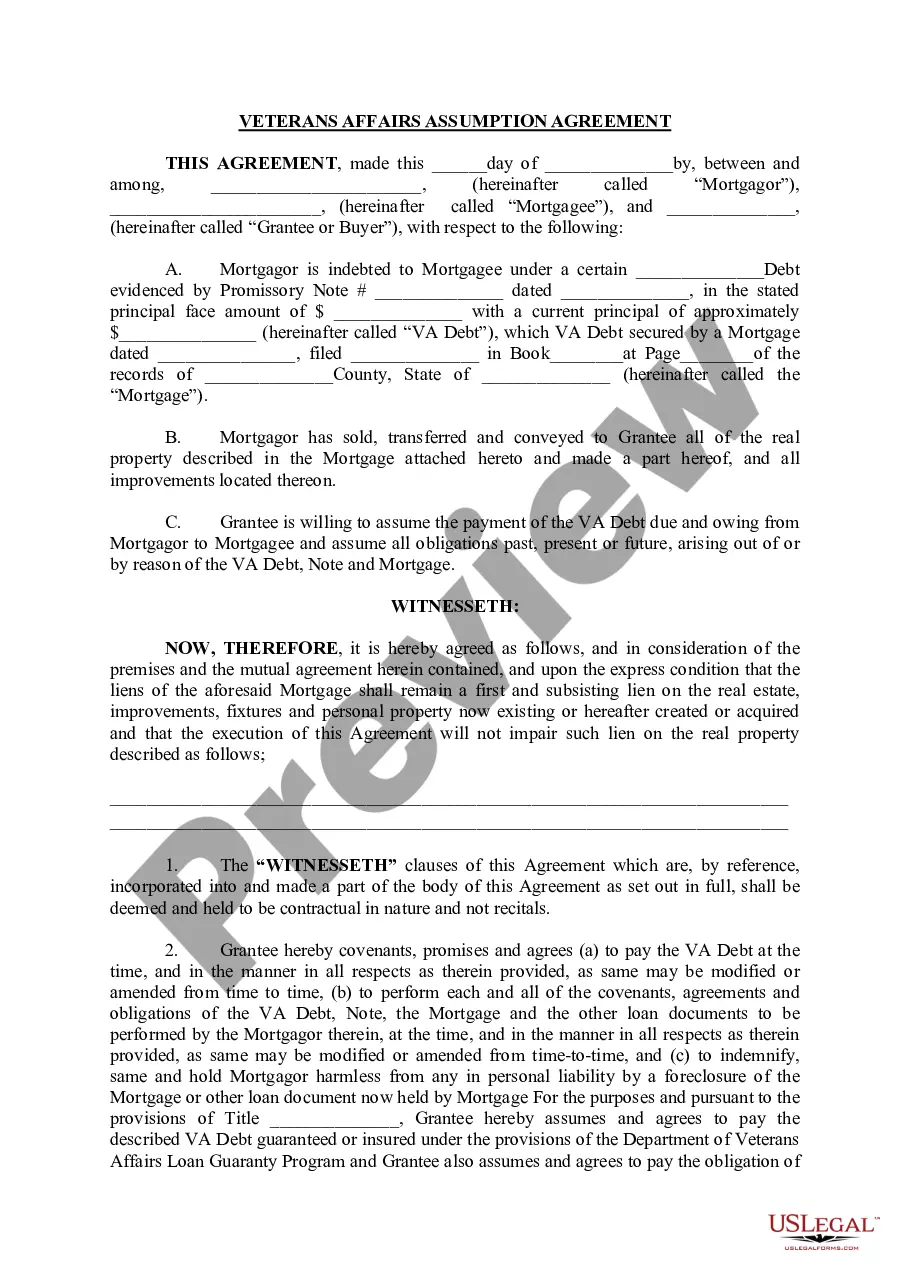

Oklahoma Veterans Affairs Assumption Agreement Agreement

Description

How to fill out Oklahoma Veterans Affairs Assumption Agreement Agreement?

In terms of submitting Oklahoma Veterans Affairs Assumption Agreement, you probably visualize a long process that consists of getting a ideal sample among countless similar ones after which needing to pay legal counsel to fill it out to suit your needs. On the whole, that’s a sluggish and expensive choice. Use US Legal Forms and choose the state-specific document within just clicks.

If you have a subscription, just log in and click Download to find the Oklahoma Veterans Affairs Assumption Agreement template.

In the event you don’t have an account yet but need one, follow the step-by-step manual listed below:

- Make sure the document you’re saving applies in your state (or the state it’s required in).

- Do it by looking at the form’s description and by clicking on the Preview function (if readily available) to view the form’s content.

- Simply click Buy Now.

- Choose the suitable plan for your financial budget.

- Sign up for an account and choose how you want to pay: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Find the document on the device or in your My Forms folder.

Skilled attorneys work on creating our samples so that after downloading, you don't have to bother about enhancing content outside of your individual details or your business’s details. Join US Legal Forms and get your Oklahoma Veterans Affairs Assumption Agreement sample now.

Form popularity

FAQ

Anyone can assume a VA mortgage as long as their income and credit qualify but children of veterans can't get VA loans themselves (unless, of course, they join the military as well). You have to be a current service member, veteran or surviving spouse of a veteran to qualify for a VA loan.

A loan can be denied by the automated underwriting system for any number of reasons. It could be that something was input wrong. It could be because something was reported wrong on your credit.

How Often Do Underwriters Deny VA Loans? About 15% of VA loan applications get denied, so if your's isn't approved, you're not alone. If you're denied during the automated underwriting stage, you may be able to seek approval through manual underwriting.

Application errors. Double check your loan paperwork. Change in employment. Keep your employment consistent throughout the loan process. Change in credit. Borrower Delays. Factors beyond your control.

Yet another benefit: VA loans are assumable. A VA loan assumption allows a borrower to take over the terms of an existing mortgage, even if they aren't a military service member, veteran or eligible surviving spouse. This type of transaction can benefit both homebuyers and sellers.

Processing. Once a loan officer has a completed loan file, income documents and a credit report, the application will be submitted to a VA underwriter for processing. Underwriters can take as long as 14 days to render a decision on underwriting a loan for individuals with a solid credit background.

Underwriters may view certain employment changes as unreliable sources of income. If a job change cannot be avoided, speak to your loan officer about new documentation or verification of income. Errors: In simpler cases, VA loans may be rejected because you made a mistake on the documents somewhere.

For a VA mortgage assumption to take place, the following conditions must be met: The existing loan must be current. If not, any past due amounts must be paid at or before closing. The buyer must qualify based on VA credit and income standards.

Veterans with VA mortgages can have their VA home loan assumed by someone else, also called a VA loan assumption. If your plans, goals, or needs changed and you need to get out of a VA loan one option is to sell your home but an alternative option is an assumable mortgage, a buyer takes over the loan.