Oklahoma Homeowners Association Assessment Lien

Description

An assessment lien allows the HOA to sell the homeowner's property to repay assessments owed to the HOA.

Key Concepts & Definitions

Homeowners Association Assessment Lien: This is a legal claim against a property by a homeowners association (HOA) for unpaid community assessments. This lien is placed when a homeowner fails to pay the association fees or special assessments, potentially leading to foreclosure if the debt is not settled.

Step-by-Step Guide

- Review HOA Documents: Start by reviewing your covenants, conditions, and restrictions (CC&Rs) to understand your financial obligations and the potential for liens.

- Notification of Assessment: The HOA will notify the homeowner of any assessments due, often with a clear payment deadline.

- Payment Grace Period: If missed, payments may have a grace period, though this varies by association.

- Lien Filing: After the grace period, the HOA may file a lien with the county recorder's office.

- Resolution: Pay the outstanding amounts to remove the lien, or it may lead to foreclosure.

Risk Analysis

- Financial Risk: Unpaid liens can lead to significant financial liability, including foreclosure.

- Credit Impact: Liens negatively affect your credit score, making future borrowing more difficult or expensive.

- Legal Expenses: Contesting a lien involves legal costs, and losing a case can include the plaintiff's costs as well.

Common Mistakes & How to Avoid Them

- Ignoring Communications: Always address HOA notices immediately. Ignoring them can lead to escalated conflicts.

- Failing to Budget for Assessments: Include HOA fees and potential assessments in your monthly budget plan.

- Not Consulting Legal Help: Seek legal advice if you are unsure about the lien process or your rights.

Key Takeaways

Understanding and managing your obligations as a homeowner in an HOA can prevent legal complications like assessment liens. Ensure timely payment of all fees, and always consult with legal professionals when receiving a lien notice.

