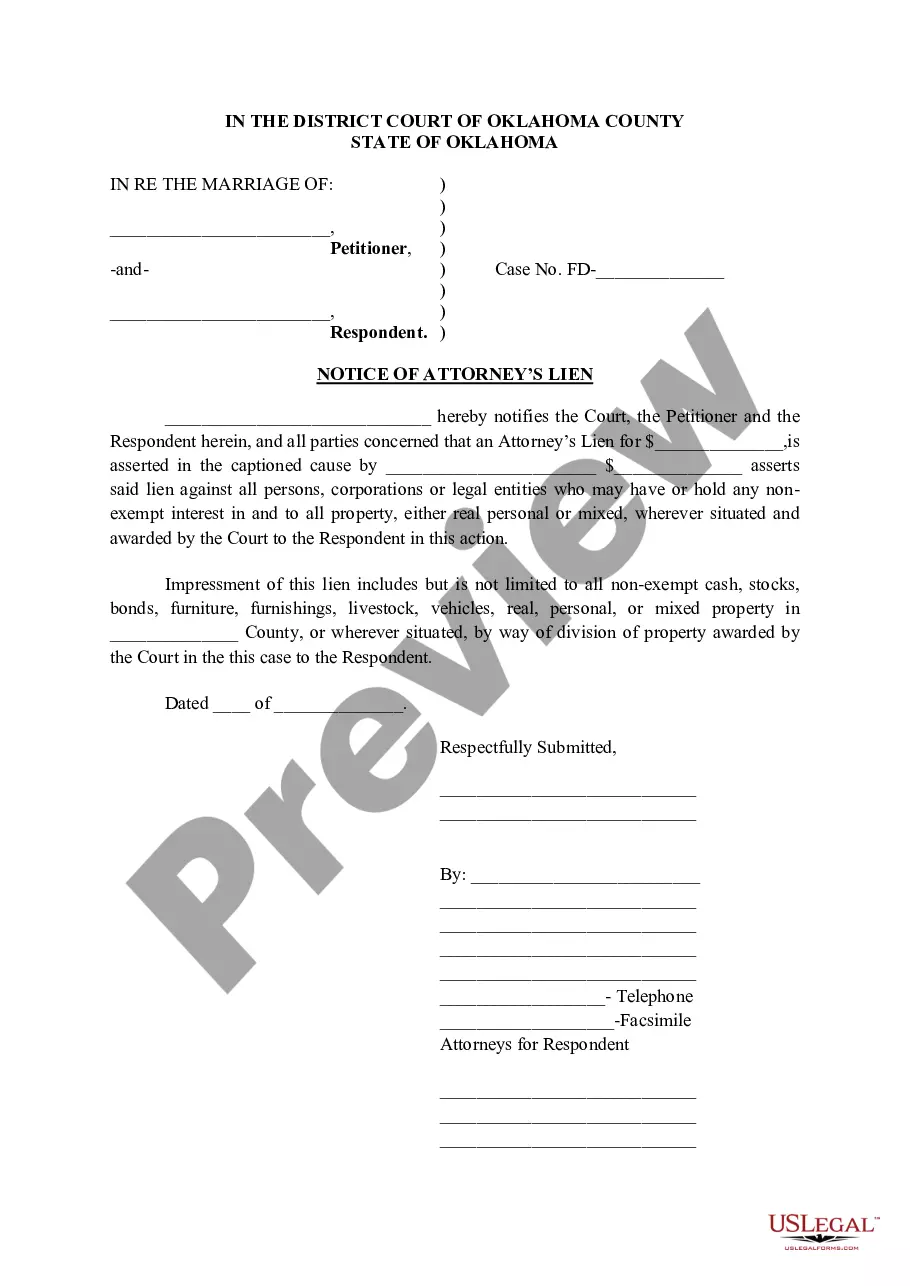

Oklahoma Notice of Attorney's Lien

Description

Key Concepts & Definitions

Notice of Attorney's Lien: A legal claim or hold on a judgment or settlement funds due to the attorney's help in winning the case.Attorney Lien Claim: The formal claim made by an attorney for the right to be paid from the proceeds of a client's litigation victory.

Referral Fee Split: An agreement where attorneys share fees based on their contribution to a case or referral.

Step-by-Step Guide

- Filing an Attorney's Lien: Check with local state laws, often beginning with drafting a notice stipulating the intent to claim a lien.

