Oklahoma Intercreditor and Subordination Agreement

Description Inter Creditor Agreement

How to fill out Oklahoma Intercreditor And Subordination Agreement?

When it comes to filling out Oklahoma Intercreditor and Subordination, you almost certainly think about an extensive procedure that requires finding a perfect sample among hundreds of similar ones then having to pay legal counsel to fill it out to suit your needs. Generally, that’s a slow-moving and expensive choice. Use US Legal Forms and select the state-specific document in just clicks.

If you have a subscription, just log in and click Download to find the Oklahoma Intercreditor and Subordination form.

If you don’t have an account yet but need one, stick to the point-by-point guide listed below:

- Make sure the document you’re getting is valid in your state (or the state it’s needed in).

- Do it by looking at the form’s description and by clicking the Preview option (if readily available) to see the form’s information.

- Click Buy Now.

- Find the suitable plan for your budget.

- Subscribe to an account and choose how you would like to pay: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Get the document on the device or in your My Forms folder.

Skilled lawyers work on drawing up our templates so that after downloading, you don't have to worry about editing and enhancing content material outside of your personal details or your business’s info. Join US Legal Forms and get your Oklahoma Intercreditor and Subordination example now.

What Is Intercreditor Agreement Form popularity

FAQ

An intercreditor agreement is an agreement among creditors that sets forth the various lien positions and the rights and liabilities of each creditor and its impact on the other creditors.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

An Intercreditor Agreement, commonly referred to as an inter-creditor deed, is a document signed between two or more creditors.In a typical scenario, there are two creditors involved in a given agreement a senior(s) and subordinate (junior) lender(s) Capital stack ranks the priority of different sources of financing

When a Borrower wishes to refinance the property, they must request a subordination request to the Lender. The Lender will subordinate their loan only when there is no cash out as part of the refinance.