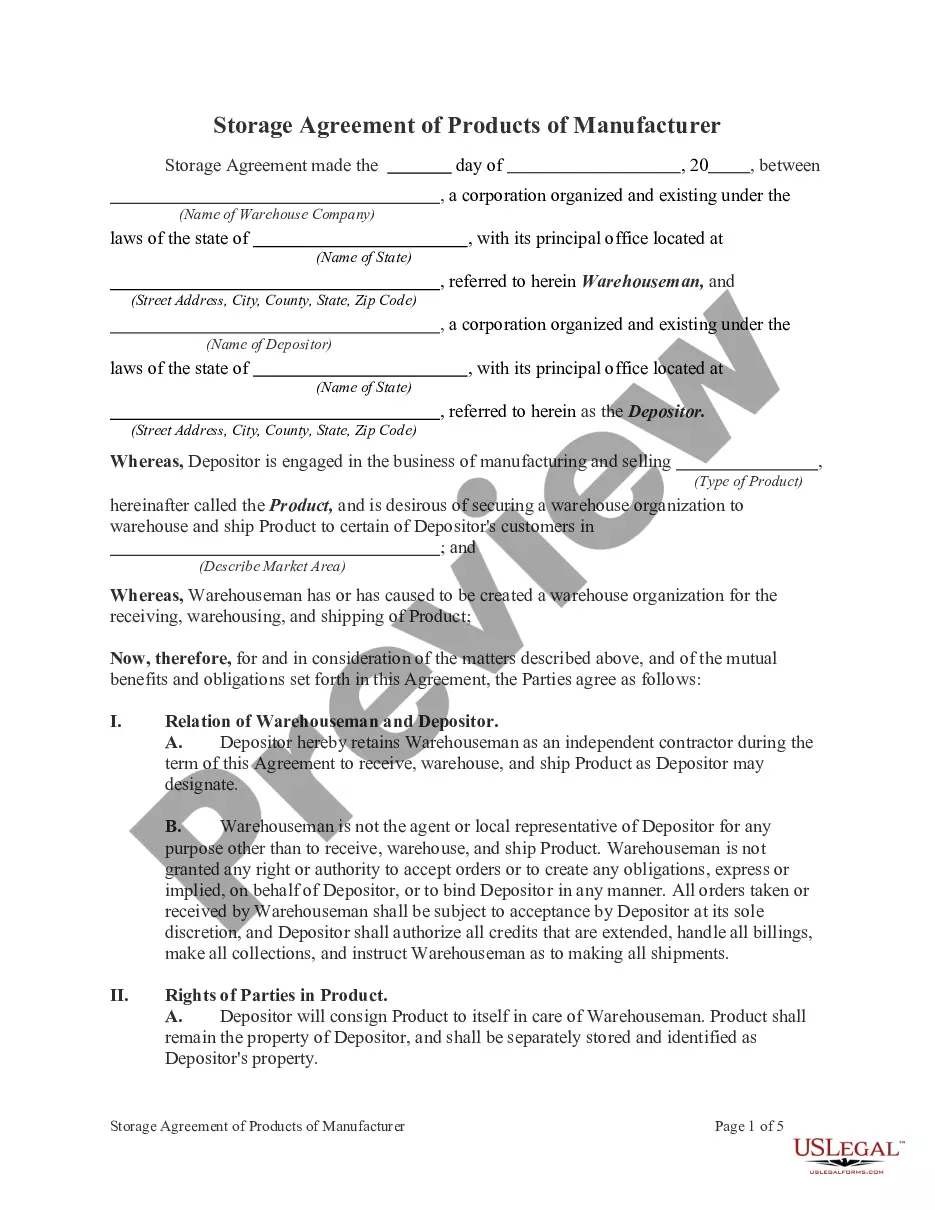

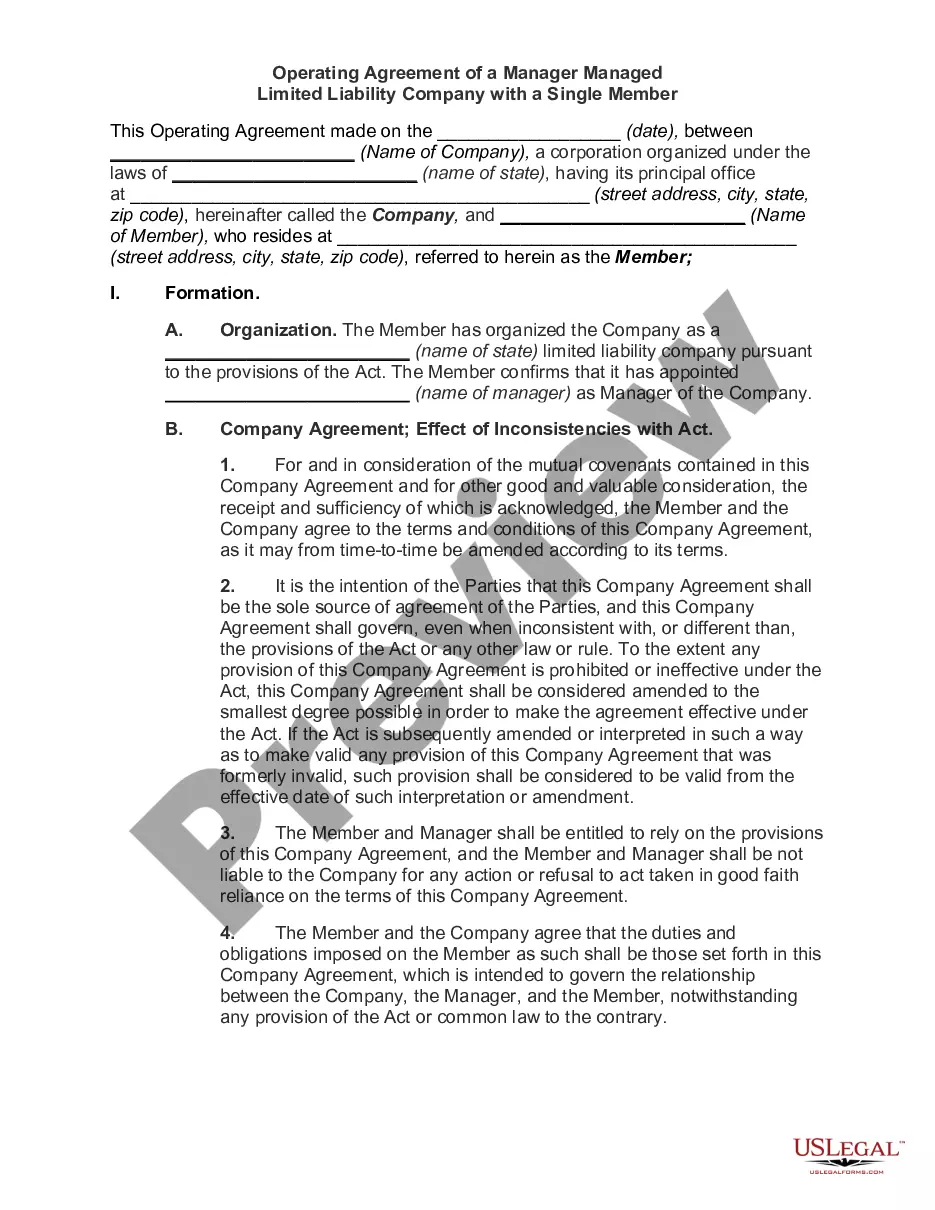

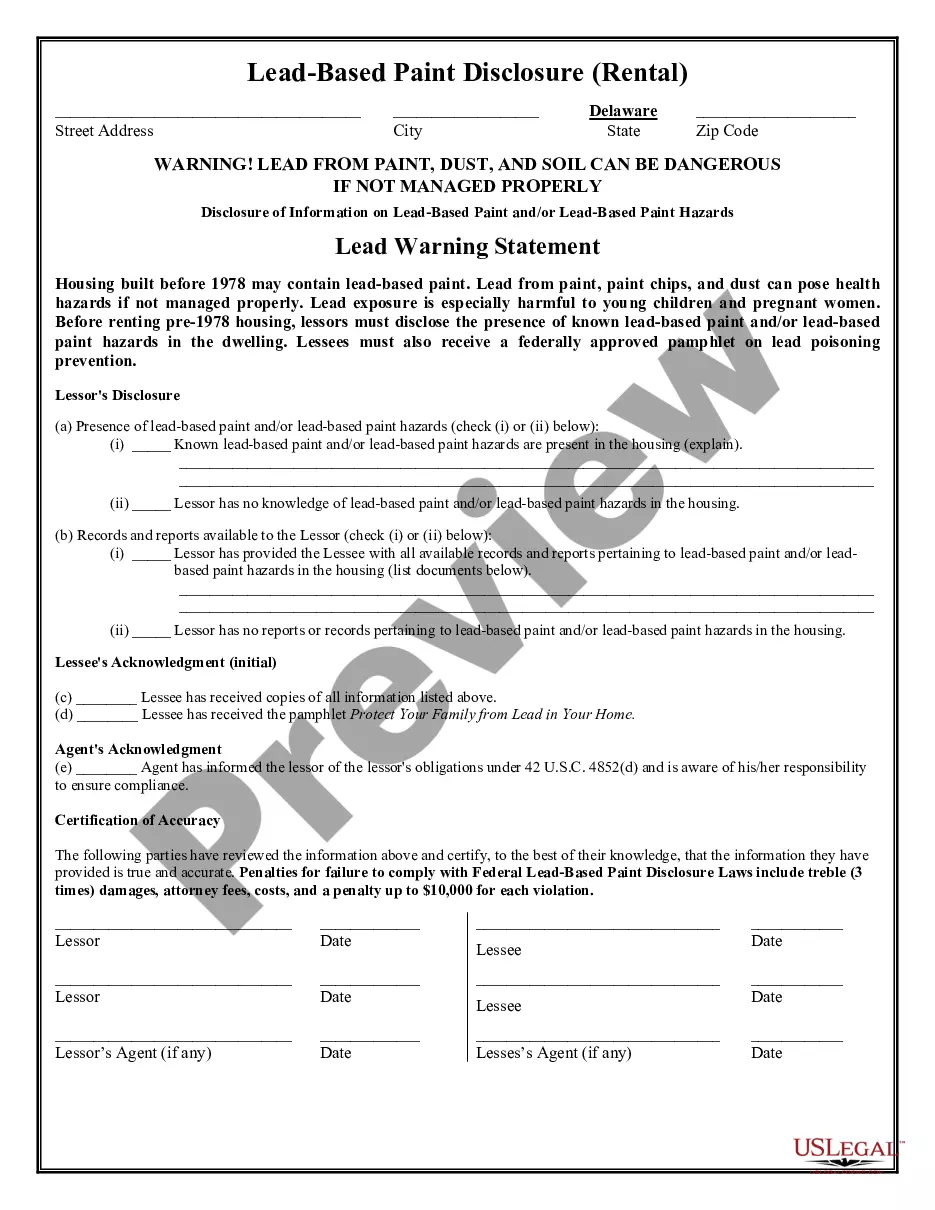

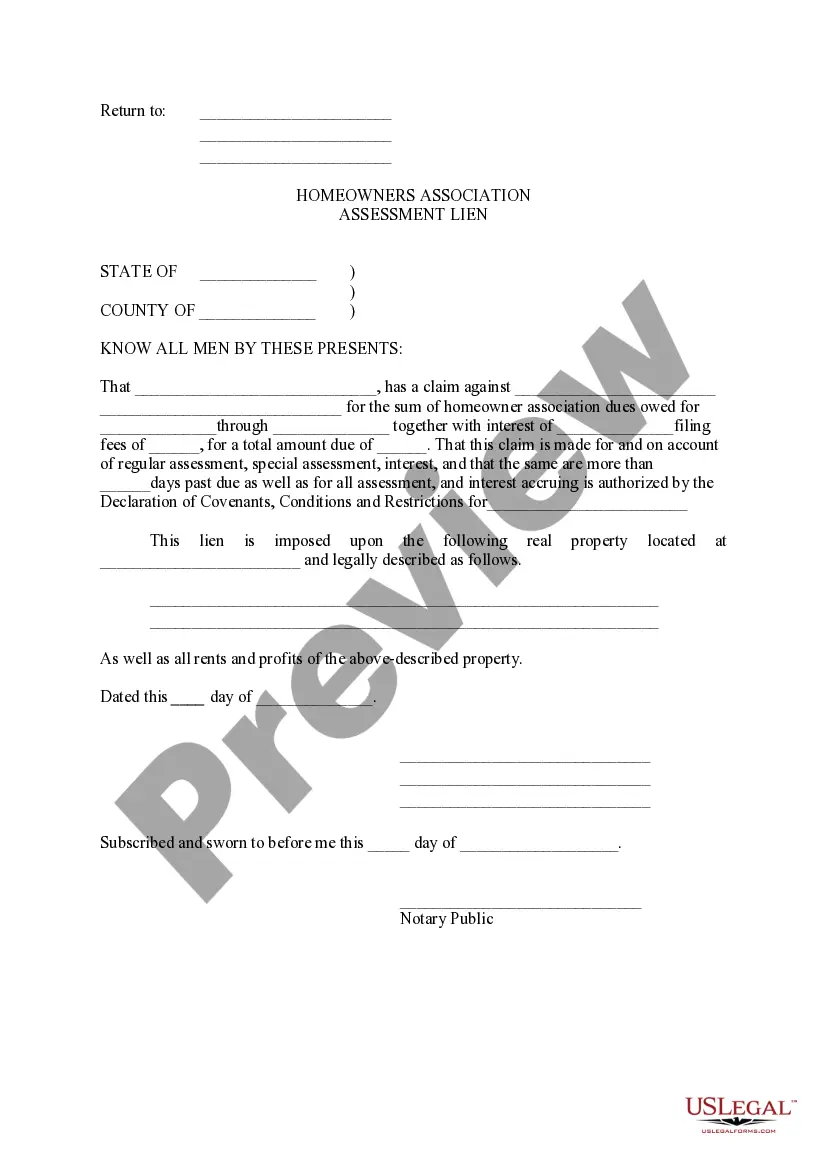

How to fill out Oklahoma Homeowners Association Assessment Lien?

When it comes to submitting Oklahoma Homeowners Association Assessment Lien, you most likely imagine a long process that consists of getting a suitable sample among countless similar ones and then needing to pay a lawyer to fill it out for you. On the whole, that’s a slow and expensive option. Use US Legal Forms and choose the state-specific template within clicks.

In case you have a subscription, just log in and then click Download to get the Oklahoma Homeowners Association Assessment Lien template.

In the event you don’t have an account yet but need one, keep to the point-by-point guideline listed below:

- Be sure the file you’re downloading applies in your state (or the state it’s required in).

