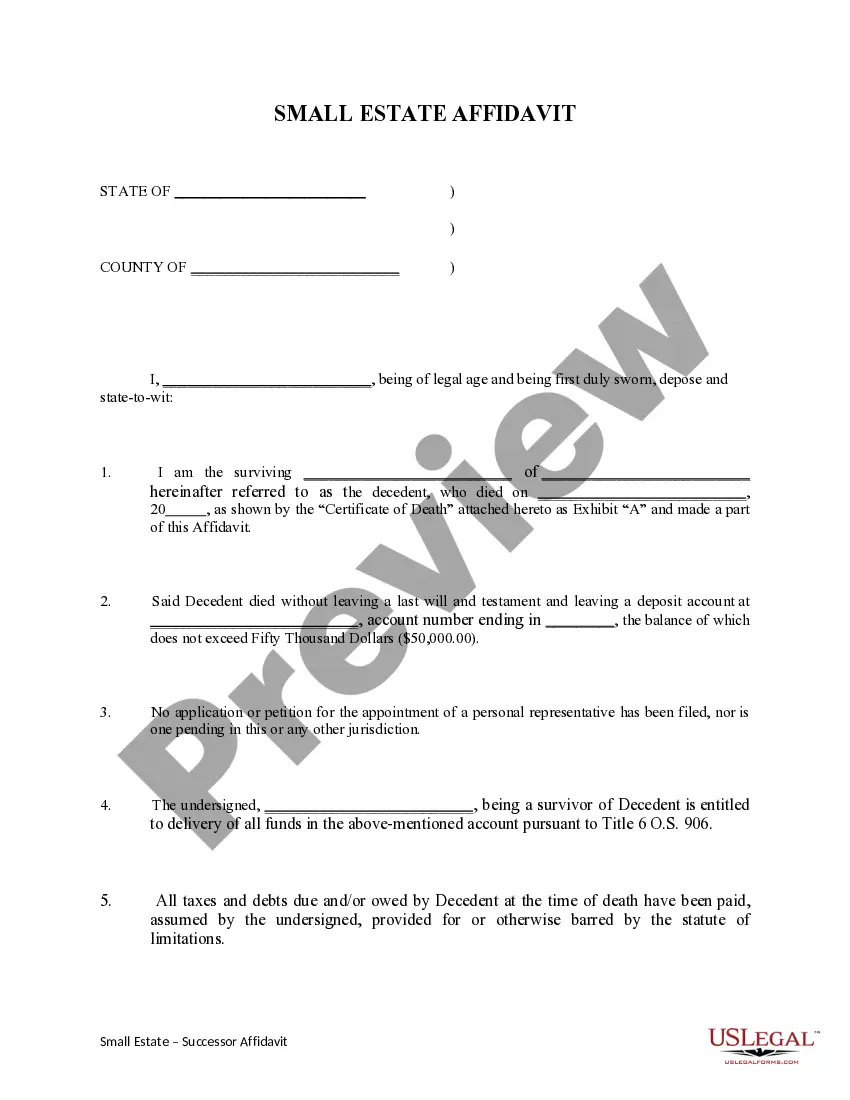

Oklahoma Small Estate Successor Affidavit - Not to Exceed $50,000

Description Oklahoma Small Estate

How to fill out Oklahoma Small Statement?

