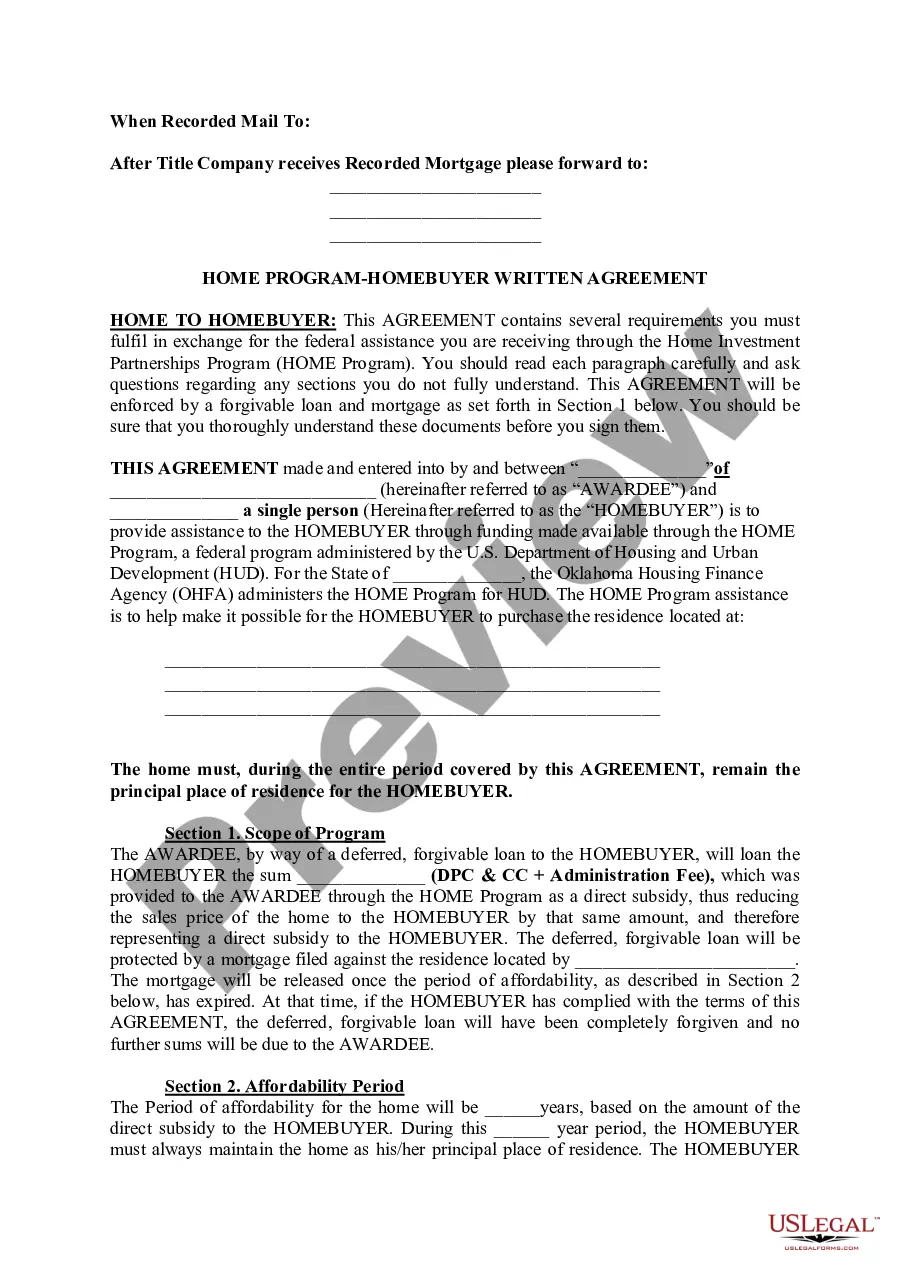

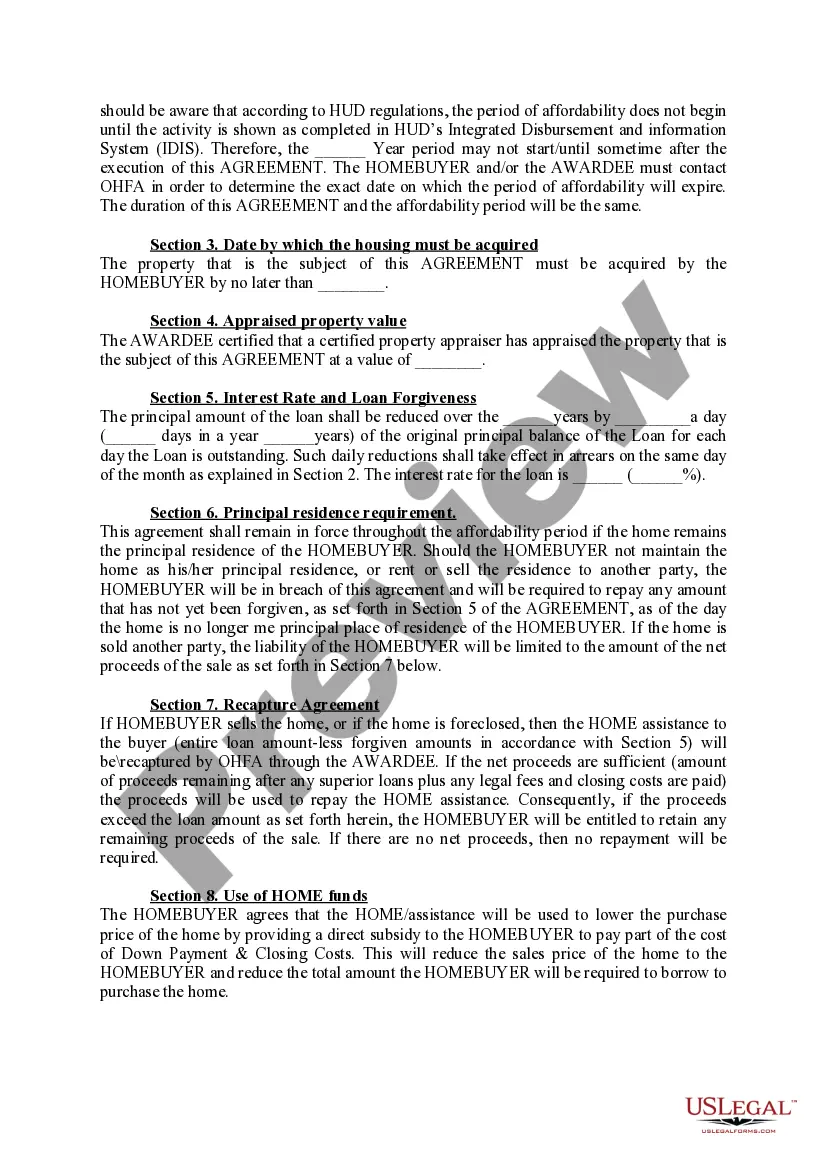

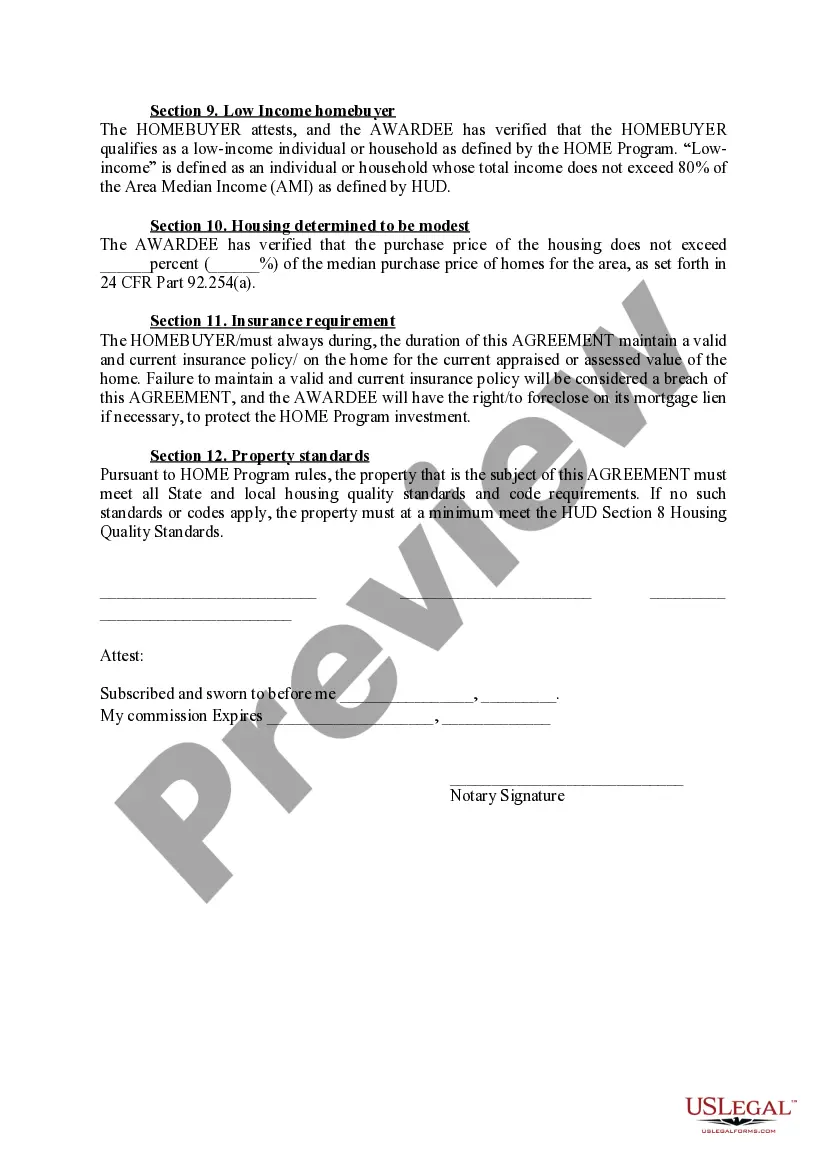

Oklahoma Home Program-Homebuyer Written Agreement

Description

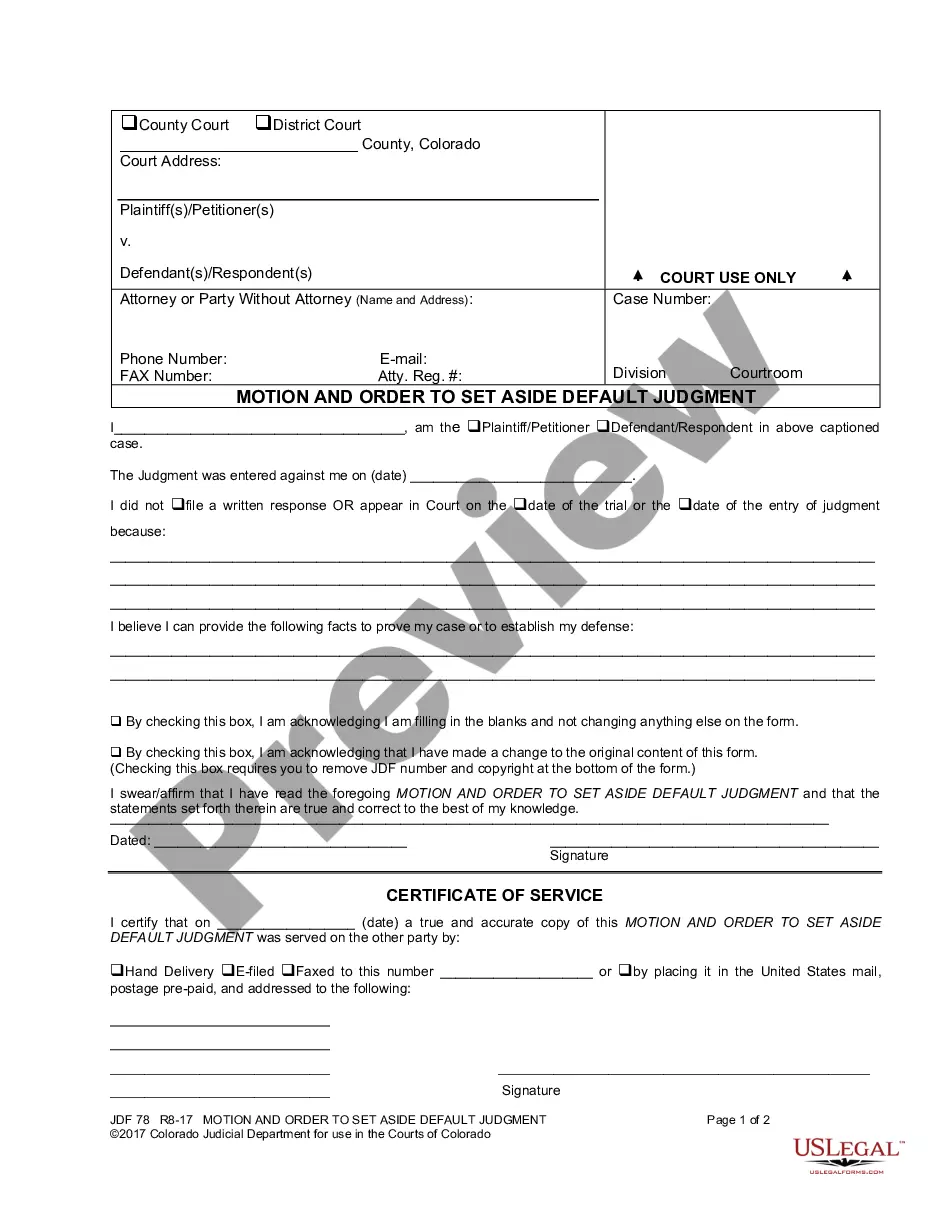

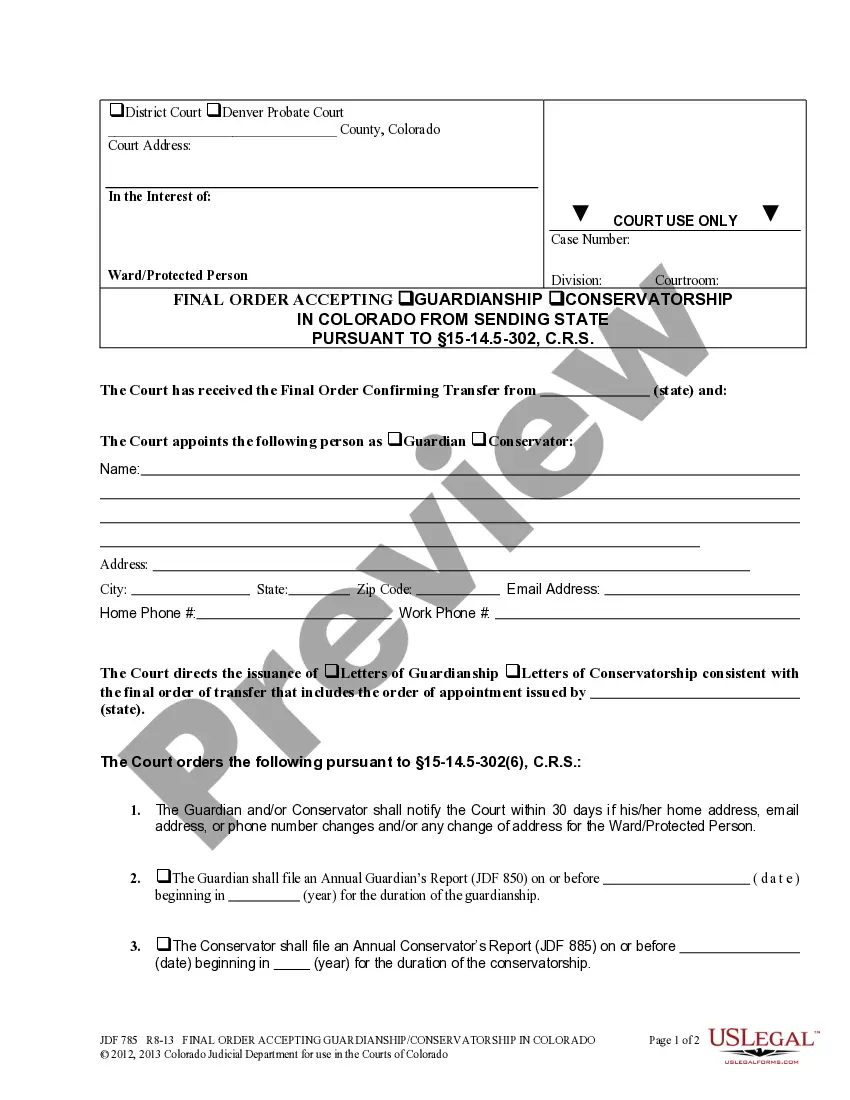

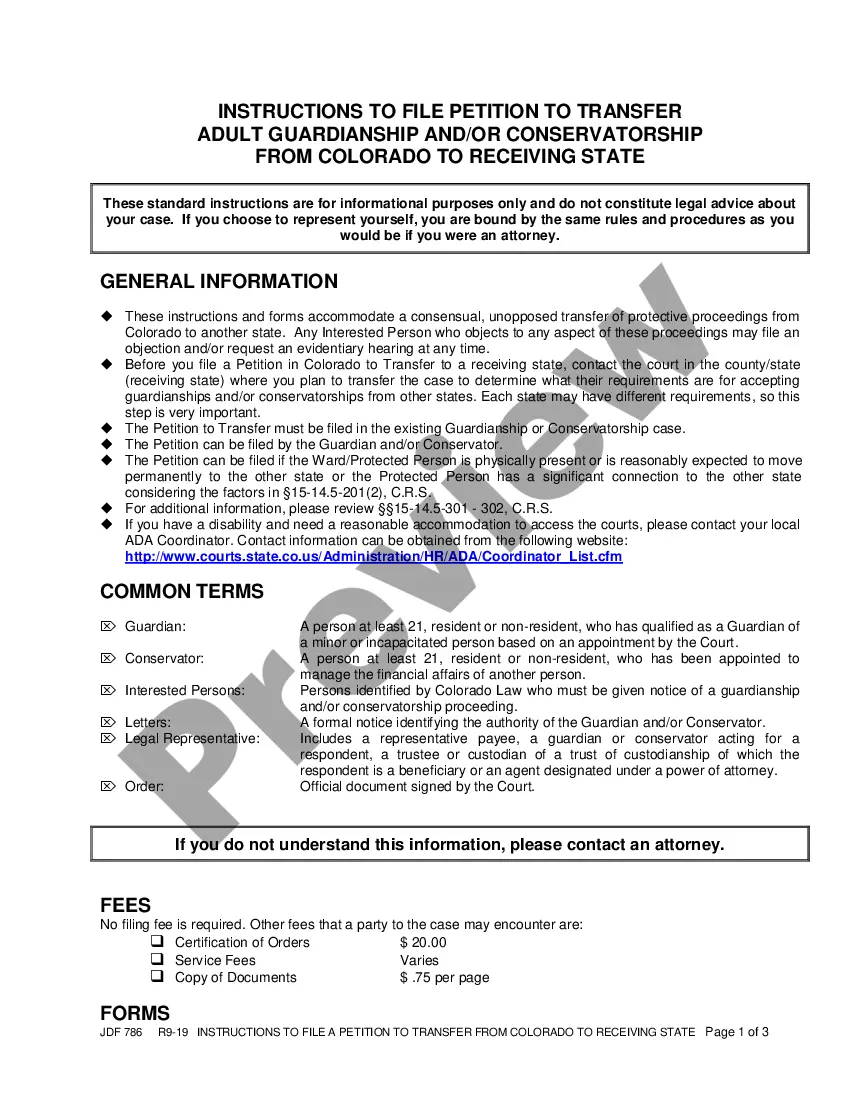

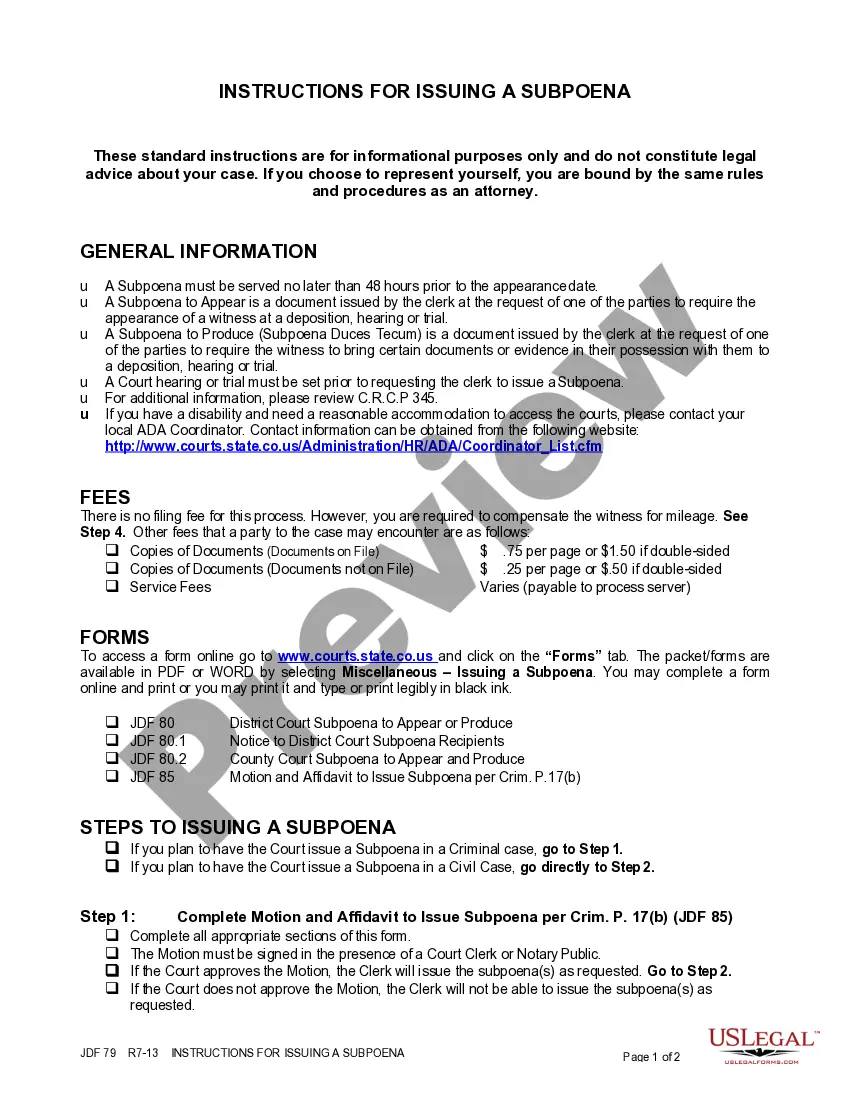

How to fill out Oklahoma Home Program-Homebuyer Written Agreement?

When it comes to completing Oklahoma Home Program-Homebuyer Written, you almost certainly visualize an extensive procedure that involves getting a suitable form among numerous very similar ones then being forced to pay out legal counsel to fill