- Referral Fee Arrangement: Draft an agreement that clearly states the percentage of the fee that will be shared and under what conditions.

- Enforcing the Lien in Court: If the client does not honor the lien, the attorney may need to enforce the lien through a court order in compliance with local jurisdiction, such as the Florida Bankruptcy Court or Chicago Litigation Process.

Risk Analysis

- Legal Risks: Failing to comply with specific procedural requirements can invalidate the lien.

- Financial Risks: Attorneys risk non-payment if the lien is not enforceable.

- Relationship Risks: Liens can strain the attorney-client relationship.

Key Takeaways

- Understanding the local regulations and proper procedures for filing a notice is essential.

- Clear agreements on referral fee splits prevent conflicts.

- Legal clarity and compliance with CRPC Rule and quantum meruit cases are critical for lien enforcement.

Common Mistakes & How to Avoid Them

- Not Obtaining Second Attorney Consent: Ensure all partnering attorneys consent to fee agreements and liens to avoid legal complications.

- Ignoring Local Rules: Each jurisdiction, such as Chicago or Florida, has specific laws governing attorney liens. Always consult local guidelines.

Case Studies / Real-World Applications

Case studies on successful attorney liens, such as securing a financial settlement agreement in a high-profile bankruptcy case, underscore the importance of adhering to local court specifications. For instance, attorneys in the Florida Bankruptcy Court have navigated the complexities of enforcing liens and maximizing recovery efficiently.FAQ

What is a lawyer referral fee? Its a fee that one lawyer may pay to another for referring a client, usually expressed as a percentage of the earned legal fees.How does the Chicago litigation process impact attorney liens? Due to specific local laws, the process for registering and enforcing an attorney's lien in Chicago might differ from other regions.

How to fill out Oklahoma Notice Of Attorney's Lien?

In terms of completing Oklahoma Notice of Attorney’s Lien, you most likely think about an extensive process that consists of choosing a appropriate sample among hundreds of very similar ones and after that needing to pay legal counsel to fill it out for you. In general, that’s a slow and expensive option. Use US Legal Forms and pick out the state-specific template in just clicks.

For those who have a subscription, just log in and click Download to get the Oklahoma Notice of Attorney’s Lien template.

If you don’t have an account yet but need one, keep to the step-by-step guideline listed below:

- Be sure the document you’re downloading applies in your state (or the state it’s needed in).

- Do so by reading through the form’s description and by clicking the Preview option (if offered) to view the form’s information.

- Click on Buy Now button.

- Select the appropriate plan for your financial budget.

- Sign up to an account and choose how you would like to pay: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Find the document on the device or in your My Forms folder.

Skilled lawyers draw up our samples to ensure that after saving, you don't have to bother about editing content material outside of your individual info or your business’s details. Sign up for US Legal Forms and receive your Oklahoma Notice of Attorney’s Lien sample now.

Form popularity

FAQ

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

The deadline to enforce an Oklahoma mechanics lien is 1 year from the date the lien was filed. Note, however, that Oklahoma is a rare state that makes a claimant wait before they can enforce their lien. An Oklahoma claimant must wait at least 90 days after filing their lien to enforce it.

The attorney may retain the papers until the claims are satisfied and may apply the money to the satisfaction of the claims." An attorney's potential lien on property is set forth by a later subsection, but limits the lien on real property to instances in which there was an action "for the recovery of real or

To attach the lien, the creditor files the Statement of Judgment with the county clerk in any Oklahoma county where the debtor has property now or may have property in the future.

For a Lien only: $10.00 Lien fee plus $1.55 Mail fee. 3. The MLA will stamp and record the date, time and receipt number on the face of the titling documentation and attach one copy of the MV-21-A and one copy of the lien fee receipt.

Voluntary and Involuntary Liens. Creditors, such as a mortgage or car lender, can ask borrowers to put up the purchased property as collateral as part of the condition of the loan. Creditors With Involuntary Liens. Judgment Liens. Other Types of Involuntary Liens.

Can a lien be placed on your property without you knowing? Yes, it happens. Sometimes a court decision or settlement results in a lien being placed on a property, and for some reason the owner doesn't know about it initially.

If you have unpaid debt of any kind, this can lead the creditors that you owe money to place a lien on your assets.In other cases, liens may be placed on property by a court order as a result of legal action.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.