Oklahoma Offering/Sale of Unregistered Securities-Elements is a set of requirements and regulations that must be met in order for an issuer to offer or sell securities in the state of Oklahoma without registration. The elements include: 1. Adequate Disclosure: The issuer must provide full and accurate disclosure of all relevant information to investors in order to facilitate informed decision-making. 2. Resale Restrictions: The issuer must impose restrictions on the resale of the securities in order to protect the interests of the investors. 3. Investor Suitability: The issuer must determine that the prospective investors are suitable to purchase the securities in terms of their financial capacity and understanding of the risks associated with the securities. 4. Escrow: The issuer must place the proceeds from the offering into an escrow account in order to ensure that the issuer will use the proceeds for the purposes stated in the offering. 5. Qualified Purchasers: The issuer must ensure that the prospective investors are qualified purchasers as defined by the Oklahoma Uniform Securities Act. 6. Registration: The issuer must register the offering with the Oklahoma Department of Securities in order to comply with the applicable regulations.

Oklahoma Offering/Sale of Unregisterd Securiteis-Elements

Description

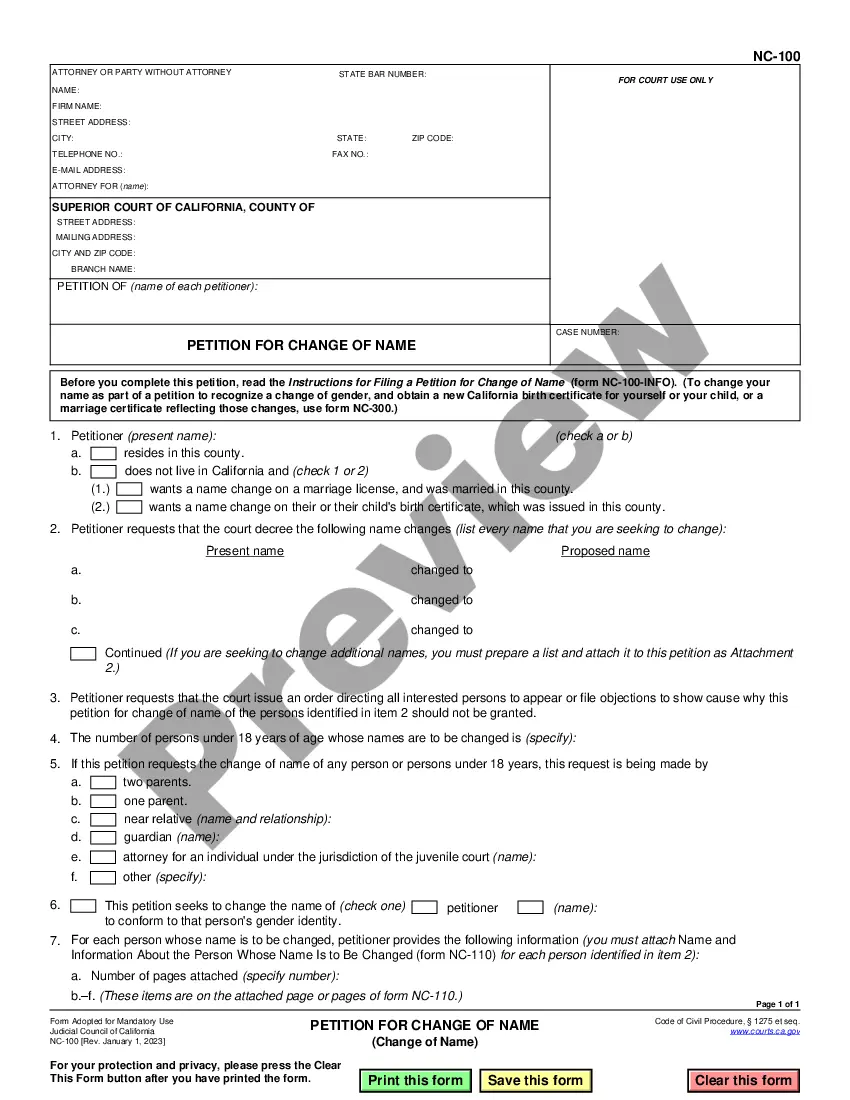

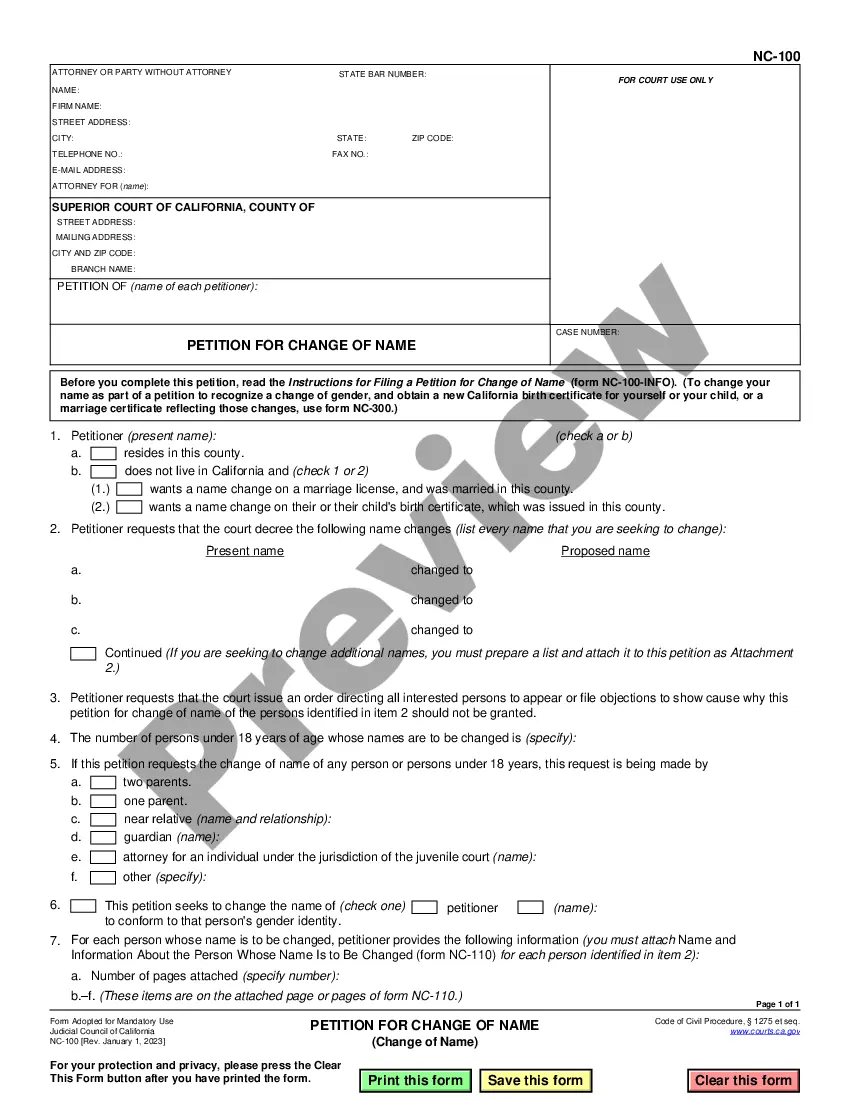

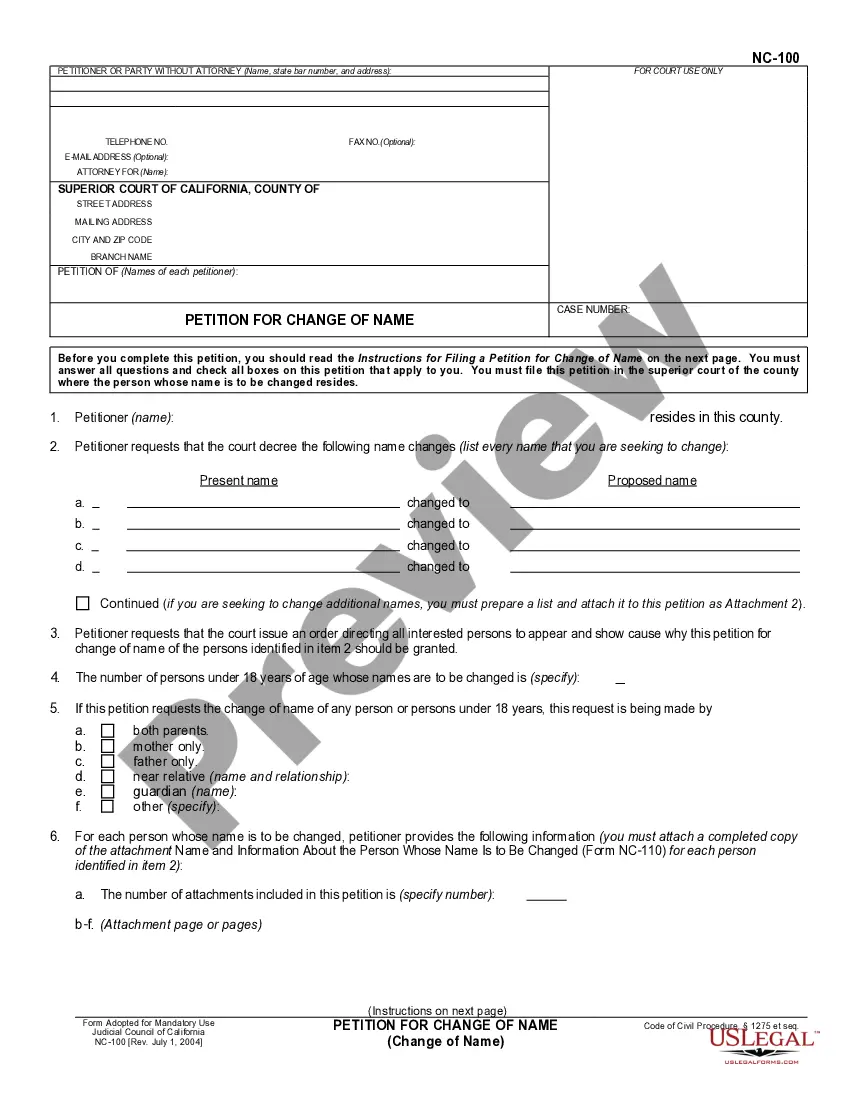

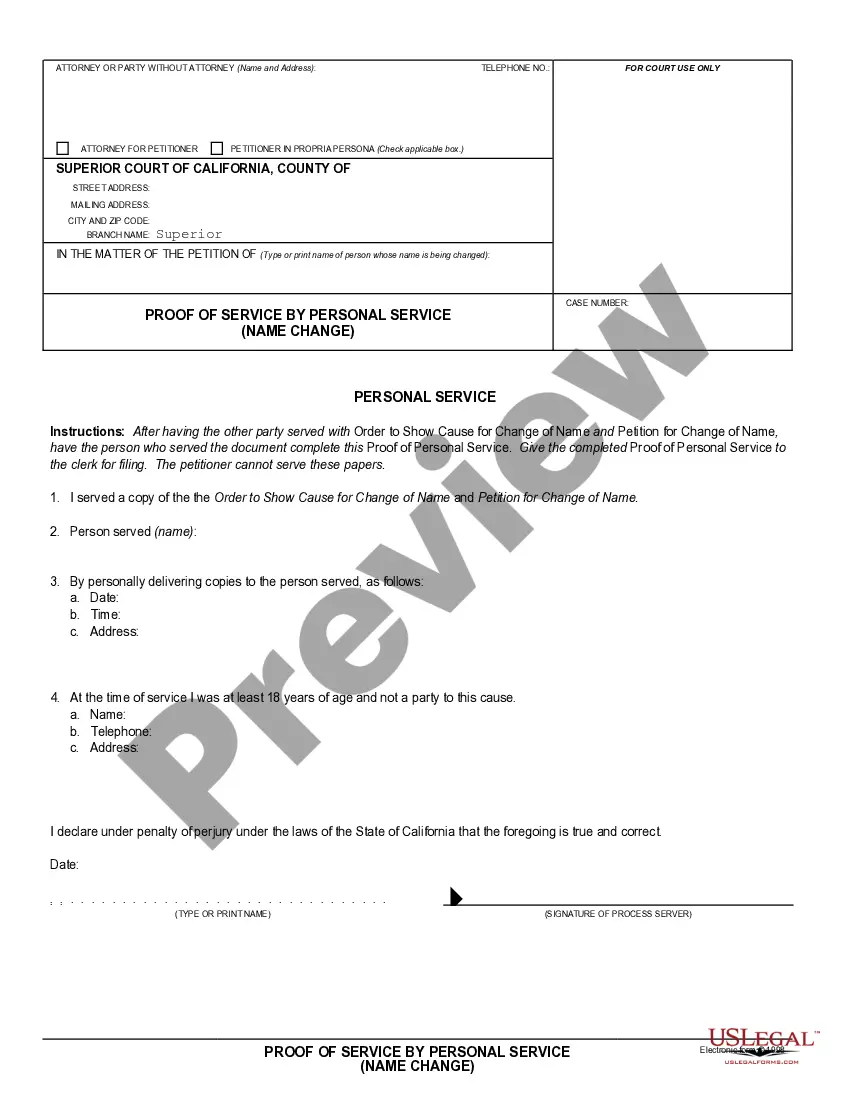

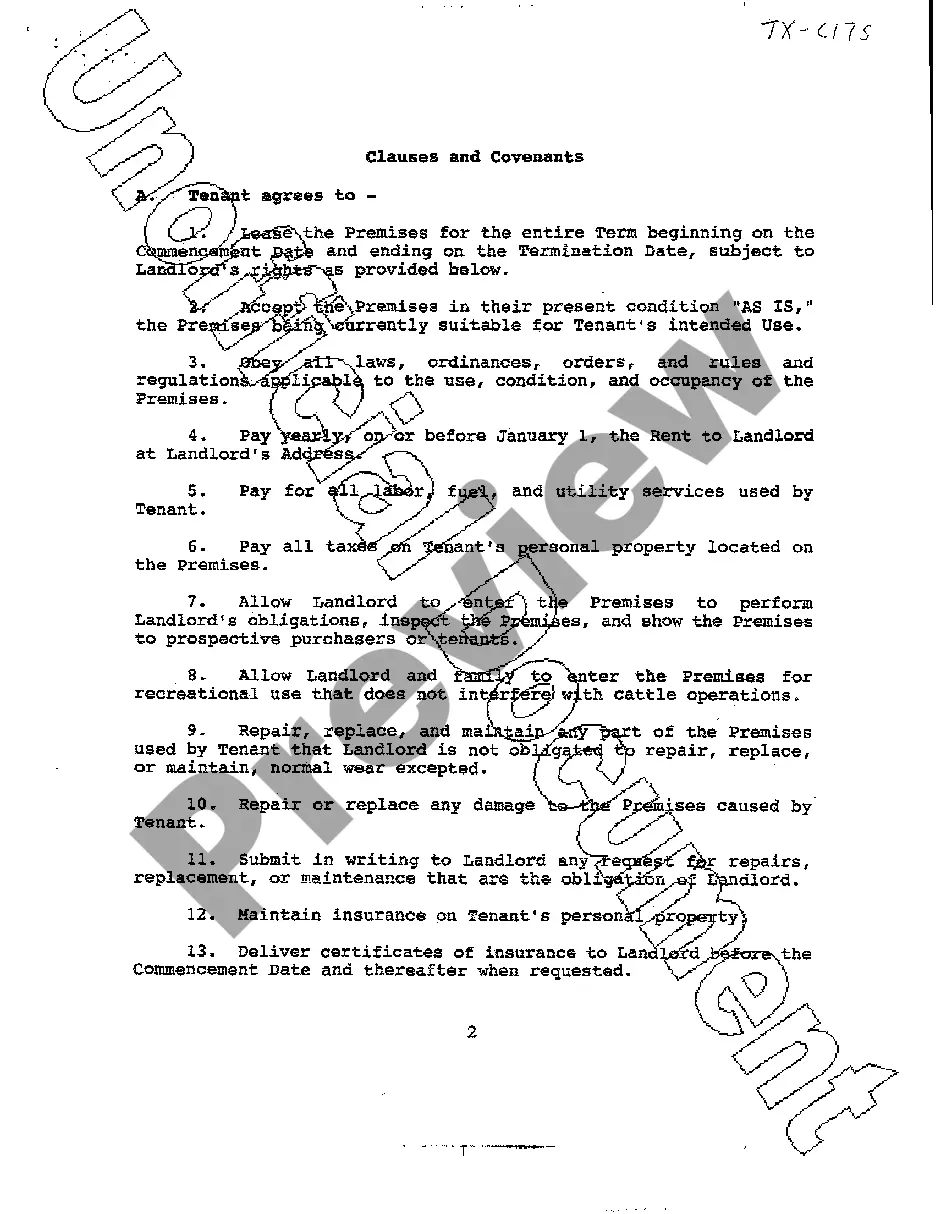

How to fill out Oklahoma Offering/Sale Of Unregisterd Securiteis-Elements?

If you’re looking for a way to properly prepare the Oklahoma Offering/Sale of Unregisterd Securiteis-Elements without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every personal and business scenario. Every piece of paperwork you find on our web service is drafted in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Adhere to these simple instructions on how to acquire the ready-to-use Oklahoma Offering/Sale of Unregisterd Securiteis-Elements:

- Ensure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and choose your state from the list to locate an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to save your Oklahoma Offering/Sale of Unregisterd Securiteis-Elements and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it quickly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

The Private Placement Exemption is Narrow Indeed, the only investors that are eligible to purchase unregistered securities through a private placement are: Corporate insiders and. 'Qualified' buyers. The bottom line is that selling unregistered securities to public investors is illegal.

Before securities?like stocks, bonds, and notes?can be offered for sale to the public, they first must be registered with the Securities and Exchange Commission (SEC). Any stock that does not have an effective registration statement on file with the SEC is considered "unregistered." 1?

An unregistered offering is the offer and sale of securities in a transaction that is not registered with the Securities and Exchange Commission (the ?SEC?) under Section 5 of the Securities Act of 1933, as amended (the ?Securities Act?), in reliance on an exemption from registration under that act.

Selling unregistered shares is typically considered a felony, but there are exceptions to this rule. SEC Rule 144 lays out the conditions under which unregistered shares may be sold: They must be held for a prescribed period. There must be adequate public information about the security's historical performance.

Section 15 of the Exchange Act of 1934 (?Act?) makes it unlawful for any broker or dealer to purchase, sell, or effect transactions in securities, using the means or instrumentalities of interstate commerce, unless they have been registered with the Securities and Exchange Commission (?SEC?).

Under the federal securities laws, a company may not offer or sell securities unless the offering has been registered with the SEC or an exemption to registration is available. If the offering is not registered, it is often called a private placement or unregistered offering.