- Do it by looking at the form’s description and also by visiting the Preview option (if readily available) to view the form’s information.

- Click on Buy Now button.

- Pick the suitable plan for your financial budget.

- Join an account and choose how you would like to pay out: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Get the document on your device or in your My Forms folder.

Professional legal professionals work on drawing up our samples so that after downloading, you don't have to bother about editing content outside of your personal info or your business’s details. Sign up for US Legal Forms and receive your Oklahoma Homeowners Association Assessment Lien sample now.

Form popularity

FAQ

Liens Wiped Out, Not Debt The HOA first sends you a notice of the delinquent fees and ways to resolve the debt.Foreclosure by a mortgage lender wipes out the HOA lien, but doesn't resolve the debt itself.

Removal of Association's LienTo remove a lien on a property, homeowners must first satisfy the debt owed to the homeowners association. To pay off an HOA lien, the homeowner must make payment to the association in the amount of the delinquent assessments, plus interest and any applicable fees.

Majority of Members Must Consent to Dissolution of HOA Because an HOA technically consists of two parts, the legal entity plus its membership, one part usually needs the consent and approval of the other in order to take an extreme action like dissolution.

Removal of Association's Lien To remove a lien on a property, homeowners must first satisfy the debt owed to the homeowners association. To pay off an HOA lien, the homeowner must make payment to the association in the amount of the delinquent assessments, plus interest and any applicable fees.

An assessment lien is a legal claim or "hold" on an owner's unit or lot making the property collateral against delinquent assessments, whether regular or special assessments, owed to the association.

HOA Fees Are Usually Non-Negotiable Generally, you cannot negotiate HOA fees. The fees have a lot of governing legal documents that can include your state's HOA and/or Condo Act as well as bylaws and/or Covenants, Conditions and Restrictions (CC&Rs) that apply to all homeowners in your specific HOA.

A homeowner can sue HOA for selective enforcement if they feel it is warranted they have every right to do so. Naturally, an HOA board will want to do everything in its power to prevent legal action from taking place.

All negative information, including the HOA lien, affects your credit score. The HOA lien stays on your credit report for seven years.If your HOA pursues foreclosure after placing the lien, it would force your first mortgage holder to also file foreclosure.

If an HOA has a lien on a homeowner's property, it may forecloseeven if the home already has a mortgage on itas permitted by the CC&Rs and state law. The HOA can foreclose either through judicial foreclosure or a nonjudicial foreclosure, depending on state law and the terms in the CC&Rs.