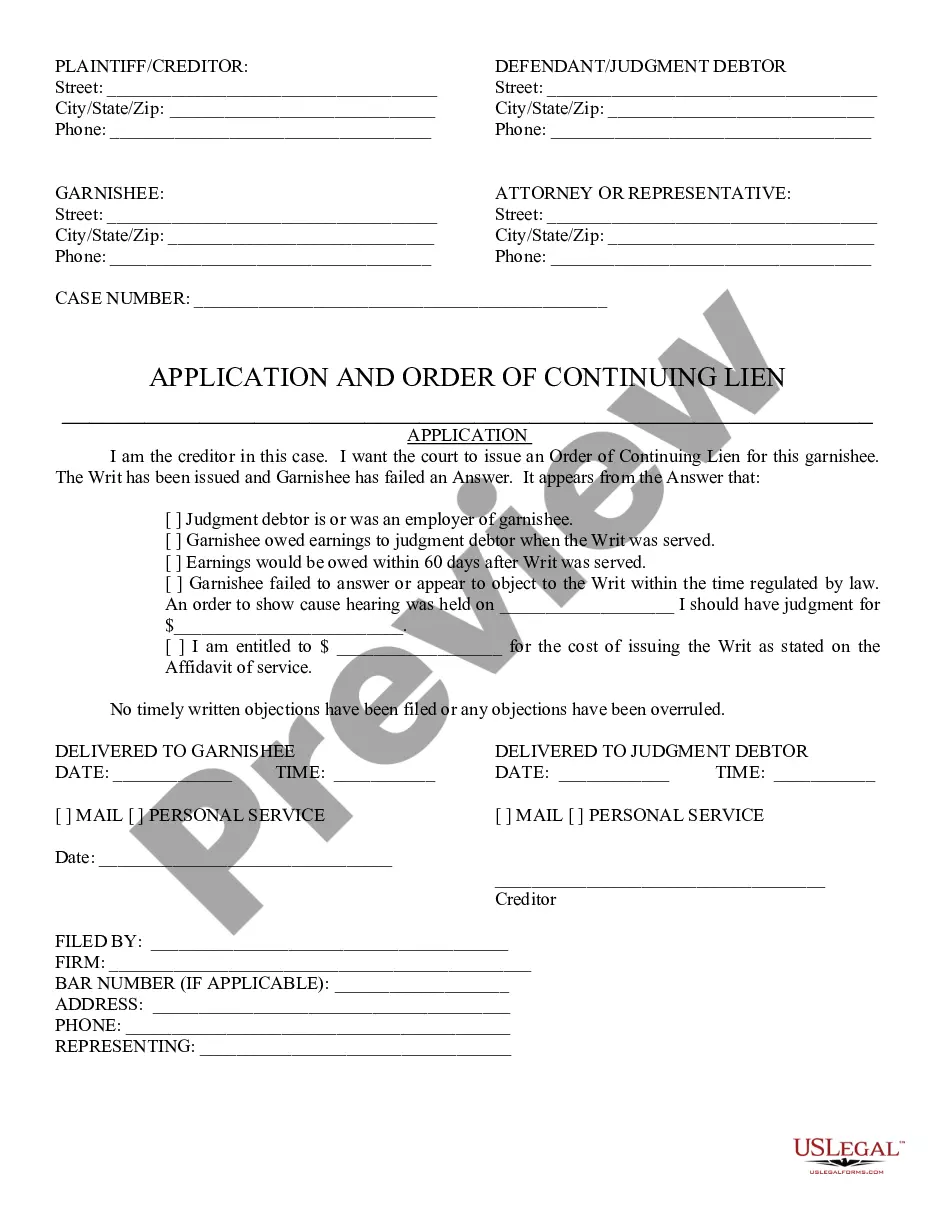

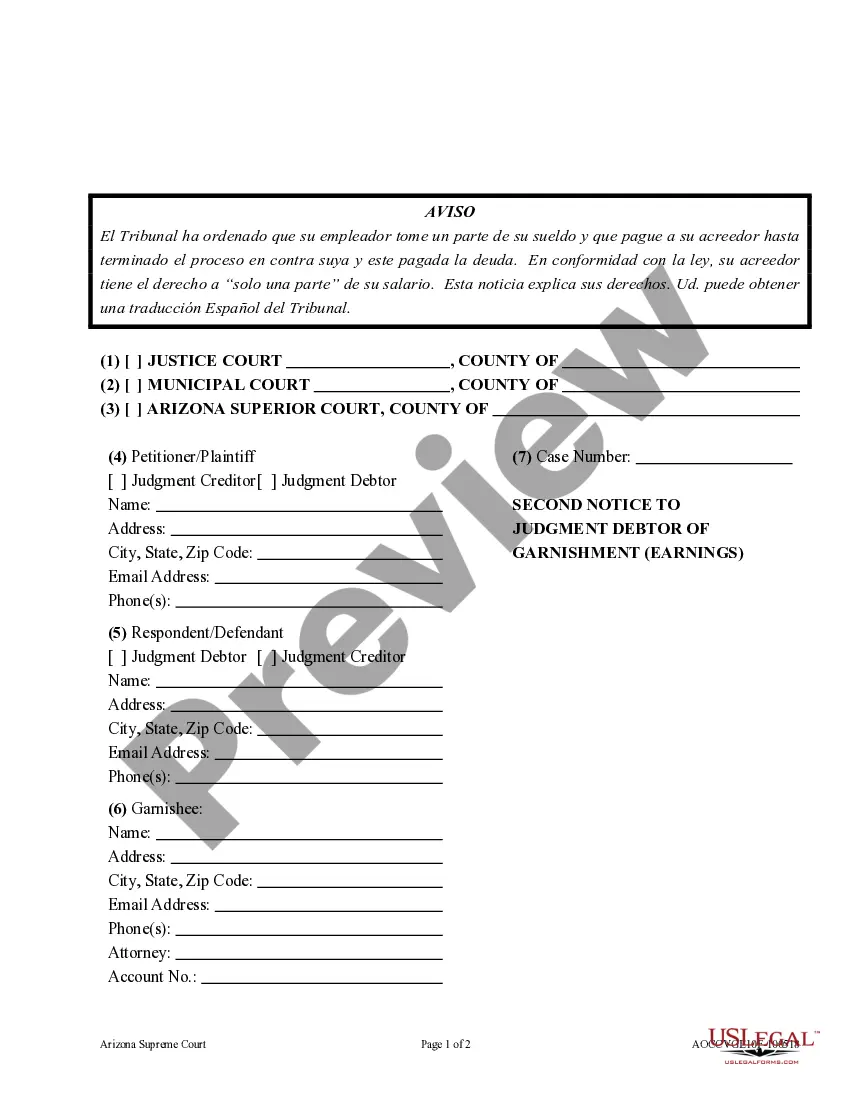

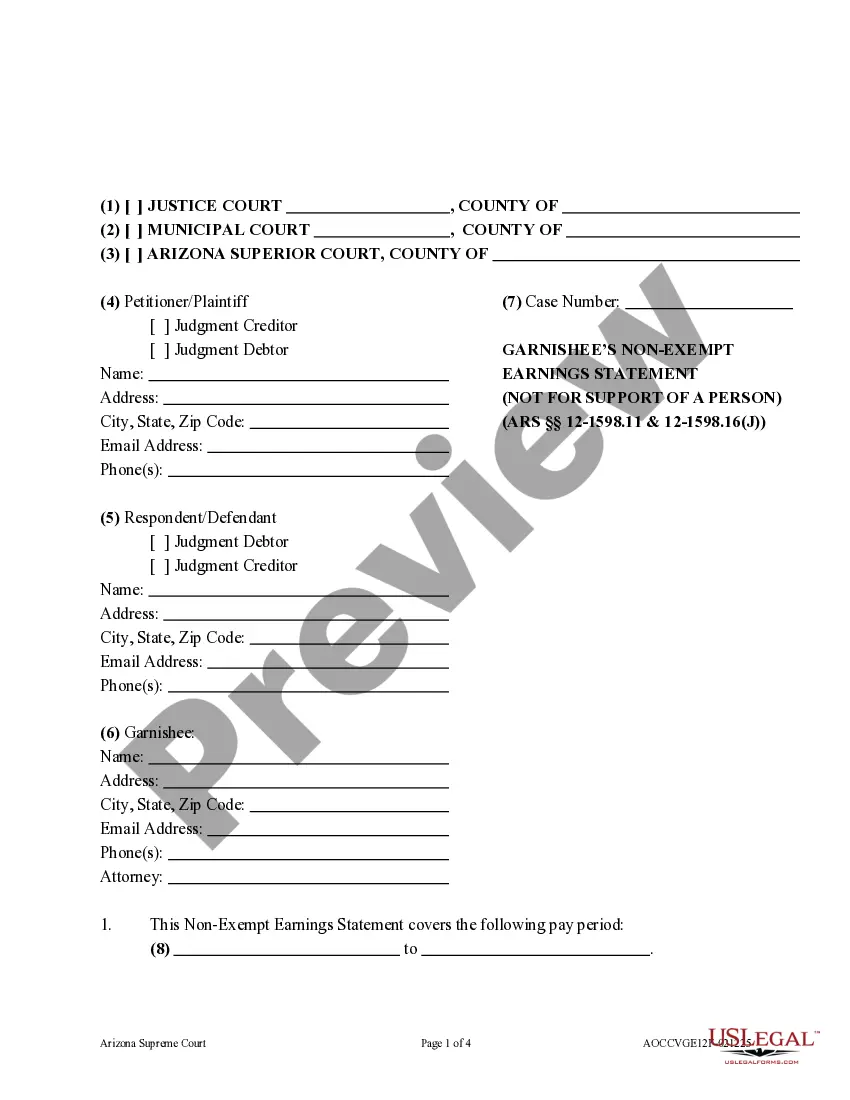

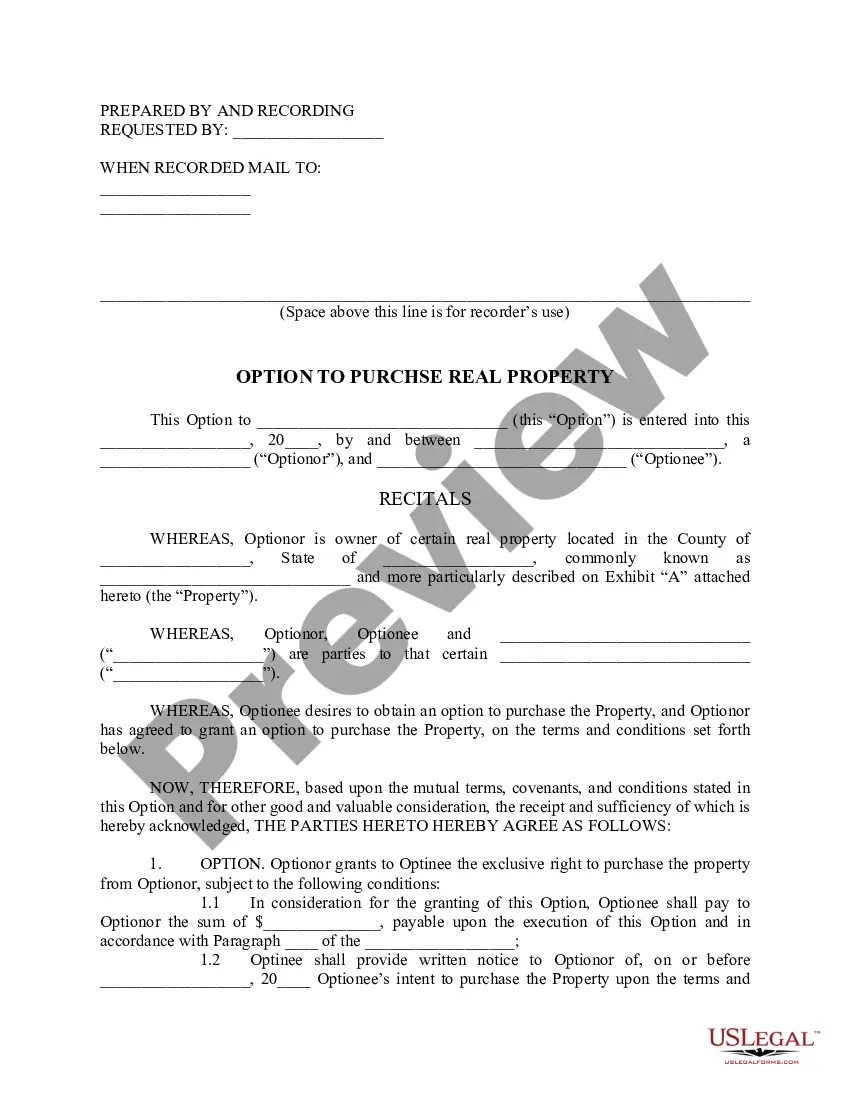

In terms of completing Oklahoma Small Estate Successor Affidavit - Not to Exceed $50,000, you probably think about a long procedure that requires choosing a appropriate sample among countless very similar ones after which being forced to pay out a lawyer to fill it out for you. In general, that’s a sluggish and expensive choice. Use US Legal Forms and select the state-specific template within just clicks.

If you have a subscription, just log in and then click Download to have the Oklahoma Small Estate Successor Affidavit - Not to Exceed $50,000 form.

If you don’t have an account yet but want one, follow the step-by-step manual listed below:

- Be sure the document you’re downloading applies in your state (or the state it’s required in).

- Do it by reading the form’s description and also by clicking the Preview function (if accessible) to view the form’s content.