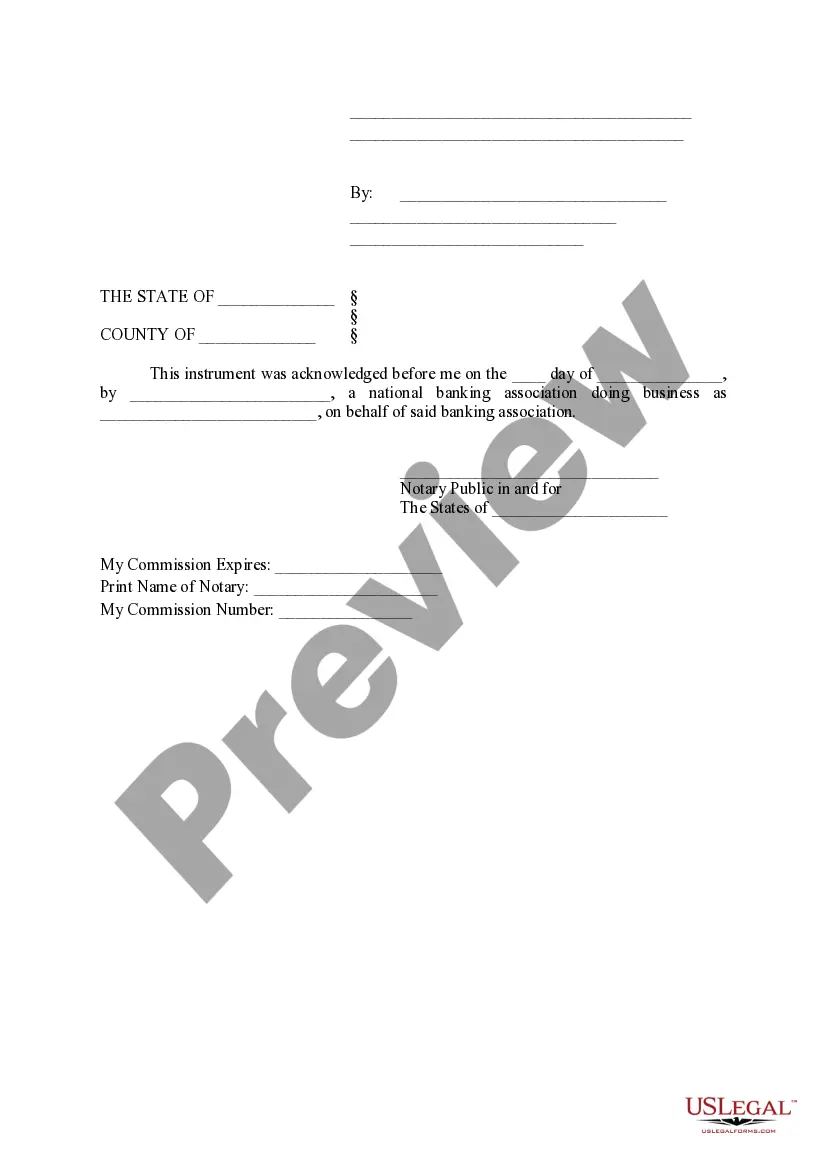

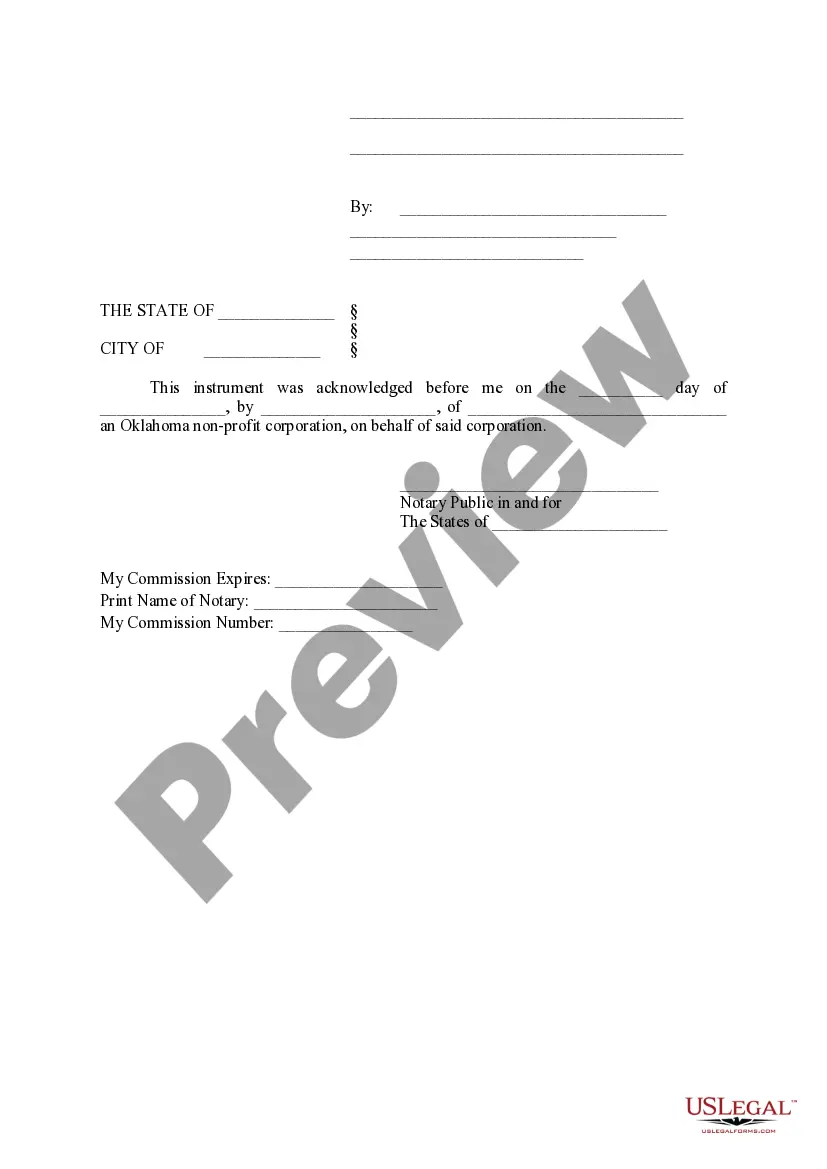

Unless there is a subordination agreement, it is virtually impossible to refinance your first mortgage. The document agreeing to the subordination must be signed by the lender and the borrower and requires notarization.

Payment subordination is where the subordinated lender agrees (subject to carve-outs noted in the agreement) to fully subordinate the payment of the subordinated obligations to the prior repayment in full of the senior obligations.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

An agreement among lenders, or classes of lenders, describing their respective rights and obligations with respect to the borrower and its assets.This agreement can also specify how payments from the borrower are to be applied among the lenders.

An intercreditor agreement is a bit different than a subordination agreement. They both serve to do the same thing, allow two different lenders to split up the collateral of a business so both can be secured in the first lien on their respective collateral.