it out to suit your needs. Generally speaking, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific template in a matter of clicks.

If you have a subscription, just log in and click Download to get the Oklahoma Home Program-Homebuyer Written sample.

In the event you don’t have an account yet but want one, keep to the step-by-step guide listed below:

- Be sure the document you’re downloading applies in your state (or the state it’s required in).

- Do it by looking at the form’s description and also by visiting the Preview option (if accessible) to view the form’s content.

- Simply click Buy Now.

- Find the proper plan for your financial budget.

- Subscribe to an account and choose how you would like to pay: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Get the document on the device or in your My Forms folder.

Skilled legal professionals work on creating our samples so that after downloading, you don't have to bother about modifying content outside of your individual info or your business’s info. Be a part of US Legal Forms and get your Oklahoma Home Program-Homebuyer Written sample now.

Form popularity

FAQ

Programs for borrowers buying a house with a 600 credit score include: FHA home loan These are government loans insured by the Federal Housing Administration (FHA). FHA loans are intended for people with lower credit; they allow a minimum credit score between 500 and 580.

If they are approved, selected and then find an apartment or house with the voucher, their local housing authority starts sending payments directly to landlords. The payments cover some or all of the voucher holder's rent. On average, each household will pay somewhere between 30% and 40% of its income on rent.

Still, to buy a home, aim for a score of at least 620, recognizing that other factors weigh in the decision and that some banks may require a higher score. With an FHA mortgage, however, a FICO score of 600 or higher is enough to qualify for the 3.5% down payment loan.

A no-down-payment mortgage allows first-time home buyers and repeat home buyers to purchase property with no money required at closing, except standard closing costs. Other options, including the FHA loan, the HomeReady mortgage, and the Conventional 97 loan, offer low down payment options with a little as 3% down.

The Federal Housing Administration, or FHA, requires a credit score of at least 500 to buy a home with an FHA loan. A minimum of 580 is needed to make the minimum down payment of 3.5%. However, many lenders require a score of 620 to 640 to qualify.

Formal application processing is four to six weeks. Once the formal application processing is complete and if you are eligible, you are issued a voucher and have sixty days to find an appropriate Section 8 rental unit.

Eligibility requirements Must have a credit score of at least 640.

Proof of identity. A broker or lender will ask you to provide a valid government issued photo ID, such as a passport, state issued ID card or state issued driver's license. Proof of income. Proof of assets. Proof of credit history. Proof of gifts. Proof of renting history.

Can I get a mortgage with a 600 credit score? Yes. FHA loans are available to borrowers with a credit score of 580 or higher. If you have a 600 credit score, you should be in an excellent position to qualify.