- Simply click Buy Now.

- Select the suitable plan for your financial budget.

- Subscribe to an account and choose how you want to pay: by PayPal or by credit card.

- Download the file in .pdf or .docx file format.

- Get the record on the device or in your My Forms folder.

Professional lawyers draw up our samples to ensure after downloading, you don't need to bother about modifying content material outside of your personal details or your business’s details. Sign up for US Legal Forms and get your Oklahoma Small Estate Successor Affidavit - Not to Exceed $50,000 example now.

Small Affidavit Not Form popularity

Ok Estate Oklahoma Other Form Names

Oklahoma Successor Ok FAQ

Located in this state if all of the property that the decedent owns, located in this state, is of a total value less than $50,000, it's a small estate.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

You can use the simplified small estate process in Oklahoma if the value of the estate is $200,000 or less, if the deceased person has been dead for more than five years, or if he or she resided in another state at the time of death.

A small estate affidavit is a sworn written statement that authorizes someone to claim a decedent's assets outside of the formal probate process.

A typical probate can be completed in around 4-6 months, but could last much longer depending on the size of the estate, creditor claims and whether there is a challenge to the will or to appointment of the Personal Representative. For small estates, Oklahoma has procedures called summary administration.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

Step 1 Fill in the county in which you are signing the document. Step 2 Write in your name as successor in interest of decedent. Step 3 Write in your relationship to decedent and decedent's name and date of death in Section 1. Make sure to attach a certified death certificate.

In Michigan you can use an Affidavit if the estate does not include real property and the value of the entire estate, less liens and encumbrances, is less than $15,000. There is a 28-day waiting period.